Who says shipping freight from Vietnam to Italy has to be as daunting as eating a bowl of hot Pho without a spoon?! Indeed, it can be tricky grasping the varying rates, digesting transit times, and decrypting intricate customs regulations. That's where this comprehensive guide comes in. We aim to shed light on all aspects of freight transportation including air, sea, road, and rail options, explore the complicated world of customs clearance, break down duties and taxes, and provide you with business-specific advice for smoother operations. If the process still feels overwhelming, let FNM Vietnam handle it for you! As your international freight forwarder, we'll transform every shipping challenge into a success story for your business.

Which are the different modes of transportation between Vietnam and Italy?

Selecting the right mix of transport to ship goods from Vietnam to Italy can feel like solving a puzzle. Nestling in Europe's boot, Italy isn't exactly next door to Vietnam. When you glance at a globe, you'll spot patches of land and vast seas separating them—providing both challenges and options. It's like choosing a costume for a party—you have to consider different factors and pick the perfect fit for your unique requirements. Is air freight the quickest at the expense of cost, does sea freight offer the balance between speed and budget, or does a combination hold the key to the puzzle? Let's dive in and find out.

How can FNM Vietnam help?

Looking to ship goods between Vietnam and Italy? Trust FNM Vietnam to handle it all. From customs clearance to overdue paperwork, we are your one-stop solution. Don't juggle multiple services, let us simplify it for you! Click to receive your free estimate within 24 hours. Got a question? Our experts are just a call away.

FNM Vietnam Tip: Sea freight might be the best solution for you if:

- You're moving big loads or large items. Sea freight offers roomy, cost-effective solutions.

- Your shipment isn't time-critical. Ocean routes take longer but are often more reliable.

- Your supply chain links major ports, tapping into a broad network of sea lanes.

Sea freight between Vietnam and Italy

Trade between Vietnam and Italy is a bustling corridor, connecting the bustling manufacturing hubs of Hanoi and Ho Chi Minh City with Italy's dynamic markets like Milan and Rome. A cargo journey that links east with west, playing out over the vast expanse of the ocean. Despite it being a slow route, businesses opt for sea freight for its affordability, especially when shipping hefty containers of goods – imagine it like a budget-friendly, long-distance shared ride for your products.

However, sailing your shipment from Vietnam's ports like Cai Mep or Hai Phong to Italy's Genoa or Naples can feel like maneuvering through a storm. Shippers often stumble over unforeseen difficulties, wrestling with customs, mismanaging paperwork, or failing to follow best practices. Worry not! In this guide, we detail what to anticipate, how to avoid missteps, and keep your sea freight journey as smooth as a sunlit Mediterranean voyage. It's time to navigate these waters with confidence. Welcome aboard for a better shipping experience.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Located in the city of Hai Phong, this port is critical to North Vietnam's economy, handling over 45.31 million tons of merchandise annually.

Key Trading Partners and Strategic Importance: Serving as a significant trading node with China, Japan, and South Korea, the Port of Hai Phong commands strategic importance in the Gulf of Tonkin.

Context for Businesses: If you're considering expanding to North Asian markets, Port of Hai Phong offers convenient access due to regular freight routes from these countries.

Port of Da Nang

Location and Volume: Located on the coast of Da Nang city, this port handles up to 8 million tons of cargo annually, serving as the largest in Central Vietnam.

Key Trading Partners and Strategic Importance: With its trading partners primarily in Southeast Asia, the Americas, and Europe, the Port of Da Nang is essential for ASEAN's intra-regional trade.

Context for Businesses: Companies looking to penetrate the Southeast Asian market should consider Port of Da Nang for its great connectivity within the region.

Port of Cai Mep

Location and Volume: As part of the bustling metropolis of Ho Chi Minh City, Cai Mep port processes approximately 11 million TEU annually, making it one of the busiest ports in Vietnam.

Key Trading Partners and Strategic Importance: The port, a crucial hub for trans-Pacific trade, majorly facilitates transports with the US, European Union, and other Asian nations.

Context for Businesses: If your aim is to reach global markets, particularly in the Americas and Europe, Port of Cai Mep could play a pivotal role in your trade strategy due to its prominent position in trans-Pacific routes and container handling capacity.

Port of Quy Nhon

Location and Volume: Situated in Binh Dinh Province, the Port of Quy Nhon processes around 2.7 million tons of cargo per year, making it pivotal for Central and Highlands Vietnam.

Key Trading Partners and Strategic Importance: Besides being integral to domestic trade, the Port of Quy Nhon has a substantial trade footprint with the US, Australia, China, and several European countries.

Context for Businesses: For companies planning on reaching the central regions or highlands of Vietnam, Quy Nhon Port offers advantageous access to these vital economic areas.

Port of Nha Trang

Location and Volume: Located in Khanh Hoa Province, Nha Trang port handles about 4 million tons of cargo annually.

Key Trading Partners and Strategic Importance: As a point of export for regional products such as coffee, seafood, and rice, the Port of Nha Trang has strong trading bonds with Russia, South Korea, and Japan.

Context for Businesses: If your business deals with agri-commodities, Port of Nha Trang can provide the perfect gateway to major buyers in these countries.

Port of Can Tho

Location and Volume: Situated in Vietnam's Mekong Delta, the Can Tho Port handles an impressive 15.5 million tons of cargo annually.

Key Trading Partners and Strategic Importance: Can Tho Port acts as a vital gateway for the agriculturally rich Mekong Delta region, with substantial trade relations with US, Australia, and China.

Context for Businesses: If your business is geared towards agricultural commodities, leveraging Port of Can Tho in your logistics strategy could connect you to a wealth of opportunities in various key markets.

Main shipping ports in Italy

Port of Genoa

Location and Volume: The Port of Genoa is situated in the heart of the city of Genoa, the busiest port in Italy and one of the most important in the Mediterranean. It boasts an annual shipping volume of over 2.6 million TEUs.

Key Trading Partners and Strategic Importance: Some of the primary trading partners include Spain, France, and Germany from Europe; China, India, and Taiwan from Asia; and the United States from the Americas. The port plays a pivotal role in transshipment within the Mediterranean area and also serves as a key distribution point for Italy’s industrial north.

Context for Businesses: If seeking direct access to Mediterranean and European markets, the Port of Genoa's central position, combined with its extensive intermodal connections, makes it an attractive choice for international businesses.

Port of La Spezia

Location and Volume: The Port of La Spezia is located in the northern region of Liguria. It’s the second busiest port in Italy handling approximately 1.5 million TEUs annually.

Key Trading Partners and Strategic Importance: Main trading partners are primarily located in Asia, Europe, and the Americas. The port notably specializes in handling containerized goods; making it strategically important for companies shipping these types of products.

Context for Businesses: Businesses in need of efficient container handling services would find the Port of La Spezia efficient and strategically located with good access to both rail and road networks.

Port of Naples

Location and Volume: Situated in Campania, the Port of Naples is one of the largest Italian seaports with an annual traffic capacity of around 500,000 TEUs.

Key Trading Partners and Strategic Importance: The Port of Naples predominantly exchanges with regions in Europe, Africa, and Asia. It holds a strategic position in national and international maritime traffic, particularly for the Mediterranean area.

Context for Businesses: If your business seeks a balance between cargo volume and accessibility to southern Italy and Mediterranean regions, the Port of Naples could be a viable option for your shipping strategy.

Port of Livorno

Location and Volume: The Port of Livorno in Tuscany records a yearly shipping volume of just over 700,000 TEUs.

Key Trading Partners and Strategic Importance: Principal trading partners include countries from Asia, North Africa, and Europe. More than just a commercial port, Livorno is also a crucial terminal for the automotive industry.

Context for Businesses: Companies operating in the automotive sector, or those requiring a gateway to the Tuscan logistic hub would benefit from capitalizing on the Port of Livorno.

Port of Cagliari

Location and Volume: Located on the southern tip of the island of Sardinia, the Port of Cagliari handles approximately 1.4 million TEUs annually.

Key Trading Partners and Strategic Importance: It primarily trades with regions like Asia, Africa, and Europe. It stands as a significant hub for transshipping activities in the western Mediterranean.

Context for Businesses: For businesses relying on transshipment within the western Mediterranean, the Port of Cagliari, with its extensive facilities and strategic location, could figure prominently in your logistics plan.

Port of Gioia Tauro

Location and Volume: The Port of Gioia Tauro in Calabria is the largest transshipment port in the Mediterranean, handling close to 3 million TEUs on an annual basis.

Key Trading Partners and Strategic Importance: Main economic partners include nations from Asia, the Americas, and Europe. The port has significant strategic importance due to its ability to process vast amounts of transshipped goods quickly.

Context for Businesses: If you are part of a business looking to optimize transshipment procedures in the Mediterranean, the Port of Gioia Tauro with its vast handling capability and strategic location can significantly enhance your shipping effectiveness.

Should I choose FCL or LCL when shipping between Vietnam and Italy?

Shipping goods from Vietnam to Italy? The choice between Full Container Load (FCL) and Less than Container Load (LCL) or consolidation could be a game-changer for your business. It's more than a mere choice - it's a strategic decision. The impact stretches far beyond cost, influencing delivery times and overall success. Ready to unravel the complexities? This guide will serve as your compass, helping unfold the intricacies of FCL and LCL to ensure your shipping experience goes smoothly. Let's equip you with the knowledge to make that business-savvy shipping choice!

LCL: Less than Container Load

Definition: Less than Container Load (LCL) shipping involves consolidating multiple shipments from various shippers into one container. An LCL shipment is optimal for smaller cargo that does not fill a whole container.

When to Use: Consider LCL freight when shipping cargo from Vietnam to Italy if your shipment is less than 13, 14, or 15 cubic meters. If you can't fill a full container or if you don't need goods to be delivered by a specific date, this flexibility can decrease costs and accommodate lower volumes.

Example: For instance, a small furniture company in Vietnam might be beginning to export their products to Italy but don't yet have the volume to fill a full container. In this case, they can benefit from the flexibility and price of LCL shipping.

Cost Implications: LCL shipping costs are determined by the volume of the shipment, not the weight. The low volume cargo is potentially more cost-effective compared to hiring a whole container. However, keep in mind that LCL freight often entails other costs, including warehousing and handling fees, which can increase the overall cost compared to Full Container Load (FCL) shipping.

FCL: Full Container Load

Definition: FCL, or Full Container Load, is a type of shipping service where an entire container is exclusively dedicated to a single cargo.

When to Use: Choose FCL shipping when your shipment volume is more than 13/14/15 CBM. It offers economic advantages for high-volume shipments and added security since the container is sealed from origin to destination.

Example: For example, suppose you're exporting ceramic goods from Vietnam and require a 20'ft FCL container. This ensures that your merchandise has ample space and is protected, as the container won't be opened until it reaches Italy.

Cost Implications: FCL's cost-effectiveness comes into play with larger shipments. The fcl shipping quote for a 20'ft or 40'ft container might seem higher upfront compared to less than container load (LCL) but becomes cheaper per unit as the volume increases. However, remember that the entire fcl container cost must be absorbed, regardless of whether it's fully loaded or not. Thus, maximizing container space is key to leveraging FCL's economy.

Say goodbye to shipping headaches!

Choosing between consolidation or a full container for your Vietnam-Italy shipping can be tricky. That's why at FNM Vietnam, we simplify this task for you. Our ocean freight experts take into account factors such as your budget, cargo size, timing, and shipping urgency to advise the best fit for your business. See the complexity of international shipping fade away, as our well-versed team nudges your shipping journey in the right direction. Intrigued? Reach out to us for a free estimation and let's make cargo shipping seamless together.

How long does sea freight take between Vietnam and Italy?

Sea freight journeying the ocean between Vietnam and Italy generally takes between 30 to 45 days, encompassing a myriad of influencing factors. Individual port used, the weight and nature of the goods you're shipping could all impact that duration. For a shipping time tailored to your unique shipment, engaging a freight forwarder like FNM Vietnam for a quote is highly recommended.

Bon voyage to your cargo with our simplified average transit time table below for the main freight ports in Vietnam and Italy:

| Vietnam Ports | Italy Ports | Average Transit Time (Days) |

| Port of Hai Phong | Port of Genoa | 40 |

| Port of Da Nang | Port of La Spezia | 38 |

| Port of Ho Chi Minh City | Port of Napoli | 35 |

| Port of Quy Nhon | Port of Gioia Tauro | 42 |

Remember, these are general estimates, and actual times can vary.

How much does it cost to ship a container between Vietnam and Italy?

Determining the exact shipping cost to transport a container via ocean freight between Vietnam and Italy is a complex task. The rates generally range widely per cubic meter (CBM), influenced by numerous variables such as the Point of Loading, Point of Destination, carrier choice, nature of goods, and monthly market fluctuations. Given these nuances, we don't offer flat rate quotes. Instead, our shipping specialists meticulously evaluate each request, ensuring you receive the most competitive, tailor-fit quote. Although the process may feel intricate, rest assured we're on your side, striving to offer the best ocean freight rates customized just for your shipment.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is designed to carry out of gauge cargo, cargo that exceeds standard container dimensions. These containers are beneficial when dealing with oversized, heavy, or awkwardly-shaped items.

Suitable for: Any cargo that surpasses the standard freight dimensions, including heavy machinery, large equipment, and oversized structures.

Examples: A logistics firm might utilize an OOG container to ship an industrial crane from Vietnam to a construction site in Italy.

Why it might be the best choice for you: If your company is shipping goods that don't fit within standard container specifications, OOG container can be the perfect solution.

Break Bulk

Definition: Break bulk refers to a method in which goods are loaded individually, not in containers, and are usually managed separately.

Suitable for: Large, uncontainerizable items such as construction equipment, big machinery, or extremely heavy items.

Examples: A mass of steel beams being shipped from Vietnam to Italy for a building project.

Why it might be the best choice for you: If your cargo is too large or heavy to fit into a container, break bulk can offer the flexibility you require.

Dry Bulk

Definition: Dry bulk refers to the transportation of homogenous, un-packaged, loose cargo load in large quantities such as grains, coal, or fertilizer.

Suitable for: Businesses in industries like farming, mining, or construction where they typically need to transport large quantities of loose goods.

Examples: A business shipping a load of rice from Vietnam to Italy.

Why it might be the best choice for you: If you're a part of an industry that deals with loose and granular cargo, dry bulk is a cost-effective and efficient way to manage your export needs.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro, or Roll-on/Roll-off, uses a ro-ro vessel where vehicles and machinery can be driven on and off the ship on their own wheels or using a platform vehicle.

Suitable for: All types of motor vehicles and machinery, including cars, trucks, semi-trailer trucks, trailers, and railroad cars.

Examples: An auto dealership shipping cars from Vietnam to sell in the Italian market.

Why it might be the best choice for you: If you're in a business that involves frequent transportation of vehicles or heavy machinery, the Ro-Ro option provides ease, safety, and quick handling of your cargo.

Reefer Containers

Definition: A reefer container is a refrigerated shipping container used for transporting perishable commodities which require temperature-controlled handling.

Suitable for: Businesses trading temperature-sensitive items such as medicines, fruits, vegetables, dairy products, or seafood.

Examples: A seafood exporter moving fresh shrimp from Vietnam's coast to Italian restaurants.

Why it might be the best choice for you: It’s worth considering reefer containers if your product is perishable or temperature-sensitive to maintain its quality during transit.

Our team at FNM Vietnam is available to help you select the most ideal option according to your shipping needs. Get in touch for a free shipping quote within less than 24 hours. We are looking forward to helping your business reach new heights.

FNM Vietnam Tip: Air freight might be the best solution for you if:

- You're on a tight schedule. Air freight delivers speed unmatched by other modes.

- Your cargo is under 2 CBM, a good fit for air's smaller capacity.

- Your destination is off the usual routes, making air's global network a key asset.

Air freight between Vietnam and Italy

Transporting goods via air freight from Vietnam to Italy is like having an express ticket for your products. It's swift, steady, and particularly cost-effective for small but high-value items. Consider your designer sunglasses or gourmet coffee beans, the transport costs might be a small fraction compared to their selling price. Air freight paves the way for them to arrive speedily and secure in Milan or Rome.

However, some businesses stumble upon common pitfalls. Like misjudging the weight of their goods - a vital element determining freight charge. Many overlook nuances, such as using the 'chargeable weight' formula which could be a game changer. Others might not be aware of hidden costs or time-saving tactics in the air freight process. But hold tight! Our guide can help you dodge these glitches and maximize your air shipping efficiency.

Air Cargo vs Express Air Freight: How should I ship?

Choosing the perfect shipping method for your business between Vietnam and Italy is crucial. Let's simplify your decision: Imagine air cargo like booking a seat on a commercial airline, whereas express air freight is more like hiring a dedicated plane - both have their own perks and drawbacks. In this guide, we'll help you explore and decide which flight is best suited for your shipping needs. Join us, and let's send your goods smoothly and efficiently from Hanoi to Rome or anywhere in between.

Should I choose Air Cargo between Vietnam and Italy?

If your shipment between Vietnam and Italy weighs over 100/150 kg (220/330 lbs), you might find air cargo to be the ideal solution. Major airlines like Vietnam Airlines and Alitalia provide reliable air freight services. Contrary to popular belief, these services can be cost-effective whilst offering quick transit times. However, bear in mind the fixed airline schedules could lead to longer transit times. Explore all possibilities before making a choice that aligns with your time and budgetary requirements. For more information, visit the official websites of Vietnam Airlines and Alitalia.

Should I choose Express Air Freight between Vietnam and Italy?

Express air freight serves as your quickfix for shipping small cargo loads from Vietnam to Italy. Think of under 1 CBM or 100/150 kg (220/330 lbs). This specialized service employs dedicated cargo planes sans passengers, ensuring faster delivery. FedEx, UPS, and DHL are international frontrunners in this domain. Handy for meeting tight deadlines or shipping high-value goods, they offer prompt door-to-door deliveries and handle customs clearance. If time's your primary concern, opting for express air freight can be a game-changing decision for your business logistics.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: With an annual capacity of over 1.5 million tonnes, Tan Son Nhat stands as Vietnam's largest airport.

Key Trading Partners: This airport has strong partnerships with countries like the US, China, and Japan.

Strategic Importance: Located in Ho Chi Minh city, it serves as a primary hub for international trade in southern Vietnam.

Notable Features: Besides its large cargo handling infrastructure, the airport boasts cutting-edge technological support for shipping processes.

For Your Business: If your business frequently ships to or from southern Vietnam, Tan Son Nhat makes an excellent choice to leverage high-volume and high-frequency flights.

Noi Bai International Airport

Cargo Volume: Boasting a cargo volume of over 1 million tonnes annually, Noi Bai is second to Tan Son Nhat in terms of size.

Key Trading Partners: Key trade is conducted with countries like South Korea, Japan, and the US.

Strategic Importance: Situated near Hanoi, it acts as a significant hub for trade and shipping in northern Vietnam.

Notable Features: Noi Bai has vast cargo terminals and a modern cargo handling system for efficient operations.

For Your Business: If your business has strong ties in northern Vietnam, using Noi Bai can tap into its vast network and easy accessibility to Hanoi and neighboring provinces.

Cam Ranh International Airport

Cargo Volume: Although smaller than Noi Bai and Tan Son Nhat, Cam Ranh handles a substantial cargo volume of around 200,000 tonnes per year.

Key Trading Partners: Main trading partners include China, Thailand, and Russia.

Strategic Importance: The airport is strategically located in the province of Khanh Hoa, a prominent tourist destination and emerging business hub.

Notable Features: The airport is known for its efficiency, reliable handling of goods, and excellent connectivity within the region.

For Your Business: If transportation to and from central Vietnam is required, Cam Ranh offers reliable and timely connections to do so.

Da Nang International Airport

Cargo Volume: Da Nang handles over 100,000 tonnes of cargo annually, serving as a vital node for international shipping.

Key Trading Partners: Key trading partners include South Korea, the USA, and China.

Strategic Importance: Being the third largest international airport in Vietnam, it is crucial for the economic development of central Vietnam.

Notable Features: It possesses advanced cargo handling facilities, efficient logistics services, and good transport links.

For Your Business: Should your business need access to central Vietnam, incorporating Da Nang into your shipping strategy could result in better transit times and enhanced supply chain management.

Cat Bi International Airport

Cargo Volume: Cat Bi handles a modest volume of around 20,000 tonnes of cargo annually.

Key Trading Partners: Typically, key trading partners include China, South Korea, and Japan.

Strategic Importance: This airport, based in Hai Phong city, is a pivot point for international trade in the North East coastal region.

Notable Features: The airport prides itself on streamlined custom procedures, efficient cargo handling, and convenient access to northeastern provinces.

For Your Business: If your shipping routes involve the northeast coast of Vietnam, you may find Cat Bi International Airport to be a flexible and reliable choice.

Main international airports in Italy

Leonardo da Vinci–Fiumicino Airport

Cargo Volume: Handles over 2 million metric tons of cargo annually.

Key Trading Partners: Major trading partners are the USA, China, and Germany.

Strategic Importance: As Italy's largest airport, it's a central hub for international cargo handling in Southern Europe.

Notable Features: It offers extensive cargo storage facilities, flexible cargo services, and state-of-the-art security systems.

For Your Business: If you need guaranteed, rapid access to Southern European markets, Rome's Fiumicino Airport should be at the top of your list. Its extensive facilities can cater to a variety of cargo needs and ensure swift, secure transit.

Malpensa Airport

Cargo Volume: Annually processes over 500,000 tonnes of cargo.

Key Trading Partners: Principal trading partners include China, the United States, and the Middle East.

Strategic Importance: Plays a critical role in Northern Italy's industrial sector, serving as the primary air cargo gateway to industrial regions like Lombardy.

Notable Features: Renowned for its modern cargo terminal which handles a broad range of cargo types including temperature-sensitive goods.

For Your Business: If you are shipping to or from Northern Italy or other parts of Europe, Malpensa's state-of-art facilities and well-connected air routes can provide a seamless shipping experience.

Bologna Guglielmo Marconi Airport

Cargo Volume: Handles around 50,000 tonnes of cargo annually.

Key Trading Partners: Primary trading partners include Germany, France, and the UK.

Strategic Importance: Serves as a secondary hub for freight, particularly for express couriers, in the northern-central part of Italy.

Notable Features: Has immense warehousing systems and the ability to handle large freighter aircraft.

For Your Business: If speed is of paramount importance, Bologna Airport's efficiency and express courier focus could greatly benefit your business.

Turin Airport

Cargo Volume: Processes about 12,000 tonnes of cargo annually.

Key Trading Partners: Mainly deals with European nations such as France, Germany, and the UK.

Strategic Importance: Critical for the importing and exporting of goods up in the North of Italy, and it's quite versatile.

Notable Features: It offers both long-term and short-term storage solutions, and can handle a wide array of cargo types.

For Your Business: If you're trading primarily within Europe, you may want to consider using Turin Airport as your cargo base.

Venice Marco Polo Airport

Cargo Volume: Handles close to 57,000 tonnes of cargo annually.

Key Trading Partners: Predominantly trading with countries in Europe, especially Germany, France, and the UK.

Strategic Importance: Serves as the principal gateway to one of Italy's busiest tourist regions and to the industrial North East.

Notable Features: Offers extensive warehousing facilities and cargo handling services.

For Your Business: If you're dealing with high-volume, high-value goods, Venice airport's robust security, and strategic location could make this an advantageous option for your operations.

How long does air freight take between Vietnam and Italy?

On average, air freight shipments from Vietnam to Italy take approximately 6-8 days. However, it's important to remember that this timeline can fluctuate depending on various factors. These include the specific airports of departure and arrival, the weight and volume of the shipment, and the type of goods being transported. With these aspects influencing the overall transit time, one might find disparities in the expected duration. For a more detailed and personalized estimate, businesses are recommended to consult with a freight forwarder like FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and Italy with air freight?

Estimating an average cost, air freight between Vietnam and Italy ranges around $3-$8 per kilogram. However, determining a precise figure isn't straightforward due to variables including airport distance, parcel dimensions and weight, as well as the nature of goods. Hence, at our company, we believe in tailoring our quotes to each unique shipping requirement, assuring you of the best rates for your specific needs. Interested in a custom quote tailored to your needs? Contact us and receive a free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual total weight of your shipment, including packaging and pallets. It's measured simply by weighing the entire package on a scale. In contrast, volumetric weight, also known as dimensional weight, isn't about an item's actual weight, but the amount of space it takes up in an aircraft.

Let's delve deeper. To calculate the volumetric weight in air cargo shipping, you multiply the length, width, and height of the package in centimeters and then divide by 6000. For instance, if your shipment measures 40cm x 30cm x 20cm, it's 40 x 30 x 20 / 6000 = 4kg. This is equivalent to roughly 8.8 lbs.

In Express Air Freight, the formula is slightly different. Here, the volumetric weight is calculated by dividing the volume in cubic centimeters by 5000. Suppose your package has the same dimensions as the previous one, 40 x 30 x 20 / 5000 = 4.8kg, equivalent to roughly 10.6 lbs.

However, if your package actually weighs 7kg (around 15.4 lbs), your gross weight is more than your volumetric weight.

Having discussed this, why does it matter? For air freight services, shipment costs aren't solely based on actual weight. The price you pay will depend on both the actual and volumetric weight, with freight companies charging based on whichever is higher. This is crucial to keep in mind when planning to optimize your shipping cost and packaging techniques.

FNM Vietnam Tip: Door to Door might be the best solution for you if:

- You seek hassle-free shipping. Door-to-door manages the entire process for you.

- You like one go-to contact. A dedicated agent oversees your door-to-door shipment.

- You aim to limit cargo handling. Fewer transitions mean less risk of damage or loss.

Door to door between Vietnam and Italy

International door-to-door shipping is a seamless process where cargo is picked up from a location in Vietnam and delivered straight to the destination in Italy, eliminating the hassle of multi-stage shipping. It offers several advantages, like stress-free customs clearance and timely delivery. So, if you're seeking simplicity and convenience in freight forwarding, it's time to examine door-to-door shipping. Let's dive in!

Overview – Door to Door

Looking to ship goods between Vietnam and Italy, but worried about the complexities? Door-to-door shipping is your stress-free solution. It streamlines the process, handling customs, duties, and multiple leg transports. Despite the potentially higher costs compared to piecemeal shipping, its comprehensive coverage makes it our Vietnamese clients' favorite. However, it requires a deep understanding of both countries' regulations, and that's where you might face challenges. Fear not, each hassle you bypass could compensate for the investment. Make smart choices, allow door-to-door shipping to shoulder your burdens, and let your business prosper.

Why should I use a Door to Door service between Vietnam and Italy?

Baffled by logistics between Vietnam and Italy? Door to Door service is here to defuse your shipping puzzles! Let's dive into the five reasons why it's the MVP of international freight forwarding.

1. Busts Stress: With Door to Door, say goodbye to the headache of logistics. Whether it's pickup from Ho Chi Minh City or delivery in Rome, every step is meticulously handled for you.

2. Timely Delivery: Urgent shipment? No worries! Efficiency is the mantra of this service, promising swift transit times and punctual delivery, your deadlines remain our top priority.

3. Specialized Care: Got complex cargo? Fear not! Whether shipping Bánh mì or Barolo wine, your goods receive the bespoke care they deserve, right up to the doorstep.

4. Convenience is Key: Trucking through the smoggy streets of Hanoi or maneuvering the twisty lanes of Venice, we've got it covered. With Door to Door, your consignment gets a free ride right up to its final destination.

5. Comprehensive Coverage: From customs clearance in Saigon port to duties at Genoa harbour, all administrative procedures are gracefully danced around, leaving you stress-free.

So why choose Door to Door? Because we believe your time should be spent running your business, not knee-deep in shipping documents!

FNM Vietnam – Door to Door specialist between Vietnam and Italy

Experience seamless door-to-door shipping from Vietnam to Italy with FNM Vietnam. We manage every detail for you - from packing to customs, and navigate through all shipping methods. You get to sit back as our proficient team leads the way, supported by a dedicated Account Executive. Want a stress-free shipping experience, where you do nothing but wait for your goods? Contact us! We'll provide a free estimate within 24 hours, or you can chat directly with our consultants for free advice. Trust us for your A to Z shipping needs.

Customs clearance in Italy for goods imported from Vietnam

Untangling the complexities of customs clearance - the process where goods cross national boundaries legally - is crucial when shipping from Vietnam to Italy. It's a maze of unexpected fees, potential tax charges, import licenses, and quotas - slip-ups can result in goods languishing in customs. Being confident about customs duties and taxes will prevent your business from any sudden financial hits. All these nuances may seem daunting, but don't worry! Our guide will help you navigate every step. On a side note, FNM Vietnam is always ready to assist you with any shipping process worldwide. With just the origin, value, and HS Code of your goods, our team can provide an accurate estimate. So, let's uncover the mysteries of customs clearance together!

How to calculate duties & taxes when importing from Vietnam to Italy?

To make your sea voyage from Vietnam to Italy a smooth sail, you'll need to know the customs ropes. Step one to calculating customs duties is like a treasure map - all roads lead back to the goods' country of origin. Whether your cargo is full of handmade textiles or cutting-edge tech, know the manufacturing place like a cartographer knows a map.

Next, you will need to discover the Harmonized System code or HS code - think of this as your goods' personal ID in the world of international trade. The value of your goods, or 'Customs Value', is another crucial navigation point to determine duties. This isn't just the invoice value, but also includes any additional shipping cost, packaging, or insurance.

Once you've gathered your facts - country of origin, HS Code, and Customs Value - you'll find yourself at the foot of the 'Applicable Tariff Rate'. Here's where you'll decipher exactly how much you'll need to pay in duties. There could also be surprises along the way in the form of additional taxes and fees, so make sure to have your binoculars at the ready.

So, before you set sail, remember: everything begins with identifying the country where the goods were manufactured or produced. This first step is crucial to ensuring smooth sailing for your shipping adventure between Vietnam and Italy.

Step 1 - Identify the Country of Origin

Knowing the country of origin for your goods isn't just paperwork - it's critical. Here's why:

1. Trade Agreements: Vietnam and Italy have unique trade agreements impacting your final cost. Some goods may enjoy lower or zero tariffs.

2. HS Code Variation: Goods originating from different countries might have divergent HS codes, impacting duty calculations.

3. Import Restrictions: Understanding country-specific import restrictions could save your shipment from unexpected delays.

4. Duty Preferences: Some categories of goods may have preferential duty rates depending on their origin.

5. Customs Compliance: Accurate country of origin details ensure a smoother customs clearance process, keeping you on the right side of the law.

Now, how does this apply to your business? Let's say you import shoes from Vietnam. Under the EU-Vietnam Free Trade Agreement, your goods might benefit from lowered tariffs, reducing your overall landing cost. However, if these shoes fall under a restricted category, you'll need permits before you can import them. Ensuring your goods' country of origin and navigating trade agreements can be tricky. But don't sweat, our team lives for these challenges and we're here to help. Your shipping needs are our priority. Efficient, compliant, transparent shipments? You've got this!

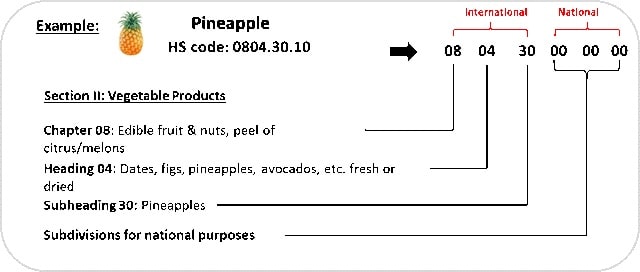

Step 2 - Find the HS Code of your product

The Harmonized System (HS) Code is a crucial component in international trade, commonly referred to as a commodity's 'passport.' These codes are used globally by customs authorities to categorize products, facilitating taxation, regulations enforcement, and statistical data collection.

Finding your product's HS code might seem challenging, but more often than not, your supplier will be familiar with the code for the goods they're exporting. It is a good practice to confirm this code with them as they're well-versed with the items they're dealing with and their corresponding regulations.

But in case you can't obtain the HS Code from your supplier, don't worry. You can easily find it yourself using a simple step-by-step process. Start by visiting the Harmonized Tariff Schedule tool. Once there, enter your product's name in the search bar.

Then, take a glance at the column marked 'Heading/Subheading.' Here, you will find the HS Code associated with your product.

While this is a relatively straightforward process, an important note to mark is the necessity of accuracy when identifying the HS Code. Ensuring the correct code is vital as any inaccuracies may lead to logistical delays and potential fines.

Here's an infographic showing you how to read an HS code.

Step 3 - Calculate the Customs Value

When importing your goods from Vietnam to Italy, understanding customs value is crucial. It isn't just the price tag on your items; it's more complex but don't fret! Customs value is what we call the CIF value: the price of your goods (let's say $5000 for illustration), plus the cost of international shipping (possibly around $800), and the insurance cost (perhaps another $200). It's easy math: $5000 + $800 + $200 = $6000. This $6000 is your customs value. Rather than only the initial price of your goods, customs look at this total figure when applying dues. By getting it right, you avoid any surprises in your budgeting and ensure smooth clearance in Italy. Be sure to check the latest regulations, as customs values can change. Efficient shipping's in the details!

Step 4 - Figure out the applicable Import Tariff

Import tariffs are taxes imposed by a country on goods imported from abroad, used to raise state revenue and protect domestic industries. Italy, as part of the European Union, follows a common external tariff system. To ascertain the import tariff for your product from Vietnam to Italy, you can recourse to the TARIC System - European Customs. Here's how you go about it:

1. Input your product's Harmonized System (HS) code (derived from the previous steps of the customs clearance process) and the country of origin.

2. The tool will then exhibit the relevant duties and taxes for your product.

Take, as an example, an HS code for ceramic tiles (69089000). After inputting this into the TARIC system, you may discover a customs duty rate of 3.2%. If your Cost, Insurance, and Freight (CIF) value is $10,000, your tariff or import duties would be 3.2% of that, i.e., $320.

Remember, getting the exact tariff rates is crucial in estimating your total import costs accurately. Practical insights and real-world examples always aid in successfully navigating through the complexities of international freight forwarding.

Step 5 - Consider other Import Duties and Taxes

As an importer in Italy, you may well be aware of the standard tariff rate applied to goods coming from Vietnam. However, note that there are often additional import duties and taxes. These can fluctuate depending on both the product's nature and its country of origin.

For instance, imagine you're importing a wooden table, which attracts an excise duty, an additional cost beyond the standard tariff. Or suppose anti-dumping taxes come into play - a measure designed to protect domestic manufacturers. These could also add up to your overall import cost.

The most substantial cost is often the Value Added Tax (VAT). In Italy, the standard VAT rate is 22%, calculated against the CIF value (Cost, Insurance, Freight) plus any duty paid. To illustrate, if the CIF value of your goods is $1,000, and you've paid $100 in duty, the VAT would be calculated as 22% of $1,100, i.e., $242.

Keep in mind that these examples are simplified and rates may vary. Always check the latest updates on the duties and taxes applicable to your shipped goods to avoid unexpected costs. This will simplify your import process and allow for precise cost forecasting.

Step 6 - Calculate the Customs Duties

Understanding customs duties in Italy could help you streamline the import process from Vietnam. Customs duties are calculated based on the customs value of your goods - a sum of the price paid, shipment cost, and insurance. Firstly, for commodities with customs duties but no VAT, you only pay the percentage of these costs that Italy's Harmonized System codes dictate, let's say 10% on a $100 shipment entailing $10 as customs duty.

Secondly, if VAT applies, it is levied on the same customs value, plus the applied customs duty. For example, with a 22% VAT rate on our $110 total (customs value + duty), an additional $24.2 is due.

Lastly, anti-dumping and excise taxes apply to specific goods. Say, there's a 5% anti-dumping tax on your $100 shipment, coupled with an excise duty of $5 per unit for 10 units, your cost increases by $55 ($5 anti-dumping + $50 excise duty).

It's vital to have precise information to avoid overcharges. That's why FNM offers top-notch Vietnam customs clearance services, covering all customs duty intricacies. Get your free quote, under 24 hours, today and let experts handle your import processes, saving you time and money.

Does FNM Vietnam charge customs fees?

Navigating customs fees can get tricky, so let's clear up some confusion. FNM Vietnam, like any custom broker, will levy a charge for customs clearance services, but this is not a customs duty. Customs duties, together with taxes, are levied by the government, and not by FNM Vietnam. You will get documents from us verifying what you paid is only what the customs office demanded which ensures transparency. So, just like you wouldn't want to mistake tomatoes for apples in a salad, don’t confuse custom clearance fees with customs duties!

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs (GDVC)

Official website: https://www.customs.gov.vn/

Italy Customs

Official name: Agenzia delle Dogane e dei Monopoli (Italian Customs and Monopolies Agency)

Official website: http://www.agenziadoganemonopoli.gov.it/

Required documents for customs clearance

Muddled by paperwork for customs clearance? We're here to uncomplicate it. We'll pick apart the essentials - the Bill of Lading, Packing List, Certificate of Origin, and CE standard Documents of Conformity. Let's trim the guesswork and simplify your shipping journey together.

Bill of Lading

Ready to ship from Vietnam to Italy? An essential cog in your shipping machine is the Bill of Lading . your golden ticket to transferring ownership of goods. Picture it like your package's passport, detailing vital info such as its origin, destination, and contents. Today, thanks to tech advancements, you have e-Bills or telex releases, a nifty digital option that lowers costs and speeds up the process. Neat, right? But remember, for air-based deliveries, you'll need an Air Waybill (AWB), which holds a similar role. Stay one step ahead by ensuring the details on these documents are accurate. This not only speeds up the clearance process but also eliminates potential hiccups. Take advantage of these tools for a smoother, stress-free shipping experience from Vietnam to the land of pasta and wine, Italy.

Packing List

The Packing List: your silent guard ensuring every detail is accounted for during your Vietnam to Italy shipment. Picture this; your cargo includes multiple packages containing different products, each crucial to satisfying your recurring Italian customers. But let's say customs officers identify an inconsistency during their routine inspection – and without an accurate packing list as a reliable reference, you could face delays or even confiscation of goods. Whether you're shipping sea freight full of handmade crafts or air freighting urgent pharmaceutical supplies, the Packing List is non-negotiable. It's a crisp, accurate tally of your consignment details that reinforces trust and accelerates customs clearance. So, never underestimate your role in its creation: your proactive accuracy averts potential hiccups, keeping shipments timely and Italian clients happy.

Commercial Invoice

Shipping goods from Vietnam to Italy? Dotting the 'i's on your Commercial Invoice can slide your shipment smoothly through customs. This vital document lists details like the buyer and seller's names, description of goods, HS codes, values, and country of origin. A tiny mistake can spell a colossal hold-up at customs. So, align this information accurately across all shipping documents - Consignment Note, Packing List, and more. For instance, if your shipment includes ceramic plates, ensure 'ceramic plates' appears consistently in all paperwork. Also, to dodge surprises, always declare the actual transaction value on your Commercial Invoice, even if it's a sample product. Quick tip - always double-check your HS code, this little numeric label could impact the duties your goods are subjected to. Remember, a gapless Commercial Invoice equals happier customs officers and faster clearances. Now, you're one step closer to tapping into the pulsating Italian marketplace!

Certificate of Origin

Navigating the logistics seascape between Vietnam and Italy? You'll want to be familiar with the Certificate of Origin (CoO). This important document affirms the 'birthplace' of your goods, and it's a vital player on the customs clearance field. Let's imagine you're shipping Hanoi-manufactured bicycles to Rimini. Having a CoO stating 'Made in Vietnam' can grant you preferential rates, potentially saving your business a significant chunk of change in customs duties. Don't underestimate the power of this simple document. Remember: correctly specifying the manufacturing country is paramount - it's the difference between sailing through customs or hitting a costly roadblock.

Certificate of Conformity (CE standard)

In shipping goods between Vietnam and Italy, a significant step is obtaining a Certificate of Conformity based on the CE standard. This documentation is pivotal to access the European market, including Italy. Unlike quality assurance, which certifies the consistent production quality of your goods, the CE marking signifies your product's adherence to European safety, health, and environmental standards. While the US has differing standards, the CE mark is recognized globally, extending your product's reach beyond just the EU. For smooth customs clearance, ensure your goods meet these standards. It's vital to work with an accredited certification body to verify product conformity, providing reassurance to customs officials and streamlining your shipment process.

Your EORI number (Economic Operator Registration Identification)

Sending goods from Vietnam to Italy smoothly starts with getting an EORI Number. It's your ticket into the EU’s import/export system. See it as a VIP pass, simplifying your customs clearance process. But it's more than just an ID for you, as every shipment with your name can be tracked anywhere within the EU. Picture it like a GPS for your business transactions. Remember, it's essential for all businesses or individuals planning to import or export goods within the EU, and it's a one-time registration. So if Italy is your destination, ensure getting an EORI number is your first step. Because when your freight's knocking on the EU's door, this is what gets it through quickly. Let's start your worry-free shipping journey with this requisite process.

Get Started with FNM Vietnam

Navigating Vietnam and Italy's intricate customs laws feels daunting? FNM Vietnam eases this load, handling every step meticulously. Our experienced team ensures a quick and cushioned customs clearance process. Don't let norms and paperwork jeopardize your shipment. Contact us now - we promise a free, comprehensive quote within 24 hours. Your hassle-free shipping experience begins here.

Prohibited and Restricted items when importing into Italy

Facing challenges with customs while shipping to Italy? It's essential to understand which items are restricted or entirely off-limits for import. Stay ahead of surprises, costly penalties, or shipment delays by getting familiar with Italy's specific regulations.

Restricted Products

1. Alcohol and Tobacco Products: You'll need to secure a permit from the Italian Customs Agency, where you'll have to adhere to the set quantity restrictions.

2. Pharmaceuticals and Medicines: You're obligated to apply for a permit under the Italian Ministry of Health, an essential step for every pharmaceutical diversion .

3. Firearms and Ammunition: You'll want to secure a special license issued by the Italian Police Force.

4. Animal and Plant Products: As part of the EU regulations, to ensure the protection of local biodiversity, you'd have to apply for a license from the Italian Ministry of Agricultural, Food and Forestry Policies.

5. Precious Metals and Stones: For shipping precious metals and stones, you'll need to gain authorization from the Department of Treasury. The process and requirements are outline.

6. Encryption Software: If your shipment includes any encryption software, you have to check with the Italian Ministry of Economic Development for the appropriate licenses. Their website with further details can be viewed her.

Remember, failure to adhere to these regulations can lead to delays, penalties, or even seizure of the goods by the Italian Customs Agency.

Prohibited products

- Narcotics and illegal substances: This includes any form of drugs which are not allowed for medical use.

- Endangered species: Products derived from endangered plants or animals, including parts and derivatives, are prohibited.

- Counterfeit items and pirated goods: This includes music, movies, software, designer clothing, and any other intellectual property.

- Weapons and ammunition: This includes firearms, knives not compliant with Italian law, other weapons, and their parts.

- Hazardous materials: Substances that can pose a significant risk to health, safety, or property due to being flammable, corrosive, or radioactive are restricted.

- Lottery tickets and advertising: These items are prohibited and will be confiscated by customs.

- Certain animal products: Fresh or processed products of bovine, ovine, and caprine origin from many non-European countries are prohibited to prevent the spread of animal diseases.

- Cultural artifacts and antiques: Any objects which might be a part of the cultural heritage of a country and are older than 100 years can be considered protected and thus are prohibited for export or import.

- Certain plants and plant products: This includes fruits, vegetables, and plants that are either not native to Italy or could potentially harbor pests or diseases.

- Soil and sand: Importing soil and sand from certain countries is prohibited due to the risk of spreading plant diseases.

Please note that this list is not exhaustive and can be subject to change based on Italian laws and regulations. Ensure to check with the relevant authorities before shipping any items.

Are there any trade agreements between Vietnam and Italy

Absolutely! Vietnam and Italy are part of the EU-Vietnam Free Trade Agreement (EVFTA), which eases tariffs and regulations, potentially speeding up your shipping process. Moreover, the Italy-Vietnam Chamber of Commerce actively promotes bilateral trade. Be aware of ongoing enhancements in shipping infrastructure, such as the Trans-Asian Railway network, which might soon provide cost-effective rail options. Prepare your venture to leverage these opportunities!

Vietnam - Italy trade and economic relationship

Italy is one of the leading European trade partners to Vietnam. The economic relationship harks back to the formal establishment of diplomatic ties in 1973. Over the years, both partners have experienced substantial growth in bilateral trade. In 2024, Vietnam-Italy trade turnover reached $7.1 billion, a notable increase from past years. Key sectors that steer this trade include machinery, textiles, footwear, and agricultural products. Italian investments have also expanded into 85 projects in Vietnam, with a total registered capital of about $420 million, underscoring Italy's trust in Vietnam's market potential. This robust trade and investment relationship has not only fostered economic prosperity but also solidifies Italy's position as Vietnam's top EU partner.

Your Next Step with FNM Vietnam

Are logistics obscurities weighing you down in your Vietnam-Italy shipping ventures? Unclog the complexities with FNM Vietnam. We specialize in de-complicating your freight forwarding needs, handling transport, customs, and more. Start your worry-free shipping journey today. Contact us now!

Additional logistics services

Dive deeper into your supply chain with FNM Vietnam's comprehensive logistics services. Beyond shipping and customs, we've got your end-to-end logistics covered, streamlining your operations and boosting efficiency. Let's conquer the logistic world together!

Warehousing and storage

Finding the right warehousing solution can be tricky. You need reliable services that understand your heat-sensitive fashion items can wilt in Vietnam's tropical climate. Fear no more! FNM's temperature-controlled warehouse facilities are here to help. More info on our dedicated page: Warehousing.

Packaging and repackaging

Shipping goods from Vietnam to Italy? Ensuring your items are securely packed is crucial. Our packaging and repackaging service assists various products, from delicate glassware to hefty machinery. A reliable partner helps prevent damages, streamlines customs clearance, and boosts your shipment's safe arrival. For instance, we once helped a furniture retailer ensure their artisan chairs arrived in Venice undamaged. More info on our dedicated page : Freight packaging.

Cargo insurance

When dealing with shipments, one mishap could be costly, unlike a store fire covered by fire insurance. Take cargo insurance - it's your shield, insuring you against unforeseen transport hiccups. Picture this: a box falls off a stack in a cargo ship and damages your merchandise. With cargo insurance, you avoid unwelcome financial setbacks. Because preventing is better than cure. For a detailed guide, visit our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Looking for Vietnamese suppliers to manufacture your products? Leave the hard work to us at FNM Vietnam! We break down language barriers, find quality local manufacturers, and oversee the entire procurement process. Picture this: You need ceramic pots, we identify factories, handle negotiations, and ensure smooth operations. Your procurement, made simple. Ready to simplify sourcing? More info on our dedicated page: Sourcing services

Personal effects shipping

Shipping your cherished belongings from Vietnam to Italy (or vice versa) can seem daunting, but rest easy. We handle everything from awkwardly shaped furniture to delicate glassware with special care and adaptability. Take Chuong's artwork collection: packaged, transported, and delivered intact right to his new Italian villa. Need more clarity? Visit our dedicated page: Shipping Personal Belongings for a more in-depth dive.

Quality Control

When shipping goods from Vietnam to Italy, quality control plays a vital role. Inspections during manufacturing or customization can make or break your delivery. Picture your handmade ceramics, failing to meet EU standards because of unnoticed, little flaws. Or imagine your bespoke furniture denied an Italian entry due to a wood treatment oversight. Avoid these challenges with our meticulous Quality Inspection services. More info on our dedicated page: Quality Inspection.

Product compliance services

Stay compliant and avoid costly delays with your overseas shipments. Need lab tests for certifications? No worries! Our Product Compliance Services ensure that your goods adhere to strict regulations. Picture this: your high-fashion garments, manufactured in Hanoi, pass rigorous testing to seamlessly enter Milan's stylish market. The world is your oyster when your products meet international standards.

FAQ | Freight Forwarder in Vietnam and Italy

What is the necessary paperwork during shipping between Vietnam and Italy?

For shipping goods from Vietnam to Italy, we at FNM Vietnam will take care of mandatory documents such as the bill of lading for sea freight or air way bill for air freight. Your responsibility will be to provide the necessary packing list and commercial invoice for your goods. Keep in mind that depending on the type of goods you are shipping additional documents such as Material Safety Data Sheets (MSDS) or certifications might be required. We are here to guide you through this process to ensure a seamless shipment for your goods.

Do I need a customs broker while importing in Italy?

While importing into Italy, engaging the services of a customs broker comes highly recommended. This is due to the intricate process and mandatory documents that need to be provided when interacting with customs authorities. As an experienced freight forwarder, we at FNM Vietnam are here to simplify the process for you. In most shipments, we step into your shoes and represent your cargo at customs, ensuring that all requirements are scrupulously met. We bring our expertise and understanding of the process to guarantee a smooth journey for your goods from origin to destination.

Can air freight be cheaper than sea freight between Vietnam and Italy?

Determining whether air freight is cheaper than sea freight from Vietnam to Italy isn't straightforward due to factors like route, weight, and volume. As a rule of thumb, if your cargo is less than 1.5 cubic meters or 300 kg (660 lbs), air freight becomes a competitive choice. At FNM Vietnam, we're committed to getting you the best possible price. Your dedicated account executive will consider all options and provide you with the most competitive, cost-efficient solution for your specific needs.

Do I need to pay insurance while importing my goods to Italy?

While insurance isn't compulsory when you're shipping goods, including imports to Italy, it's certainly a precaution we at FNM Vietnam strongly recommend. Implementing insurance protection safeguards your goods from unpredictable incidents like damage, loss, or theft that could occur during transit. Although it might seem like an additional cost, it ultimately provides peace of mind, protecting your business from potential financial losses. It's advised to consider insurance as part of your shipping budget and process to ensure a smooth, worry-free import experience.

What is the cheapest way to ship to Italy from Vietnam?

We recommend sea freight for shipments from Vietnam to Italy due to the substantial distance and to save costs. It's a more economical choice compared to air freight but do note, transit times are longer, typically taking several weeks. Suitability also depends on the nature of your goods, like perishability or urgency. For small, less-than-container load (LCL), you may consider combining with others to fill a container. We can help you optimize your shipping process, ensuring a balance between cost and efficiency.

EXW, FOB, or CIF?

It ultimately depends on your relationship with your supplier. While they may not specialize in logistics, we at FNM Vietnam can step in to manage the international shipping process and destination procedures. Typically, suppliers sell under EXW (right from their factory door) or FOB (including all local charges to the origin terminal). Nonetheless, we're fully equipped to provide a seamless door-to-door service, taking care of all elements of the journey. This way, whether you opt for EXW, FOB, or CIF, you can rest easy knowing your freight forwarding needs are in trustworthy hands.

Goods have arrived at my port in Italy, how do I get them delivered to the final destination?

If your goods have landed in Italy under CIF/CFR terms, you'll need a custom broker or freight forwarder to clear items at the terminal and manage import charges and delivery. Alternatively, hire our FNM Vietnam team for DAP terms, where we tackle it all for you. Please cross-verify this with your dedicated account executive.

Does your quotation include all cost?

Absolutely, our quotation covers all costs, barring the destination-specific duties and taxes. Here at FNM Vietnam, we strive for transparency and won't blindside you with uncalled-for fees. Do feel free to connect with your dedicated account executive for an estimate on duties and taxes. We're here to avoid any unpleasant financial surprises for you.