Freight Shipping between Vietnam and RDC | Rates – Transit times – Duties and Taxes

Picture a scene of your goods bobbing down the Mekong River on their way to the Democratic Republic of Congo (RDC) – sounds adventurous, right? Well, freight transport between Vietnam and RDC can indeed be an adventure, but the steep learning curve regarding rates, transit times, and customs regulations can add a touch of anxiety to your journey. This guide is designed to help you sail smoothly through these issues. We will delve into the nuances of air, sea, and road freight options, throw light on the intricacies of customs clearance and duties, explore different types of taxes, and offer expert advice tailored for businesses. If the process still feels overwhelming, let FNM Vietnam handle it for you! We turn these complexities into a streamlined, success-driven experience for businesses around the globe.

Which are the different modes of transportation between Vietnam and RDC?

Which are the different modes of transportation between Vietnam and RDC? Choosing the ideal transport mode for your goods between Vietnam and the Democratic Republic of Congo is akin to figuring out the most effective route for a thrilling hike; you need to consider distance, terrain, and your specific needs. Seated miles apart with a tangle of international borders in the mix, air freight steps up as the practical knight, nixing limitations and stepping on the accelerator for swifter delivery. But like deciding on a hiking trail, your shipping needs, urgency, and budget should guide your transport method decision. It's a blend of the 'plane versus ship' debate fine-tuned to your business pulse.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can FNM Vietnam help?

Sea freight between Vietnam and RDC

Embarking on the journey of ocean shipping between the vibrant port cities of Vietnam and the bustling hubs of the Democratic Republic of Congo (RDC), holds many promises. This route is a testament to the ever-evolving trade relationship between these nations. With sea freight offering cost-effectiveness for high-volume goods, it’s no surprise that key industrial centers rely heavily on ports like Da Nang in Vietnam and Matadi in RDC.

Yet, the voyage through these waters isn’t always smooth sailing. Even seasoned shippers often struggle with the myriad complications involved. Common mistakes in documentation, customs slip-ups, or miscommunication with freight carriers can sometimes turn this route into a treacherous journey.

Fear not! As challenging as it can be, sailing these seas comes with a trusty map. This section of our guide sheds light on the best practices and essential specifications that can neatly sidestep the common pitfalls in this trade route. Learn the ropes, dodge the hazards, and let the winds of expert advice navigate your ship smoothly from Vietnam to the shores of RDC.

Main shipping ports in Vietnam

Port of Ho Chi Minh City

Located in the southern part of the country, this port is essential for the majority of incoming and outgoing freight, with a shipping volume of around 6 million TEU annually.

Key Trading Partners and Strategic Importance: The Port of Ho Chi Minh City has important trading relationships with China, South Korea, the United States, and Japan. It is the busiest port in Vietnam and a major gateway for the Greater Mekong Subregion.

Context for Businesses: If you’re looking to expand your business into the robust Southeast Asian market, the Port of Ho Chi Minh City should be key to your logistics strategy, given its extensive connections and busy trade routes.

Port of Hai Phong

Located in Northern Vietnam, The Port of Hai Phong processes over 2 million TEU annually and is a critical trade outlet for Northern Vietnam.

Key Trading Partners and Strategic Importance: Its main trading partners are China, South Korea, and Japan. The port is strategically situated to facilitate trading with North East Asia.

Context for Businesses: Given the port’s proximity to China and capacity for container shipment, the Port of Hai Phong may be beneficial for your operations if your business works extensively with North East Asia.

Port of Da Nang

Located in Central Vietnam, the Port of Da Nang handles over 1 million TEU and is the third-largest port in the country.

Key Trading Partners and Strategic Importance: It serves as a crucial point in the trading network between Vietnam, Laos, and Cambodia, particularly for commodities such as coal, cement, and steel.

Context for Businesses: The Port of Da Nang may be a strategic choice if your business needs to send or receive goods from or to Cambodia and Laos, given its direct routes to these markets.

Port of Qui Nhon:

Located on the east coast of South Central Vietnam, the Port of Qui Nhon is responsible for around 600,000 TEU annually.

Key Trading Partners and Strategic Importance: It serves as a critical trading point with Thailand, amongst others, with significant volumes of rice, timber products, and bulk cargoes passing through.

Context for Businesses: The Port of Qui Nhon could be a valuable part of your logistics strategy if you are involved in the trade of commodities such as rice or timber given its specialized handling of such goods.

Port of Vung Tau

Located near Ho Chi Minh City, Vung Tau is responsible for over 3 million TEU annually.

Key Trading Partners and Strategic Importance: Serving as the gateway port for the petroleum industry, it’s a principal partner for countries like Japan, South Korea, and Singapore.

Context for Businesses: If you’re involved in the petroleum industry, Vung Tau is likely to play a prominent role in your logistics strategy due to its specialization in oil and oil-related products.

Port of Cam Pha

Positioned in Northeast Vietnam, Cam Pha handles over 1.5 million TEU per year.

Key Trading Partners and Strategic Importance: Its main trading partners include India, China, and Australia. It’s significant for coal trade due to its proximity to Quang Ninh’s coal mines.

Context for Businesses: If your business revolves around coal or mining industries, considering Cam Pha for your shipping needs, given its rich coal reserves and infrastructure for handling bulk, would be beneficial.

Main shipping ports in RDC

Port of Matadi

Location and Volume: Positioned in the Bas-Congo province, this port is crucial for the Democratic Republic of Congo’s trade due to its position as the country’s sole seaport, with a shipping volume of around 3 million tons annually.

Key Trading Partners and Strategic Importance: The Port of Matadi’s key trading partners include China, Belgium, South Africa, and Turkey. Thanks to its geographical location, it facilitates the flow of goods not just for the Democratic Republic of Congo, but also to and from other African nations.

Context for Businesses: If you’re considering reaching markets in Central Africa, particularly in the Democratic Republic of Congo, the Port of Matadi is an optimal choice. Its position as the only seaport in the country and its connections to several key trade partners make it a remarkable part of any logistics strategy targeting this region.

Should I choose FCL or LCL when shipping between Vietnam and RDC?

Sea freight between Vietnam and RDC can be a head-scratcher, leaving you torn between Full Container Load (FCL) and Less than Container Load (LCL), or consolidation. The trick is knowing that the right choice hinges on your cargo size, budget, and delivery timeframe. Perfect balance between these factors can hold the key to an affordable, prompt, and successful shipment. So, ready to dive into the nitty-gritty of FCL and LCL shipping and make a savvy decision tailored to your needs? Let’s cut through the jargon together and simplify your shipping process. Embark on this informative journey now!

Full container load (FCL)

Definition: FCL (Full Container Load) shipping is a term used in freight transportation for hiring an entire container. Either a 20'ft or 40'ft container would safely transport goods from origin to destination, sealed for the journey's duration.

When to Use: If your shipment takes up more than 13/14/15 CBM (Cubic Meters), FCL is ideal for you. It's specifically cost-effective for high volume shipments because you pay for the container rather than the volume of goods.

Example: Imagine you're a furniture supplier exporting large quantities of products from Vietnam to RDC. Given their size and quantity, they'd occupy more than 15 CBM. An FCL container would be your best option.

Cost Implications: While an FCL shipping quote might initially seem costly, remember you're paying for the space, not the weight. So, whether you fill the container or not, the price remains the same. This makes it a more economical choice for larger shipments.

Less container load (LCL)

Definition: Less Than Container Load (LCL) shipping is a type of ocean freight and refers to the transportation of goods that do not fill a full container.

When to Use: LCL shipping is ideal for businesses shipping small volumes of goods, usually less than 13/14/15 cubic meters (CBM), due to its price flexibility. It provides an economical solution without the need for enough cargo to fill a whole container.

Example: Suppose you are a business in Vietnam that manufactures bamboo furniture, shipping only 10 CBM every two months to RDC. It would be more cost-efficient and flexible to opt for an LCL shipment, as it allows you to only pay for the space you use in a shared container.

Cost Implications: As LCL freight costs are calculated based on the volume your cargo occupies in the container, it can be more cost-efficient for low volume shipments compared to Full Container Load (FCL) shipping. Plus, given that it's flexible, it would help in managing cash-flow for small and medium businesses. However, it's worth noting that, per CBM, LCL might be more expensive than FCL. So, once your cargo volume increases, you may need to reevaluate your shipping options.

Hassle-free shipping

At FNM Vietnam, our mission is to simplify your cargo shipping process. If you're unsure whether to ship by consolidation or in a full container, our ocean freight experts can guide you by considering key factors like your cargo volume, schedule flexibility, and budget. We ease the complexities of international trade, providing support every step of the way. Ready to take the hassle out of shipping? Request a free estimate now!

Shipping goods from Vietnam to the Democratic Republic of Congo (RDC) by sea freight generally takes around 35-40 days. Remember, these transit times are averages and can vary based on several factors. Specific port used, the overall weight of the goods, as well as their nature significantly affect these timelines. For shipping times tailored to your specific needs, contacting a freight forwarder like FNM Vietnam could be really beneficial.

Concerning the transit times for individual ports, the following table serves as a reference. Do note that actual times might differ:

| From Vietnam – Port | To RDC – Port | Average Transit time |

| Ho Chi Minh City | Matadi | 40 |

| Haiphong | Boma | 32 |

| Da Nang | Matadi | 40 |

| Cai Lan | Boma | 32 |

Keep in mind that the RDC is a landlocked country and uses neighboring countries’ ports for ocean freight shipping, and transit times over land can add additional time to these averages.

How much does it cost to ship a container between Vietnam and RDC?

Determining the exact shipping cost for a container from Vietnam to the Democratic Republic of Congo (RDC) can be complex due to variations in factors like Point of Loading and Destination, choice of carrier, type of goods, and shifting ocean freight rates. It’s crucial to note that market fluctuations can significantly affect costs on a month-to-month basis. For a general idea, expect a broad range within $500 to $1500 per Cubic Meter (CBM). However, fret not. Our seasoned shipping specialists are adept at tailoring the best rates suited to your individual needs, quoting on a case-by-case basis, ensuring you get the most value from your shipping expenditure.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge or OOG containers are designed for goods that exceed standard container measurements. These containers typically don’t have a roof, allowing for vertical space.

Suitable for: OOG transportation is ideal for oversized, heavy, or irregularly shaped goods that won’t fit into normal containers.

Examples: Equipment, machinery parts, or large vehicle components often require an OOG container for shipment.

Why it might be the best choice for you: If your business involves the export of bulky items from Vietnam to the Democratic Republic of Congo, an OOG container could be the perfect sea freight option, as it’s specifically designed to handle out of gauge cargo.

Break Bulk

Definition: Break Bulk is a method where goods are loaded individually or in groups onto the vessel, instead of in containers.

Suitable for: It’s best for items which are too heavy or too cumbersome to fit even in OOG containers.

Examples: Machinery, generators, turbines, timber, or steel beams are some types of break bulk cargo.

Why it might be the best choice for you: If your cargo is too large for standard or OOG containers, a break bulk shipment might be your best option to transport your goods from Vietnam to RDC.

Dry Bulk

Definition: Dry Bulk involves the shipping of unpackaged goods in large quantities, stored directly in the hull of the vessel.

Suitable for: It’s used particularly for commodities which can be poured, like grain, coal, or gravel.

Examples: Minerals, metal ores, cement are common goods shipped as dry bulk cargo.

Why it might be the best choice for you: If you’re moving large volumes of loose cargo load from Vietnam to RDC, dry bulk shipping can be a cost-effective and efficient method.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off or Ro-Ro vessels are designed for wheeled cargo such as cars, trucks, or trailers that roll on and off the ship on their own or using a platform.

Suitable for: Ro-Ro shipping is ideal for any self-propelling or towable cargo.

Examples: Automobiles, trucks, semi-trailer trucks, trailers, and railroad cars are transported using Ro-Ro vessels.

Why it might be the best choice for you: If you’re involved in the automobile industry between Vietnam and RDC, opting for a ro-ro vessel will let your wheels travel safely and efficiently.

Reefer Containers

Definition: Reefer Containers are temperature-controlled shipping containers used for goods which need to be refrigerated or frozen during transit.

Suitable for: These containers are perfect for perishable goods which require specific temperature conditions.

Examples: Meat, dairy products, fruits, vegetables, or pharmaceuticals are typically shipped in reefer containers.

Why it might be the best choice for you: If you’re exporting perishable goods from Vietnam to RDC, using refrigerated containers can ensure that your products arrive fresh and unspoiled.

Whichever method suits your shipping needs the best, FNM Vietnam is here to facilitate an effortless and efficient sea freight experience. Feel free to contact us for a free shipping quote in less than 24 hours and let us help make your shipping process hassle-free.

Air freight between Vietnam and RDC

Imagine your high-end electronics or speciality agricultural products need to travel from Vietnam to the sprawling territories of the Democratic Republic of the Congo. Every hour counts. That’s when the magic of air freight comes into play. It’s quick, safe, and designed to meet high-priority, lightweight requirements. Can’t beat that, right? But with this speedy solution, many businesses stumble – not considering key factors like correct weight calculations of their freight, rooting themselves up for a surprise bill! Misunderstandings like these are more than likely to turn a cost-effective method into something much the opposite. A story worth telling, indeed. Time for some myth busting!

Air Cargo vs Express Air Freight: How should I ship?

Juggling your shipping options between Vietnam and the Democratic Republic of Congo? Let’s break it down. Air Cargo means loading your goods onto passenger airlines, nestled with other shipments. Express Air Freight, on the other hand, is like your goods hitting the jackpot and flying on their dedicated plane. How to pick? Strap in as we turn the confusing into clarity, aligning your choice with your business needs.

Should I choose Air Cargo between Vietnam and RDC?

Considering the shipment of goods between Vietnam and the Democratic Republic of Congo (DRC)? It could be worth considering air cargo services. Notable companies like Vietnam Airlines and Congo Airways offer robust freight solutions. They strike a balance between cost-effectiveness, reliability, and slightly extended transit times. Most importantly, air shipping becomes a desirable choice for shipments over 100 to 150 kg (220/330 lbs). Remember, your financial plan and cargo capacity needs might find a suitable solution here.

Should I choose Express Air Freight between Vietnam and RDC?

If you’re delivering under 1 CBM or roughly 100/150 kg (220/330 lbs) of cargo, Express Air Freight might suit your needs. This specialized service uses dedicated cargo planes without passengers, ensuring fast and efficient deliveries, ideal for smaller shipments. International courier giants like FedEx , UPS , and DHL offer reliable Express Air Freight between Vietnam and the Democratic Republic of Congo. Their extensive networks and established processes can provide seamless shipping experiences.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Annually handling over 400,000 tons of cargo.

Key Trading Partners: China, Singapore, South Korea, Japan, and Taiwan.

Strategic Importance: Located in Ho Chi Minh City, Vietnam’s economic hub, enabling easy connections to local and regional businesses.

Notable Features: The largest airport in the country in terms of cargo capacity.

For Your Business: If timely delivery is crucial for your business, air freight through Tan Son Nhat International Airport’s extensive international network might be an optimal choice.

Noi Bai International Airport

Cargo Volume: Annually handles around 700,000 tons of cargo.

Key Trading Partners: China, Japan, South Korea, and the USA.

Strategic Importance: Based in Vietnam’s capital, Hanoi, which is a crucial point for businesses wishing to reach northern Vietnamese markets or the Chinese border.

Notable Features: Major redevelopment in 2015 substantially increased capacity and modernized the cargo handling facilities.

For Your Business: If your business requires secure, modern, and efficient cargo operations, Noi Bai International Airport provides an exceptional service with its upgraded facilities.

Cam Ranh International Airport

Cargo Volume: Handles approximately 15,000 tons of cargo annually.

Key Trading Partners: Russia, South Korea, and China.

Strategic Importance: Situated in Khanh Hoa province, a prominent foreign tourist hotspot and home to a free economic zone.

Notable Features: The airport is near to Van Phong Economic Zone, which is a central logistics hub in Vietnam.

For Your Business: If your operations revolve around the fast-growing tourism or high-tech industries, leveraging the strategic location of Cam Ranh International Airport could be invaluable for your business.

Da Nang International Airport

Cargo Volume: Manages approximately 30,000 tons of cargo every year.

Key Trading Partners: Singapore, China, Japan, and South Korea.

Strategic Importance: The central location in Vietnam makes Da Nang International Airport a gateway that connects the North, Central, and Southern parts of the country.

Notable Features: The airport was significantly upgraded in 2017 with a capacity increase and the introduction of modern cargo facilities.

For Your Business: If you are seeking a strategic, centrally located entry point to Vietnam, Da Nang International Airport is worth considering for your shipping strategy.

Cat Bi International Airport

Cargo Volume: Processes around 20,000 tons of cargo each year.

Key Trading Partners: China, Singapore, and South Korea.

Strategic Importance: Located in Hai Phong, the third-largest city in the country and a significant port city in northern Vietnam.

Notable Features: The airport undergone significant renovations in 2016, tripling its capacity.

For Your Business: If your trade operations require connectivity with northern Vietnam and northeastern Asian countries, Cat Bi International Airport is an essential destination to consider due to its strategic location near major seaports and industrial zones.

Main international airports in RDC

N’djili International Airport

Cargo Volume: It is one of the busiest in terms of cargo volume in the RDC, handling an estimated 20,000 tons per year.

Key Trading Partners: The airport has regular cargo flights to South Africa, Ethiopia, China, and various European countries, making these some of the key trading partners.

Strategic Importance: Being the largest in the Democratic Republic of Congo, N’djili has a strategic location in the capital city Kinshasa, effectively connecting it with multiple international destinations.

Notable Features: The airport is equipped with robust cargo-handling facilities, which includes dedicated terminals and specialized equipment for handling a diverse range of goods.

For Your Business: If you aim to reach a wide market within both the DRC and Central Africa, N’djili International Airport could be an ideal gateway due to its broad flight connections and extensive cargo handling capabilities.

Lubumbashi International Airpor

Cargo Volume: It handles approximately 15,000 tons of cargo annually.

Key Trading Partners: Key trading partners typically include South Africa, Zimbabwe, and Zambia, plus various European destinations.

Strategic Importance: As the second busiest airport in the country, it serves as the main air gateway to the southern part of RDC.

Notable Features: The airport features modern cargo handling facilities and the capacity to manage both large and small cargo planes.

For Your Business: If your shipping strategy targets the southern regions of DRC or aims to exploit trade with the rest of Southern Africa, Lubumbashi International Airport’s strategic geographical location and facilities can meet your needs.

Goma International Airport

Cargo Volume: With an annual cargo volume of 4,000 tons approximately, it is less busy, which might an advantage for some businesses.

Key Trading Partners: Regular cargo shipments go to East African countries, mainly Uganda, Kenya, and Tanzania.

Strategic Importance: Located in the Great Lakes region, Goma International is key for businesses targeting East and Central Africa.

Notable Features: The airport has noted an increase in infrastructure development, which includes the addition of new cargo handling abilities.

For Your Business: Goma International Airport can offer easier clearance and lower congestion if you are part of a smaller enterprise or looking to capitalize on trading routes with East African countries.

Bangoka International Airport

Cargo Volume: It annually handles about 2,000 tons of cargo.

Key Trading Partners: Direct cargo shipments are typically sent to Uganda, Kenya, and Tanzania among other African countries.

Strategic Importance: The airport is positioned in the northeastern part of the country, playing a crucial role in connecting with eastern countries.

Notable Features: The airport features a flexible cargo management system and open-station layout, making the handling process more convenient.

For Your Business: If your strategy is focused on areas in northeast DRC or you’re looking for an airport with easy cargo process requirements, Bangoka International could be your choice with its easy accessibility.

Note: The absence of links is due to the unavailability of official websites for these airports.

How long does air freight take between Vietnam and RDC?

On average, air freight shipping from Vietnam to the Democratic Republic of Congo takes approximately 6-10 days. However, keep in mind that these times are not immutable. The actual transit time can fluctuate based on factors such as the specific airports used, the weight of the cargo, and the nature of the goods being shipped. For a precise shipping timeline, it is best to consult with a seasoned freight forwarder like FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and RDC with air freight?

Typically, air freight parcels between Vietnam and RDC can range anywhere from $2.5 to $7 per kg. However, estimating an exact cost is challenging due to factors such as airport proximity, dimensions, weight, and nature of goods. But worry not! Our expert team assures personalized assistance for each shipment, providing customized quotes to ensure optimum rates. So, let’s simplify your shipping journey – reach out to us and receive a free custom quote within less than 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the total weight of a shipment, including the goods, packaging, pallets, and any other materials. On the other hand, volumetric weight reflects the amount of space your shipment takes up in an aircraft rather than its actual weight.

Gross weight is fairly easy to calculate. You simply weigh your shipment in its entirety and that gives you your total gross weight. For example, if your complete package weighs 55 kilograms, then your gross weight is 55 kg (or 121.25 lbs).

Calculating volumetric weight for Air cargo, however, is different. Here’s the formula: Length (in cm) x Width (in cm) x Height (in cm) / 6000 = Volumetric Weight (in kg). For example, if a shipment is 50cm x 40cm x 30cm, you get a volumetric weight of 20 kg (approximately 44.09 lbs).

For Express Air Freight, they use a slightly different divisor in their formula: Length (in cm) x Width (in cm) x Height (in cm) / 5000 = Volumetric Weight (in kg). Using the same dimensions as before, the shipment would have a volumetric weight of 24 kg (approximately 52.91 lbs).

These calculations matter because your freight charges rely on them. Which is higher between your gross and volumetric weight dictates the chargeable weight and consequently, the cost of your shipping. So, understanding these weights can ensure cost-effective planning and packaging for your shipments.

Door to door between Vietnam and RDC

Shipping ‘Door to Door’ is a convenient international shipping method where everything from pickup to delivery is managed for you. This makes moving freight from Vietnam to the Democratic Republic of Congo a breeze. It offers a hassle-free solution, potential cost savings, and ensures safe delivery. Ready to unravel this game-changing shipping option? Let’s dive in.

Overview – Door to Door

Grapple with overwhelming shipping complexities and want a seamless experience? Here’s why door to door shipping from Vietnam to RDC is your answer. Offering smooth customs processes, warehousing, and transit to your customer’s doorstep, it’s a stress-free logistics solution. Have doubts? Understand that while costs may be higher, the convenience and time-savings easily offset it. It’s no surprise that it’s the top choice for our clients at FNM Vietnam. Boldly enter global markets, while we manage bureaucracy matters and unpredictability of international shipping. Fasten your seatbelt, we’re set for a smooth shipping journey!

Why should I use a Door to Door service between Vietnam and RDC?

Ever felt like playing a challenging game of Tetris with your logistics? Well, chuck that game out because Door-to-Door service is here to save your day, especially if you’re shipping between Vietnam and the Democratic Republic of Congo (RDC)! Here are five compelling reasons why a Door-to-Door service might be your logistics MVP:

1. Smooth Sailing Logistics: In the world of international trading, juggling shipping arrangements can be a circus act. Door-to-Door service takes the balls out of your hands, streamlining the logistics process from collection to delivery, no dropped balls here!

2. Eat the Clock: Time is money, and with the fast rhythm of business, you can’t afford delays. Door-to-Door service handles all the nitty-gritty details to ensure your goods arrive promptly, making it ideal for those urgent shipments.

3. Handle with Care: Complex cargo can feel like an unruly beast. Thankfully, Door-to-Door services offer specialized care, keeping your most challenging cargo in check and ensuring it arrives safely.

4. Convenient and Reliable: If you ever dreamed of wizards who could teleport goods straight to their destination, this is as close as it gets! Door-to-Door service takes care of everything, including trucking and on-the-road coordination until your goods reach the final destination, convenience in its purest form!

5. Peace of Mind: Last but not least, perhaps the biggest gift Door-to-Door services offer is peace of mind. No more sleepless nights over logistics. Breathe out; you’re in good hands!

So, switch off from ‘Logistics Tetris’ and tune into relaxed, professional shipping that works for you.

FNM Vietnam – Door to Door specialist between Vietnam and RDC

Enjoy peace of mind with FNM Vietnam’s door-to-door shipping services. From packing to transport, including all shipping methods and customs procedures, we manage every step. Our team is seasoned in navigating international freight paths between Vietnam and RDC. You won’t lift a finger. Plus, a dedicated account executive ensures smooth operations and on-the-spot communication. Just contact us for a free estimate within 24 hours or chat with our consultants anytime for free. Let us take the stress out of your international shipping needs.

Customs clearance in RDC for goods imported from Vietnam

Customs clearance, the critical step of importing goods from Vietnam into the Democratic Republic of Congo (RDC), can often feel like navigating a complex maze. This process, heavily governed by regulations, often springs up unexpected fees and charges. Without a clear understanding of customs duties, taxes, quotas, and licenses, your goods could stall in customs, throwing a wrench into your business plans. But fear not – the following sections will meticulously guide you through this process. We, at FNM Vietnam, are on standby to assist you with all types of goods from anywhere globally. To help you budget your project, contact us with your goods’ origin, value, and the HS Code – three essential elements for moving forward. So, let’s demystify this intimidating process together.

How to calculate duties & taxes when importing from Vietnam to RDC?

Understanding how to estimate duties and taxes when importing from Vietnam to the Democratic Republic of the Congo (RDC) can significantly simplify your shipping process and minimize unexpected costs. The key to making these estimations involves gathering certain details about your goods. These include the country of origin, the Harmonized System (HS) Code, the declared Customs Value of the goods, the prevailing tariff rate, and awareness of any extra taxes and fees that might apply to your specific products.

This endeavor begins with identifying the country where the goods were manufactured or produced, as this vital information could impact the duty rates applied and is often the launching point for many customs forms and calculations. Armed with this knowledge, you’re one step closer to understanding the complexities of international shipping, becoming more adept at navigating associated costs and keeping your freight forwarding process smooth and predictable.

Step 1 – Identify the Country of Origin

Nailing down the Country of Origin is more than just pinning your location on a map. It lays the foundation to gauge duties and taxes, and here’s why:

1. Right HS Code: When country of origin matches your cargo, confusion over HS Code is avoided.

2. Trade Agreements: Vietnam has unique pacts with RDC that can significantly lighten your duties burden.

3. Accurate Estimates: Pre-calculating your expenses depends on having the correct country of origin.

4. Avoid Legal Hassles: Incorrectly identifying your country of origin can spark legal troubles.

5. Customs Restrictions: The RDC might have specific import rules for goods from Vietnam.

Now, onto the trade agreements. Vietnam and the RDC have several exchanges that affect customs duties. Some are general tariff reductions, while others target specific goods or industries. Look closely into your product category; you might find a lucrative agreement just for you.

RDC also imposes particular import restrictions. These range from outright bans to stringent quality checks. Don’t let these catch you off guard – ask your shipping partner or the customs department for a heads-up on what lies ahead. Remember, accurate planning equals smooth shipping!

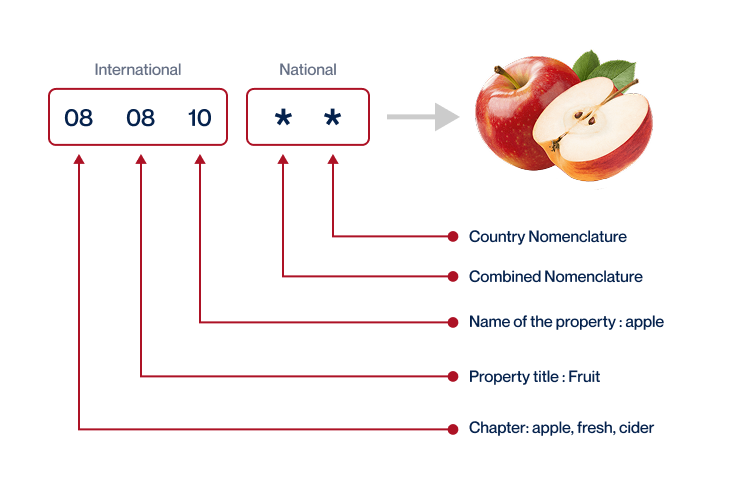

Step 2 – Find the HS Code of your product

Understanding the Harmonized System (HS) code for your product is fundamental to the shipping process. The HS code is a globally recognized, standardized system of names and numbers to classify traded products. These codes are utilized by customs authorities around the world to identify products for the application of duties and taxes.

If you’re unsure how to find this code, your easiest and most reliable source would be your supplier. They’re typically well-acquainted with the products they’re trading and related regulations, including HS codes.

However, for instances where contacting the supplier isn’t feasible, don’t fret, we’ve got you covered. Here’s a simple step-by-step guide to find your HS code using an HTS lookup tool:

1. Visit the Harmonized Tariff Schedule site.

2. Enter the name of your product in the search bar.

3. Check the Heading/Subheading column – your HS code will be listed there.

Please note that it’s crucial to accurately classify your product with the correct HS code. An incorrect code can lead to shipment delays and potential fines due to customs clearance issues. Thus, confirm the correct code multiple times to ensure a smooth shipping experience.

Right before we wrap up, here’s an infographic showing you how to read an HS code. This visual aid will help you better understand these crucial codes, ensuring your successful navigation of international shipping and customs processes.

Step 3 – Calculate the Customs Value

One hurdle you may face when shipping goods from Vietnam to the Democratic Republic of Congo (DRC) is determining the customs value. Think of it as a special value, different from the actual price tag of your products. This value isn’t just about the cost of the goods you’re shipping.

It’s what we call the CIF value, summarized as follows:

Customs Value (USD) = Cost of Goods (USD) + International Shipping Charges (USD) + Insurance (USD).

For instance, if the cost of your goods is $1000, the shipping charges are $200, and insurance is $50, the custom value becomes $1250. This simple equation will help you calculate the customs value, keeping your shipping process smooth and hassle-free.

Step 4 – Figure out the applicable Import Tariff

Import tariffs, in simple terms, are taxes imposed on imported goods. They are designed to protect domestic industries and maintain economic stability. The type of import tariff used in the Democratic Republic of Congo (RDC) falls under the Harmonized System (HS), internationally standardized system of names and numbers to classify traded products.

To find the applicable tariff rate for your products, refer to the official RDC tariff schedule or consult with a local customs broker familiar with the RDC’s import procedures.

For instance, let’s take a hypothetical scenario where you are importing leather shoes classified under HS code 6403. If the import tariff rate is 20%, and your Cost, Insurance, and Freight (CIF) cost totals to $10,000 USD, your import duties can be calculated as follows:

Import Duties = Import Tariff Rate CIF Value

= 20% $10,000

= $2,000 USD

Please take note that actual rates can be different and it’s crucial to use the most current and exact figures to avoid any discrepancies. It’s recommended to get the most accurate and up-to-date information directly from the RDC’s customs department or an experienced customs broker.

Step 5 – Consider other Import Duties and Taxes

On top of the standard tariff rate, there might be other import duties levied, depending on the origin country and the nature of the product. For instance, let’s look at excise duty, implemented on select goods such as tobacco or alcohol. Or take anti-dumping taxes, placed on cheap imports that might harm local industry.

Perhaps the most significant additional fee is Value Added Tax (VAT). This is a form of indirect tax imposed at different stages of the production and distribution process. For example, in the Democratic Republic of Congo (DRC), the standard VAT rate is 16% – but bear in mind, these figures can vary.

Here’s a brief illustrative calculation: if your product is valued at $10,000, the VAT would be 16% of $10,000, which equals $1,600. Therefore, your total cost, in this case, might be $11,600 ($10,000 + $1,600), not including other duties and taxes.

These are merely simplified examples, and actual rates and costs might differ depending on various factors. It’s essential to thoroughly research and stay updated with changing policies to avoid unexpected costs.

Step 6 – Calculate the Customs Duties

Calculating customs duties is a critical step in any international shipping process. It involves calculating the amount payable based on the customs value of the product, any additional taxes, or existing trade agreements. This value is reckoned as a percentage of the total cost, insurance, and freight (CIF) value of the goods.

Consider three scenarios:

1. A shipment of furniture valued at $5000 from Vietnam to RDC. In this case, let’s say the customs duty is 10%; you’d owe $500 in customs duties.

2. Now, add a Value Added Tax (VAT) of 16%. Your furniture shipment would attract a VAT of $800. This takes your total cost to $5,300.

3. Lastly, picture a shipment of steel, vulnerable to anti-dumping and excise duty. If the customs tax is 10%, VAT 16%, anti-dumping tax 10%, and excise duty 5%, on a shipment worth $10,000, you’d pay a $1000 on customs duties, $1600 on VAT, $1000 anti-dumping tax, and $500 excise duty, resulting in a total of $13,100.

Navigating the complexities of RDC customs can be overwhelming, and that’s where FNM Vietnam steps in. We offer comprehensive customs clearance services that eliminate the risk of overpayments and ensure smooth transportation. Contact us for a free quote; we’ll deliver expertise and efficiency to every corner of the globe within 24 hours.

Does FNM Vietnam charge customs fees?

FNM Vietnam operates as your customs broker, facilitating the process but not imposing customs duties. It’s crucial to distinguish between brokerage fees and customs duties/taxes, paid directly to the government. You’re only charged for the brokerage services, not the actual duties. Rest assured, we share all documentation from the customs office, confirming that you’re not overpaying. It’s like getting fined for a traffic violation – you pay the government, not the officer handing you the ticket! So, with FNM Vietnam, you only pay what’s rightfully charged by the authorities.

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs Official website: http://www.customs.gov.vn/

RDC Customs

Official name: Democratic Republic of the Congo Customs and Excise Department

Official website: http://www.douanes.gouv.cd/

Required documents for customs clearance

Untangling the web of customs paperwork can be tricky, right? Let’s dive into crucial documents: Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Knowing these will cut through red tape, speeding up delivery and avoiding penalties. Stick around; we’re about to make your shipping life easier!

Bill of Lading

Wondering about the Bill of Lading for your Vietnam to RDC shipping needs? Issued by your carrier, this official document signifies the shift in goods ownership, which is crucial for customs clearance in both countries. It comes in handy, especially when things get lost in the shuffle. Here’s a pro tip: An Electronic or ‘telex’ Release could be a game changer for you! It’s a quicker, paperless format of the document, which massively speeds things up at the destination port. If air cargo is your mode of choice, don’t overlook an Air Waybill (AWB) fulfilling a similar role. Ready to optimize your freight forwarding? Be sure to have a firm grip on your Bill of Lading.

Packing List

The Packing List: it’s your inventory control tower in the shipping process between Vietnam and RDC. Imagine you’re sending a diverse range of goods—say, plastic toys, ceramic dishes, and metal tools. For every item, its weight, dimensional details, nature, and number of units need to be accurately recorded on your Packing List. Whether you opt for sea freight or air freight, customs officials at both Vietnam and RDC ports will cross-verify your declared goods with this list. Mistakes here often lead to delays, extra charges, even potential penalties. So when preparing your Packing List, remember—it’s not just a rudimentary list; it’s a pivotal tool to steer goods smoothly through customs green channels. Accuracy is king; think twice, document once!

Commercial Invoice

Getting your goods from Vietnam to RDC (Democratic Republic of Congo) smoothly hinges on accurate documentation, particularly your Commercial Invoice. This key document must detail product descriptions, quantities, prices, shipper and consignee addresses, and terms of delivery. It’s imperative that this aligns with your Bill of Lading and other shipping documents.

For example, if you’re exporting 500 pairs of shoes, every detail—right from the material, design, size range, etc.—should be similar across all documents. Slight errors can cause customs hold-ups.

For seamless customs clearance, ensure that pricing details, Harmonized System (HS) codes, and Incoterms® 2020 rules are also correctly provided. This clarity aids customs officials in correctly determining import duties and taxes, accelerating your goods through customs. By focusing on these actionable insights, your shipping experience can be smoother and more predictable.

Certificate of Origin

When you’re shipping goods from Vietnam to the Democratic Republic of Congo (DRC), having a Certificate of Origin (CO) beneath your wing is non-negotiable. This paper verifies where your products are made and it’s potentially your gold ticket to preferential customs duty rates! Let’s say your cargo is laden with Vietnam-manufactured electronics—you’ll want to solidly mention ‘Vietnam’ in your CO. This simple action could dramatically slash your duty fees at the Congolese border, making your venture more profitable. Therefore, never underestimate the power of accurately declaring your goods’ country of origin—it’s a business game changer. So, next time you plan a shipment, remember, the Certificate of Origin can be your best ally against excessive costs!

Get Started with FNM Vietnam

Prohibited and Restricted items when importing into RDC

Unsure about what items pose challenges when importing into the Democratic Republic of Congo? Knowing the limits and strict regulations helps avert complications or extra costs. Let’s clear up the mystery around these items right away.

Vietnam – RDC trade and economic relationship

Vietnam and the Democratic Republic of Congo (RDC) have been trading partners for several decades, though it’s only in recent years that their economic relationship has grown substantially. The exchange of goods such as seafood, textiles, electronic goods from Vietnam, and minerals from the RDC has steadily risen. Vietnam invested heavily in RDC’s telecommunication sector in 2009, marking a significant milestone.

Key sectors in this bilateral trade include telecommunication, mining, and manufacturing. In 2023, Vietnam’s exports to RDC reached a noteworthy $92.6 million USD, showcasing the clear uptrend in the trade value of commodities between these nations. A strong emphasis has been placed on investment in infrastructure and telecommunication, exhibited by Viettel’s $400 million USD investment in the RDC market.

These detailed insights into the Vietnam-RDC trade and economic relationship highlight the value of understanding key trading routes and investment opportunities when shipping goods between these countries.

Your Next Step with FNM Vietnam

Additional logistics services

Warehousing

Finding a robust warehousing solution in Vietnam or the RDC can feel like a Herculean task. With specific goods requiring features like temperature control, the stakes are high.

Packing

When shipping goods from Vietnam to RDC, solid packaging is your ticket to damage-free delivery. Engaging an expert like us ensures your antiques or electronic parts are correctly packaged and repackaged, minimizing breakage concerns. Imagine shipping fragiles without a single scratch - that's what good packaging does.

Transport Insurance

When it comes to shipments, risks are greater than merely fire-related incidents. Our cargo insurance service ensures your goods are covered against potential damages or losses during transit, far beyond the scope of typical fire insurance. For example, imagine your goods on a stormy sea voyage, with high waves threatening their safety – this is the kind of situation cargo insurance caters for. Prevention is key, and this service provides that much-needed peace of mind.

Household goods shipping

Sending fragile or bulky items between Vietnam and RDC? With our Personal Effects Shipping service, your beloved belongings get top-tier, flexible treatment that makes the journey seamless. Picture your valued grand piano handled with utmost care and delivered safely to Kinshasa!

Procurement in Thailand

Seeking suppliers in Asia or East Europe? FNM Vietnam eases the task by overseeing the procurement process from start to finish. From locating trustworthy manufacturers to overcoming language issues, we're your guide through the complex world of sourcing. An example? We've helped a furniture retailer source high-quality oak directly from Hungary.

Quality Control

Quality Control is your secret weapon to avoid costly errors in transferring goods from Vietnam to RDC. Imagine shipping 1000 custom-made pieces, only to find 100 have defects? Devastating. That's where our QC steps in, preventing such nightmares by ensuring products meet all standards. Save time, money, and maintain that all-important reputation.

Conformité des produits aux normes

Understanding and adhering to international compliance regulations can be tedious. Here's where our Product Compliance Services come to your rescue! With our expertise, we manage the labyrinth of rules and even conduct laboratory tests for certification, ensuring that your goods are compliant every step of the way. This eases your shipping process, giving you peace of mind. For example, a clothing exporter saw a hassle-free transit with our team clearing strict compliance hurdles, saving them from potential fines and delays.