Freight between Vietnam and Switzerland | Rates – Transit Times – Duties & Taxes

What is the best method to ship your products between Vietnam and Switzerland ?

When exporting goods from Vietnam to Switzerland, you have two options: sea freight or air freight. This information has been compiled by DocShipper to help you choose the best mode of transportation for your needs.

Despite the fact that Switzerland is a small country in terms of population and territory, the standard of living of its inhabitants makes it an excellent market for any entrepreneur. This is why the country is extremely dynamic in terms of imports and exports, and why it attracts the interest of many investors. Despite its landlocked status, the country mainly uses sea freight for the transportation of goods. Air transport is also highly developed to compensate for this dependence on the ports of its neighboring countries. In this respect, the airports of Zurich and Geneva are of European importance.

FNM Vietnam offers competitive and efficient air and sea freight solutions between Switzerland and Vietnam. Our international agents and advisors will ensure that the transportation of your goods runs smoothly and without problems. To request a free estimate, please fill

Docshipper Note:

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat us on WhatsApp Fill the form

Sea freight between Switzerland and Vietnam

Overview of maritime transport from Vietnam to Switzerland

Switzerland being a landlocked country (territory completely surrounded by another), sea freight to its destination must pass through one of the closest Mediterranean ports. The two main ports near Switzerland are Marseille and Genoa. Despite the fact that Switzerland is landlocked, sea freight is the most common method of transferring goods. Indeed, sea freight is by far the most competitive solution for large quantities of goods. The main disadvantage of this method is its duration, which is generally 4 weeks to connect the 2 continents.

The main Vietnam seaports

Ho Chi Minh City’s port

On the Sai Gon river, HO CHI MINH CITY’S port is situated. It is a system that may be defined as a port network that serves as a swing bridge for products imported and exported from southern Vietnam. Several businesses, including mining and fruit and vegetable processing. It is the most important geographic site in the nation, accounting for roughly two-thirds of the country’s GDP.

Qui Nhon’s Port

Binh Dinh Province’s Qui Nhon port is a major port. It is the most accessible and nearby cities of Laos and Cambodia within the Binh Dinh region, with almost ten routes connecting by water between international ports like as Singapore, Japan, and Thailand.

Hai Phong’s Port

The port of Hai Phong (cng Hi Phng) is a collection of ports in the huge city of Haiphong that service the country’s north. It is the most major port in the country’s north, with three terminals.

Shipping companies operating between Vietnam, Marseille and Genoa

FNM Remark:

Between Vietnam and Switzerland, we can offer you very attractive rates for services with the above shipping companies. This is possible thanks to the quality of our relationship with them, which we have been maintaining for more than ten years. Contact us so that we can help you.

The port of Fos-Marseille

Thanks to its number of passengers and its annual volume of goods, the port of Marseille is the largest in France. A total of 80.36 million tons of cargo passed through the port in 2017, which represents a 9% increase over the previous year. Of these, 20.5 million tons arrived by container, corresponding to a total volume of 1.35 million TEUs during the year. The remainder is divided between dry and liquid bulk, with 13.6 million and 46.3 million tons respectively. The port of Fos/Marseille is about 450 km from Geneva and about 700 km from Basel.

The port of Genoa

The port of Genoa is the most important port in Italy. In 2017, this port received 55 million tons of goods, which is an increase of 8.6% compared to 2016. Container traffic accounted for 35.5 million tons of cargo. Liquid bulk traffic in the port of Genoa was 15 million tons, and solid bulk traffic was 3.5 million tons in the same year. Passenger transport is also very high in this port, which explains its position as the main port of the country.The port of Genoa is about 400 km from Geneva and about 500 km from Basel.

Transit time between Switzerland and Vietnam ports

At this time, it is impossible to know the exact time that your delivery by sea freight will take due to the situation (conflicts, port congestion…). For more information, we invite you to contact one of our experts by filling out this contact form.

DocShipper Alert :

A wrong route will waste time and additional costs. For advice on the best route for you and your cargo, based on your needs, request a free quote here.

Should I ship between Vietnam and France in a groupage or a whole container?

The following are three typical container sizes:

- The 20-foot container has a 33-m3 capacity.

- The 40-foot container has a 67-m3 capacity.

- The 40-foot HQ container has a 76-m3 capacity.

You may choose between two modes of transportation, which are described below:

LCL: Less than Container Load

Consolidation is a method of grouping contracts from various customers with the same port of arrival but with insufficient contents to completely fill a cargo box. This method allows you to pay only for the space you need for your business, rather than for the entire vessel. Therefore, this method is suitable for your smaller shipments. If and only if the following criteria are met, this technique will pay off:

- You need your products consolidated into one shipment.

- Your shipments have a smaller cubic capacity than purchases from large suppliers.

Air freight is more attractive than ocean freight for shipments under 2m3. In addition, air freight has shorter delivery times than ocean freight. Air freight takes less than a week to arrive door-to-door, but ocean freight takes about 40 days (LCL).

FCL: Full Container Load

Full container load (FCL) is a delivery system in which a single customer leases the cargo from loading to delivery. Because handling is minimal, costs are lower with this design. In addition, the cargo is protected during its journey from origin to destination. This strategy is particularly advantageous when purchasing large quantities of goods. Not only is the full container approach safe and secure, it is also significantly less expensive than importing a larger volume. It is also advantageous for a half-full shipment. The same strategy is particularly advantageous for shipments of 15 m3 or more, and is less expensive than the LCL method.

This method is best suited for cargoes weighing more than 13/14 m3. Even if the cargo is only half full, the cost will be lower because the port will handle it less. This method is also safer.

Advantages of a full container load (FCL)

- For large quantities, this is the most cost-effective option.

- The vessel is fully enclosed from the time it leaves the production site until it arrives at the final destination of the products in question.

- There is not much room for maneuver.

Disadvantages of full container load (FCL)

- For this form of transport, a comparable quantity of 15m3 is required.

- The journey takes a long time.

Advantages of Less than Container Load (LCL)

- The cost is determined by the amount of work performed.

- For small quantities, this is the most cost-effective mode of transportation.

- This transportation system has a great capacity to handle all kinds of imported goods.

Disadvantages of Less Than Container Load (LCL)

- Products are processed, which increases the risk of spoilage.

- Information must be delivered at the right time.

- Pallet transport is essential.

Special sea freight services

Roro

Roll-on/roll-off (Ro-Ro) boats are used to move cargo on rollers. Ro-Ro boats use their own tires to transport freight on and off the boat.

Ro-Ro freight requires less physical handling and is less likely to be damaged by sea or weather conditions since it is often carried in a single move using customised decks (from point of entry to point of destination). Goods are stored on the ship’s platforms during the journey.

This is the safest and most cost-effective way to move large or unusual cargo.

Reefer container

This technique of shipping in thermal containers was devised specifically for “delicate” goods and is often used for easily damaged foods or medications. These containers may alter the environment, humidity, and temperature in a variety of ways. They are available in a variety of sizes, enabling them to be tailored to the needs of providers.

OOG

Non-standard OOG vessels are divided into two categories:

Open-top ships are used to transport enormous, heavy cargoes of finished goods. Because it may be handled by a crane or overhead crane, this kind of transportation need close monitoring.

A “Flat Rack Container,” on the other hand, is a box with a level floor. They’re used to transport large, heavy, or big objects that are both wide and tall.

This vessel is used to carry products that cannot be sent in boxes. They also improve container security while also allowing for faster loading and unloading.

Bulk

The goods supplied on “container ships” are divided into two categories: “bulk” goods that are loaded into the ship’s cargo and “general cargo” goods. Ships are designed to transport a variety of cargo, including coal, minerals, and other goods.

Tip FNM :

DocShipper’s professionals are here to answer all your questions about heavy lifting or other types of cargo. They will answer all your questions and provide you with the best option for your needs. Contact us.

How long does it take a ship to travel from Vietnam to Genoa or Marseille ?

The transit times of the ships between Vietnam and these two cities are indicated below:

| Haiphong | Qui Nhon | Ho Chi Minh City | |

| Fos – Marseille | 30 days | 29 days | 28 days |

| Genoa | 29 days | 28 days | 27 days |

How much does it cost to ship a container between Switzerland and France ?

It is impossible to give a price range quite simply because several factors must be taken into account, such as port of departure, port of arrival, carrier, type of goods, quantity and volume.

In addition, the prices are updated monthly, taking into account the market and its developments.

The volume and weight of items transported have an impact on the cost of products delivered by sea. To calculate this ratio, it is necessary to know the weight and volume of items.

The equivalence technique is used to determine the weight/volume ratio, which is comparable to “1 ton = 1 m3″.

Traditional transportation and consolidation into payment units are calculated using the weight/volume ratio calculation and assuming that 1 ton = 1 m3 (UP). In reality, there are two methods of defining these units of measure: in terms of volume (cubic meters) and mass (kilograms).

The value that benefits the container, i.e. the cargo, is always used, regardless of the measurement. This is the highest possible estimate.

If a cargo weighs 8 tons and has a capacity of 10 m3 , for example, the cost will be 10 UP. If, on the other hand, the cargo weighs 9 tons and has a volume of 4 m3, the cost is 9 UP.

The cost of a full container will be defined by the “ship’s package”, which will be influenced by the type of ship used as well as the delivery companies.

Supplements to the tariffs

Surcharges that are added to the carrier’s standard prices are called rate surcharges. These charges vary depending on the circumstances.

BAF – Bunker Adjustment Factor.

The Bunker Adjustment Factor is a surcharge applied to the base transportation cost. This surcharge has been in place since 1973, during the first oil crisis, and fluctuates with oil prices.

CAF – Currency Adjustment Factor

The Currency Adjustment Factor (CAF) is a rate that is set by the freight and BAF. This rate varies with the value of the dollar. To protect themselves from currency fluctuations, companies choose to price their products in US dollars.

THC – Terminal Handling Charge.

The Terminal Handling Charge covers all expenses related to processing at the port, including the unloading and loading of products. The amount will remain fixed and equal to the cost of the container in the case of a vessel. The cost will be modified in case of consolidation, and the amount will be determined by the number of tons or m3.

Congestion in the port

Companies collect a tax to compensate for the loss of revenue when one of their ships cannot unload its cargo due to congestion in the port. In this situation, the vessel may have to wait several days to arrive and unload.

Demurrage

Demurrage is a charge levied by the charterer on the shipowner if the shipowner fails to meet the original loading or unloading deadline. This charge is imposed whenever the charterer exceeds the deadline, whether through his own fault or as a result of a strike or traffic jam. In shipping industry jargon, “demurrage” refers to the cost of hiring vessels for transportation while they are still in port.

Air freight shipping between Vietnam and France

Air freight is used to move goods quickly to their final destination. In practice, it is the fastest mode of transport, since it takes only a few days to transfer products from Vietnam to Switzerland. Air freight is the most reliable mode of transportation. It is particularly suitable for high-value items, as well as publications, electronics, clothing and other items that deteriorate quickly at sea.

Airfreight Express shipments are transported in dedicated airfreight aircraft. Door-to-door delivery is provided by FedEx, TNT, UPS, DHL and other courier companies.

Express mail allows items to be sent in a short period of time, such as a week, and can be delivered to homes anywhere on the planet.

The user does not seem to need to manually clear lower value goods, as it is a complete service. This approach is particularly suitable for small volume goods (up to 1 m3) as it is much cheaper than sea freight such as LCL.

Traditional Air Freight: Using the available capacity of commercial aircraft, goods can be transported by commercial airlines such as Qatar Airways, Air France, Emirates, Air China.

Main airport in Switzerland

- BSL – Basel international airport

- GVA – Geneva international airport

- ZRH – Zurich international airport

Main airport in Vietnam

- SNG – Tân Sơn Nhất International Airport

- HAN – Nội Bài International Airport

- CXR – Cam Ranh International Airport

- DAD – Đà Nẵng International Airport

- VCA – Cần Thơ International Airport

- DLI – Liên Khương International Airport

- HUI – Phú Bài International Airport

- HPH – Cát Bi International Airport

- PQC – Phú Quốct International Airport

What is the cost of air freight between Vietnam and Switzerland ?

The costs of this mode of transport, like those of maritime transport, are measured in taxable weight and multiplied by the rate per kilo.

The IATA weight scale is a degressive pricing system that allows a discount depending on the number of flights. This price varies by country, but is required in the vast majority of cases. A minimum tax rate applies to reduced exports.

Despite higher fixed costs, air cargo delivered on a commercial route by a conventional airline would cost less per kg than air cargo handled by “courier companies”. It should be remembered that, as with ocean freight, air freight prices are based on gross weight or volumetric weight, whichever is greater. This assumption applies to both conventional and expedited air freight.

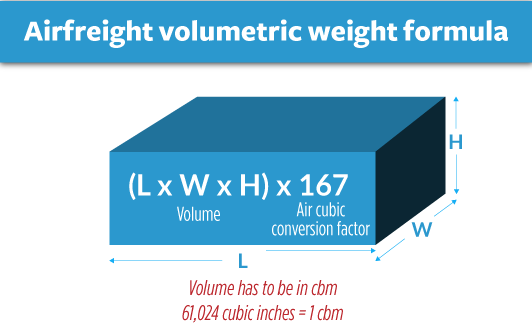

How to calculate the volumetric weight of your shipment?

The rule of correspondence in case of air freight express is the following: 1 ton for 5 m3, i.e. a weight/volume ratio of 1 for 5. For example, 1 m3 is equivalent to 200 kilograms (1:5).

The general rule for conventional air freight is 1 ton per 6 m3, i.e., a weight/volume ratio of 1:6, with gross weight charges for ratios less than or equal to 1:6. In this example, the actual volume is divided by 6 to obtain a volumetric weight that can be used as a reference for pricing. For example, 1 m3 is equivalent to 167 kg (1:6).

How long does the air freight between Vietnam and Switzerland last ?

It takes about 20 hours for your belongings to arrive in Switzerland by air freight from Vietnam.

How much does it cost to send a package from Vietnam to Switzerland ?

As with ocean freight, air freight requires a lot of information to be organized and priced. As we treat each request individually, the quotation we provide will be tailor-made. Therefore, contact our consultants for the latest air freight prices to Switzerland. They will get back to you within 24 hours of your request.

FNM tip :

If you are interested in this means of transport, you have the possibility to contact one of our specialists here.

Customs clearance in Switzerland for goods imported between Vietnam and Switzerland

How to calculate customs duties and taxes?

To know how much you will have to pay in total, you need to know how much tax and duty will be applied to the items you want to import.

The first step is to determine the “HS code” or tariff category of the items.

The customs value of the items, the origin of the products and the HS code of the products must be combined to determine the customs procedure.

For imported and exported commodities from ASEAN member nations, Vietnam has adopted the Harmonized Tariff System (HS) (ASEAN). You may now discover what an HS code is, what it stands for, and how it is organized.

The HS code, or harmonized categorization system, is presently used in over 205 countries and covers 97 percent of worldwide commerce. This approach enables the systematic establishment of categories for all countries that utilize it. Each product that is part of international trade items is given a number. As a result, it is feasible to compare trade flows using valuable data such as statistics and offers.

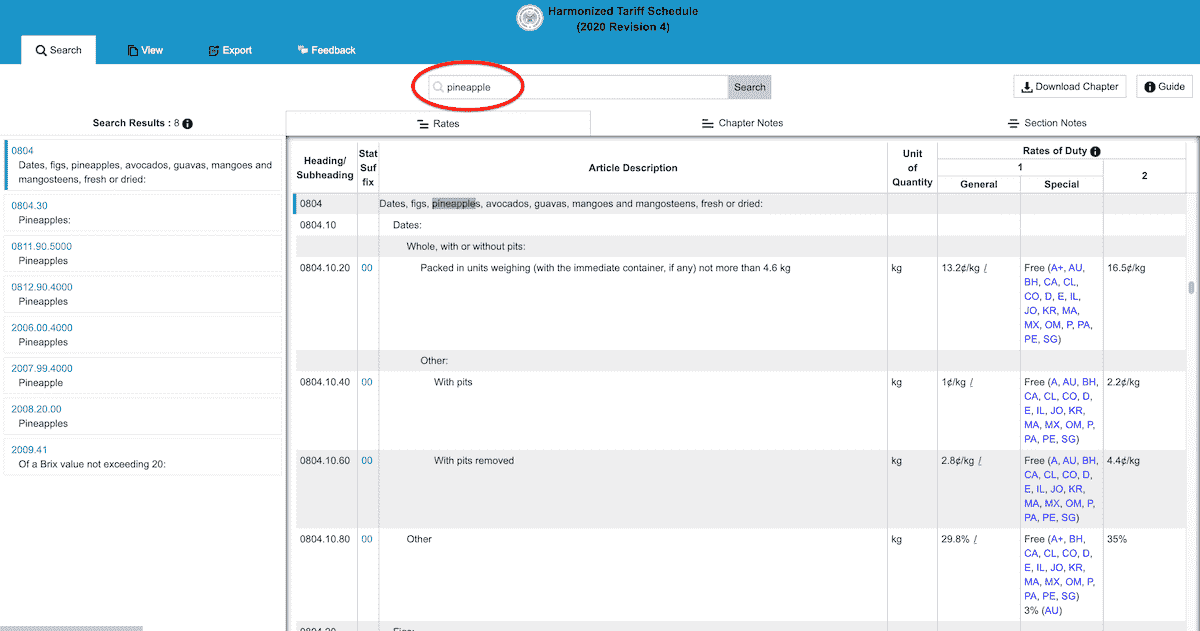

Calculate the applicable customs duties with the HS code

The following image takes a pineapple as an example, to identify the information contained in an HS code:

If you don’t know the HS code for your products, the FindHS.codes website has a handy tool to determine it. Simply enter your product name or photo and you will find its HS code.

Otherwise, you can search for them by chapter, directly on the website of the Swiss customs Tares platform.

Take the pineapple as an example. The import taxes you will need to pay in Switzerland are as follows:

You read that the customs duty applied is 0%, thanks to the GSP, because Vietnam is considered a developing country. The functioning of the GSP is detailed in the rest of this article.

VAT in Switzerland

In Switzerland, as in many other countries, three different VAT rates are applied to goods and services. There is the standard rate of 7.7%, the special rate of 3.7% and the reduced rate of 2.5%:

- The standard rate of 7.7% – This applies to most common goods and services. All products not specified for the rates below are subject to the normal VAT rate.

- Special rate of 3.7% – This is applied to hotel services in Switzerland (which is not the subject of this article).

- Reduced rate of 2.5% – This applies to the most useful goods, such as non-alcoholic beverages, foodstuffs, newspapers, books, magazines and medicines.

Taxation of tobacco and alcohol

As for pineapple, be aware that all import taxes are specified when you search for customs duties on the Swiss Customs Tares system.

Monopoly duty (tax on spirit drinks)

This duty is levied on all beverages containing more than 1.2° of alcohol. This tax is deducted by the Swiss customs authorities from your importer’s customs account. If you do not have a customs account, you will have to pay this tax directly to the Swiss customs office concerned. The two possible means of payment are by credit card or cash.

Beer Tax

In Switzerland, a special tax exists on both the production and import of beer. It is 13 CHF per 100kg gross, for imports of containers containing more than 2 hectoliters of beer, but also for imports of beer contained in glass bottles not exceeding 2 liters per bottle. For containers containing between 2l and 2hl, this tax is 8 CHF per 100 kg gross.

However, since Vietnam benefits from the GSP customs treatment, Vietnamese beers are not subject to this tax when imported.

Glass beverage packaging (Advance Disposal Fee)

The purpose of this tax is to finance the costs of recycling and disposal of bottles and other glass packaging. This tax is also valid for imports. It must be paid to an organization designated by the Federal Office for the Environment. More information is available on this page of the Swiss customs website.

Tobacco tax

Tobacco products produced in Switzerland or imported are taxed according to the type of product. Also, tobacco products containing cannabis with a THC content of less than 1% are allowed in Switzerland, and are specially taxed. If they have more than 1% THC, these products are illegal in Switzerland. For more information about import taxes on tobacco products, please consult the notices written for each type of product.

How can I get an exemption from customs duties?

There are several situations where you can be exempted from customs duties in Switzerland:

- If the re-imported goods had been permanently exported from Switzerland, all by yourself (for example defective products)

- If they are works of art and cultural items intended for museums

- If the goods are personal effects imported as part of a move

- If the goods are temporarily imported and must be re-exported within a certain period of time, without having been processed in Switzerland

- If the goods are temporarily imported and must be re-exported after having undergone repairs or processing in Switzerland

- If the goods come from developing countries (including Vietnam) and are eligible for the provisions of the Generalized System of Preference.

We will explain the GSP in more detail in the following lines. If you wish to have more information on the other situations listed, please consult the page of importation in Switzerland.

The Generalized System of Preferences (GSP)

Switzerland, like the EU, allows importers of goods produced in developing countries to benefit from tariff preferences. These preferences take the form of a reduction or total exemption from customs duties, to promote the social and economic development of these countries. Vietnam is one of these encouraged countries.

Depending on the items you are importing, they can benefit from an exemption or a reduction of customs duties. Some products considered too competitive internationally do not benefit from this measure, this is the case of most textile products.

To benefit from the GSP for an import from Vietnam, you must provide customs with the Certificate of Origin (Form A) produced in French or English, as well as the declaration of origin on invoice. Please note that this procedure is specific to Vietnam. Other countries of origin, registered in the GSP, have different formalities described here.

Suspension or tariff quota

Duty suspensions are measures allowing Swiss industries to import raw materials or semi-finished products necessary for their activity with an exemption. This measure is intended to strengthen the competitiveness of Swiss industries. The prerequisite for the temporary suspension of taxes is that the customs examination of the economic reasons for the request is accepted, and that the products concerned cannot be sourced in Switzerland or in insufficient quantities. Follow the link on the Swiss Customs website for more information on tariff suspensions.

Tariff quotas in Switzerland are preferential customs treatments for certain imported goods belonging to the agricultural sector. Several preferential provisions are part of the tariff quota. Thus you can benefit from the quota for various reasons. More information is available on the Swiss customs page about the tariff quota.

Does Docshipper charge customs duties?

DocShipper does not charge customs fees. All documents, including European customs documents, are returned to you with a statement that we do not charge a fee.

Because our professionals produce the appropriate documents for you to present to customs, DocShipper collects the customs clearance fees. The government collects the taxes and duties.

Forbidden items

- Narcotics and drugs

- Pornographic materials

- Counterfeit products

- Hazardous waste materials

- Animal products and live animals (except for pets)

- Weapons, ammunition, and explosives

- Radioactive materials

- Toxic and hazardous substances

Limited items

- Alcohol and tobacco products (limited quantities allowed for personal use only)

- Plants and plant products (subject to plant quarantine requirements)

- Electronic products (require certification from the Indonesian Ministry of Communication and Information)

- Medical devices and pharmaceutical products (require certification from the Indonesian Ministry of Health)

- Food products (require certification from the Indonesian Ministry of Agriculture)

- Cosmetics and personal care products (require certification from the Indonesian Food and Drug Administration)

Switzerland Customs

Official name: Swiss Federal Customs Administration

Website: Swiss Customs

Documents required

Packing list

The packing list is a document created by carriers for various supply chain partners. This official document, which is required for all sea and air shipments, lists all product and packaging details for each shipment.

Bill of Lading

The Bill of Lading is a shipping document that certifies that the exporter has shipped the items listed on the document. This formal agreement defines the terms and conditions of the contracts between the carrier and the shipping company in charge of the goods. For example, the price of the items is disclosed, as well as the names of the many locations to which the products are shipped.

The bill of lading is a legally binding document that must be followed exactly as written. It also includes all the information necessary to properly manage and report the cargo.

The air cargo variant of this document is called an Air Waybill (AWB).

Certificate of Origin

The certificate of origin guarantees the origin of the items being transported. This document, necessary in international trade, specifies the country of manufacture, which should not be confused with the country of origin of the goods. It is therefore the nation in which the articles were created that is specified in this official document. This document is necessary to benefit from reduced customs taxes on certain types of goods.

Original Invoice

You must receive an official invoice to clear your goods through customs in Vietnam and France. It is essential to verify that the invoice number and the packing list number are identical.

Prohibited or Restricted Products

Licenses and/or permits are required for certain goods and/or objects, as well as specific and severe import restrictions. Some items are even prohibited from entering France or Europe. To check if your product is legal on the national or continental territory, consult the list below:

Restricted products

- Animals

- Agricultural products

- Alcohol, Tobacco

- Chemical product

- Livestock feed

- Food supplements

- Pharmaceutical products

Prohibited products

- Explosives

- Drugs

- Weapons

- Pornography

- Counterfeit products (textiles, accessories, medicines, electronics, etc.)

- Ivory

DocShipper Advice :

More than 10 years of expertise on the Asian continent, allows us to offer tailor-made freight solutions at more than competitive prices. Do not hesitate to contact our dedicated specialists for more information on your transfer, we are always happy to serve and disseminate our knowledge, we respond within 24 hours!

Other logistics services

Warehousing and storage

We offer comprehensive warehousing services in China, with multiple distribution centers located in key urban areas to ensure efficient and timely delivery of your merchandise to Thailand. Our experienced team is equipped to handle complex logistics needs, including consolidation of orders from multiple suppliers or splitting of containers for later shipment. You can trust us to ensure the safe and secure storage of your goods with our advanced inventory management systems and strict security protocols. For more information on our warehousing services, please refer to our dedicated article : Warehousing services

Packaging and repackaging

Calculating the assurance for transportation involves multiplying the premium rate by the pronounced sum. The cost of insurance can vary based on several factors, including the mode of transportation, the nature of the cargo, and the insurance company. To accurately determine the cost, it is essential to declare both the shipping charges and the value of the goods. For further information on transportation insurance, we invite you to consult our dedicated article : Packing services

Transport insurance

The measure of assurance for transport is determined with premium rate x pronounced sum. The protection rate changes as indicated by the strategy for transportation utilized, the sort of merchandise and the insurance agency... In order to be aware of the exact amount, the supporter has to proclaim the measure of costs that is related to the transportation just as the worth of the merchandise. Check our dedicate article : Transport insurance

Supplier management in China

We take a proactive approach to ensure seamless operations and customer satisfaction. As such, we initiate contact with your supplier well in advance to provide a comprehensive service that guarantees the quality of the products you receive. Our team is proficient in evaluating product attributes such as CE standards, product condition, and packaging, and will ensure that the products are packaged appropriately before being dispatched under our close supervision. With our commitment to exceptional service, we guarantee a hassle-free experience from start to finish. Our team, which is fluent in Mandarin, English, and French, has the necessary expertise to verify crucial details such as accurate measurement and proper HS code classification of your goods. More information can be found on our dedicated page: Sourcing service

Shipment of personal effects

Are you in the midst of planning a relocation, or have you recently returned from a trip that has left you with a surplus of luggage to manage? Do you find yourself grappling with the complexities of packing, storage, packaging, or customs clearance? Let us alleviate the burden of packing, storage, packaging, and customs clearance for your upcoming move or unexpected return from a busy trip. We offer comprehensive solutions for transporting your belongings from China to Europe, or any other destination around the globe. Rest assured, we take ownership of the logistics and handle everything with care and attention to detail. More informations on our dedicated page : Moving services

FAQ | Freight between Vietnam and Switzerland | Rates – Transit times – Duties & Taxes – Advices

The best way to travel between Vietnam and Switzerland depends on several factors. These factors are the nature of the goods, the quantity, the size, the route, the point of departure and the point of arrival ... By taking all this into account, it will then be possible to suggest the best means of transport for you.

It depends on your experience with Swiss customs. If you have never, or only occasionally, cleared goods for import into Switzerland, it is highly recommended to use the services of a customs broker, such as FNM Vietnam. If you are an experienced importer, doing it yourself should not cause any delays and unforeseen costs.

The CO guarantees that the goods sent have an origin and come from a traceable place. This document can be issued by a notary office or an administration. It is important that you have it in order to take advantage of the Common Effective Preferential Tariff (CETP) that exists between the two nations.

These taxes are customs charges applied by the country on foreign goods crossing its customs territory. This taxation is also called transit tariff.

Docshipper offers you a storage and packaging service : As a company with experience, we have our own warehouse sites, which we offer solutions to more easily check your goods at any time, and so avoid unpleasant surprises