Freight Shipping between Vietnam and India | Rates – Transit times – Duties and Taxes

Think of exporting goods from Vietnam to India as an exciting game of Tetris, but in real life! Recognizing the surprising complexity of matching transit time demands, customs regulations, and variable rates can often require more than a beginner's level of playing.

Looking ahead in our guide, expect a detailed walkthrough of the freight options, an insider's view into customs clearance requirements, insights on possible duties and taxes, and tailored advice on effective transport strategies for your business.

If the process still feels overwhelming, let FNM Vietnam handle it for you! We turn complicated logistics into smooth journeys, ensuring your shipments move as swiftly and seamlessly as the perfect Tetris match.

Which are the different modes of transportation between Vietnam and India?

Choosing the perfect transport method between Vietnam and India is like finding the best route in a board game. You've got mountains, seas, and different nations in between - a challenging terrain! Now, think of two viable paths: air and sea freight. Air gets your goods there fast like a speedy jet, but at a higher cost. Sea, in contrast, is like a giant cargo ship - slower, yet economical. Balancing cost, timing, and your unique shipping requirements is key. It's all about getting your goods from the bustling markets of Hanoi to the busy streets of Mumbai efficiently and effectively.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can FNM Vietnam help?

Sea freight between Vietnam and India

The deep-rooted commercial bond between Vietnam and India breathes life to the bustling seaways that bridles the two nations. Key industrial centers connect fervently through cargo ports like Ho Chi Minh City and Nhava Sheva, ensuring constant flow of goods. Although ocean shipment isn’t known for its speed, it plays a grand part in being a wallet-friendly remedy for moving high-volume commodities.

But the path isn’t always smooth sailing. Shippers often face threatening obstacles that can cause headaches – convoluted customs clearance procedures, puzzling paperwork, and everything in between. Think of it as preparing a complex dish, where ignoring just one ingredient can make all the difference.

In this guide, we will explore these complexities, compare it to the ease of following an intricate recipe, providing you a wealth of best practices that can smoothen out the wrinkled shipping process. Stick with us and alleviate the needless stress of shipping across the turquoise expanse.

Main shipping ports in Vietnam

Port of Saigon

Location and Volume: Located in the heart of Ho Chi Minh City, the Port of Saigon is essential for supporting the Mekong Delta’s peppers, rice, and fish industries, with a shipping volume of 97 million TEUs.

Key Trading Partners and Strategic Importance: Several regional and international trading partners heavily depend on this port, including Japan, South Korea, and the United States. Strategically, this port can allow for direct access to the booming Ho Chi Minh City market.

Context for Businesses: If you’re looking for a direct link to some of Asia’s most bustling markets, the Port of Saigon could play an integral role in your logistics strategy due to its optimal location and robust volume capacity.

Port of Hai Phong

Location and Volume: Positioned in the northern part of the country, Port of Hai Phong is indispensable for handling northern Vietnam’s imports and exports, hosting a shipping volume of 119 million tons of cargo.

Key Trading Partners and Strategic Importance: Key trading partners are China and Singapore. Its strategic importance lies in providing direct sea access for thriving industries and businesses in North Vietnam.

Context for Businesses: For businesses eyeing opportunities in North Vietnam’s rapidly evolving market, the Port of Hai Phong should be a key consideration in shipping strategies given its proximity to major manufacturing sectors.

Da Nang Port

Location and Volume: Located in central Vietnam, Da Nang Port is central Vietnam’s largest sea port with a shipping volume of around 11 million tons of cargo.

Key Trading Partners and Strategic Importance: Key trading partners are the United States, Russia, and Japan. The port is strategically important due to its central location and diversified cargo handling capabilities.

Main shipping ports in Vietnam

Port of Saigon

Location and Volume: Located in the heart of Ho Chi Minh City, the Port of Saigon is essential for supporting the Mekong Delta’s peppers, rice, and fish industries, with a shipping volume of 97 million TEUs.

Key Trading Partners and Strategic Importance: Several regional and international trading partners heavily depend on this port, including Japan, South Korea, and the United States. Strategically, this port can allow for direct access to the booming Ho Chi Minh City market.

Context for Businesses: If you’re looking for a direct link to some of Asia’s most bustling markets, the Port of Saigon could play an integral role in your logistics strategy due to its optimal location and robust volume capacity.

Port of Hai Phong

Location and Volume: Positioned in the northern part of the country, Port of Hai Phong is indispensable for handling northern Vietnam’s imports and exports, hosting a shipping volume of 119 million tons of cargo.

Key Trading Partners and Strategic Importance: Key trading partners are China and Singapore. Its strategic importance lies in providing direct sea access for thriving industries and businesses in North Vietnam.

Context for Businesses: For businesses eyeing opportunities in North Vietnam’s rapidly evolving market, the Port of Hai Phong should be a key consideration in shipping strategies given its proximity to major manufacturing sectors.

Da Nang Port

Location and Volume: Located in central Vietnam, Da Nang Port is central Vietnam’s largest sea port with a shipping volume of around 11 million tons of cargo.

Key Trading Partners and Strategic Importance: Key trading partners are the United States, Russia, and Japan. The port is strategically important due to its central location and diversified cargo handling capabilities.

Main shipping ports in India

Port of Nhava Sheva Jawaharlal Nehru Port

Location and Volume: Located on the Arabian Sea of Maharashtra, Jawaharlal Nehru Port is the busiest port in India, handling around 5,63 million TEUs annually.

Key Trading Partners and Strategic Importance: Main trading partners include the Middle East, Europe, Africa, and the United States. As India’s first port operated under private management, it remains a strategic and economic cornerstone of the country’s trade infrastructure.

Context for Businesses: If you’re looking to ship large volumes or obtain access to markets in the regions mentioned, Jawaharlal Nehru Port’s high capacity and worldwide connections may serve as essential cornerstones in your shipping strategy.

Mundra Port

Location and Volume: Mundra is situated in the province of Gujarat, on the Arabian Sea. It’s India’s largest private port with a shipping volume of over 144 million TEUs annually.

Key Trading Partners and Strategic Importance: Mundra Port regularly trades with other Asian countries, the US, and Europe. Offering a number of services including cargo handling and storage, it plays a significant role in international trade, contributing to Gujarat rapidly becoming India’s most industrialized state.

Context for Businesses: If you’re considering a shipping plan in Western India, Mundra Port’s versatility and extensive facilities could provide crucial advantages.

Port of Chennai

Location and Volume: Located on the Bay of Bengal in the state of Tamil Nadu, the Port of Chennai handles over 48,3 million TEUs each year.

Key Trading Partners and Strategic Importance: Its key trading partners are China, Malaysia, and Singapore. As one of the oldest ports in India, it houses a considerable number of warehouses near its berths, offering the ability to store a tremendous volume of cargo.

Context for Businesses: For businesses considering an entry into or expansion within the South Asian market, the Port of Chennai is a crucial consideration given its proximity to crucial trade partners and substantial storage facilities.

Kolkata Port Syama Prasad Mookerjee Port

Location and Volume: Located on the Hooghly River in West Bengal, Kolkata Port handles around 65 million TEUs annually.

Key Trading Partners and Strategic Importance: Main trading partners include Bangladesh, China, and Myanmar. Given Kolkata’s emergence as an economic and cultural hub, the port plays a vital role in the region’s trade.

Context for Businesses: For companies focusing on Eastern India or trade with Southeast Asia, integrating Kolkata Port into your logistic strategy could be vital due to its strategic geographical placement in the region.

Visakhapatnam Port

Location and Volume: Located on the east coast of India in the state of Andhra Pradesh, Visakhapatnam Port handles about 72,7 million TEUs annually.

Key Trading Partners and Strategic Importance: Key trading partners are primarily located in East Asia, including Singapore and Myanmar. This port is also one of the largest cargo handling ports in the country.

Context for Businesses: If your business demands regular shipments to East Asian markets, taking advantage of Visakhapatnam Port and its ample cargo handling capacity could be a strategic advantage.

Cochin Port

Location and Volume: Situated on the Arabian Sea in the state of Kerala, Cochin Port manages around 32 million TEUs per year.

Key Trading Partners and Strategic Importance: Trading partners include Europe, the USA and China. This port has been a major gateway to South Western India for centuries and remains a significant stopover in international trade.

Context for Businesses: If you’re targeting markets in south-western India or global destinations, then Cochin Port, with its rich history and proven reliability, could be a key element of your logistical planning.

Should I choose FCL or LCL when shipping between Vietnam and India?

Deciding between Full Container Load (FCL) and Less than Container Load (LCL), or consolidation, for your sea freight from Vietnam to India? It’s a pivotal choice that directly impacts your cost, delivery speed, and overall success. Grasping the nuances of these options can prove a game-changer for your shipping strategy.

Let’s dive into the intricacies of both and tailor the best shipping approach for your unique needs. It’s time to demystify sea freight and become a well-informed decision-maker in the world of international logistics.

Full container load (FCL)

FCL, or Full Container Load, is a type of ocean freight shipping where one container is dedicated to a single shipper's cargo, regardless of whether it fills the container. FCL shipping can be inexpensive for high volumes as you're paying for the use of the entire container, represented in sizes like 20'ft or 40'ft containers.

You should opt for FCL Shipping if your cargo is more than 13/14/15 CBM. This method is safer as the container remains sealed from origin to destination, reducing the risk of damage or loss.

Consider a company exporting furniture from Vietnam to India, with a cargo volume of 18 CBM. FCL would be more cost-effective and safer, avoiding the hassle of sharing a container.

As to the cost, obtaining an FCL shipping quote can provide a clear picture, but the cost generally includes a flat fee for the FCL container and additional costs based on destination, season, and other factors. Keep in mind, even if the container is not fully utilized, you will still pay for the entire space. Thus, maximizing volume improves cost-effectiveness.

Less container load (LCL)

Definition: Less than Container Load (LCL) shipping is a method where cargo from multiple businesses is combined and shipped together in one container. This is typically used when the shipment is not large enough to fill a full container.

When to Use: LCL is most cost-effective and flexible for low-volume shipments. If your cargo is less than 13/14/15 cubic meters, LCL might be the right choice for you.

Example: Consider a Vietnam-based furniture manufacturer shipping a handful of custom items to a buyer in India. With just a small volume, they could choose LCL shipping, only paying for the space their items take up in the shared container.

Cost Implications: LCL is typically less expensive than booking a full container, especially for low volume shipments. However, costs could rise due to packaging and handling required for sharing container space. Be aware, LCL shipments do take longer to arrive compared to FCL due to various stops and unloading needed along the way. Therefore, if time is of essence, weigh the speed over cost benefits.

Hassle-free shipping

Looking to ship between Vietnam and India but unsure whether to opt for consolidation or a full container? FNM Vietnam is here to help. Our expert team makes cargo shipping hassle-free, assessing your specific needs, from the volume of your goods to delivery timelines, and optimizing costs. Trust the difficult decisions to us and focus on your business. Ready to sail smoothly over the choices? Contact us now for a free estimation simplifying your cargo journey.

When shipping goods between Vietnam and India by sea freight, you can expect it to take on average 20 days. However, it’s essential to understand that these transit times fluctuate due to factors such as the specific ports used, the weight and nature of the goods being transported. For a more customized quote tailored to your specific shipping requirements, we’d recommend reaching out to a comprehensive freight forwarder like FNM Vietnam.

Following is a table that provides average shipping times between the four main freight ports in both countries.

| Vietnam Ports | India Ports | Average Shipping Time |

| Port of Hai Phong | Port of Kandla | 18 |

| Port of Da Nang | Port of Nhava Sheva | 15 |

| Port of Quy Nhon | Port of Chennai | 12 |

| Port of Ho Chi Minh City | Port of Kolkata | 12 |

*Remember, these times are averages and can vary based on numerous factors. For precise transit information, contact a freight forwarder.

How much does it cost to ship a container between Vietnam and India?

An accurate estimate of shipping costs per CBM from Vietnam to India can range widely, encompassing variables from Point of Loading to carrier choice and the specifics of the goods in question. This extensive scope underscores that nailing down an exact figure is a challenge due to the frequent market fluctuations and the variety of elements at play in ocean freight rates.

But don’t worry – our freight forwarding specialists are on hand! They’ll guide you through the process, analyzing your unique situation to ensure you secure the best shipping cost suitable for your business. Remember, we quote on a case-by-case basis, keeping your specific needs paramount.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG Container is a specialized ocean freight shipping method designed for over-dimensioned or ‘out of gauge cargo’. These containers have removable tops or open sides to accommodate oversized items.

Suitable for: Oversized, long, wide, or heavy items, typically machinery or equipment, that would not fit into standard shipping containers due to their size.

Examples: Construction machinery, large parts of boats, wind turbine blades, oil and gas machinery are perfect fits.

Why it might be the best choice for you: If your business deals with oversized items that cannot be disassembled or heavy machinery, choosing an OOG container for your Vietnam-India shipments might be the most effective solution.

Break Bulk

Definition: Break bulk shipping involves goods that must be loaded individually, and not in containers, often referred to as the loose cargo load.

Suitable for: Large items that are lifted individually onto the ship, such as timber, paper reels, or steel beams.

Examples: Cement, grains, or other commodities shipped in sacks, bags, or packets.

Why it might be the best choice for you: If you are transporting large quantities of individual, non-containerized items, opting for break bulk shipping might offer a cost-effective and efficient way to move your goods from Vietnam to India.

Dry Bulk

Definition: Dry bulk shipping involves non-packaged goods that are transported in large quantities in the vessel’s cargo hold.

Suitable for: Commodities like coal, grain, metal ores, cement, and other similar goods.

Examples: A business with large quantities of rice or iron ore to ship would use dry bulk.

Why it might be the best choice for you: If you’re dealing with large quantities of granular or dry commodities across Vietnam and India, dry bulk shipping is an efficient way to deliver them.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro ships are designed to carry wheeled cargo, such as cars, trucks or trailers, that are driven on and off the ro-ro vessel on their own wheels.

Suitable for: Motor vehicles, semi-trailer trucks, trailers, and railroad cars.

Examples: Automobiles, tractors, or even trains can be shipped via Ro-Ro.

Why it might be a good choice for you: If your business involves shipping vehicles or any wheeled and drivable heavy machinery, opting for a Ro-Ro vessel is a practical and efficient choice.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers often used for the transportation of perishable products.

Suitable for: Products requiring temperature control, such as fruits, vegetables, pharmaceuticals, and other perishable goods.

Examples: Seafood, dairy products, frozen foods or medicines are typically shipped in reefer containers.

Why it might be the best choice for you: If your business transports perishable goods between Vietnam and India, using reefer containers is a sure way to preserve their quality.

We at FNM Vietnam are here to make your international shipping smooth and efficient. If you’re unsure about which method to choose or need a cost estimate, don’t hesitate to contact us. We can provide you with a free, no-obligation shipping quote in less than 24 hours.

Air freight between Vietnam and India

Choosing to send your high-value textiles or electronics by air from Vietnam to India? You’ve made a smart choice! With air freight, speed is king — simply the fastest way to get your goods from Hanoi to Mumbai. It’s reliable too, strict timelines mean fewer delays. And don’t worry about cost. Yes, it’s pricier than sea or road transport, but if your shipment is small and valuable, like jewellery or tech gadgets, it actually becomes cost-effective.

But hold on, not planning right can burn a hole in your pocket. Imagine misjudging the weight of your goods, a common stumble. Air freight doesn’t just consider the actual weight of goods but its dimensional weight too. This miscalculation can have you paying way more than budgeted. Through this guide, we’ll shed light on these unseen icebergs and help you make air freight between Vietnam and India smooth sailing every time!

Air Cargo vs Express Air Freight: How should I ship?

Scrambling to choose between Air Cargo and Express Air Freight for your Vietnam to India shipments? Well, it’s like deciding between a shared airline flight (air cargo), where your goods fly economy, or chartering an entire plane (express), with your shipments getting the VIP treatment. This guide will help make that choice clearer as we dive into the nitty-gritty of both options and dissect which one could suit your shipping needs the best.

Should I choose Air Cargo between Vietnam and India?

For shipping between Vietnam and India, you might find Air Cargo a fitting choice, particularly for consignments above 100/150 kg (220/330 lbs). This method utilizes leading airlines such as Vietnam Airlines and Air India, known for reliability and regular, albeit fixed, schedules.

While transit times may be longer, the cost-effectiveness and dependability of air cargo can significantly align with your budgetary needs. Such prudent planning enables lucrative business expansion in fast-growing markets, making air cargo an attractive option.

Should I choose Express Air Freight between Vietnam and India?

Express Air Freight is a unique service utilizing cargo-only planes, sans passengers. Quicker than regular air freight, it’s ideal for shipping smaller loads under 1 CBM or 100/150 kg (220/330 lbs). Worldwide courier giants like FedEx , UPS , and DHL lead the way in express air freight. If you have limited cargo to ship between Vietnam and India, this method guarantees swift passage and delivery – while potentially reducing expenses incurred by larger-scale shipments. Consider this solution for time-sensitive, lightweight goods and gain access to an efficient network of international distribution.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Approximately 1.1 million tonnes annually.

Key Trading Partners: China, Japan, South Korea, USA, Malaysia.

Strategic Importance: As the busiest airport in Vietnam, strategically located in Ho Chi Minh City, the country’s economic hub.

Notable Features: Currently, the airport has two cargo terminal areas that operate 24/7, equipped with advanced facilities to handle sizable and sensitive shipments.

For Your Business: If your operation focuses on large quantities and you are looking for steady and reliable operations, this airport should be your top pick due to its advanced handling capabilities.

Noi Bai International Airport

Cargo Volume: More than 900,000 tonnes annually.

Key Trading Partners: China, USA, Japan, South Korea, Singapore.

Strategic Importance: Being the second busiest airport in Vietnam and located in the capital city, Hanoi, it serves as a crucial link in the north of Vietnam.

Notable Features: It has cargo facilities that include freezer and refrigerator facilities, as well as designated areas for valuable and vulnerable goods.

For Your Business: If your goods require special and advanced storage conditions, Noi Bai International Airport is a feasible choice for shipping.

Da Nang International Airport

Cargo Volume: Over 150,000 tonnes annually.

Key Trading Partners: China, Cambodia, Thailand, South Korea, and Malaysia.

Strategic Importance: Vietnam’s third largest airport and an essential gateway to the central part of the country.

Notable Features: Although handling less cargo volume compared to the other two, it is currently undergoing development projects to increase its cargo handling capacity.

For Your Business: If your business involves shipment to or from Central Vietnam, Da Nang airport’s strategic location and its current development progress make it an excellent choice for your shipping strategy.

Main international airports in India

Indira Gandhi International Airport

Cargo Volume: Approximately 1,2 million tonnes per year.

Key Trading Partners: USA, China, UAE, Hong Kong, Singapore.

Strategic Importance: This is the busiest cargo airport in India and is a vital hub connecting South Asia with the rest of the world.

Notable Features: It has dedicated cargo terminals with cutting-edge technology ensuring efficient handling and tracking of cargo.

For Your Business: If you’re trading in high volumes or with heavy goods, the advanced cargo handling at Indira Gandhi International Airport ensures speedy delivery and minimal delay.

Chhatrapati Shivaji Maharaj International Airport

Cargo Volume: Over 800,000 tonnes per year.

Key Trading Partners: United Kingdom, United Arab Emirates, South Africa, China.

Strategic Importance: This airport is crucial for its connection to Mumbai, India’s commercial capital.

Notable Features: It is equipped with state-of-the-art warehousing and storage facilities.

For Your Business: Excellent connectivity and rapid turnaround times make this a preferred hub for perishable and time-sensitive goods.

Chennai International Airport

Cargo Volume: About 400,000 tonnes per year.

Key Trading Partners: Singapore, Dubai, Colombo, Frankfurt.

Strategic Importance: This airport is the gateway to South India’s manufacturing and IT hub.

Notable Features: Special provisions for handling sensitive cargo items, equipped with a perishable cargo complex.

For Your Business: Ideal for businesses involved in the IT or manufacturing sectors dealing with sensitive or perishable goods.

Rajiv Gandhi International Airport

Cargo Volume: Over 210,000 tonnes per year.

Key Trading Partners: Spain, Hong Kong, USA, Belgium.

Strategic Importance: It’s a crucial hub for southern and central India.

Notable Features: The airport’s cargo section features a Pharmaceutical Cold Zone for life science and healthcare products.

For Your Business: A great choice for pharmaceutical and healthcare businesses, as products are maintained at optimal conditions.

Kempegowda International Airport

Cargo Volume: About 470,000 tonnes per year.

Key Trading Partners: USA, Belgium, Germany, United Kingdom.

Strategic Importance: The airport serves Bengaluru, the silicon valley of India, making it a digital hub.

Notable Features: Equipped with technologically advanced security and handling systems.

For Your Business: This airport is perfect for high-value shipments, especially in the tech and electronics sector, due to the highest security provisions available.

How long does air freight take between Vietnam and India?

With an average transit time of 3-5 days, shipping goods via air freight between Vietnam and India is relatively swift. However, the exact delivery time can vary significantly, depending on factors such as the specific airports in use, the weight of the shipment, and the nature of the goods. For precise delivery times, it’s advisable to seek guidance from an experienced freight forwarder like FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and India with air freight?

Air freight shipping rates between Vietnam and India generally range widely, with a ballpark figure around $3 to $6 per kg. However, an exact cost is impossible to specify upfront due to factors such as proximity to departure and arrival airports, parcel dimensions, weight, and the nature of the goods. Rest assured, we customize each quote based on these factors to provide the most competitive rates. We are here to ease your shipping concerns and give clear, comprehensive guidance. Contact us to receive a free quote tailored to your needs in less than 24 hours.

What is the difference between volumetric and gross weight?

In air freight shipping, two key measurements are considered: Gross weight refers to the actual physical weight of your shipment, while Volumetric weight reflects the amount of space the cargo occupies. These are calculated a bit differently in Air cargo and Express air services.

In Air cargo, you calculate the volumetric weight by multiplying the three dimensions (length, width, and height in cm) of your package and dividing that by 6,000. The Gross weight, straightforwardly, is the actual weight of your package in kilograms.

Let’s say you have a package (we’ll call it Shipment A) that occupies a box of 50cm x 40cm x 30cm and weighs 35kg. The calculation goes as follows:

For Volumetric Weight: (504030) / 6000 = 10 kg (22 lbs)

Gross Weight: 35 kg (77 lbs)

Now with Express air, the divisor differs; you divide by 5,000 instead.

Volumetric Weight for Express Air: (504030) / 5000 = 12 kg (26 lbs)

Freight charges matter greatly because they are based upon the higher of the two weights—a choice between the volumetric and gross weight. This means, for Shipment A using Air Cargo, you’d be charged based on the higher weight, 35 kg. In Express air, the charges also consider the higher weight which would still be 35kg. Getting these calculations right ensures you’re not surprised by unexpected freight charges!

Door to door between Vietnam and India

Understanding Door to Door shipping is key in the dynamic world of international trade. Picture this: Your shipment smoothly transported from Vietnam all the way to India, with no hassle in between. The convenience, the time efficiency – it almost sounds too easy, doesn’t it? But it’s possible, and it’s incredible. So, without further ado, let’s dive in!

Overview – Door to Door

Looking to ship between Vietnam and India without a hitch? Our Door to Door service might be your hero, eliminating the logistical headache usually involved in comprehensive shipping. Despite a slightly higher cost, the seamless transition can offset any extra investment with simplicity and peace of mind.

It conquers the complexities of international shipping, handling everything from packaging, loading, to customs clearance for you. No wonder it’s FNM Vietnam’s most popular service! Remember, a hassle-free process can save you hidden costs in time, stress, and errors. Choose smart, go Door to Door.

Why should I use a Door to Door service between Vietnam and India?

Transporting goods from Vietnam to India and feeling like you’ve been through a whirlwind? Sit back and gulp your coffee as Door to Door service swoops in to be your knight in shining armor. Here are five reasons why it might just be your hero.

1. Stress-Free Logistics: With Door to Door service, the nightmare of handling complex logistics yourself is a thing of the past. Everything from pickup, transportation, to delivery at the destination – consider it done!

2. Swiftness & Punctuality: Next time your goods need to be transported urgently, fret not. This service prides itself on time-bound delivery, ensuring that your shipment reaches its destination right when you need it.

3. Special Care for Complex Cargo: Moving delicate or complicated items? Door to Door service showers them with the TLC they deserve, ensuring they reach their final destination in perfect condition.

4. End-to-End Convenience: Imagine a world where you don’t have to worry about finding and coordinating with multiple transporters. Welcome to the reality of Door to Door service, door-to-door trucking handled to perfection.

5. Peace of Mind: Probably the biggest reason of all – tranquility. With one service handling all your shipping needs, you’re free to focus on what you do best – growing your business!

Ready to let Door to Door service simplify your international shipping? Embrace the ease, speed, and convenience it provides, and watch your shipping headaches go bye-bye.

FNM Vietnam – Door to Door specialist between Vietnam and India

Effortless, door-to-door shipping from Vietnam to India with FNM Vietnam. We manage A to Z of your goods’ transportation – packing, transport arrangements, customs clearance, employing all shipping methods. Our skillful team ensures a stress-free process.

With a dedicated Account Executive by your side, you can sit back and relax. Need a free estimate? We’ll have it ready in under 24 hours. Have questions? Our consultants are here to help at no cost. Trust us for a shipping experience unlike any other!

Customs clearance in India for goods imported from Vietnam

Customs clearance, the essential yet complicated passage between transporting goods over international borders, can become a minefield of potential issues, particularly when importing goods from Vietnam to India. Unexpected fees, shifting tax obligations, intimidating quotas, and necessary licenses could play spoil-sports, putting your cargo at risk of a prolonged customs hold.

However, knowledge is power! With an in-depth understanding about customs duties and regulations, you’re well-armed to avoid such bottlenecks. In the following sections, we’ll unfold these intricacies, so you can navigate this process smoothly. As your reliable partner, FNM Vietnam stands ready to aid you in this complex journey. Reach out to us with your goods’ origin, value, and HS Code for a comprehensive cost estimate, helping you efficiently budget your project.

How to calculate duties & taxes when importing from Vietnam to India?

Navigating the labyrinth of international duties and taxes might seem daunting, but with some key information in hand, you’re well on your way to becoming a pro at estimating your import costs.

Estimating duties and taxes for your shipment from Vietnam to India requires a few key details: the country of origin, the HS (Harmonized System) Code of the goods, the customs value of the goods, and the applicable tariff rate. Further, each shipment may attract additional taxes and fees, so it’s crucial not to overlook these.

Now that we have our checklist, let’s begin with the most fundamental step. Identifying the country where the goods were manufactured or produced is imperative, as this forms the foundation of calculating your duties and taxes. Set out on a solid footing, and the journey of importing becomes a whole lot smoother.

Step 1 – Identify the Country of Origin

Knowing the Country of Origin, in this case Vietnam, is vital for a smooth importing process to India for five primary reasons.

First, a clear Country of Origin allows you to determine the appropriate Harmonized System (HS) code for your goods, an international nomenclature to classify traded products.

Second, it informs you about any prevailing trade agreements. For example, India and Vietnam are both members of the ASEAN-India Free Trade Area (AIFTA), which enables certain goods to be traded duty-free or at discounted rates.

Third, being aware of the Country of Origin helps to anticipate potential import restrictions. Some product categories from Vietnam, such as certain textiles, face restrictions in India.

Fourth, this knowledge can affect transport methods. Certain ports have direct transport links, which can influence cost and transit time.

Lastly, understanding the Country of Origin can identify potential additional costs, like anti-dumping taxes.

When importing, ensure you stay updated on the specifics of trade agreements and customs rules. A misstep could result in penalties or shipment delays, so attention to these details can save time and money in the long run.

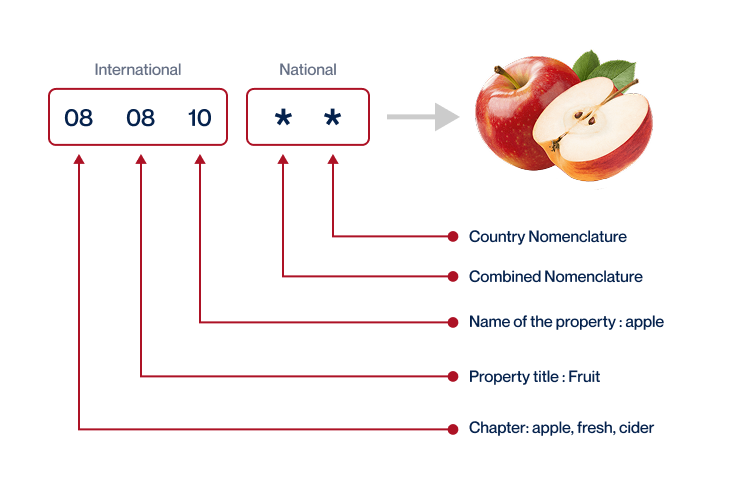

Step 2 – Find the HS Code of your product

The Harmonized System Code, often simply referred to as an HS code, is a universal standardized numerical method used to classify traded products. The World Customs Organization has developed it to ensure trade happens seamlessly and uniformly at ports across 180+ countries worldwide.

If you’re shipping goods, you’ll likely come across the term HS code. Each traded product has a unique HS code associated with it that helps customs to recognize the nature of the product. This information is fundamental in determining import duties and taxes.

You might wonder how to find the HS code of your product. The simplest route is to ask your supplier. They’re usually quite familiar with the commodities they’re importing, and they understand the related rules and regulations well.

When directly consulting your supplier is not feasible, you can still find the HS code for your product with a few easy steps. By utilizing the Harmonized Tariff Schedule (HS lookup tool), you can get the necessary information.

1. Use this Harmonized Tariff Schedule to look for your product.

2. Type the name of your product into the search bar.

3. The HS code can be found in the Heading/Subheading column.

It’s crucial to note the importance of accuracy when determining the HS code. Incorrect entry of HS Code can lead to shipment delays and potential fines, as customs authorities strictly observe these codes to monitor the inflow and outflow of goods.

Here’s an infographic showing you how to read an HS code:

Step 3 – Calculate the Customs Value

Understanding customs value is crucial in managing your imports from Vietnam to India. Though it might seem like the value of your goods, customs value is a distinctive concept. In simple terms, it’s the total cost of the goods you’re importing, including the price of the goods (let’s say, $10 per item), the international shipping costs (maybe $0.50 per item), plus insurance (another $0.20 per item).

So, the customs value for one item in this instance is $10 (cost of goods) + $0.50 (freight) + $0.20 (insurance) which totals $10.70. This CIF value forms the basis for customs clearance and calculating duties. By arriving at the accurate customs value, you can avoid unforeseen expenses, ensuring a smooth shipping process to India.

Step 4 – Figure out the applicable Import Tariff

Import tariffs are taxes imposed on imported goods. Specifically for goods imported into India from non-European Union countries like Vietnam, these tariffs play a significant role in determining the final cost of the product. The Central Board of Indirect Taxes and Customs (CBIC) in India classifies different types of tariffs such as basic, additional, protective, and others based on the product and its origin.

To identify the applicable import tariff for your product, follow these steps:

1. Visit the Indian Custom’s website and enter the Harmonized System(HS) code of your product, which you’d have identified before this step.

2. After inputting the origin country as Vietnam, you’ll be able to view the corresponding import tariff for your product.

Let’s bring this to life with a practical example: You’re importing ceramic tableware (HS Code: 69120010) from Vietnam. The import tariff rate offered is 20%. If your CIF (Cost, Insurance, Freight) is $10,000, your import duties would be $10,00020/100, which comes to $2,000. Therefore, the total cost incurred would be $12,000 ($10,000+$2,000). Always remember to cross-check current tariffs against up-to-date resources.

Step 5 – Consider other Import Duties and Taxes

When bringing goods into India from Vietnam, the Standard Tariff rate isn’t the only potential cost. Depending on what you’re shipping and its country of origin, additional duties and taxes might come into play, significantly impacting your bottom line.

For instance, certain commodities are subject to Excise Duty, an internal tax applied to specific goods. Anti-dumping duties are also feasible. If a product is being exported at a price lower than its natural value, leading to ‘dumping,’ this tax is imposed to protect indigenous industries.

However, the real game-changer can be VAT (Value-Added Tax), a tax applied at each value-addition stage in the goods’ pathway. It’s usually represented as a percentage of the product cost. In India, for example, VAT can range from 5 to 28% depending on the items (note: these rates are illustrative and actual rates may vary). If your product costs $1000, and VAT is 18%, that’s an additional $180 to account for.

In essence, keep an eye out for these import duties and taxes – unforeseen expenses can sneak up making your shipping costs potentially higher than expected. Plan accordingly and leave room for these costs in your budget to maintain a healthy profit margin.

Step 6 – Calculate the Customs Duties

Calculating customs duties in India can be tricky, but you don’t need to worry about it. There’s a formula that involves the customs value of your goods, Value Added Tax (VAT), and possible anti-dumping taxes.

For instance, if your goods have a customs value of $10,000, and the customs duty is set at 7.5%, you’d pay $750 in duties – no VAT in this case.

In the second scenario, let’s have the same customs value but add VAT at 12%, which works out to $1,200. So, you’d pay $1,200 in VAT plus $750 in customs duties, a total of $1,950.

Thirdly, imagine a situation where customs value and duty remain the same. However, now VAT, anti-dumping taxes (8%), and Excise Duty (10%) are added. You’d pay $1,200 in VAT, $800 in anti-dumping taxes, and an Excise of $1000 – this makes your total $3,750 in taxes.

Remember these calculations are mere estimates as rates can change. But don’t let these complexities slow you down! Let FNM’s Vietnam customs clearance services handle everything for you. Drop us a line for a free quote in less than 24 hours, and we’ll ensure you don’t pay a cent more than necessary.

Does FNM Vietnam charge customs fees?

You might be wondering about the costs of customs duties with FNM Vietnam. As international custom brokers, we don’t charge these duties. Your expenses with us are limited to customs clearance fees. The customs duties and taxes? Those go directly to the government. Think of it like a dinner bill where the meal cost and the tip are separate, but both part of the final total. We’ll supply you with official documents from the customs office, offering full transparency, so you’ll know you paid exactly what the government charged. No hidden fees, surprises or inflated charges.

Contact Details for Customs Authorities

Vietnam Customs

Official name: Vietnam Customs Official website: https://www.customs.gov.vn/

India Customs

Official name: Central Board of Indirect Taxes and Customs (CBIC), India Official website: https://www.cbic.gov.in/

Required documents for customs clearance

Forging through customs can seem like a maze, right? Minimize roadblocks by familiarizing yourself with key documents—Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). We’ll define these and help you sail smoothly through the customs clearance process. Ready? Let’s dive in!

Bill of Lading

Navigating customs between Vietnam and India demands a keen understanding of key documents; the Bill of Lading being at the helm. This powerful piece of paper is more than just an official shipping document, it’s your golden ticket marking the change of ownership from supplier to your business. Imagine the Bill of Lading as the shipping world’s ‘proof of purchase’.

It often comes in two styles: the traditional paper version and the newer, more versatile electronic (telex) release. Choosing the teal electronic version can streamline your shipping process by allowing quicker access, reducing shipment delays. On the flip side, say your goods are taking the sky route – an Airway Bill (AWB) steps in, performing the same function as its ocean-going cousin.

Whichever your transport method, don’t underestimate the power of these essential documents – they’re your business’s passport to successful international commerce.

Packing List

Ready to ship from Vietnam to India? Make sure you prepare your Packing List with utmost precision. It details the contents, weight, and packaging type of each item in your shipment, making it a must-have document for both sea and air freight. Think of it as a shopping receipt, listing every single product you’ve bought. Customs authorities, in both Vietnam and India, use this document to determine duties and ensure nothing prohibited is being shipped.

For instance, incorrect labeling or weight could invite trouble, including shipment delays or even fines. So, whether you’re shipping electronics or apparel, double-check your Packing List for accuracy; it’s one document you truly can’t afford to get wrong!

Commercial Invoice

Shipping between Vietnam and India? Your Commercial Invoice is non-negotiable. It’s a ticket for a smooth customs clearance, disclosing important details about your goods. It should precisely list product descriptions, seller and buyer’s details, terms of delivery, the Harmonized System (HS) Codes, prices, and country of origin. Remember, accuracy is key here!

Any mismatch with your Packing List or Bill of Lading can cause delays, extra costs or even shipment seizures. For instance, if your Commercial Invoice mentions ‘automobile parts’ with HS Codes, make sure this matches across all your shipping documents. Follow this advice to avoid potential hiccups and fast-track your shipment. With meticulous documentation, you’ll have your goods sailing smoothly from Hanoi to Delhi in no time.

Certificate of Origin

If you’re exporting goods from Vietnam to India, acquiring a Certificate of Origin (COO) is a non-negotiable step. The COO acts as a passport for your goods, verifying their birthplace, and can unlock preferential duty rates – a boon for your financials. Let’s say, you’re shipping bamboo products made in Hanoi; your COO states ‘Made in Vietnam,’ confirming its origin, which eases the entire customs process.

Without it, your shipment could face unnecessary delays, pile up those dreaded demurrage charges, or even get denied entry. For a smooth sailing freight journey, make sure your COO is in order.

Get Started with FNM Vietnam

Prohibited and Restricted items when importing into India

Avoid shipping snags and customs clearance headaches by understanding which items are restricted or outright banned from importation into India. Let’s unravel the complexities together to keep your business compliant and shipments smooth.

Vietnam – India trade and economic relationship

In 2024, the trade and economic relationship between Vietnam and India continues to strengthen, with both countries actively engaging in various sectors. Bilateral trade reached approximately $14.82 billion, with India exporting goods worth $5.47 billion and importing goods valued at $9.35 billion from Vietnam. Key Indian exports include engineering goods, agricultural products, chemicals, and pharmaceuticals, while major imports from Vietnam consist of electronic goods, mobile phones, machinery, and footwear.

Vietnam views India as a significant partner in its development goals and both nations are working together in areas such as trade, investment, science and technology, and digital transformation. Additionally, strategic dialogues and joint commissions are regularly held to facilitate cooperation and address mutual interests.

Your Next Step with FNM Vietnam

Additional logistics services

Warehousing

Unsure about storage and warehousing in Vietnam and India? It's tricky ensuring the right conditions for items, like temperature-sensitive goods. We've got you. Our reliable solutions prioritize your good's needs, taking off that weight from your shoulders. Get the nitty-gritty about our services on our dedicated page: Warehousing

Packing

Absolutely crucial for successful freight transport between Vietnam and India, proper packaging and repackaging safeguards your goods against damage. An experienced freight forwarder, akin to a reliable shield, can tailor this service to suit anything from delicate ceramics to heavy machinery. For example, think of the drastic differences between packing a batch of Hanoi ceramics and a robust Mysore silk weaving machine. More info on our dedicated page: Freight packaging

Transport Insurance

Picture this: Your cargo onboard a ship faces unexpected turbulence, causing potential damage. It's not like a warehouse fire—preventable and specific. With cargo insurance, you're covered for such unpredictable events. It's about mitigating risks and keeping your peace of mind—like avoiding ocean waves instead of putting out fires. Learn more on how to safeguard your freight in such scenarios, on our dedicated page: Cargo Insurance

Household goods shipping

Transitioning personal belongings between Vietnam and India can be tricky, especially if they're fragile or bulky. That's why we're here! Our experts meticulously handle and deliver your items safely, offering flexibility for disparate shipping needs. For instance, a precious family heirloom or an unwieldy sofa, both receive unparalleled care. Want to dive deeper? More info on our dedicated page: Shipping Personal Belongings

Procurement in Thailand

Need to manufacture in Asia, East Europe, or elsewhere but hit a language barrier? At FNM Vietnam, we step in, locating the perfect suppliers and orchestrating your procurement process, making sourcing a breeze. Consider the time we helped an Indian tech firm find a reliable electronic components supplier in Vietnam! More info on our dedicated page: Sourcing services

Quality Control

When shipping goods between Vietnam and India, quality inspection is crucial to catch any inconsistencies before they impact your bottom line. Think of that time when a major retailer suffered a huge recall due to faulty zippers - a quality control check at the source could have prevented the loss. Our Quality control service ensures your products meet the standards and avoid embarrassment or costly recalls. Get peace of mind knowing your products are up to par. More info on our dedicated page: Quality Inspection

Conformité des produits aux normes

Moving your goods and running into regulatory walls? Our Product Compliance Services are your solution. We test your products in a lab to get them certified and ensure they follow the rules at their new home. Think of it as breaking the customs barrier, just like a locally-made cell phone flying through certification and hitting shelves on time. Conforming means smooth shipping, don't let regulations hold your business back.