Freight Shipping between Vietnam and UK | Rates – Transit times – Duties and Taxes

Chickens might not cross the road, but your freight certainly has to cross continents and oceans! For many businesses, figuring out the freight transport logistics between Vietnam and the UK can feel like a riddle nearly as tricky as that chicken joke. With concerns spanning from comprehending rates and transit times to the complexity of customs regulations, it might feel overwhelming. That's where this guide comes in. Expect in-depth insights into various types of freight options, the nitty-gritty of customs clearance procedures, and important information on duties and taxes. We'll also provide practical advice tailored to businesses shipping goods between these two countries. If the process still feels overwhelming, let FNM Vietnam handle it for you! Our expertise as an international freight forwarder translates into taking care of every step of your shipping process, effectively turning challenges into successful business outcomes.

Which are the different modes of transportation between Vietnam and UK?

Which are the different modes of transportation between Vietnam and UK? Choosing the right mode of transport for shipping goods from Vietnam to the UK is a bit like picking the best route for a road trip. You need to account for factors like the 8,000-mile distance and navigating across several international borders. Air freight offers speed, while sea transport brings cost benefits. On the other hand, road might be less practical due to its length. Let's delve into the sea vs air debate, weighing up their pros and cons to help you chart the best course for your goods. It’s all about finding the right balance for your specific shipping needs!

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can FNM Vietnam help?

Sea freight between Vietnam and UK

Welcome to the world of tropical teak, vibrant textiles, and aromatic coffee! It’s no wonder that the bustling trade relationship between Vietnam and the UK encompasses such a diverse mix of goods. Key cargo ports like the Port of Hai Phong and Port of Southampton bridge vibrant industrial centres, fostering an intricate trade network across the seas. But it’s not all smooth sailing.

While sea freight is a cost-effective solution for high volume goods – especially enticing for those sizable, budget-conscious shipments – it’s also the slowest method. But time isn’t the only challenge. Businesses often grapple with the ins and outs of shipping between these two nations. It’s like attempting to play chess without knowing the rules; frustrating, confusing, and fraught with mistakes. But don’t worry, we are here to flip the board. In this section, you’ll gain practical insights into best practices and specifications simplifying the shipping process. It’s time we turned your shipping experience from a guessing game into a strategic win. Let’s delve into the journey of ocean shipping between Vietnam and the UK.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Located in Northern Vietnam by the East Sea, Port of Hai Phong plays a crucial role for the northern provinces, with a shipping volume of over 28 million tons of cargo annually.

Key Trading Partners and Strategic Importance: The port’s key trading partners include China, Japan, and South Korea. Its location is of strategic importance because of its close proximity to Hanoi.

Context for Businesses: For businesses looking to expand in the northern region of Vietnam or optimize shipping routes to other parts of Asia, Hai Phong can be a beneficial part of their strategy with its large and advanced facilities.

Port of Da Nang

Location and Volume: The Port of Da Nang is located in central Vietnam by the Han River and the East Sea. With an annual throughput of over 6 million tons, it is the central region’s most significant port.

Key Trading Partners and Strategic Importance: It services links to Southeast Asia, Northeast Asia, America, and Europe, making it essential on international shipping lanes.

Context for Businesses: Companies looking to tap into Central Vietnam’s growing markets will find the Da Nang port an invaluable resource due to its well-equipped container handling facilities.

Port of Quy Nhon

Location and Volume: The Port of Quy Nhon is another prominent port in Central Vietnam. Its strategic location, coupled with a capacity of 4 million tons a year, makes it indispensable for exports from Central and Northeast Cambodia.

Key Trading Partners and Strategic Importance: Quy Nhon’s main trade partners include several Asian and European nations.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Located in Northern Vietnam by the East Sea, Port of Hai Phong plays a crucial role for the northern provinces, with a shipping volume of over 28 million tons of cargo annually.

Key Trading Partners and Strategic Importance: The port’s key trading partners include China, Japan, and South Korea. Its location is of strategic importance because of its close proximity to Hanoi.

Context for Businesses: For businesses looking to expand in the northern region of Vietnam or optimize shipping routes to other parts of Asia, Hai Phong can be a beneficial part of their strategy with its large and advanced facilities.

Port of Da Nang

Location and Volume: The Port of Da Nang is located in central Vietnam by the Han River and the East Sea. With an annual throughput of over 6 million tons, it is the central region’s most significant port.

Key Trading Partners and Strategic Importance: It services links to Southeast Asia, Northeast Asia, America, and Europe, making it essential on international shipping lanes.

Context for Businesses: Companies looking to tap into Central Vietnam’s growing markets will find the Da Nang port an invaluable resource due to its well-equipped container handling facilities.

Port of Quy Nhon

Location and Volume: The Port of Quy Nhon is another prominent port in Central Vietnam. Its strategic location, coupled with a capacity of 4 million tons a year, makes it indispensable for exports from Central and Northeast Cambodia.

Key Trading Partners and Strategic Importance: Quy Nhon’s main trade partners include several Asian and European nations.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Situated in Suffolk on the eastern coast, Port of Felixstowe is the UK’s busiest container port. It manages over 4 million TEUs Twenty-Foot Equivalent Units annually.

Key Trading Partners and Strategic Importance: As the primary port for trade with Asia, North America, and Europe, it holds a significant place in the UK’s international trading system.

Context for Businesses: If you’re keen on expanding your trade links with Asia or North America, the Port of Felixstowe might serve as an efficient pivot point for you. Its status as the main UK port for transatlantic and Asian trade makes it highly relevant.

Port of Southampton

Location and Volume: Located on the south coast of England, the Port of Southampton handles approximately 2 million TEUs a year.

Key Trading Partners and Strategic Importance: The port’s key trading partners include the United States, China, and countries in the European Union. Known as the UK’s number one vehicle handling port, the Port of Southampton also has a vital role in the nation’s automobile industry.

Context for Businesses: For those businesses in the automobile sector intending to boost their international trade or expand into US, Chinese, or EU markets, this port holds plenty of promise due to its substantial vehicle handling volume.

Port of London

Location and Volume: The Port of London, based on the River Thames, is the second largest in the UK, handling over 50 million tonnes of cargo each year.

Key Trading Partners and Strategic Importance: Serving over 80 countries worldwide, it plays a vital role in trade with the Asia-Pacific region, Europe, and the Americas.

Context for Businesses: If your export strategy revolves around reaching a variety of markets across the globe, the Port of London could serve as a valuable hub in your logistics due to its vast global connections.

Port of Liverpool

Location and Volume: The Port of Liverpool, located in the northwest of England, manages around 33 million tonnes every year.

Key Trading Partners and Strategic Importance: Strategically important for trade with North America and Europe, it is also known as the only UK port with west-facing deep-sea capacity.

Context for Businesses: Businesses aiming to build trade links with North America and Europe might find the Port of Liverpool particularly convenient for their needs, with its unique attribute of being a west-facing deep-sea port offering a distinctive advantage.

Port of Immingham

Location and Volume: Situated on the east coast of England, the Port of Immingham is the UK’s largest port by tonnage, handling about 60 million tonnes per year.

Key Trading Partners and Strategic Importance: The port’s key trading partners are largely European countries as well as Russia for oil and coal.

Context for Businesses: If your business is involved in the oil or coal sectors, or your primary aim is to expand trade within Europe and Russia, the Port of Immingham potentially offers an excellent base for your shipping strategy.

Port of Grimsby

Location and Volume: The Port of Grimsby, neighboring the Port of Immingham on England’s eastern coast, is a smaller but crucial port, particularly noted for its seafood trade.

Key Trading Partners and Strategic Importance: Specializing in trade with Iceland and Norway, it’s also one of the largest car importers in the UK.

Context for Businesses: If you’re in the seafood business or automobile import business, the Port of Grimsby could be an absolutely vital part of your trading strategy, particularly if you’re dealing with Iceland or Norway.

Should I choose FCL or LCL when shipping between Vietnam and UK?

Choosing between Full Container Load (FCL) and Less than Container Load (LCL) – often called consolidation – when shipping from Vietnam to the UK isn’t just about size and cost. The right choice can significantly affect your delivery timeline and the overall success of your shipping process. Let’s dive into the details and differences of these sea freight options, ensuring you make the best decision, whether shipping an entire container’s worth of goods or filling only a fraction of one. The perfect strategic choice will not only be budget-friendly but will guarantee a smooth journey for your precious cargo.

Full container load (FCL)

Definition: FCL or Full Container Load refers to a standard of shipment where a container is exclusively used by a single party. It encompasses two sizes, mainly the 20'ft (about 33 CBM) and 40'ft (about 67 CBM) container options.

When to Use: Shipping a high volume of goods becomes more cost-effective with FCL as the charge is per container, not weight or size. More than 13/14/15 CBM justifies choosing FCL shipping. Safety is another advantage of FCL. The sealed container remains so from Vietnam to the UK, minimizing risks associated with handling.

Example: Consider a furniture exporter from Vietnam exporting multiple sets of hardwood dining sets. The volume could easily surpass 15 CBM, making FCL shipping the appropriate choice. The sealed container reduces the risk of potential damages during transit.

Cost Implications: While the fixed FCL shipping quote might be greater than that of LCL for smaller volumes, bulkier shipments translate to more affordable charges per CBM. You'll find that the more you ship, the less it costs per unit of cargo. As a rule of thumb, for shipments with volume breaching 15 CBM, the FCL container should be your go-to for cost-effectiveness and increased protection.

Less container load (LCL)

Definition: LCL or Less-Than-Container-Load shipping refers to the transportation of goods that don't fill up a whole container. This option allows multiple consignees to share container space, keeping your LCL freight cost-effective.

When to Use: LCL is an ideal choice when your cargo measures less than approximately 15 cubic meters (CBM). Lower volume means less weight, offering flexibility and reducing cost implications.

Example: Suppose you're a Vietnamese chimneys manufacturer with an order for 10 units, which lump together total to 12 CBM. Given their size, LCL would be best as they won't occupy an entire 20ft container (which has around 28 CBM capacity). You'd share this space with other exporters, aiding your lcl shipping quote.

Cost Implications: LCL shipment is a budget-friendly option as you're only paying for the space your goods are occupying within the container, not the whole container. Keep in mind though, that while it appears economical upfront, the cumulative costs including customs clearance, trucking and handling charges at both origins can be higher than FCL on a per unit basis.

Hassle-free shipping

Unsure whether to ship by consolidation or full container from Vietnam to the UK? FNM Vietnam is here to help! Our ocean freight experts aim to make cargo shipping hassle-free for businesses. They consider critical factors such as your cargo volume, budget, and urgency, to guide you in choosing the best shipping option. Don't leave cost-savings at the dockside– reach out to us today for a free estimation! Your seamless shipping experience is only a call away with FNM Vietnam.

The sea freight shipping time between Vietnam and the UK typically averages around 30-35 days. However, it’s important to note that this time can vary depending on factors such as the specific ports being used, the weight, and the nature of the goods being shipped. Finding an accurate and personalized shipping time estimate can be achieved by reaching out to a specialized freight forwarder like FNM Vietnam, where you can get a tailored quote.

| Vietnam Port | UK Port | Average Transit Time (in days) |

| Cat Lai | Port of Felixstowe | 30 |

| Hai Phong | Southampton | 32 |

| Da Nang | London Gateway | 33 |

| Cam Pha | Port of Liverpool | 34 |

This table above outlines the average transit times understandably, keeping in mind that real-world conditions can cause these times to vary.

How much does it cost to ship a container between Vietnam and UK?

Estimating the shipping cost between Vietnam and the UK is a bit of a puzzle, with many pieces to fit together. Ocean freight rates can broadly range, primarily influenced by factors such as Point of Loading and Destination, the chosen carrier, specifics of your goods, and the ebb and flow of monthly market trends. This intricate mix makes pinpointing an exact cost challenging. But fear not! Our expert shipping specialists thrive on this complexity. We dive deep into the details, considering each factor in this puzzle, to ensure we deliver a quote tailored to your shipment’s unique needs. Remember, we calculate rates on a case-by-case basis, promising the best deals in the industry for you. So, let’s pave the smoothest, most cost-efficient path for your container’s journey together.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is specifically designed to accommodate your out of gauge cargo that doesn’t conform to standard container dimensions.

Suitable for: Large items that need substantial space due to their width, length, or height beyond standard dimensions.

Examples: Industries such as oil and gas, construction, or machinery manufacturing often ship goods like boilers, turbines, construction equipment or elements, and oversized vehicles via OOG containers.

Why it might be the best choice for you: With extensive external space, OOG containers eliminate the need for disassembling larger fixtures, which can be both time and cost-intensive.

Break Bulk

Definition: Break bulk involves shipping cargo that’s loaded individually rather than in containers, mainly because they may be too large or heavy.

Suitable for: Oversized cargo exceeding the dimensions of OOG containers, heavy equipment, or machinery.

Examples: Windmill blades, yachts, steel beams, cranes, or transformers often use the break bulk method.

Why it might be the best choice for you: In settings where the size and weight of your cargo are excessive, break bulk can secure safe and efficient delivery.

Dry Bulk

Definition: Dry bulk refers to the shipment of loose cargo load like granular materials, which are loaded directly into the vessel’s hold.

Suitable for: Dry commodities such as coal, grain, or minerals, among others.

Examples: Construction and power generation companies often ship goods like cement, sand, gravel, coal, or even cereal grains as dry bulk cargo.

Why it might be the best choice for you: For businesses dealing with loose granular goods, dry bulk shipping can be the most direct, cost, and time-effective solution.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro vessels are designed with built-in ramps that allow wheeled cargo, such as cars, trucks, or trailers, to be driven on and off the ship.

Suitable for: Vehicles or any towable machinery.

Examples: Automotive companies frequently use Ro-Ro for transporting cars, trucks, buses, tractors, and even specialized mobile equipment like mining or farming machinery.

Why it might be the best choice for you: Ro-Ro minimizes the necessity for cranes to load or unload, thus reducing risks and maintaining the vehicle’s functionality in the process.

Reefer Containers

Definition: Reefer containers are refrigerated containers used to transport temperature-sensitive cargo.

Suitable for: Perishables including fruits, vegetables, meat, seafood, dairy, pharmaceuticals, etc.

Examples: Businesses in the food industry, farming, fishing, or medicare often utilize reefers to ship goods like fresh produce, frozen seafood, or temperature-controlled medicines.

Why it might be the best choice for you: Reefers provide a controlled environment necessary for goods that require particular temperature or humidity levels, securing fresh, frozen, or chilled delivery.

At FNM Vietnam, we’re committed to helping navigate your shipping needs – whether they be standard or specialized. Feel free to reach out to us for a free shipping quote, delivered to you in less than 24 hours.

Air freight between Vietnam and UK

Quick and dependable, air freight from Vietnam to the UK, is the superstar of international shipping for small, high-value items. Think the sheen of Vietnamese silk or the curb appeal of innovative tech gadgets – such items find their best ally in airlift, flying across skies while preserving their prime condition.

However, it’s no stroll in the park. Many shippers unwittingly stumble into pitfalls, like underestimating costs by using incorrect weight calculations. It’s like trying to stuff a load of rice into a too-small pot and expecting it not to overflow – a surefire recipe for disaster that can leave you with soaring expenses. Correct pricing and knowledge of best practices are crucial to effectively navigate this terrain. We’re here to untangle the complex knots in this part.

Air Cargo vs Express Air Freight: How should I ship?

Want to fly your goods between Vietnam and the UK, but puzzled over the best choice? Here’s a simple breakdown: Air Cargo refers to stuffing your items in regular airliners, while Express Air Freight gets them a VIP ride on a dedicated plane. The right choice vastly depends on your specific business needs – so let’s dive straight into understanding when and why one works better than the other!

Should I choose Air Cargo between Vietnam and UK?

Opting for air cargo from Vietnam to the UK could align well with your budget and transport needs. Airlines like Vietnam Airlines and British Airways are key players in this arena, renowned for their reliability. However, bear in mind the potentially longer transit times due to fixed schedules. Fittingly, if your shipment exceeds 100/150 kg (220/330 lbs), air freight becomes increasingly cost-effective, offering more value for your money. Balancing these factors will help you make a decision that best suits your business requirements.

Should I choose Express Air Freight between Vietnam and UK?

Express Air Freight, often facilitated by renowned courier firms such as FedEx, UPS, or DHL, is an advantageous option for shipping smaller cargo from Vietnam to the UK. Specializing in rapid, dedicated service, these carriers use cargo-exclusive planes ensuring prompt delivery. Ideal for packages under 1 CBM or weighing up to 100/150 kg (220/330 lbs), this service ensures swift, efficient transport despite the distance. So, if you require speedy delivery of compact shipments, opting for Express Air Freight can be a wise choice. Reliable and quick, it could be the perfect fit for your cargo transportation needs!

Main international airports in Vietnam

Tân Sơn Nhất International Airport

Cargo Volume: Over 400,000 metric tons annually

Key Trading Partners: China, the United States, Japan, and South Korea

Strategic Importance: Based in Ho Chi Minh City, this airport is in close proximity to the city’s business district and the southern economic hub of Vietnam.

Notable Features: It’s the busiest airport in Vietnam, handling the majority of the country’s international cargo load.

For Your Business: If your supply chain is centered in the southern part of Vietnam, this airport would be your most convenient and efficient option. Its international cargo services are well-established and reputable, decreasing your chances of shipping delays and disruptions.

Nội Bài International Airport

Cargo Volume: Approximately 700,000 metric tons annually

Key Trading Partners: China, South Korea, Japan, Taiwan, and the United States

Strategic Importance: Located near Hanoi, this is the main airport for the north of Vietnam, serving a key economic and political region.

Notable Features: This airport boasts the ability to handle wide-body and large freight aircraft, contributing to high cargo volume.

For Your Business: If your supply chain involves Northern Vietnam, Nội Bài is a strong choice for its logistical capabilities, the capacity to handle high volumes and wide varieties of freight.

Da Nang International Airport

Cargo Volume: Nearly 200,000 metric tons annually

Key Trading Partners: Myanmar, Laos, Cambodia, and Thailand

Strategic Importance: Placed in Central Vietnam, Da Nang airport is integral to hosting international cargo shipments for the central and highlands areas.

Notable Features: Expanded cargo terminal facilities and capacity to serve major freight carriers.

For Your Business: If you trade primarily with Southeast Asian countries and have a central Vietnam supply chain, this airport offers a strategic advantage to your operations.

Cần Thơ International Airport

Cargo Volume: Around 80,000 metric tons annually

Key Trading Partners: Japan, Thailand, Singapore, and Malaysia

Strategic Importance: It serves the Mekong Delta area of Vietnam, a significant agricultural region of the country.

Notable Features: Geared towards the export market, particularly agricultural and seafood products.

For Your Business: If your business is in the agricultural sector, particularly in the Mekong Delta region, this airport caters to your specific needs with its specialized handling and shipping capabilities.

Phú Quốc International Airport

Cargo Volume: Approximately 30,000 metric tons annually

Key Trading Partners: Thailand, Cambodia, and Singapore

Strategic Importance: Being on Phú Quốc Island, it facilitates cargo trans-shipments amongst regional Southeast Asian countries.

Notable Features: Focused on small-scale, highly frequent cargo shipments.

For Your Business: If your business operations require short but frequent shipping intervals to neighboring Southeast Asian countries or if you operate on an island supply chain, Phú Quốc is your ideal airport.

Main international airports in UK

Heathrow Airport

Cargo Volume: Over 1.7 million metric tons annually.

Key Trading Partners: USA, China, India, HK, Japan.

Strategic Importance: Heathrow is the busiest airport in Europe and the seventh busiest globally by total cargo volume, making it a key node in global supply chains.

Notable Features: Heathrow boasts specialised cargo handling facilities, including temperature-controlled areas for perishable goods, secure areas for valuable cargo, and robust facilities for dangerous goods.

For Your Business: Heathrow’s frequent global connections offer versatility and speed, making it ideal for time-sensitive goods. Its comprehensive facilities ensure safe handling of a wide range of cargo types, adding assurance to your shipping strategy.

London Gatwick Airport

Cargo Volume: Over 96,000 metric tons annually.

Key Trading Partners: Europe, UAE, USA.

Strategic Importance: Gatwick is the UK’s second busiest airport and has strong trade relations with Europe, making it an important gateway for European trade.

Notable Features: Gatwick features state-of-the-art cargo handling services, accommodating all types of cargo.

For Your Business: Gatwick’s strong links with Europe make it an excellent choice if you’re looking to expand or strengthen your business ties with European markets.

East Midlands Airport

Cargo Volume: Over 365,000 metric tons annually.

Key Trading Partners: Spain, Ireland, Germany, UAE.

Strategic Importance: East Midlands Airport is the UK’s largest pure cargo airport and a major hub for freight to Europe & UAE.

Notable Features: It houses several major logistics companies on-site, including DHL, TNT, and UPS.

For Your Business: If you operate in the e-commerce sector, East Midlands could be your ideal logistics hub, given its significant freighter and express operations.

London Stansted Airport

Cargo Volume: Over 260,000 metric tons annually.

Key Trading Partners: USA, Germany, UAE.

Strategic Importance: Stansted is the third largest cargo airport in the UK with a particular focus on transatlantic and European trade.

Notable Features: Stansted features excellent road connections to South East England, making it easy to arrange onward ground transportation.

For Your Business: Stansted’s links to the USA and Europe, combined with its efficient ground transport capabilities, can expedite the delivery of your goods and enhance your shipping strategy’s reach and efficiency.

Manchester Airport

Cargo Volume: Over 123,000 metric tons annually.

Key Trading Partners: USA, UAE, Germany.

Strategic Importance: Manchester is the UK’s fourth largest airport for cargo, serving a broad variety of international destinations for freight transport.

Notable Features: Manchester houses the World Freight Terminal, a dedicated cargo facility with 24/7 operations and capable of handling all cargo types.

For Your Business: With its comprehensive cargo handling facilities and wide-ranging international connectivity, Manchester Airport could provide the reliability and global reach your business’ shipping operations require.

How long does air freight take between Vietnam and UK?

Transit between Vietnam and the UK by air typically takes anywhere between 3 to 6 days. However, please be aware that this timeframe is only a rough estimate. Actual transit times can fluctuate depending on the specific departure and arrival airports involved, the weight and nature of the goods being transported. For accurate timelines tailored to your shipment, it’s best to consult with a freight forwarder, such as FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and UK with air freight?

The cost of air freight shipping from Vietnam to the UK typically ranges from $3 to $5 per kilogram. However, exact pricing is contingent on a variety of factors, including airport locations, parcel dimensions, weight, and nature of goods. As such, we recommend getting a custom quote for the most accurate information. Our team is committed to providing you the best rates and will evaluate your specific needs on a case-by-case basis. Reach out to us and receive a free quote within 24 hours!

What is the difference between volumetric and gross weight?

Gross weight refers to the total weight of a shipment, including the goods and all packaging material. On the other hand, volumetric weight, also called dimensional weight, considers the size of a package, a significant factor in air freight.

To calculate gross weight of a parcel in Air Cargo and Express Air Freight services, it’s straightforward: weigh your package and measure in kilograms (remember, 1kg equals about 2.2 lbs).

Calculating the volumetric weight requires a simple equation. Measure your parcel’s length, height, and width in centimeters. Multiply these dimensions to get the parcel’s total volume. Divide this total by the factor 5000 in Air Cargo and by 5000 or 6000 (depending on the carrier’s preference) in Express Air Freight, giving the dimensional weight in kilograms. For instance, suppose your package measures 50cm x 60cm x 40cm. In Air Cargo, the volumetric weight is (50 x 60 x 40) / 5000, equating to 24kg (or 52.9 lbs).

Important to note, freight charges are impacted by these measurements. Carriers charge based on the higher of the two weights – gross or volumetric. As such, understanding these calculations will guide your packing decisions and help manage costs.

Door to door between Vietnam and UK

Navigating the world of international shipping? Consider door-to-door service: a hassle-free method where logistics providers handle everything from pick-up in Vietnam to delivery in the UK. This seamless approach cuts out the middlemen and saves you time. Ready to explore this convenient shipping method? Let’s dive in.

Overview – Door to Door

Door to Door shipping between Vietnam and the UK is the ultimate hassle-free solution for your logistics needs. This service tackles the complexity of international shipping, providing seamless management of everything from customs procedures to local deliveries—it’s like having a personal logistics assistant. While it may cost more than traditional shipping, the convenience is unmatched. The robust support throughout the shipping process eliminates hidden costs and uncertainties. It’s no wonder Door to Door shipping is the top choice for our FNM Vietnam clientele. Opt for this stress-free service and see why it’s an experiences game-changer.

Why should I use a Door to Door service between Vietnam and UK?

Want peace of mind and less hair-pulling in logistics? Discover the magic of Door to Door service from Vietnam to the UK!

1) Say Goodbye to Logistics Stress: This service completely handles the logistics, from goods pick-up in Vietnam to delivery in the UK. These means you can spend less time fretting over complex logistics and more time on what you do best: running your business.

2) Just In Time Delivery: Got an urgent shipment? A Door to Door service offers a seamless shipping process ensuring that your goods arrive just when they need to. No waiting, no sweating – just speedy, reliable delivery.

3) Special Cargo, Special Care: Need to ship something complex or fragile? No worries, this service provides specialized care to ensure your complex cargo arrives in the UK safe and sound. You can rest easy knowing that you aren’t trusting your precious cargo to just anyone.

4) Ultimate Convenience: Imagine not dealing with the nitty-gritties of trucking, customs, or other paperwork! With a Door to Door service, all you have to do is sit back and let experts handle everything from start to finish.

5) Start to Finish Responsibility: One of the best things about Door to Door service is that one entity is responsible for the entire journey. This means if anything goes awry, there’s no passing the buck. You know exactly who to ring, and they’re invested in setting things right.

Choose Door to Door, and let your shipping be as serene as a Zen garden.

FNM Vietnam – Door to Door specialist between Vietnam and UK

Experience seamless door-to-door shipping between Vietnam and the UK with FNM Vietnam. We ensure a stress-free process, taking care of everything from packing to customs clearance, across all shipping modes. Our proficiency in this domain guarantees a smooth journey for your goods. Enjoy the luxury of a dedicated Account Executive, ready to aid in all your shipping needs. Reach out for a free, no-obligation quote in less than 24 hours or consult with our experts at your convenience. With FNM Vietnam, moving goods has never been easier.

Customs clearance in UK for goods imported from Vietnam

Customs clearance is a pivotal step in transporting goods from Vietnam to the UK, laden with complexity and potential pitfalls like unforeseen charges. It’s crucial to grasp duties, taxes, quotas, and licenses intricately. One misstep can land you in a frustrating situation with stalled goods. We’ll dive deeper into these areas shortly. Remember, understanding these details could save you time, money, and potential headache. Luckily, FNM Vietnam is here to assist with the whole process anywhere in the world. If you need an estimate to crunch numbers for your project, contact our team with key details: the origin, value, and HS Code of your goods. It’s a mandatory trio we need to proceed with your precise estimate. So, let’s navigate the labyrinth of UK customs together, allowing a smooth sail for your goods from Vietnam.

How to calculate duties & taxes when importing from Vietnam to UK?

Understanding the calculation of customs duties and taxes is a key part of successfully importing items from Vietnam to the UK. It’s rather like a formula, where you need specific ingredients: the Country of Origin, the Harmonized System (HS) Code, the Customs Value, the Applicable Tariff Rate, along with any other applicable taxes, levies, or fees that may apply to your products.

Now, let’s put it into action. Your very first step would be to precisely identify where your goods were manufactured or produced. Simply put, discerning the ‘Country of Origin’ sets the stage for your entire import journey.

Step 1 – Identify the Country of Origin

Identifying the exact Country of Origin is your first step and it’s crucial, with five key reasons anchoring its importance.

Firstly, the country of origin can directly influence import duties. Vietnam and the UK have unique trade agreements, including the UK-Vietnam Free Trade Agreement that reduces or eliminates certain tariffs.

Secondly, certain products may face additional duties or restrictions based on their origin. For instance, certain agriculture products from Vietnam have specific limits in the UK.

Thirdly, meticulously noting the origin prevents mix-ups, aiding accurate record-keeping.

Fourthly, knowing the origin country of your goods aids in calculating possible import taxes and in understanding if preferential duty rates apply.

Lastly, correct identification helps in avoiding fines or penalties for false declarations.

Remember, each trade agreement has different stipulations that can affect customs duties. Familiarize yourself with these to make the most out of your shipping budget. Also, make a note of the specific import restrictions the UK places on certain goods from Vietnam for a smoother transit. Identifying the country of origin may seem like an obvious step, but it holds significant impact on your shipping process. Ball’s in your court: make sure to give it ample attention!

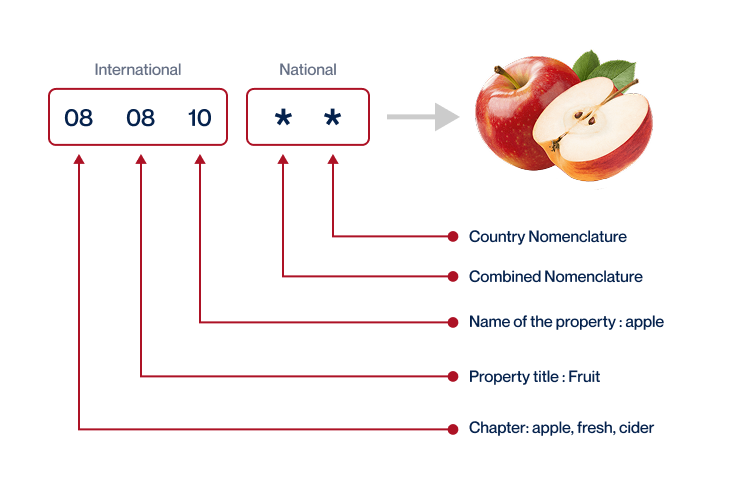

Step 2 – Find the HS Code of your product

In international trade, every item that is shipped is categorized under a specific code known as the Harmonized System (HS) Code. The code, composed of a series of numbers, is recognized globally and is used as a common language in trade to unmistakably identify goods. When you’re shipping goods internationally, understanding your product’s HS code is fundamental. It’s used not just for determining customs duties and taxes, but also for statistical purposes and for complying with local and international trade laws.

Normally, to find the HS Code of a product, the easiest course of action is to ask your supplier. They typically know the codes and regulations related to what they’re importing or exporting. However, if that’s not an option, we’ve got you covered with the following easy-to-follow steps.

1. Visit the “Harmonized Tariff Schedule” here. This looks up the HS code for you.

2. When you’re there, utilize their search function by entering the name of your product.

3. After completing your search, check the Heading/Subheading column where you will find your needed HS Code.

Please be warned, it’s essential to be accurate when identifying your goods’ HS Code. Incorrect codes can lead to hold-ups, misunderstandings, and could result in additional costs or fines due to non-compliance with trade regulations.

Finally, to help you understand better, here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Knowing the customs value of your Vietnam-origin goods can be a bit like learning a new language. It’s more than just the product’s price tag; rather, it wraps in several costs you might not have considered. Customs value really is the total of the goods’ actual price, the cost of international transport, and insurance costs – we call this the CIF (Cost, Insurance & Freight) value.

For example, if you bought goods worth $5,000, with shipping fees of $500, and insurance of $100, your customs value isn’t $5,000 but $5,600. It’s an essential part of the puzzle when paying duties in the UK and can directly impact your business’s bottom line. So, keeping abreast with this calculation can keep you ahead in your import game.

Step 4 – Figure out the applicable Import Tariff

Import tariffs, commonly known as customs duties, represent the taxes you’ll need to pay when importing goods into a country. For the UK, they’re determined based on the product’s Harmonized System (HS) code, which classifies traded products on an international scale.

To figure out what tariff applies to your goods, the UK provides its own Trade Tariff ,Here’s how you can use it:

1. Enter the HS code of your product and the country of origin (Vietnam).

2. View the duties and taxes that apply to your product.

Let’s illustrate this with an example. Suppose you’re importing faux leather jackets from Vietnam under HS code 4203. The UK tool reveals a duty rate of 12%. If your Cost, Insurance and Freight (CIF) value is $5,000, then your import duties would be 12% of that, equalling $600. Thus, understanding import tariffs helps in budgeting and offers cost certainty, reducing shocks in your financial planning.

Step 5 – Consider other Import Duties and Taxes

When importing goods from Vietnam to the UK, you’ll find that it’s not just a matter of standard tariffs. Other import duties may come into play depending on your product and its country of origin. Let’s dissect this further with some hypothetical examples:

Excise duty applies to certain goods like tobacco and alcohol. Suppose you’re importing wine, UK’s excise duty might add an extra $100 per 100 liters.

Anti-dumping taxes are imposed when cheap imports might harm local industry. For instance, if you’re bringing in significantly underpriced steel, you might be hit with an extra duty, say around 25%.

Finally, most significant could be Value Added Tax (VAT). In UK, the standard VAT rate is 20%. So, a consignment worth $10000 could attract a VAT of $2000.

Now, these are just examples to illustrate potential costs you could incur. Real rates will fluctuate and require you to consult the latest regulations. Understanding these charges can help strategize your import process, planning for costs, and avoiding legal repercussions. Evaluate your products and import conditions carefully, because even a small oversight can lead to significant costs.

Step 6 – Calculate the Customs Duties

Calculating customs duties can be intricate. Let’s break it down into a step-by-step formula.

For goods imported from Vietnam into the UK, first add the customs value (price paid for the goods) to the cost of transport and insurance, obtaining the CIF value. Then, apply the applicable duty rate to this CIF value, getting the customs duty.

In situations where Value Added Tax (VAT) is charged, calculate it by adding up the CIF value, customs duty, and, if applicable, the anti-dumping tax. Multiply the outcome by the VAT rate.

Let’s illustrate with three examples, all in USD:

1. Goods costing $1000, shipped for $200. The duty rate is 5%. The CIF value is $1200, and customs duties are $60.

2. Add a VAT rate of 20% to the above. Your total duties and taxes become $60 in duties and $252 in VAT.

3. Now, let’s introduce a 10% anti-dumping tax. The duties and taxes calculation becomes $60 (duty), $252 (VAT), and $120 (anti-dumping tax). If there’s an additional Excise Duty, it would be applied to the sum of all the above values.

Remember, FNM Vietnam navigates these intricacies effortlessly. We offer customs clearance services worldwide, ensuring you don’t overpay. For a no-obligation, free quote within 24 hours, simply reach out to us. We’re here to take the load off your shoulders.

Does FNM Vietnam charge customs fees?

FNM Vietnam, as a customs broker, manages your shipments between the UK and Vietnam, charging for customs clearance but not duties. Duties and taxes are separate and go directly to governments. The notion that brokers charge duties can cause confusion. As a transparent process, any fees are detailed and documented, ensuring that you only pay the government-mandated charges. We provide all customs documents to prove this. So you see, with FNM Vietnam, you only cover fees for our brokerage and the compulsory duties, with no hidden charges. Think of it as a bridge of trust between you and customs.

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs Official website: http://www.customs.gov.vn/

UK Customs

Official name: Her Majesty’s Revenue and Customs (HMRC) Official website: https://www.gov.uk/

Required documents for customs clearance

Unsure about what paperwork you need for customs clearance? Unchecked boxes or missing documents can lead to delays and stress. Let’s break down essential forms like the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard) to ensure smooth, hassle-free shipping.

Bill of Lading

Understanding the Bill of Lading (BoL) is crucial when shipping goods from Vietnam to the UK. Acting as your official proof of ownership, this document is a handshake in paper form, seamlessly transitioning your products from one entity to another. One considerable advantage of today’s tech-driven world is the electronic or ‘telex’ release of the BoL. Gone are the days of misplaced papers or waiting in line; now, a few clicks provide quicker and easier access to your documents.

Similar to the BoL, but for air cargo, is the Air Waybill (AWB). These tools are your golden tickets in the world of international shipping.

Here’s a tip: Leverage the convenience of ‘telex’ released BoLs to accelerate your shipping process, save time, and budget effectively. Empower your business with these game-changers to master your Vietnam-UK shipping ventures.

Packing List

Wrapping your head around the Packing List might seem challenging, but it’s actually an essential cog in your shipping journey from Vietnam to the UK. Think of it as the blueprint of your cargo – it lists details about your shipment like weight, dimensions, and contents. Just picture the customs agent checking your shipment against the Packing List. If there’s a mismatch – say you’ve listed 100 home decor vases but there are 110 in the crate – complications can arise, causing delays in clearance. That’s frustrating, isn’t it? Accurately preparing your Packing List, whether you’re shipping by sea or air, helps avoid such hiccups. Remember, the key here is precision. So, get those weight scales and measuring tapes ready, and let’s get your goods smoothly transported.

Commercial Invoice

Managing shipments from Vietnam to the UK requires a Commercial Invoice, the cornerstone document for customs clearance. It must detail specific elements like your goods’ value, a detailed description, HS codes, and country of manufacture. But remember, this isn’t just a list. Any discrepancy between your Commercial Invoice and your shipping documents can cause costly delays or fines. So, assess your goods meticulously. For instance, if you are exporting handcrafted pottery, ensure it’s described accurately – ‘Handcrafted Vietnamese Blue Ceramic Pots’ rather than just ‘Pottery’. Capture every detail, align it with your other documents, and let your shipment voyage smoothly through customs from the bustling ports of Ho Chi Minh City to the thriving markets of London.

Certificate of Origin

Shipping between Vietnam and the UK involves comprehensive documentation, one of them being the Certificate of Origin. This document is vital in affirming where your goods were produced. It can unlock preferential duty rates, potentially driving down your shipping costs and boosting your bottom line. Don’t neglect to accurately indicate the manufacturing country on your certificate; it’s the crux of the document. Imagine you’re shipping handicrafts produced in Hanoi to London. With a correctly filled out Certificate of Origin, you could take advantage of the Generalised Scheme of Preferences (GSP) duty rate instead of the World Trade Organization (WTO) rate, thereby saving a significant chunk of your budget. A small detail, yet significant enough to impact your profitability!

Certificate of Conformity (CE standard)

When shipping from Vietnam to the UK, documents are your lifeline and a Certificate of Conformity (CoC) is essential. Unlike quality assurance, which often deals with internal processes, the CoC validates that your goods comply with UK standards. In the case of the UK, the CE standard isn’t applicable anymore since the UK now uses its own marking, the UKCA. A real-world example would be a Vietnamese manufacturer exporting toys to the UK. These toys must meet British safety standards, verified with a CoC. Without this, the consignment could be held up at customs, costing you time and money. Therefore, before shipping, ensure your goods possess the necessary certifications to avoid any hold-ups.

Your EORI number (Economic Operator Registration Identification)

Imagine you’re a UK business shipping to Vietnam, you’ll need an EORI Number, which is like your passport in the world of import-export. Think of it as your unique ID that customs officials across different countries, including the now non-EU UK, use to monitor shipments. It’s a crucial little sequence of letters and numbers that unlocks the doorway to seamless international trade. So how do you get one? You can apply through the UK Government’s website, and usually, it’s a pretty straightforward process. Once you’ve got it, this number will accompany your shipments, helping streamline your trade activities. Remember, no EORI, no shipping!

Get Started with FNM Vietnam

Prohibited and Restricted items when importing into UK

Understanding what’s barred and limited while shipping goods into the UK can be a real minefield. Mistakes can lead to delayed deadlines, hefty fines, or seized shipments. Let’s navigate this complex domain together to prevent unpleasant surprises.

Vietnam – UK trade and economic relationship

Vietnam and the UK share a riveting history with diplomatic relations established in 1973. Their trade relations significantly improved post-2010 with the signing of the Strategic Partnership Agreement. Noteworthy sectors like education, healthcare, and infrastructure are keystones of this convergence. The major commodities spanning from Vietnam to the UK principally include footwear, garments, and electronic goods.

UK’s investments in Vietnam, accumulating to over $3 billion in 2024, manifest a continued faith in Vietnam’s robust economic growth. This fervor is reciprocated with Vietnam’s exports to the UK surging, hitting approximately $5.92 billion in 2024. The UK remains among Vietnam’s top 10 trading partners, making this partnership one destined for continuous exploration and growth

.

Your Next Step with FNM Vietnam

Additional logistics services

Warehousing

Storing goods, especially temperature-sensitive products, in Vietnam or UK isn't child's play. Nailing the right conditions for your goods is crucial. Imagine thawed ice cream or damp paperwork! Our top-notch warehousing solutions eliminate these headaches. Find relief and specifics on our dedicated page: Warehousing.

Packing

Minimize the risks of damages in your shipments from Vietnam to the UK with our Packaging and Repackaging services. From electronics to textiles, or bulky goods, we ensure your items are properly protected for their journey. An importer's nightmare, wrong packaging can lead to damaged goods and hefty customs penalties. Dodge those hurdles with our dedicated and experienced team. Check out real-life examples on our dedicated page: Freight packaging.

Transport Insurance

Imagine having the peace of mind knowing your goods are covered in an unexpected sea storm. Unlike fire insurance, cargo insurance speaks to your freight's needs during transit and beyond, filling the void left by restrictive policies. Picture this: a sudden road mishap in transit, but with cargo insurance, your business is protected. Seeking to prevent headaches before they occur? Check out our one-stop guide for Cargo Insurance.

Household goods shipping

Moving from Vietnam to the UK--or vice versa--and fretting over your fragile or bulky items? Our Personal Effects Shipping offers expert handling of your precious cargo, delivering it safely and flexibly to your new home. Think grandmother's antique vase or your well-loved grand piano. More info on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Are you having trouble sourcing products in Asia or East Europe? FNM Vietnam takes the headache out of procurement by finding suppliers and handling the whole process end-to-end. With us, language or cultural barriers will no longer be a hurdle. Think of us as your compass, orienting you through the complex global supply chain terrain. More info on our dedicated page: Sourcing services

Quality Control

Quality control is your secret weapon in ensuring your goods, be it bespoke ceramics or electronic parts, measure up from Vietnam to the UK. Picture this: you've got a batch of custom scooters from Ho Chi Minh City, only to find wheel alignment issues upon arrival in London. Nightmare, right? Quality inspections nip such surprises in the bud, safeguarding your peace of mind. Check out the details on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Addressing the crucial step of product compliance can be challenging, especially when your goods are crossing borders. Our services ensure your items are in line with all essential regulations. Through lab testing, we ascertain their conformity and assist you in obtaining necessary certifications, ensuring smooth sailing at the destination customs. Think of this like formulating an international recipe; obeying the list of ingredients ensures a tasteful arrival.