You don't have the time to read this article? Play the bellow button and listen to it!

The commercial invoice is perhaps the most important commercial document in the batch of documents for an import / export transaction. We can never repeat it enough, the documents and the administrative part is one of the most important point in international logistics, it is therefore important to comply with the conditions imposed by the customs of the country of destination.

Summary

Import customs clearance

The commercial invoice is used for customs clearance at destination and its possession does not prove ownership of the goods. It is

issued by the exporter, once the sales transaction has been confirmed, so that the buyer pays the amount of the products and services provided. It is also an accounting document which serves as the basis for the application of customs duties for the passage of goods through customs.

If it is a non-Community transaction, the buyer will always need this document in order to be able to carry out the corresponding customs procedures.

Commercial invoice requirements

The requirements that invoices must contain are set out in many European laws. At a minimum, the following information must be included in an invoice:

- Number and, if applicable, series of the product(s).

- Date of your shipment.

- Full company name, both of the person required to issue an invoice and of the recipient of the operations.

- Tax identification number assigned by the local administration or, where applicable, by that of another Member State of the European Community, with which the operation necessary for the issuance of the invoice has been carried out.

- Recipient's tax identification number.

- Precise denomination and quantity of goods.

- Unit and total price of the goods in the agreed currency. Do not indicate, for example "$", which leads to doubts or confusion between American dollars, Canadian dollars, Hong Kong dollars, etc.

- In the case of full container shipments (not groupage), you must specify the container number, the goods loaded in each container and the total weight of the goods also per container.

Commercial invoice and packing list

If all this information, due to the quantity or type of goods, cannot be indicated on the invoice, there is a packing list.

In this case, we would issue the commercial invoice with a more or less generic description, mentioning therein, "according to the packing list attached". In turn in this packing list, it should be mentioned that what is detailed corresponds to the bill number…

The container number is also specified in the upper right corner of the container by 4 acronyms and 7 digits. XXXX-123456-7. This description is based on an international ISO standard.

Incoterms and commercial invoice

These points are related to the incorterms and should be on the commercila invoice:

- Terms of delivery of the goods (by referring if we had accepted, to the conditions of international negotiation published by the International Chamber of Commerce). Remember that the use of Incoterms is in no way compulsory, being an agreement between the parties.

- Origin of the goods, which is not the same as the origin. A Chinese mobile, it will always be Chinese, no matter how much we paid for VAT and import duties. In the absence of an indication of the origin of the goods, the customs office of export may in fact refuse to issue a certificate of origin such as EUR-1.

- Indicate if the "merchandise is exported definitively" (to be sold / consumed on the spot), or if the "merchandise is exported temporarily" (in particular to participate in events such as "Trade Show").

- It is advisable to identify each product, according to its codification in the 10-digit Community Tariff (TARIC) or at the 8-digit level (Harmonized Commodity [HS] code) with the Nn to speed up customs procedures.

- It would be practical to issue as many copies as necessary for each of the required procedures (customs, banks, etc.).

- The copies agreed between the buyer and the seller, which summarize all the details of the transaction, are written in English generally (or sometimes in French), for a better understanding of both parties, whether they are English-speaking countries or French-speaking, provided that sometimes the customs authorities of the importing country require presentation in their official language. Import and export customs may require an official translation of invoices that are not written in a language or official. The commercial invoice must be completed with the customer's instructions or the requirements of the destination country (references to licenses, certificates, etc.).

- The tax rate, if any, applied to transactions.

- The tax quota which, if any, is passed on, must be recorded separately.

DocShipper Info: Incoterms can seem very complicated but if you have an e-commerce or if you work in international trade, it is necessary for you to know them and identify them. This is why we wrote an article in our blog to help you with everything you need to know about incoterms 2020. Do not hesitate to contact us!

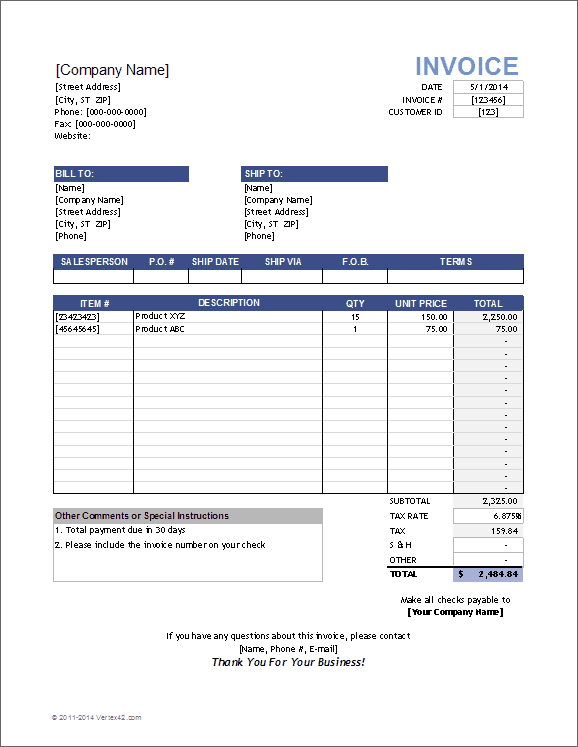

Commercial invoice template

There is no specific template, although the most widely used and benchmark template for exporting companies is the one provided by the United Nations as part of its United Nations Electronic Commercial Documents Program (UneDocs).

How does VAT work in intra-Community transactions?

Do I have to pass the VAT when I sell to a natural or legal person established in the territory of the Union (EU)?

As a general rule, the first thing to check is whether the sale is made to a professional, a company or an individual.

If it is an individual, of course, the VAT will be passed as a general rule. There is a delivery taxed in the country of origin and exempt in the country of destination, with exceptions such as the acquisition and transport of vehicles and distance selling when it exceeds certain billing limits.

How does VAT work in transactions with third countries?

In this situation, the regulations are even clearer. We will not only apply the corresponding VAT on our sales invoice if the export SAD, the Single Administrative Document, which proves the exit of our goods from our territory is in our possession. This is extended as in the previous case even when we sell under EXW or FCA conditions where the customs export formalities are the responsibility of the importer-buyer.

Therefore, be careful not to obtain or claim the corresponding export SAD

In certain circumstances, generally imposed by the buyer (importer), the data entered in the commercial invoice presented to the customs office of origin, where customs clearance is carried out, do not always coincide with the data indicated in the commercial invoice addressed to buyers (importer).

This is due to the fact that most goods are taxed at their customs value. This circumstance leads to the fact that in countries where the customs administration has a questionable reputation, importers, in order to seize a lower amount in terms of customs duties, submit commercial invoices with a lower amount.

This clearly illegal practice results in economic sanctions against the importers who practice it, and the sales of the exporting company in this country may be compromised.

In some cases, the commercial invoice serves as a sales contract and collection method, for which it must be signed by the buyer, importer, before the shipment of the goods as proof that the conditions have been accepted by him, as well than the arbitration clauses corresponding to the International Sales Contracts which we have agreed.

DocShipper Tip: Customs are a hard thing to deal with. This is why DocShipper provides you with a customs clearance service that can handle all this burden for you: the paperwork and all the other procedures. You won't have to worry about getting stuck in customs! Contact us for further details!

Some mistakes made with Incoterms

Incoterms do not deal with the transfer of ownership, you must read the introductory notes in the latest edition of Incoterms 2020, so this problem must be resolved in the sales contract, where the domain reservation agreement, for example, disconnects transfer of ownership transfer of possession over the goods

The biggest mistake made with Incoterms is to believe that they provide a complete sales contract, when the only thing that concerns Incoterms is when and where the delivery of the goods (possession) takes place and with it, the transmission of risks from the seller to the buyer, who pays the costs of delivery and who takes care of customs formalities, and nothing else.

They do not deal with the price or the method of payment, whether or not there is an obligation to pay in the event of a default, etc. All of these problems are resolved in the sales contract, which is the only way to transfer ownership.

Remember that if you use the Incoterms in the sales contract between the buyer and the seller, it should not be confused with the transport contract between the sender and the transporter.

Something as simple as indicating for example: "The purchasing company detailed in this invoice acquires ownership of the goods when it has demonstrated full payment" allows:

- That the property does not pass to the buyer until the price is paid in full, therefore the good is delivered but not the property.

- That if the buyer has debts, the creditors cannot execute the property that we have sold, because in the absence of payment of it, the seller is still the owner of it.

EORI - Economic Operators Registration and Identification number

The EORI is a number unique throughout the European Union, assigned by the customs authority of a Member State to economic agents (companies) or individuals. By registering for customs purposes in a Member State, an economic operator can obtain an EORI number valid throughout the European Union.

In order for a company to obtain its EORI number, it must be carried out in the Member State where it will carry out its first import or export. The state is generally the country of origin. Once the EORI ID is obtained, it will be valid for all Member States of the European Union.

For example, in case your company is not registered in Spain but nevertheless has a tax representative or has obtained a VAT number in France, you also need the EORI identification, which will be identical to the one you obtained in your country of origin linked to the FNI obtained in France. Finally, you must request this link to customs.

How to get your EORI number?

In the case of Spanish companies, whose NIF begins with A or B, the VAT NIF will coincide with their EORI number. The Spanish administration has registered the vast majority of applicants in the EORI database and the process is automatic when it is sent to legal persons which are a public limited company or a public limited company. However, it may happen that there are Spanish NIFs that do not have EORI, so it is recommended to consult the validity of the Spanish EORI on the official website of the European Union.

Deadline for obtaining your EORI number

After the request and registration with the tax authorities, you must wait approximately 48 hours until it is activated and the goods can be dispatched.

If you are a foreigner, the EORI number is not enough!

It is necessary to request the link between your EORI and your NIF. You can contact us to help you process it.

DocShipper Alert: Are you worried about your products' quality? You're afraid of getting scammed by a supplier after spending a huge amount of money? Don't worry about that! Thanks to our quality control service, we can make sure your goods have a good quality before having to buy a big quantity and ship it! Contact us for more!

FAQ | Commercial invoice in international trade

What is a commercial invoice?

A commercial invoice is a document issued by the exporter after the sale has been made that must be given to customs for clearance. This document is always requested when trading abroad.

Where can I find a sample commercial invoice?

It is very important to have certain details in your commercial invoice, so you will need a template to make your own. Find a free commercial invoice template in the FNM Vietnam article with everything you need.

What should be on a commercial invoice?

A commercial invoice is a very important piece of paper and you must therefore respect certain information to be included in it. These are: the date of shipment, the full company name, the tax identification number, the exact name and quantity of the goods, the unit and total price, the serial number of the product and the container number if you are sending goods. For more information about this, please refer to the article of FNM Vietnam.

What is the difference between a commercial invoice and a packing list?

These two documents work together since a commercial invoice indicates the commercial value of the goods to be given to customs, whereas a packing list makes it possible to check the conformity of the shipment with the order. When making international sales, it is therefore important to do both.

What is an EORI?

It is very important to know what an EORI is when you need to make commercial invoices in the European Union since EORI stands for Economic Operators Registration and Identification number, and therefore allows you to do business securely within the European Union.

DocShipper info: Did you like this article? You may also like the following:

Adivce FNM :We help you with the entire sourcing process so don't hesitate to contact us if you have any questions !

- Having trouble finding the appropriate product? Enjoy our sourcing services, we directly find the right suppliers for you!

- You don't trust your supplier? Ask our experts to do quality control to guarantee the condition of your goods!

- Do you need help with the logistics? Our international freight department supports you with door to door services!

- You don't want to handle distribution? Our 3PL department will handle the storage, order fulfillment, and last-mile delivery!

DocShipper | Your dedicated freight forwarder in Vietnam !

Due to our attractive pricing, many customers trust our services and we thanks them. Stop overpaying the services and save money with our tailored package matching will all type of shipment, from small volume to full container, let us find the best and cost-effective solution.

Communication is important, which is why we strive to discuss in the most suitable way for you!