Shipping stuff between Vietnam and Canada? Seems easier to herd cats, doesn't it? As a business owner, it's not uncommon to feel daunted by the complexities of figuring out freight rates, unpredictable transit times, and the labyrinth of customs regulations. Rest assured, this guide will de-mystify these unknowns and make international shipping less intimidating. We will walk you through different freight options (air, sea, road, and rail), break down the process of customs clearance, and help understand any associated duties and taxes. Further, we'll provide tailored advice to help your business overcome common pitfalls and factors that could affect your shipments. If the process still feels overwhelming, let FNM Vietnam handle it for you! As experienced international freight forwarders, we work tirelessly to turn these daunting challenges into a friction-free, successful shipping experience for your business.

Summary

Which are the different modes of transportation between Vietnam and Canada?

Choosing your transport method from Vietnam to Canada is like planning the best route for a global treasure hunt. With thousands of miles and oceans in between, it's no walk in the park. Should you fly like a bird or sail like Columbus? Maybe ride the 'Iron Horse'? Each road has its pros and cons. This guide will help you make sense of it all, balancing your cargo needs, delivery speed, and budget, while juggling various international rules. Strap in as we explore these options, making your shipping decisions smoother than a well-oiled engine.

How can FNM Vietnam help?

Need to ship goods from Vietnam to Canada? FNM Vietnam simplifies that for you. We handle all the weighty paperwork, secure optimal transport routes, and even steer you clear of customs hassles. Ready to elevate your shipping experience? Our consultants are just a call away. Contact us for a free estimate within 24 hours.

FNM Vietnam Tip: Sea freight might be the best solution for you if:

- You're moving big loads or large items. Sea freight offers roomy, cost-effective solutions.

- Your shipment isn't time-critical. Ocean routes take longer but are often more reliable.

- Your supply chain links major ports, tapping into a broad network of sea lanes.

Sea freight between Vietnam and Canada

Ocean shipping: a term quite popular among the trading circles of Vietnam and Canada. These countries enjoy a thriving trade relationship that often weaves its way through bustling cargo ports like Port of Hai Phong and Port of Ho Chi Minh City in Vietnam, and Port of Vancouver in Canada. These ports not only connect key industrial hubs but also serve as lifelines for high-volume goods. If you're dealing with such cargo, sea freight should be your go-to move. It's slow, but boy, is it cost-effective!

But here's a 'sea' secret: Ocean shipping can be tricky. Many shippers learn this the hard way. The waves of shipping regulations, customs clearances, and container specifics can cause a shipload of confusion, leading to costly mistakes. It's like trying to sail without a compass—tough, isn't it? Don't fret! Our simple and straightforward best practices are your compass, guiding you smoothly with the ins and outs of shipping between Vietnam and Canada. Stay tunned and let's turn those frowns into smiles.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Located on the Cam River Delta, Northeast of Haiphong city, this port is pivotal in Vietnam's maritime trade, with a shipping volume of over 40 million tons annually.

Key Trading Partners and Strategic Importance: It operates extensive trade routes with key partners such as China, South Korea and the U.S, and holds a vital position as the main maritime gateway to Northern Vietnam.

Context for Businesses: If you're focusing on trade in Northern Vietnam or markets with direct connectivity, consider the Port of Hai Phong due to its strategic location and sizable shipping volume.

Port of Saigon

Location and Volume: Nestled on the Saigon River, Ho Chi Minh city, this is one of the busiest ports in Vietnam, handling over 140 million tons annually.

Key Trading Partners and Strategic Importance: A key player in exchanges with ASEAN countries, U.S, Europe, and Japan and also has strategic prominence due to its accessibility to the Vietnamese industries, hence, being the largest potential consumer market.

Context for Businesses: If your business aims to target the ASEAN region or large Vietnamese consumer markets, the Port of Saigon's high traffic volume and industrial proximity make it an obvious choice.

Port of Cai Mep-Thi Vai

Location and Volume: Located in the South East region of Ho Chi Minh City, Cai Mep-Thi Vai commands prominent shipping volume of over 140 million tons each year.

Key Trading Partners and Strategic Importance: Primarily transacts with the U.S, China, Europe, and earned its strategic importance for being the only port in Vietnam capable of directly receiving international mother vessels.

Context for Businesses: If direct international connectivity, especially with the U.S or China, is central to your business, Port of Cai Mep-Thi Vai should be in your shipping strategy due to its distinctive direct shipping capabilities.

Da Nang Port

Location and Volume: Situated in Central Vietnam on the Han river, Da Nang port manages a shipping volume of over 12 million tons per annum.

Key Trading Partners and Strategic Importance: Key trade relations include Japan, China, and South Korea, marking its strategic importance due to its central location, acting as a crucial logistic hub for the Central and Western Highlands of Vietnam.

Context for Businesses: If your business strategy involves markets in Central Vietnam or the Western Highlands, the Port of Da Nang, due to its optimal location, would be a beneficial consideration.

Port of Vung Tau

Location and Volume: Located in Southern Vietnam, the Vung Tau port handles an annual shipping volume of 130 million tons.

Key Trading Partners and Strategic Importance: It has multiple trade connections, most notably with ASEAN countries, the U.S, and China. This port boasts strategic importance as it's the leading port for containers, coal, and oil products in Vietnam's Southern region.

Context for Businesses: Should your business involve container shipping or oil-related industries, the Port of Vung Tau, with its specialized handling capabilities, will prove valuable for your logistics strategy.

Cam Ranh Port

Location and Volume: Situated on the South Central Coast, Cam Ranh port manages a shipping volume of 1.5 million tons per year.

Key Trading Partners and Strategic Importance: The port primarily trades with India, Australia, and Japan, gaining its strategic importance through its distinctive ability to handle and repair aircraft and warships.

Context for Businesses: If your commerce is defense-related or involves interaction with India, Australia or Japan, incorporating Cam Ranh port in your transportation strategy would have pertinent implications.

Main shipping ports in Canada

Port of Vancouver

Location and Volume: Located in Vancouver, British Columbia, this port is the largest in Canada as it handles the largest volume of goods with a shipping volume of around 142 million tons. It's a key player in Canadian exports, bringing goods to over 150 trading economies globally.

Key Trading Partners and Strategic Importance: This port has strong trading relationships with several economies, including the USA, China, Japan, and South Korea. Its strategic location and its diverse range of cargo further make it a vital part of Canada's maritime industry.

Context for Businesses: If your business is looking to expand international reach, particularly in the Pacific region, the Port of Vancouver could play a pivotal role in your logistics strategy due to its high trading volume and global connections.

Port of Montreal

Location and Volume: Situated in Montreal, Quebec, this port stands as the second busiest port in Canada, with an annual traffic volume of approximately 35 million tons.

Key Trading Partners and Strategic Importance: Dominant trading partners include Europe and the Mediterranean, but it also has significant trading volumes to North America, Africa, and the Middle East. The Port of Montreal is notably vital for container transport.

Context for Businesses: If your business specializes in containerized goods or seeks to tap into the trade markets of Europe and the Mediterranean, the Port of Montreal could be an integral point in your supply chain.

Port of Prince Rupert

Location and Volume: Located in the city of Prince Rupert, British Columbia, this port is outstanding in terms of the shipping potential it offers to businesses. It manages approximately 23 million TEU.

Key Trading Partners and Strategic Importance: The Port of Prince Rupert is a critical gateway to Asian markets. It's Canada's closest port to Asia with a strategic benefit of 58 hours' sailing time saving compared to other West Coast Ports.

Context for Businesses: If your business heavily involves trade with Asia, the Port of Prince Rupert can prove an efficient logistical route due to its proximity to the continent.

Port of Halifax

Location and Volume: Situated in Halifax, Nova Scotia, this port is known for its colossal capacity, handling a volume of around 5 million TEU annually.

Key Trading Partners and Strategic Importance: The Port of Halifax has global connections but boasts strong trading ties mainly with Europe, the Mediterranean, the Middle East, and the Indian Subcontinent. It houses the largest container terminal in Eastern Canada.

Context for Businesses: If your supply chain serves markets in Europe or the Indian Subcontinent, integrating the Port of Halifax could ensure seamless and voluminous transport of your goods.

Port of Hamilton

Location and Volume: Located in Hamilton, Ontario, along the West end of Lake Ontario, this port principally serves the Great Lakes region and manages a volume of about 11 million tons annually.

Key Trading Partners and Strategic Importance: It mainly entertains trade within North America, serving as Canada's busiest port on the Great Lakes. Its strategic importance lies in its strong connections to the industrial heartland of the region.

Context for Businesses: If your operations revolve around North American trade, particularly involving Great Lakes region, the Port of Hamilton could substantially bolster your logistics efficiency.

Port of Toronto

Location and Volume: Situated in Toronto, Ontario, this port is particularly relevant to businesses serving central and eastern Canada and the US. It handles an annual volume of over 2.3 million tons of cargo.

Key Trading Partners and Strategic Importance: The Port of Toronto has significant dealings with partners across the Great Lakes region, North America, and the St. Lawrence Seaway System. It's a well-rounded shipping hub, catering to a wide range of commodities.

Context for Businesses: If your company engages in diverse cargo types or looks to optimize logistics within North America, particularly the Great Lakes region, the Port of Toronto could serve as a reliable hub in your trading network.

Should I choose FCL or LCL when shipping between Vietnam and Canada?

Choosing between Full Container Load (FCL) and Less than Container Load (LCL) when shipping from Vietnam to Canada marks a crucial milestone in your logistics journey. Both methods have their merits, affecting your shipping cost, delivery schedule, and overall logistical success. This section sheds light on these sea freight options, empowering you to make informed decisions that align with your business's unique shipping needs. Let's dive in and determine which approach - FCL or LCL - might just be your golden ticket to seamless international shipping.

LCL: Less than Container Load

Definition: LCL (Less Than Container Load) shipping brings together goods from different shippers into a single container. Sugested when the cargo volume doesn't justify the cost of a whole container.

When to Use: Choose LCL shipment if the cargo volume is less than 13-15 CBM. Being a cost-effective and flexible solution, it showcases value for smaller shipments ensuring you pay only for your cargo's space within the shared container.

Example: Imagine a Vietnamese manufacturer shipping 10 CBM of electrical components to a retailer in Canada. Choosing LCL shipping instead of a full container (FCL) saves cost, as the price would be relative to the space utilized.

Cost Implications: While LCL freight is more cost-effective for small volumes, bear in mind, it generally has a higher cost per CBM compared to FCL. This situation is due to the additional logistics involved such as separate handling, processing, and warehousing of LCL commodities. Thus, the overall cost would be more economically beneficial once you start moving more substantial load volumes.

FCL: Full Container Load

Definition: FCL, or Full Container Load, is a type of shipping where an entire container, either a 20'ft or a 40'ft, is dedicated solely to your goods. This option, also known as FCL shipping, ensures the seal of the container remains intact from origin to destination, adding a layer of security.

When to Use: If your cargo measures more than approximately 13/14/15 CBM, FCL can be a more cost-effective and secure choice. The essence lies in the volume-above this capacity, the FCL shipping quote often becomes cheaper than various LCL, or Less than Container Load, quotes.

Example: Imagine you're shipping furniture from Ho Chi Minh City to Toronto. Your shipment could fill up more than half of a 20'ft container, in this case, using an FCL container for a one-time, high-value shipment ensures safety and is economically smart.

Cost Implications: While the upfront FCL shipping quote may seem steep, remember it's a fixed cost covering your entire cargo. This is where the metric of volume kicks in- the larger the shipment, the more cost-effective FCL becomes. Smaller shipments can opt for LCL, where costs are distributed among multiple shippers sharing the same container.

Say goodbye to shipping headaches!

Got logistics woes from Vietnam to Canada? Rely on FNM Vietnam – your freight forwarder committed to making cargo shipping smooth and efficient. Whether you're considering consolidation or a full container, our ocean freight experts are here to assist. Leverage our deep expertise in assessing shipment size, timing, costs and customs processes to tailor the best shipping strategy. Ready to streamline your ocean freight? Request a free, no-obligation quote from us today.

How long does sea freight take between Vietnam and Canada?

Shipping your goods from Vietnam to Canada by sea freight generally takes about 29 to 36 days. However, the total transit time is influenced by several factors. For instance, the specific ports used, the weight of your shipment, and the nature of the goods all play a role in determining the overall duration. For an accurate and personalized quote, it's best to contact a veteran freight forwarder such as FNM Vietnam.

Following is a quick reference guide indicating average transit times between the main freight ports in both countries:

| Vietnam Port | Canada Port | Average Transit Time (in days) |

| Port of Hai Phong | Port of Vancouver | 28-33 |

| Port of Hai Phong | Port of Montreal | 35-40 |

| Port of Ho Chi Minh City | Port of Vancouver | 22-27 |

| Port of Ho Chi Minh City | Port of Montreal | 37-42 |

*Please note these times are averages and actual times may vary.

How much does it cost to ship a container between Vietnam and Canada?

Estimating the shipping cost between Vietnam and Canada isn't a simple calculation. The price could range widely, depending heavily on multiple factors like Point of Loading, Point of Destination, carrier choice, nature of goods, and the monthly market shifts affecting ocean freight rates. We understand that this variability can be daunting, but worry not, our shipping specialists are at your service. Working with you closely, we'll analyze your specific freight needs, scan the market, and provide you with the most competitive rates aligned with your requirements. This personalized, case-by-case approach ensures you receive the best service and shipping terms every time.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (OOG) Container is specifically made for cargo that exceeds the dimensions of a standard shipping container. They are ideal for large and heavy items that can't be dismantled.

Suitable for: Any large or awkwardly shaped items that outstretch standard container sizes.

Examples: Certain types of machinery, houses, large statues, cable reels, industrial equipment, and architectural structures.

Why it might be the best choice for you: If your cargo dimensions don't align with the sizes of the traditional shipping containers, an OOG container can accommodate your items maintaining their intact form during transportation.

Break Bulk

Definition: Break Bulk refers to good that needs to be loaded individually, and not in containers nor in bulk. It's designed for goods that are oversized or overweight.

Suitable for: High-volume goods not fitting in a container, like construction equipment.

Examples: Manufactured goods, oversized vehicles, boilers, generators, wood, steel, or iron beams.

Why it might be the best choice for you: If you have high volume, non-containerized cargo, break bulk would allow for individual loading and unloading, minimizing the potential of damage.

Dry Bulk

Definition: Dry Bulk involves transporting unpackaged goods in large quantities. These goods often include commodities like grain, coal or minerals.

Suitable for: Loose cargo load of homogeneous and hardy commodities not vulnerable to elements exposure.

Examples: Coal, iron ore, grain, bauxite, sand or fertilizers.

Why it might be the best choice for you: If you need to ship large quantities of commodities that are not sensitive to exposure, dry bulk can be an efficient and cost-effective option.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) ships are vessels designed for carrying wheeled cargo that can be driven on and off the ship on their own wheels or using a platform vehicle.

Suitable for: Vehicles, trailers, semi-trailer trucks, trailers, and railroad cars.

Examples: Cars, trucks, construction equipment, and agriculturally used machinery.

Why it might be the best choice for you: If you're transporting wheeled machinery or vehicles, the Ro-Ro vessel simplifies the loading and unloading process, saving substantial manpower and cost.

Reefer Containers

Definition: Reefer Containers are refrigerated shipping containers for cargo requiring temperature-controlled environments.

Suitable for: Perishable commodities requiring a consistent temperature or humidity level during transit.

Examples: Fresh or frozen food, plant products, pharmaceuticals, chemicals, and electronic equipment.

Why it might be the best choice for you: If your cargo is temperature-sensitive, a reefer container will ensure the optimal condition of your goods from departure to arrival.

FNM Vietnam is committed to facilitating your shipping experience. For more guidance on which shipping method complements your requirements, feel free to contact us for a free shipping quote. We'll respond in less than 24 hours to discuss your needs.

FNM Vietnam Tip: Air freight might be the best solution for you if:

- You're on a tight schedule. Air freight delivers speed unmatched by other modes.

- Your cargo is under 2 CBM, a good fit for air's smaller capacity.

- Your destination is off the usual routes, making air's global network a key asset.

Air freight between Vietnam and Canada

When it comes to swift and reliable shipping, air freight from Vietnam to Canada steals the spotlight. Picture this: your high-tech electronic components zipping through the skies, landing safely within days. It's a boon for businesses with small, high-value products craving speed. Yet, many overlook the nuances of air freight, like using the right weight formula to estimate costs. Consider this: using box dimensions instead of actual weight in your calculations - a common slip leading to unpleasant surprises. To triumph in air freight, it's all about knowing the rules of the game. Now, let’s dive into the nitty-gritty of avoiding these costly blunders.

Air Cargo vs Express Air Freight: How should I ship?

Ready to discover the best shipping option for your Vietnam-Canada shipments? Let's dive into the world of air cargo and express air freight! Keep it simple: air cargo is your go-to for bulk shipping on commercial airliners, while express air freight speeds things up, chartering entire planes just for your goods. Choosing the right one can drastically impact your business's efficiency and bottom line - let's figure it out together!

Should I choose Air Cargo between Vietnam and Canada?

Air cargo is a reliable and cost-effective method for shipping goods between Vietnam and Canada. Prominent airlines such as Vietnam Airlines and Air Canada offer robust cargo services. However, anticipate longer transit times due to fixed schedules. This method becomes increasingly attractive for shipments exceeding 100/150 kg (220/330 lbs). If you're seeking a balance between price and speed, air cargo could be a favorable choice for your business needs.

Should I choose Express Air Freight between Vietnam and Canada?

Express air freight, like that provided by FedEx, UPS, or DHL, is an ultra-fast, dedicated logistics service, focusing solely on cargo with no passengers. If your business needs to transport goods less than 1 CBM or under 100/150 kg (220/330 lbs), this option delivers them promptly. As a business, time could be your most significant asset, and express air freight can help safeguard it. For example, if you're shipping high-demand items, avoiding those inventory out-of-stock situations can result in happy customers and a healthier bottom line.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Tan Son Nhat International handles approximately 1 million metric tons of cargo annually.

Key Trading Partners: The United States, China, and Japan are significant trading partners, with the focus on electronics, fashion, and machinery.

Strategic Importance: Located in Ho Chi Minh City, it's the busiest airport in Vietnam, offering a strategic connection to Southeast Asia and beyond.

Notable Features: With two cargo terminal facilities, it can accommodate all types of goods and offers a range of services including 24/7 customs clearance.

For Your Business: If your business involves regular shipping in the southern region of Vietnam and with key Asia-Pacific economies, Tan Son Nhat provides the needed connectivity and reliability.

Noi Bai International Airport

Cargo Volume: Noi Bai International handles about 700,000 metric tons of cargo each year.

Key Trading Partners: Key trade partners are China, South Korea, and Japan, focusing on industries like fresh produce, textiles, and electronics.

Strategic Importance: Situated in Hanoi, it serves as the main gateway to Northern Vietnam and acts as a vital link to other Asian countries.

Notable Features: Includes a cargo terminal with certified handling capabilities for all cargo types, including temperature-sensitive goods.

For Your Business: If your trade involves perishable goods or you need strong links with Northern Vietnam and other Asian markets, Noi Bai offers tailored solutions for effective logistics.

Da Nang International Airport

Cargo Volume: Da Nang International processes more than 50,000 metric tons of cargo annually.

Key Trading Partners: Significant trading partners include countries in Southeast Asia, with emphasis on textiles, footwear, and coffee.

Strategic Importance: Located in Central Vietnam, this airport offers appropriate connectivity to both southern and northern regions of the country.

Notable Features: The airport features proficient handling and storage capabilities, ensuring smooth transit of goods.

For Your Business: Suited for businesses focused on Asian markets and requiring a strategic location for goods consolidation in Vietnam, Da Nang International could serve your need effectively.

Cần Thơ International Airport

Cargo Volume: Processes about 150,000 metric tons of cargo yearly.

Key Trading Partners: Places like Taiwan, South Korea, and Japan are key trading partners, heavily focusing on fisheries, agriculture, and textiles.

Strategic Importance: Situated in the Mekong Delta region, it provides access to a populous and agriculturally rich region of Vietnam.

Notable Features: Cần Thơ International has modern cargo handling facilities and can handle all types of goods.

For Your Business: If your supply chain heavily relies on agricultural products and seafood from Mekong Delta, Cần Thơ International can be an apt choice.

Cát Bi International Airport

Cargo Volume: Cát Bi handles approximately 15,000 metric tons of cargo annually.

Key Trading Partners: Shared trading partners include China, Hong Kong, and South Korea specializing in machinery, chemicals, and textiles.

Strategic Importance: Positioned in the northeastern region, it acts as a key mid-way point between Hanoi and Quảng Ninh Province's major industrial zones.

Notable Features: Ensures seamless transfer of goods also offering custom clearance, ground handling services, and warehousing.

For Your Business: If you seek a strategic location for operations between Hanoi and China or need smooth transit in northeastern Vietnam, Cát Bi International can be an excellent choice.

Main international airports in Canada

Toronto Pearson International Airport

Cargo Volume: Toronto Pearson handles around 45% of Canada's air cargo, making it the busiest cargo airport in the nation.

Key Trading Partners: Top trading partners involve countries such as the United States, China, and The United Kingdom.

Strategic Importance: Boasting a convenient location, this airport provides excellent links to the highly populated eastern seaboard of North America. Its proximity to Toronto's urban and industrial centers makes it strategically vital for freight forwarders.

Notable Features: With two operating terminals and extensive cargo facilities, the airport is well-equipped to handle a high volume of cargo traffic and can accommodate a wide variety of cargoes.

For Your Business: If your business frequently ships to or from the United States, Europe, or Asia, you may find Toronto Pearson a highly convenient transport hub. It's especially suited for high volume, time-critical shipments due to its extensive cargo handling capabilities and capacity.

Vancouver International Airport

Cargo Volume: Vancouver International handles over 25% of Canada's air cargo, making it a significant player in the nation's air transport industry.

Key Trading Partners: Major trading partners include the United States, China, Japan, and South Korea.

Strategic Importance: Vancouver International is Western Canada's gateway to Asia and the US. Its strategic location makes it a crucial transport hub for trans-Pacific and North America-Asia shipping lanes.

Notable Features: The airport's state-of-the-art cargo terminal facilities accommodate everything from courier shipments to large-scale freight.

For Your Business: If your enterprise involves trans-Pacific deliveries or the Asia-Pacific forms a significant portion of your market, the Vancouver International would be an efficient churning infrastructure for optimal customer satisfaction.

Montréal–Pierre Elliott Trudeau International Airport

Cargo Volume: Handling around 8% of Canada's total air cargo, Montreal Trudeau is the third largest cargo airport in the country.

Key Trading Partners: France, United States, Germany, and the United Kingdom form the major trading partners.

Strategic Importance: Geographically situated to cater to the Atlantic market, it provides essential strategic potential particularly for businesses involved in the Europe-Canada or vice-versa supply chain.

Notable Features: High-quality cargo services and a highly connected freight network allow it to handle a wide range of cargo types.

For Your Business: Businesses dealing in European goods or serving European customers might find Montreal Trudeau as an excellent access point to reach European markets swiftly and efficiently.

Calgary International Airport

Cargo Volume: Home to 7% of Canada's total cargo, Calgary International is a key logistics hub in Western Canada.

Key Trading Partners: Featuring Main trading partners such as the United States, Europe, and Asia.

Strategic Importance: Calgary International offers a direct, efficient gateway to the US and Asian markets, as well as to Europe. This airport's central location in the continent is ideal for businesses needing quick access to multiple markets.

Notable Features: The airport has a state-of-the-art 100,000 sq ft cargo facility combined with extensive freight forwarding services.

For Your Business: Businesses focusing on transcontinental trade involving Asia, Europe, or America would benefit from the strategic location of Calgary International.

Edmonton International Airport

Cargo Volume: Handling around 7% of Canada’s air cargo, Edmonton is among the top cargo airports in Canada.

Key Trading Partners: Major trading partners involve the United States, China, and Europe.

Strategic Importance: As part of the Alberta Industrial Heartland, the airport garners high strategic importance. It serves as a crucial hub for trade involving oil, gas, and pharmaceutical industries.

Notable Features: It hosts a full-service cargo operation capable of accommodating large cargo aircrafts.

For Your Business: Businesses involved in oil, gas, pharmaceutical or perishable goods might find Edmonton International advantageous due to its cargo-specific facilities and strong intermodal connectivity.

How long does air freight take between Vietnam and Canada?

Typically, air freight shipping between Vietnam and Canada averages around 5-8 days. However, this timeline can significantly deviate depending on the dispatch and arrival airports, the weight of your shipment, and the type of goods you're transporting. For example, some items may require additional customs checks or special handling, potentially causing delays. To navigate these variables and receive the most accurate shipping timeframes, we recommend scheduling a consultation with a seasoned freight forwarder, such as FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and Canada with air freight?

The average cost of air freight from Vietnam to Canada ranges widely from $3 to $10 per kg. However, it's critical to note that exact pricing is influenced by various factors - airport locations, parcel dimensions and weight, the nature of the goods, etc. Rest assured, our team is committed to providing optimal rates tailored specifically to your needs. We pride ourselves on our bespoke quoting services, treating each business case individually. For a personalized and free quote in less than 24 hours, please contact us.

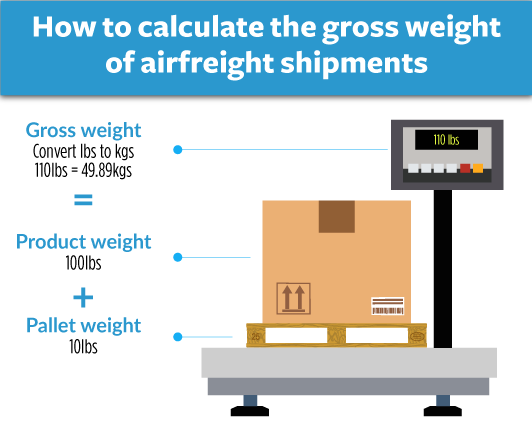

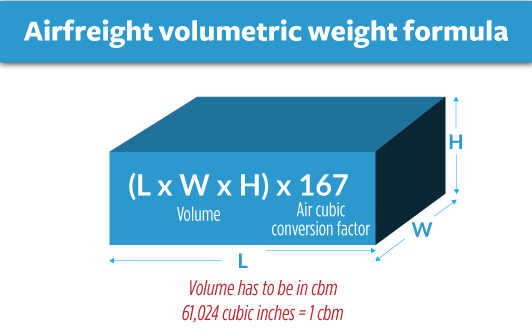

What is the difference between volumetric and gross weight?

Sure, let's first define these two important concepts. Gross weight is the actual weight of your shipment, including the goods and all packaging. Volumetric weight, on the other hand, is a value derived from the space your shipment takes up, rather than its actual weight.

Now, how do we calculate these? In Air cargo, volumetric weight is calculated by multiplying the length, width, and height of each package (in centimeters) and then dividing by 6000. For Express Air Freight services, the division is by 5000 instead.

Here's a quick example:

Let's assume your package dimensions are 50 cm (L) x 40 cm (W) x 30 cm (H) and its actual weight is 20 kg (or 44 lbs). The volumetric weight in Air cargo would be 50x40x30/6000 = 10 kg (or 22 lbs), and in Express Air Freight, it would be 50x40x30/5000 = 12 kg (or 26.4 lbs).

So, why does this matter? Freight charges are typically determined by comparing the gross and volumetric weight - the higher of the two will be used. This way, carriers ensure they're compensated for transporting bulky, lightweight items that may take up more space than heavier, compact items.

FNM Vietnam Tip: Door to Door might be the best solution for you if:

- You seek hassle-free shipping. Door-to-door manages the entire process for you.

- You like one go-to contact. A dedicated agent oversees your door-to-door shipment.

- You aim to limit cargo handling. Fewer transitions mean less risk of damage or loss.

Door to door between Vietnam and Canada

Navigating the world of international shipping can feel complex, but ever thought about door-to-door options between Vietnam and Canada? It's seamless, handing off your goods at one location, only for them to reappear at your desired location. It's efficient, hassle-free, and often cost-effective for businesses. Eager to save time and money on your shipping? Then let's dive in!

Overview – Door to Door

Opting for door-to-door shipping between Vietnam and Canada eliminates the hassle of handling complex logistics yourself. It's a relief, especially when dealing with the intimidating maze of international shipping regulations. While it may initially seem costlier, door-to-door service can often be more economical in the long run by preventing clearance and storage fees. Notably, it's the top choice among FNM Vietnam's clients due to its streamlined simplicity. However, keep in mind that it requires trusting your logistics partner implicitly, as any errors on their part could have a ripple effect on your business. Grasp the convenience; weigh the responsibilities.

Why should I use a Door to Door service between Vietnam and Canada?

Ever wondered why sleepless nights are the unofficial freight forwarders’ club? This delightful cycle could be avoided with a Door to Door service. Here's why:

1. Stress-Free Logistics: One real beauty of Door to Door service between Vietnam and Canada is logistics peace. No more constant tracking and coordination! With goods pickup at source, your sleep schedule can remain undisturbed.

2. Urgent Shipments: Operating on a tight schedule? This service excels in precise timing. It lends you the 'Flash' powers, speeding your urgent shipments from Vietnam directly to Canada.

3. Specialized Care for Complex Cargo: Got something that resembles a spaceship component more than a regular package? Door to Door services handle complex and fragile cargo like professional baby-sitters - with dedicated care and patience.

4. Convenience Factor: Imagine your freight’s journey being one continuous ride - from Vietnam all the way to Canada. Door to Door service arranges everything, including the trucking until final delivery. Sit back and sip your coffee as your shipment navigates the logistics puzzle!

5. Timely Delivery: Lastly, it ensures your shipment's arrival doesn't coincide with major world events - it's superb for keeping delivery timelines intact!

Overall, Door to Door service between Vietnam and Canada is like a helicopter parent for your cargo, minus the annoying calls. It takes handling international freight in its stride, leaving you free to focus on your business. Sleep tight, the night-shift is on us!

FNM Vietnam – Door to Door specialist between Vietnam and Canada

Experience the ease of shipping with FNM Vietnam. We provide comprehensive, door-to-door shipping from Vietnam to Canada, managing all the details along the way. From packing to customs clearance and across all shipping modes, our dedicated Account Executives ensure a hassle-free process. Whether you're in need of a quick estimate or have questions, we're here to assist you. Get a free estimate within 24 hours or speak with our expert consultants at no cost. Let us take the stress out of international shipping for you.

Customs clearance in Canada for goods imported from Vietnam

Customs clearance involves navigating a busy crossroads of regulation, paperwork, and taxes when shipping goods between countries. The path from Vietnam to Canada is marked by complexities and potential hiccups such as unforeseen charges. It's crucial to know the ins and outs of customs duties, taxes, quotas, and licenses to avoid your goods getting waylaid. This guide will go in-depth on these critical matters, ensuring your shipping journey is smoothly navigated. Plus, our partner, FNM Vietnam, can assist throughout the process for all types of goods globally. For project estimates, reach out to our team supplying origin, value, and HS Code of your goods. Dive into the following sections to unlock a successful and efficient freight forwarding experience.

How to calculate duties & taxes when importing from Vietnam to Canada?

Knowing the ropes of calculating customs duties is like a ticket to smoother international trading. It's essentially based around five key components: the country of origin, the HS Code, the Customs Value, the Applicable Tariff Rate, along with any other taxes and fees applicable to your merchandise. Each of these factors plays a significant role in determining the overall cost of importing goods.

Now, let's unravel these components and make the process a little less daunting. The starting point of this journey is pinpointing the country where your goods were actually manufactured or produced. Getting this step right paves the way for an accurate estimation of duties and taxes, ultimately saving you from untidy surprises down the line. This is just the beginning, so gear up and let's explore deeper into the world of international shipping.

Step 1 - Identify the Country of Origin

Identifying the country of origin - that's Vietnam in our case - is more than just ticking a box. It's like setting the coordinates for your cargo's journey, and here's why:

1. Trade deals: Canada and Vietnam are part of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which affects your duty rates. Surprising, isn't it? Better rates might await if you know your deals.

2. Import restrictions: Canada has specific rules for Vietnamese goods. Your cargo could end up stuck in customs if you're not aware of these finer details.

3. Accurate duty calculation: It’s no guesswork - your cargo's origin is key to precise duty estimation.

4. HS code: Before you immerse yourself in the world of Harmonized System codes, you need your origin sorted. It's part of the puzzle.

5. Legal compliance: Tick off 'Vietnam' and you're on the safe side, legally speaking.

So, take time to verify your goods' origin - it's more than a routine step, it's the gateway to smooth sailing in international trade. That simple country tag could save you from choppy waters, cutting delays, reducing chances of fines, and often, slicing your duty fees! Who knew logistics could hold such treasure? Now you do. Enjoy the voyage!

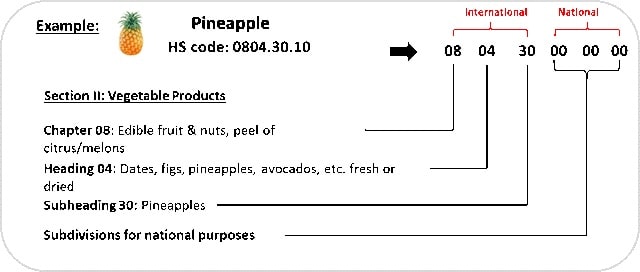

Step 2 - Find the HS Code of your product

The Harmonized System (HS) Code is an internationally standardized system of names and numbers used to classify traded products. Think of it as a universal language that helps you clarify exactly what you're shipping around the world. The HS code matters greatly as it informs customs about the contents of your package. This, in turn, determines the amount of taxes or duties payable for your exported goods.

Typically, your supplier would be the best source to provide you with the accurate HS code for your product. They are experts in their domain and fully aware of related import/export regulations.

In situations where the supplier isn't available, or you wish to verify the HS code, don't worry. We've got you covered with an easy, step-by-step process.

Firstly, access the Harmonized Tariff Schedule which is an HS lookup tool. Here, you can simply enter your product's name in the search bar.

The next step is to check the Heading/Subheading column. This is where you can locate the HS code corresponding to your product.

Be sure to remember this one crucial point—a small mistake in the HS code could lead to significant repercussions. Inaccuracies in the HS code can cause delays in shipment and might even lead to penalties. So, accuracy is paramount in this process.

To make things easier for you, here's an infographic showing you how to read an HS code.

Step 3 - Calculate the Customs Value

Understanding the customs value of your goods imported from Vietnam to Canada can feel like a Rubik's cube. So, here's a breakdown for you: Customs value isn't just about the price tag on the products. It's the total CIF (Cost, Insurance, and Freight) value. This CIF bit gets a bit technical, but stay with us.

Think of it like this: You purchase a shipment of products for $2000. Shipping costs are $300, and you've wisely paid $100 for insurance. So, the CIF value (the customs value of your goods) is $2400. That's $2000 Product Value + $300 Shipping Cost + $100 Insurance = $2400 CIF Value. That's the magic number you need to calculate your customs duties in the true north. Did you just crack that Rubik's cube? We bet you did!

Step 4 - Figure out the applicable Import Tariff

An import tariff is a tax imposed on goods imported into a country. In Canada, you'll often encounter the Most-Favored-Nation (MFN) Tariff and the Applicable Preferential Tariffs. To identify the import tariff for your product, here's what you need to do:

- Visit the Canada Border Services Agency's (CBSA) Customs Tariff page.

- Using the Harmonized System (HS) code identified earlier, search for your product.

- Check the tariff that applies to your goods when coming from Vietnam.

As a practical example, let the HS code be 610910 (T-shirts of cotton). The MFN Tariff could be 18%. To calculate your import duties, consider CIF (which includes Cost, Insurance, and Freight) as $10,000 USD. So, the import duty would be $10,000 (CIF cost) x 18% (tariff rate) = $1,800 USD.

Remember, tariffs can influence the final cost of your goods and can significantly impact your profit margins. So make sure to calculate your potential duties before shipping goods internationally.

Step 5 - Consider other Import Duties and Taxes

In addition to standard tariff rates, remember that other import duties can apply based on the product’s nature and origin. For instance:

1. Excise Duty: If you’re importing goods like alcohol or tobacco, an excise duty might apply. For example, the excise tax on spirits is typically around $12 per litre in Canada (keep in mind, this is just an example and the rates can vary).

2. Anti-Dumping Taxes: To protect local industries, Canada may impose these taxes on goods that are priced below market value. If you're importing steel from Vietnam priced at $500/ton while the average price is $700/ton, an anti-dumping fee might apply.

3. VAT (Value Added Tax): Most essential, you’ll have to pay VAT. In Canada, it’s known as the Goods and Services Tax (GST), a 5% tax assessed on the customs value of the imported goods.

Essentially, your landed cost formula could look something like this: Customs value (product cost + shipping + insurance) + Tariff rate + Excise Duty (if applicable) + Anti-Dumping Taxes (if applicable) + GST = Landed Cost.

Remember, every import scenario is unique, and costs can vary. Consulting a customs broker or your freight forwarder can provide more accuracy.

Step 6 - Calculate the Customs Duties

Calculating customs duties when importing goods from Vietnam to Canada combines various factors - customs value, VAT, anti-dumping taxes, and at times, Excise Duty. The formula factors in the CIF freight value (Cost+Insurance+Freight) and duty rates.

For instance, a $5000 shipment with a 20% customs duty results in a payable duty of $1000 ($500020%). If no VAT is applicable, your total due will be $1000.

In case VAT applies, its rate is applied to the sum of the customs value and duty value. For a $5000 shipment with a 20% customs duty and 5% VAT, the customs duty is $1000, and the VAT is $300, totaling $1300.

In a more complex scenario, with customs duties, VAT, and anti-dumping taxes plus Excise Duty factored in, the formula changes. For example, with a $5000 shipment, a 20% customs duty, 5% VAT, 15% anti-dumping tax, and 10% Excise Duty, the total due is customized to the calculated values.

For your convenience, let FNM Vietnam handle your customs clearance procedures. We ensure correct calculations and prevent overcharges. Contact us for a free quote and experience a hassle-free customs clearance globally within 24hrs.

Does FNM Vietnam charge customs fees?

FNM Vietnam, your trusty customs broker for Vietnam and Canada, doesn't charge customs duties. However, customs clearance fees are a part of our service. It's crucial to distinguish between these fees and the customs duties and taxes paid directly to the government. We maintain transparency by providing you with official documents from customs office, ensuring you only pay what's stipulated by the authorities. Think of us as your navigators through the often confusing sea of import and export fees. Your challenges are ours to alleviate, together we sail smoother shipping seas!

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs

Official website: https://www.customs.gov.vn/

Canada Customs

Official name: Canada Border Services Agency

Official website: https://www.cbsa-asfc.gc.ca/menu-eng.html

Required documents for customs clearance

Unsure how to get goods through customs? It's all about having the right paperwork. In this section, we'll demystify the jargon and detail key documents like the Bill of Lading, Packing List, Certificate of Origin, and Conformity Docs (CE standard) to ease your shipping worries.

Bill of Lading

As your freight moves from Vietnam to Canada, a Bill of Lading (BoL) is your best friend. Unlike a casual name-tag, this official document establishes proof of ownership—it's almost like a passport for your shipment! Once your goods are on the carrier, the BoL signals the shift of custody. And let's not forget about the convenience of a telex release, allowing for electronic transmission of the BoL. In today's digital age, it's faster, cutting down paperwork and wait times. You see, with ocean freight, BoL is the star, but for air cargo, the equivalent rockstar is the Air Waybill (AWB). The gist? Always ensure your BoL or AWB is correctly filled out and safely stored – it's the key to opening doors at customs!

Packing List

Imagine you're sending a much-awaited shipment from Hanoi to Toronto and it gets stuck at the border. Oops, an error in your Packing List! This key document provides a comprehensive view of your goods, from what's inside the shipping container to the gross weight down to the net, even the quantity and packaging type. It's your responsibility as a shipper to ensure every detail is right, whether using sea or air freight. A simple error like misreporting a product's weight could lead to undue customs delays or worse, goods returned. The importance of a meticulous Packing List? Think of it as your shipment's ID card, a must-have for that smooth journey from the vibrant streets of Vietnam to the bustling markets of Canada. Accuracy here spells the difference between a merry Canadian customer receiving their Vietnam-sourced items pronto and a logistical nightmare. Shipping isn't a guessing game, and your Packing List shouldn't be either.

Commercial Invoice

In international shipping, the Commercial Invoice is your golden ticket to a seamless customs experience between Vietnam and Canada. This document is your way of saying, Here's what's in my shipment, and here is its value. Without it, your goods could be in customs limbo, a place no business wants to be. Make sure to include detailed descriptions of the items, country of origin, recipient's contact details, and correct Harmonized System (HS) codes. These mundane but essential details can be the difference between quick customs clearance and long, costly delays. A common mistake? Misalignment between the Commercial Invoice and other shipping documents. So, double-check them all for consistency. Get this right, and you'll turn the customs clearance mountain into a molehill. Pro tip: Always back up electronic copies; it is the insurance you never knew you needed!

Certificate of Origin

Shipping between Vietnam and Canada? Navigating customs can be challenging, but the Certificate of Origin (CoO) is your secret weapon. Essential for declaring the 'birthplace' of your goods, the CoO can unlock preferential customs duty rates, saving your business those precious dollars. Imagine, you're a Vietnamese coffee exporter, shipping to Canada. Including a CoO validates your goods as Vietnamese-made, potentially qualifying for duty rate reductions under the Canada-Vietnam trade agreement. It's a paperwork lifesaver! However, ensure absolute accuracy in detailing the country of manufacture. Fuzzy information can lead to shipment delays or even refusals, a cost your business can certainly do without. Clear, accurate documentation is key to smooth, profitable transporting.

Get Started with FNM Vietnam

Understanding customs procedures for shipping between Vietnam and Canada can be challenging. Let FNM Vietnam simplify this process for you. Our proficient team addresses all customs clearances intricacies, making your freight forwarding effortless. Interested in shipping healthily without the administrative headaches? Reach out now! We promise a free quote delivered to your inbox in less than 24 hours.

Prohibited and Restricted items when importing into Canada

Shipping to Canada? Watch out for those tricky prohibited and restricted items. It's critical to know what you can and can't import to avoid unexpected hitches and costly penalties that could derail your operations. Let's straighten out this process for you.

Restricted Products

- Dairy Products: You need to get a license from the Canadian Dairy Commission. This is because dairy imports are subject to supply management controls.

- Firearms and Ammunition: You'll need to request a permit from the Royal Canadian Mounted Police (RCMP). The permit is necessary due to regulations outlined in the Firearms Act.

- Pharmaceuticals: If you're planning to import any kind of pharmaceutical product, it's crucial to first get a license from Health Canada. They regulate the import of prescription drugs to ensure public safety.

- Tobacco Products: You have to obtain a license from the Canada Revenue Agency (CRA). The CRA controls the import of tobacco products, in an attempt to limit illegal trade.

- Alcohol: Before importing alcoholic beverages, you must first get a permit from the Alcohol and Gaming Commission of your province. For example, if you're importing to Ontario.

- Plants and Plant Products: You need to apply for a permit from the Canadian Food Inspection Agency (CFIA). It's all because of the Plant Protection Act, which controls the import of plants to prevent the introduction of plant pests.

- Animals and Animal Products: If you're thinking about bringing in any animal or animal product, it's necessary to first obtain a permit from the Canadian Food Inspection Agency (CFIA). The CFIA helps to prevent the spread of diseases that could impact Canada’s agriculture and economy.

Prohibited products

- Narcotics and controlled substances without proper permits

- Unauthorized firearms and weapons

- Explosives, fireworks, and ammunition without proper permissions

- Counterfeit money or goods

- Certain plants and animals, including their parts, and items made from endangered species

- Cultural property that has been illegally exported from another country

- Obscene materials or pornography

- Hate propaganda

- Poultry and poultry products from specified countries

- Certain foodstuff, meat or dairy products from certain countries.

Are there any trade agreements between Vietnam and Canada

Yes, there are trade agreements in place between Vietnam and Canada. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a Free Trade Agreement that greatly reduces tariffs on goods transported between member countries, including Vietnam and Canada. If you're shipping products between these countries, this could mean lower costs for your business. However, remember it's crucial to comply with specific product regulations to enjoy these benefits. Additionally, both nations are continuously exploring opportunities to enhance trade relations, thereby signaling potential future prospects.

Vietnam - Canada trade and economic relationship

Vietnam and Canada have enjoyed a robust economic relationship over the years. Having diplomatic ties since 1973, the two countries ramped up trade cooperation in the past decade, resulting in bilateral merchandise trade worth CAD $14 billion in 2023. Top commodities include textile and apparel, seafood, and furniture from Vietnam, with Canada trading mineral fuels, machinery, and wood pulp.

With a long-standing partnership in sectors like agriculture, clean technology, and infrastructure, Canadian direct investment in Vietnam was estimated at CAD $202 million in 2023, highlighting opportunities for reciprocal growth. Their shared commitment to a rules-based trading system materialized with the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), offering a promising future for both nations' businesses. This prosperous trade and economic relationship paves the way for successful international shipping ventures between Vietnam and Canada, continually evolving over time.

Your Next Step with FNM Vietnam

Journeying through international trade routes? Don't wrestle the waves alone. Let FNM Vietnam tame the trade winds of shipping between Vietnam and Canada for you. We simplify every freight forwarding step, from customs clearance to administrative procedures. Ease your shipping woes and focus on your business. Let's pave your path in global trade together. Contact us today!

Additional logistics services

Delve into our extra logistics offerings! From warehousing to packaging, FNM Vietnam perfects your supply chain beyond just shipping and customs. Let us simplify your operations end-to-end.

Warehousing and storage

Sourcing dependable warehousing in Vietnam or Canada can feel like a treasure hunt without a map. Factor in specific conditions, like temperature control for your perishable goods, and it can become a real headache. But don't fret! Detailed advice and various solutions are just a click away on our dedicated page: Warehousing

Packaging and repackaging

Sending goods between Vietnam and Canada? Don't let poor packaging compromise your shipment. The right agent ensures your products are properly packed, whether it's coffee beans needing airtight sealing or delicate ceramics requiring protective padding. With our packaging and repackaging services, you can transit with peace of mind. Get the full scoop on our dedicated page: Freight packaging

Cargo insurance

Cargo insurance steps in where fire insurance falls short, offering extensive protection for your shipment. Dealing with damaged goods could be costly and frustrating, right? Imagine a scenario where your goods sustain water damage during an unexpected storm at sea. Cargo insurance can cover that! It's about prevention and playing smart against unforeseen risks. Learn more about safeguarding your shipments on our dedicated page: Cargo Insurance

Supplier Management (Sourcing)

Looking to source and manufacture in Asia or East Europe? FNM Vietnam is your trusted ally, finding the perfect suppliers and simplifying procurement. We expertly bridge language gaps and guide you every step of the way, just like we've done for businesses tapping into new ceramic suppliers in northern Vietnam. Get the full scoop here on our dedicated page: Sourcing services

Personal effects shipping

Shifting between Vietnam and Canada? Our Personal Effects Shipping service makes your transition seamless, handling delicate or hefty items with a careful touch. For instance, your Grandma's antique vase or your oversized sectional sofa? We've got it under control. More info on our dedicated page: Shipping Personal Belongings

Quality Control

Quality control inspections can make or break the success of your shipping operations from Vietnam to Canada. They are vital to certify that your goods meet Canadian standards and expectations. Ever had a batch of wooden toys rejected due to sub-par finish? With quality control inspections, such painful experiences can be avoided. They ensure your goods are up to mark and ready for successful shipment. Get the full scoop on our Quality Inspection page.

Product compliance services

Ensure a smooth shipping experience with our Product Compliance Services. Avoid costly hiccups by certifying that your goods line up with destination regulations. Benefit from our laboratory tests and obtain the needed certifications. Think about an electronic manufacturer; non-compliant goods could mean recalls or hefty fines. Don't risk it – trust our experts to keep your operations efficient and compliant.

FAQ | Freight Forwarder in Vietnam and Canada

What is the necessary paperwork during shipping between Vietnam and Canada?

When shipping from Vietnam to Canada, we'll take care of the bill of lading for sea freight or air way bill for air freight. You need to provide us with the packing list and commercial invoice. Depending on the nature of your goods, there may be additional documents required, such as Material Safety Data Sheet (MSDS) or certifications. We aim to make this process as smooth as possible for you, handling the complexities of international shipping on your behalf. Let us alleviate your shipping concerns, allowing you to focus on what's important - your business.

Do I need a customs broker while importing in Canada?

While it isn't technically required, employing a customs broker is highly recommended when importing goods into Canada. The interaction with customs authorities can prove quite complex, requiring adherence to certain procedures and provision of mandatory documents. We at FNM Vietnam often represent our clients' cargo at customs during most shipments. This saves you from navigating the intricacies of customs processes. Our professionally trained team ensures that these usually complicated procedures are handled efficiently and in compliance with regulations, reducing the chances of delays or refusals. So, to make your importing experience smoother, consider utilizing a customs broker.

Can air freight be cheaper than sea freight between Vietnam and Canada?

Determining whether air freight is cheaper than sea freight between Vietnam and Canada is highly dependent on variables like route, weight and volume. Often, when your shipment is less than 1.5 cubic meters or weighs under 300 kg (660 lbs), air freight might be the right choice from a cost perspective. Rest assured, at FNM Vietnam, our dedicated account executives are committed to providing the most competitive option tailored to your unique needs. We evaluate each scenario thoroughly, ensuring you get the best service at the most competitive rates.

Do I need to pay insurance while importing my goods to Canada?

At FNM Vietnam, we strongly suggest you consider insurance for your goods when importing to Canada. Although insurance isn't a requirement for shipping, it's highly advised due to potential unforeseen issues. Risks such as damage, loss, or theft can happen, particularly in international logistics. Having insurance can provide a financial safeguard against these unfortunate incidences. It's a proactive step to protect your business interests, ensuring peace of mind during the shipping process.

What is the cheapest way to ship to Canada from Vietnam?

For shipments from Vietnam to Canada, the most cost-effective method is typically sea freight, specifically by Full Container Load (FCL) or Less than Container Load (LCL) depending on your cargo volume. It takes longer but is significantly cheaper than air freight. However, for urgent, lightweight, or high-value shipments, air freight, despite its higher cost, could be a preferable option. We always suggest consulting with your freight forwarder to determine the best choice based on your specific needs.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF entirely depends on your relationship with your supplier. Remember, your supplier might not be a logistics expert, so it's wise to let a professional agent such as ourselves, at FNM Vietnam, handle the international freight and destination processes. Typically, suppliers sell under EXW (at their factory door) or FOB (including all local charges till the origin terminal). Regardless of the situation, we offer comprehensive door-to-door service to ensure your freight reaches its destination smoothly and efficiently. Let us guide you through the process and make international wholesaling a breeze.

Goods have arrived at my port in Canada, how do I get them delivered to the final destination?

If your cargo is under CIF/CFR incoterms at Canada's port, you need to engage a customs broker or freight forwarder to clear goods at the terminal and arrange payment for import charges. However, our team at FNM Vietnam can simplify this for you if you choose DAP incoterms. We'd handle the entire process. Please consult with your dedicated account executive to clarify further.

Does your quotation include all cost?

Absolutely, at FNM Vietnam, we ensure transparency in our costs. Our quotation includes all charges, barring the duties and taxes at your shipment's destination. However, you can always consult your dedicated account executive for an estimation. This way, we assure you that there are no hidden fees and the risk of unexpected surprises is minimized.