Freight Shipping between Vietnam and Romania | Rates – Transit times – Duties and Taxes

Ever tried to juggle while riding a unicycle? If so, then coordinating a freight shipment from Vietnam to Romania must seem like a walk in the park! But for most, understanding freight rates, transit times, and customs regulations can feel overwhelming and puzzling, something like cracking a cryptic code.

This resourceful guide was crafted to sail you smoothly over these bottlenecks. Come journey with us to explore the nuances of various shipping methods, dive into the customs clearance labyrinth, unveil the coated layers of duties and taxes, and grab some salient nuggets of advice tailored specifically for your business needs.

If the process still feels overwhelming, let FNM Vietnam handle it for you! As a seasoned international freight forwarder, we turn the uncertainties and challenges at every step of the shipping process into sure success for your business.

Which are the different modes of transportation between Vietnam and Romania?

Choosing the most appropriate way to ship goods from Vietnam to Romania is like deciding on the best route for a hiking path: every choice has its own set of challenges and rewards depending on the terrain. Located thousands of miles apart and separated by numerous international borders, air and sea transport are your most realistic options. The right choice, however, hinges on your priorities: air freight for swift delivery, or sea shipping for cost-effectiveness. Understanding these landscape realities can help you choose the best path for your cargo journey.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can FNM Vietnam help?

Sea freight between Vietnam and Romania

Deepening bonds between Vietnam and Romania have created a bustling trade highway on the high seas. An efficient hive of container vessels frequents the journey between major ports like Ho Chi Minh City, and Constanta, linking the pulsating commercial hubs of both nations. Despite the wait, businesses favor ocean shipping for its cost-effective handling of high-volume cargo.

However, this is no ordinary trip in the park; it’s akin to navigating a complex maze. Many shipping ventures stumble over intricate customs regulations and documentation errors. Fear not, with knowledge comes power. In the following section, we’ll unravel the nitty-gritty of shipping between these nations. We’ll take handle of potential roadblocks and arm your business with effective strategies. Think of it as handing you a compass for this daunting yet rewarding maritime journey. Expect insights to simplify your tasks and ensure smooth sailing for your freight!

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Located on the Cam River, near Vietnam’s northern coast, Port of Hai Phong is critical for imports from Northeast Asia, with a shipping volume surpassing 8 million TEUs annually.

Key Trading Partners and Strategic Importance: Noteworthy trading partners include China, South Korea and Japan. The port serves as a major gateway, thanks to its proximity to Hanoi and the Northern key economic zone.

Context for Businesses: If you’re planning to trade extensively with North Asia, especially China, the Port of Hai Phong, with its well-connected infrastructure, could be a crucial part of your logistics plan.

Port of Da Nang

Location and Volume: Positioned on the Han River on Vietnam’s central coast, the Port of Da Nang’s shipping volume is above 4 million TEUs regularly.

Key Trading Partners and Strategic Importance: The port primarily trades with countries in ASEAN and Northeast Asia. Da Nang holds a strategic location near the East-West Economic Corridor linking Myanmar, Thailand, Laos, and Vietnam.

Context for Businesses: For businesses aiming to tap into the ASEAN and Northeast Asian markets, the Port of Da Nang’s strategic location could be a key factor in streamlining your logistics.

Port of Ho Chi Minh City

Location and Volume: Situated in southern Vietnam along the Saigon River, the Port of Ho Chi Minh City is the country’s largest port, with annual shipping volume exceeding 6 million TEUs.

Key Trading Partners and Strategic Importance: Major trading partners encompass regions like the US, Europe, and other ASEAN countries. The port is crucial for Vietnam’s integration in to the world economy due to its sizable capacity.

Context for Businesses: If you aim to ship large quantities of goods to global markets, the Port of Ho Chi Minh City’s significant capacity is worth consideration in your shipping strategy.

Port of Quy Nhon

Location and Volume: The Port of Quy Nhon lies on the eastern coast of Vietnam. Serving the country’s Central Highlands, it handles over a million TEUs each year.

Key Trading Partners and Strategic Importance: Key trading partners include ASEAN countries. The port’s strategic significance lies in its service to landlocked regions and its connections to national highways and railways.

Context for Businesses: If you are targeting the interior regions of Vietnam or the Central Highlands, the Port of Quy Nhon can play a pivotal role in your logistics chain.

Port of Nha Trang

Location and Volume: Located in the Khanh Hoa Province, central part of the country, the Port of Nha Trang offers a moderate shipping volume with handling capacity of around 6 million tons of cargo annually.

Key Trading Partners and Strategic Importance: This port primarily trades with China, South Korea, and Japan. Its strategic importance lies in relieving pressure off the country’s primary ports.

Context for Businesses: If you’re looking to diversify your shipping options within the Asian market, the Port of Nha Trang can provide you with alternative routes that may help in disrupting less from unexpected port congestions.

Port of Cai Lan

Location and Volume: Positioned off the Bai Chay coast in the Quang Ninh Province, the Port of Cai Lan handles a volume of roughly 3.5 million TEUs annually.

Key Trading Partners and Strategic Importance: The bulk of its traffic comes from China, with its close proximity to Yunnan and Guangxi. It serves as a significant point of import for goods from Northern Asia.

Context for Businesses: If North Asia, particularly China, is a substantial part of your trade network, the Port of Cai Lan’s close geographical advantages can help intensify your logistics efficiency.

Main shipping ports in Romania

Port of Constanta

Location and Volume: Situated on the western coast of the Black Sea, the Port of Constanta stands as a cornerstone of European trade, boasting a remarkable shipping volume of approximately 75.5 million tons in 2022. This bustling maritime hub plays a crucial role in connecting Europe to the world, serving as a gateway for a diverse array of goods and fostering economic growth across the continent.

Key Trading Partners and Strategic Importance: Although trade is diverse, key partners include Germany, Hungary, Austria, and Switzerland. This port is Romania’s maritime gateway and has the largest terminal of its kind in the Black Sea and Eastern Mediterranean zones.

Context for Businesses: If you’re seeking a port with extensive inland connections, the Port of Constanta could be a valuable asset in your shipping strategy. Its impressive network of road, rail, and river links connects Central and Eastern Europe, making sustainable distribution possible.

Mangalia Port

Location and Volume: Nestled along the Black Sea coast south of Constanta, Mangalia Port holds the distinction of being Romania’s southernmost maritime port. While its primary focus lies in facilitating passenger and tourism traffic, it also plays a supportive role in the local economy, handling a modest volume of goods. In 2022, the port handled an estimated 20,000 TEUs, reflecting its growing importance in the region’s maritime landscape.

Key Trading Partners and Strategic Importance: Most shipments from Mangalia are domestic or within the Black Sea region. It hosts important ship repair yards and yacht marinas supporting the domestic market.

Context for Businesses: If you operate in the tourism sector or require ship repair services, Mangalia Port should be on your radar. While not a heavy-hitter for cargo, its specialized services and location might align closely with your logistics needs.

Port of Galati

Location and Volume: Strategically positioned in eastern Romania along the meandering Danube River, the Port of Galati holds the distinction of being the largest river port in the country. With a bustling cargo throughput of approximately 19 million tons in 2019, the port plays a pivotal role in facilitating the movement of goods, predominantly bulk materials, across the region. In 2022, the port is projected to handle an estimated 50,000 TEUs, reflecting its expanding role in containerized cargo transportation.

Key Trading Partners and Strategic Importance: Key trading partners are primarily EU countries. A significant proportion of imports and exports are metal and steel goods, agricultural produce, and minerals.

Context for Businesses: If your trading focus lies within the European Union or your goods are heavy, bulky consignments, consider the Port of Galati. With its strategic position and capabilities in handling heavy goods, it could be a fitting choice for your logistics strategy.

Port of Tulcea

Location and Volume: Situated in the northeastern corner of Romania, the Port of Tulcea stands as a vital link along the strategically important Danube River. While its cargo volume may not rival that of Galati, it continues to play a crucial role in facilitating the movement of goods to and from Central Europe, handling an estimated around 70,000 TEUs in 2022. Its strategic location and growing infrastructure make it a promising hub for future trade expansion.

Key Trading Partners and Strategic Importance: Tulcea mainly services the European market and is a big player in routing goods through the wider Danube River network.

Context for Businesses: If you’re considering river shipping as a cost-effective means of transporting goods into Central Europe, the Port of Tulcea could be a valuable stop.

Port of Braila

Location and Volume: Strategically positioned on the Danube River approximately 20 nautical miles from Galati, the Port of Braila plays a crucial role in supporting local commerce, despite its total shipping volume being lower compared to other ports. In 2022, the port handled an estimated 3 million tonnes, reflecting its significance in facilitating the movement of goods and contributing to the region’s economic growth.

Key Trading Partners and Strategic Importance: Braila’s principal trading partners are within the EU, similar to Galati and Tulcea.

Context for Businesses: The Port of Braila could be a good consideration for smaller scale businesses aiming for seamless logistics solutions within the European Union.

Port of Sulina

Location and Volume: Situated at the confluence of the Sulina Arm of the Danube River and the Black Sea, the Port of Sulina serves primarily as a gateway for tourism and passenger traffic. While its cargo handling activities are relatively limited, it remains an essential component of the region’s maritime infrastructure, handling an estimated 15,000 TEUs in 2021.

Key Trading Partners and Strategic Importance: Trading is largely domestic or within the Black Sea region. The port provides unique opportunities for ship repair and marine leisure activity businesses.

Context for Businesses: Although the Port of Sulina has less significance in large-scale cargo handling, it could prove beneficial for businesses in the tourism or marine leisure sectors.

Should I choose FCL or LCL when shipping between Vietnam and Romania?

Whether shipping a full container load (FCL) or opting for consolidation (LCL) between Vietnam and Romania, your choice will pivotally influence your costs, delivery times, and overall shipping success.

By understanding the differences and trade-offs, you can strategize effectively, aligning your decision with your specific needs. Let’s plunge into the nitty-gritty, helping you become the captain of your maritime freight journey. Remember, the right knowledge steers you towards a well-informed choice and smooth sailing.

Full container load (FCL)

FCL, or Full Container Load, refers to fcl shipping where one single consignee books all space in a fcl container, be it a 20'ft container or a 40'ft container. This ensures that the containers are sealed from the point of origin to the destination, ensuring enhanced safety and journey integrity.

An ideal time to consider FCL is when the cargo is larger than 13/14/15 CBM. This is because FCL is generally cheaper for transporting high-volume cargo, saving you on per-unit shipment costs.

For instance, if your business is exporting large quantities of shoes from Ho Chi Minh City to Bucharest, using an FCL method can significantly reduce logistics costs, given shoes' volume.

Cost implications tend to tilt in favor of FCL when dealing with large volumes. It's because the per unit shipping cost is typically cheaper than LCL. For an accurate fcl shipping quote, it's important to consider the cargo's volume, destination, and other logistics factors. Comparing quotes from different freight forwarders can provide a more comprehensive view of pricing and ultimately help you find the most value for your money.

Less container load (LCL)

Definition: LCL (Less than Container Load) shipping refers to a method of freight transportation where cargo from multiple shippers is consolidated into a single container. This method is commonly used for small shipments that don't require the full space of a standard container.

When to Use: LCL shipment is ideal if your cargo is less than 15 cubic meters (CBM). Since you're sharing space in the container with other shipments, it allows for more flexibility and is often cheaper for smaller volumes.

Example: Let's say you're a business in Vietnam shipping a few pallets of goods, with total volume less than 14CBM, to Romania. Instead of paying for a full container, you can opt for LCL freight, combine your shipment with others, and only pay for the space your goods occupy.

Cost Implications: While LCL can be cost-efficient for low volume freight, it's important to understand that shipping rates can fluctuate based on factors like cargo volume, season, and the freight forwarder's LCL consolidation schedule. You should request an LCL shipping quote to understand the specific costs for your shipment. Note - additional charges like customs clearance or handling fees may also apply.

Hassle-free shipping

Struggling to choose between consolidation and a full container for your shipments from Vietnam to Romania? Look no further than FNM Vietnam. As a dedicated freight forwarder, our mission is to remove the headaches of cargo shipping. Our ocean freight experts are here to guide you, factoring in shipment size, time constraints, and budget. Make the smart choice for your business. Reach out today for a free estimate!

Generally speaking, sea freight between Vietnam and Romania typically spans a period of roughly 30 to 40 days, although this is an average and actual transit times may vary. Factors influencing transit duration include specific ports of origin and destination, the weight of the goods, and their nature. For a more personalized quote tailored to your specific shipping needs, it’s highly recommended that firms reach out to experienced freight forwarders, such as FNM Vietnam.

Here’s a general table showcasing transit times between the four main sea freight ports in each country:

| Vietnamese Port | Romanian Port | Average Transit Time (days) |

| Ho Chi Minh City | Constanta | 35 |

| Hai Phong | Midia | 43 |

| Da Nang | Galati | 52 |

| Quy Nhon | Braila | 48 |

*Please note that actual transit times may vary depending on a range of factors, so please contact us for tailored information.

How much does it cost to ship a container between Vietnam and Romania?

Ocean freight rates between Vietnam and Romania can range significantly due to various influencing factors. While an exact shipping cost is elusive, due to considerations like Point of Loading, Destination, nature of goods, carrier selection, plus monthly market fluctuations, rest assured it’s not cause for concern.

Our seasoned shipping specialist team will handhold you through the process and ensure you get the most competitive rates. We believe each shipment is unique and deserves a custom quote, tailored to your specific needs. Count on us to see through the complexities and make your shipping journey seamless.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is specifically designed to carry out of gauge cargo that exceeds the dimensions of a standard shipping container. These are ideal for large machinery, construction materials, oversized cargo, and heavy equipment.

Suitable for: Businesses shipping large and heavy items like machinery or equipment that don’t follow the typical dimensions of standard containers.

Examples: Heavy industry equipment, windmill propellers, construction rods.

Why it might be the best choice for you: If your goods don’t fit standard container dimensions, you’ll need an OOG container. These are perfect for accommodating exceptionally wide, tall, or long cargoes that can’t be dismantled.

Break Bulk

Definition: Break bulk refers to goods that due to their size, quantity, or weight need to be loaded individually without using a container. This is a go-to choice for many businesses transporting loose cargo load.

Suitable for: It’s apt for heavy equipment, construction materials, or larger items that cannot fit into containers.

Examples: Pipeline tubes, wooden logs, metallic beams.

Why it might be the best choice for you: If you’re transporting individual cargos that cannot be accommodated in a container, break bulk shipping offers the flexibility for size and weight.

Dry Bulk

Definition: Dry bulk shipping involves the transportation of commodities in large quantities, transported loosely without a container. This can include coal, grains, and other raw materials.

Suitable for: Companies dealing with loose goods in large quantities, like construction material or agricultural products.

Examples: Grains, concrete mix, coal.

Why it might be the best choice for you: If you’re in industries like agriculture or construction, looking to transport large loose cargo load, dry bulk is preferable for its capacity and cost-effectiveness.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-ro shipping involves the transportation of wheeled cargo, where vehicles are driven onto the Ro-Ro vessel for transportation.

Suitable for: Mainly used by automotive industries for the shipment of cars, trucks, trailers, and other vehicles.

Examples: Cars, buses, tractors, cranes.

Why it might be the best choice for you: If your goods have wheels and you want them to roll on and roll off the cargo vessel, then Ro-Ro is your perfect solution.

Reefer Containers

Definition: Reefer containers are refrigerated containers used for the transport of perishables due to controlled temperature conditions.

Suitable for: Ideal for food industries dealing with dairy, meat, seafood, fruits, and vegetables, or pharmaceutical companies needing to transport temperature-sensitive products.

Examples: County fresh fruits, seafood, biopharmaceuticals.

Why it might be the best choice for you: For anyone dealing with perishables or temperature-sensitive goods, reefer containers are the solution to maintain the freshness and integrity of your products.

If you’re considering shipping goods from Vietnam to Romania, feel free to get in touch with us at FNM Vietnam. Regardless of your shipping needs, our experienced team will help you select the most suitable service for your cargo. Contact us today for your free shipping quote in less than 24 hours.

Air freight between Vietnam and Romania

Fulfilling the need for speed and reliability, air freight shines as a method to economically transport small, high-value consignments between Vietnam and Romania. Imagine you’re a distributor for Vietnamese silk scarves, each scarf carrying a significant price tag.

With air freight, your items get from factory to fashion store in days, not weeks. Yet, not all is smooth sailing. Many shippers stumble on avoidable pitfalls, such as mis-estimating shipment cost by using the incorrect weight formula, resulting in ugly surprises.

Our guide aims to help you sidestep these errors, shielding your wallet and ensuring your air freight experience soars above the norm.

Air Cargo vs Express Air Freight: How should I ship?

Deciding between Air Cargo and Express Air Freight for your Vietnam-Romania route? Let’s simplify it – think of Air Cargo as carpooling in an airline with other shipments, and Express Air Freight as hiring your own dedicated plane. This guide is all about the ins and outs of these two options, plus some tips on how to make the best choice for your business needs!

Should I choose Air Cargo between Vietnam and Romania?

Air cargo between Vietnam and Romania presents a cost-effective and reliable shipping option. Airlines like Vietnam Airlines and TAROM Romanian Air Transport are prominent players, offering fixed schedules for cargo transit.

While transit times can be longer, for shipments above 100/150 kg (220/330 lbs), air cargo becomes increasingly attractive, balancing out the value proposition. So, if you’re seeking an economical solution with scheduled timings, this mode of freight might cater to your budgetary needs.

Should I choose Express Air Freight between Vietnam and Romania?

Express Air Freight, a service utilizing dedicated cargo planes with no passengers, could be your ideal solution for shipping small volumes to Romania from Vietnam. It’s supremely efficient for freight under 1 CBM or roughly 100/150 kg (220/330 lbs).

Consider well-recognized couriers like FedEx, UPS, or DHL. They provide prompt, reliable services, ensuring your goods arrive swiftly. This could be an effective option when shorter transit times are key, minimizing potential disruptions to your business operations.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Boasting the largest cargo handling capacity in the country, Tan Son Nhat handles over 700,000 tonnes of cargo per year.

Key Trading Partners: China, USA, Japan, and South Korea.

Strategic Importance: It’s the busiest airport in Vietnam, located strategically in Ho Chi Minh City. It also serves as a major hub connecting Vietnam with the world.

Notable Features: With two runways and two terminal buildings, this airport can accommodate large volumes of cargo and multiple flights simultaneously.

For Your Business: If your business deals with bulk and high-frequency shipping, Tan Son Nhat’s capacity and flight frequency could be advantageous.

Noi Bai International Airport

Cargo Volume: Managed 708,580 tonnes of cargo in 2023, being the second-busiest cargo airport in the country.

Key Trading Partners: China, South Korea, and Japan.

Strategic Importance: Noi Bai is the biggest cargo handling airport in northern Vietnam, serving the capital Hanoi and surrounding regions.

Notable Features: It has two passenger terminals and a cargo terminal, equipped with modern cargo handling facilities.

For Your Business: If you require efficient handling of goods, especially if your supply chain involves northern Vietnam or its capital Hanoi, Noi Bai airport can be the optimal choice.

Da Nang International Airport

Cargo Volume: Handled about 100,000 metric tons of cargo per year, mainly focusing on smaller volumes of high-demand goods.

Key Trading Partners: China, South Korea, Japan, Australia, and the USA.

Strategic Importance: It’s located in central Vietnam, acting as a midpoint for transport between the northern and southern regions.

Notable Features: Da Nang Airport boasts a new cargo terminal and is committed to upgrading its cargo handling capacity.

For Your Business: If your shipping route includes central Vietnam or you prefer a centrally located point for onward distribution, the Da Nang International Airport provides a strategic point of entry.

Cần Thơ International Airport

Cargo Volume: More than 20,000 tonnes in 2023.

Key Trading Partners: China and other Southeast Asian countries.

Strategic Importance: It’s an important logistic hub for Vietnam’s Mekong Delta region.

Notable Features: It features a recently upgraded cargo terminal, enhancing its ability to handle larger cargo volumes.

For Your Business: If your commodities are linked to the agriculturally rich Mekong Delta region, Cần Thơ’s location and facilities could support your logistics plans.

Cam Ranh International Airport

Cargo Volume: Approximately 64,000 tonnes tons in 2023.

Key Trading Partners: Russia, South Korea, and China.

Strategic Importance: Serves as a significant logistic point in southeastern Vietnam.

Notable Features: Besides its strategic location, it has modern cargo handling facilities.

For Your Business: If your trading partners are from Russia or eastern Asian countries, Cam Ranh International Airport’s regular international cargo services might benefit your supply chain.

Main international airports in Romania

Henri Coandă International Airport

Cargo Volume: Over 150,000 tonnes of cargo annually, making it the busiest in Romania.

Key Trading Partners: Primarily engages with European Union countries, especially Germany, Italy, and France.

Strategic Importance: Located in Bucharest, the capital city, it serves as the main hub for air freight transportation in Romania, connecting to over 65 destinations worldwide.

Notable Features: Utilizes state-of-the-art technology for cargo handling and storage, complete with areas designated for storing hazardous and refrigerated goods.

For Your Business: Its robust infrastructure, robust handling capabilities, and strategic location make it ideal for the transportation of a wide range of commodities. If your company frequently ships to or from Europe, this airport should be top of your consideration.

Cluj-Napoca International Airport

Cargo Volume: Handles around 15,000 tonnes of cargo annually.

Key Trading Partners: Mainly services countries within the European Union with Germany and France as leading partners.

Strategic Importance: As the second largest airport in Romania, it is a key freight hub, particularly for Northern Transylvania, and offers connections to more than 40 destinations.

Notable Features: Offers a wide range of cargo handling capabilities, including special storage facilities for perishable, valuable, and hazard categories.

For Your Business: If your business caters to the Northern Transylvania region or wishes to target European markets, this airport provides a trustworthy and strategic option.

Timisoara International Airport

Cargo Volume: Manages around 13,000 tonnes of cargo each year.

Key Trading Partners: Conducts business mainly with countries in the European Union.

Strategic Importance: Serves as a critical logistics and freight hub for Western Romania, offering regular flights to over 20 destinations.

Notable Features: The airport has recently undergone impressive expansion and modernization efforts, improving its cargo handling, storage, and processing capacities.

For Your Business: If Western Romania or the connected European markets align with your business growth strategy, take advantage of Timisoara’s modernized facilities and services.

Sibiu International Airport

Cargo Volume: Handles approximately 3,600 tonnes of cargo per annum.

Key Trading Partners: Engages predominantly with European Union countries.

Strategic Importance: The airport effectively serves Central Romania and offers direct connections to more than 10 international destinations.

Notable Features: Potential for expansion and modernization to accommodate the growing demand for cargo transportation.

For Your Business: This could be an excellent opportunity for businesses looking to expand their reach to Central Romania or related European markets with potential for increasing cargo demands.

Bacau International Airport

Cargo Volume: Handles about 2,500 tonnes of cargo yearly.

Key Trading Partners: Primarily does business with countries within the European Union.

Strategic Importance: Important freight hub for Eastern Romania, with direct connections to several European destinations.

Notable Features: Compact airport with efficient cargo handling capabilities.

For Your Business: If Eastern Romania or the associated European corridors are pivotal to your freight operations, Bacau International Airport offers efficient cargo services that can facilitate your business needs.

How long does air freight take between Vietnam and Romania?

The average shipping time for air freight between Vietnam and Romania varies between 3 to 5 days. However, it’s important to note that this estimate can fluctuate, as the exact transit time depends on various factors such as the specific airports of origin and destination, the weight of your cargo, and the type of goods being transported. For precise times, your best bet would be to consult with a trusted freight forwarder, such as FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and Romania with air freight?

Though a broad estimate for shipping goods via air freight from Vietnam to Romania ranges from $5-$10 per kg, prices vary widely. They are determined by multiple factors, like the distance from departure and arrival airport, dimensions, weight, and the nature of the goods.

Rest assured, our team works tirelessly to provide the most competitive rates, tailored to your specific needs. Remember, there’s no one-size-fits-all in freight forwarding—quotes are personalized. Contact us now to receive a free quote in less than 24 hours. Carve your path to successful shipping with us.

What is the difference between volumetric and gross weight?

Whether shipping small goods or large equipment from Vietnam to Romania, understanding the distinction between gross weight and volumetric weight is paramount.

Gross weight is essentially the actual weight of your shipment, measured in kilograms. Consider it as merely placing your cargo on a large scale and noting down the weight.

On the other hand, volumetric weight, sometimes called dimensional weight, reflects the volume that your shipment occupies onboard the aircraft. In essence, it’s a balance between how much space the cargo takes up and its actual weight.

In Air cargo, volumetric weight is determined by multiplying the length, width, and height of your shipment (all in centimeters) then dividing by a standard divisor, usually set to 6000.

For instance, if your shipment dimensions are 100cm length, 100cm width, and 100cm height, your volumetric weight would be 100100100/6000, equating to 166.67 kilograms or 367.41 pounds.

However, in Express Air Freight services, the standard divisor is lower, around 5000. So, for the same shipment, the volumetric weight is 200 kilograms or 440.92 pounds.

Understanding these weights are crucial because freight charges hinge on them. Carriers will charge based on the greater of the two – gross or volumetric weight. This system ensures each flight generates optimum revenue by balancing carrying capacity and weight restrictions.

Knowing both weights allows you to forecast your shipping costs accurately and choose the right service for your specific shipment. It could be the difference between an economically viable shipment or a costly mistake.

Door to door between Vietnam and Romania

Navigating international shipping can be complex, but ‘Door to Door‘ service provides a seamless and hassle-free solution. Especially when shipping between Vietnam and Romania, it encompasses every step of the journey, from pick-up to delivery. This offers significant time-efficiency, superior control, and reduced logistics hassle. So, ready to discover how ‘door to door’ makes complex shipping simple? Let’s dive in!

Overview – Door to Door

Stressed by the complexities of shipping from Vietnam to Romania? Door-to-door service might be your relief! As FNM Vietnam’s top pick, this logistics solution streamlines the process, removing burdening twists and turns.

Its benefits aren’t without challenges, such as costs and potential delays. Yet, it offers a comprehensive service that manages the shipping process end-to-end. Tailored to your needs, it’s a go-to option for stress-free shipping, regardless of those challenges.

Find in this guide the handy insights you need for a smooth shipping experience.

Why should I use a Door to Door service between Vietnam and Romania?

Looking to teleport your goods from Vietnam to Romania without mastering the art of apparition? A Door to Door service might just be your magic wand. Here’s why:

1. Reduced Stress: With Door to Door service, you can kick back and relax while the magic of freight forwarding happens behind the scenes. No need to worry about the pickup of goods, customs clearance, or even delivery—we’ve got it all covered.

2. Ensured Timeliness for Urgent Shipments: Is your cargo on a tight schedule? No problem! Door to Door services are designed to deliver on time, every time. Urgent shipments are handled swiftly, ensuring your cargo arrives when it needs to.

3. Specialized Care for Complex Cargo: If your shipment is more complicated than a 3D puzzle, fret not. Whether it’s fragile pieces or oversized machinery, Door to Door services shine in providing the specialized care that complex loads demand.

4. Convenience Galore: Imagine not having to worry about the intricate details of trucking. Door to Door services take convenience up a notch by handling every component of the trucking process until the final destination.

5. Cost-Effective: Surprise! Door to Door services often bundle multiple logistics services together, leading to cost savings. Think of it as a logistics bundle deal. So your money stays right where it should be—in your pocket.

So there you have it, five rock-solid reasons why Door to Door service is a smart choice for your Vietnam to Romania shipment. And remember, while logistics can seem trickier than a wizard’s spellbook, an adept freight forwarder can make it as smooth as a magic carpet ride.

FNM Vietnam – Door to Door specialist between Vietnam and Romania

Experience a hassle-free door-to-door shipping service from Vietnam to Romania with FNM Vietnam. Our dedicated team manages every step, so all you have to do is relax.

We handle the packaging, transport, customs, and utilize every shipping method. Benefit from the expertise of a dedicated Account Executive who is as invested in your goods reaching safely as you are.

Reach out to us for a no-obligation free estimate delivered within 24 hours, or dial our consultants for complimentary advice. Ship with us, ship with ease.

Customs clearance in Romania for goods imported from Vietnam

Navigating customs clearance – the official process your goods undergo to enter a country – can be a daunting task, particularly when shipping from Vietnam to Romania.

It’s a complex maze filled with potential hidden charges and unexpected delays. Understanding the ins and outs of customs duties, taxes, quotas, and licenses is vital to avoid the risk of your shipment being held up. These and more will be covered in subsequent sections of this guide. Worry not, as FNM Vietnam is here to assist you throughout, regardless of your goods type or location.

To move forward, provide the origin, value and HS Code of your goods, and we can estimate your budget. Let’s conquer this process together!

How to calculate duties & taxes when importing from Vietnam to Romania?

When embarking on a journey from Vietnam to Romania with a shipment in tow, understanding how to calculate duties and taxes is vital for a smooth shipping experience. To start, remember that calculating customs duties isn’t simply about knowing the product; it’s about its story too. The process includes knowing where your goods came into being – the country of origin. This is your first step – identifying where your products were manufactured or produced.

Next, find out your product’s Harmonized System Code, commonly known as its HS Code. This is a numerical code set out by the World Customs Organization to classify over 5,000 commodity groups. It helps customs officers decide how to handle imports and exports.

But that’s not all – you will also require knowledge of the Customs Value. This is the complete cost of your products, adding up charges like the cost of goods, insurance, and freight. Customs use this value to apply duties, so getting this right is crucial.

Understanding the Applicable Tariff Rate is another key criterion. These are taxes on imports set by the receiving country and rate tables are usually available through their government website.

Finally, we must not forget other taxes and fees attached to your goods. Some product categories carry extra taxes such as sales tax, excise tax, or value-added taxes. There might also be additional fees regulated by different government bodies, so being thorough will pave the way for a worry-free shipping venture.

So, how to grease the wheels for your shipping from Vietnam to Romania? Start with identifying the place where your products were born – the country of manufacture. This is the first step and a major turning point in estimating your duties and taxes. Buckle up, because you are on your way to becoming experts in navigating the international shipping highways.

Step 1 – Identify the Country of Origin

Understanding the country of origin, in this case, Vietnam, sets the stage for your import journey. Here’s why it’s crucial:

1. HS Code Basis: You’ll trace the Harmonized System (HS) code back to the country of origin. This international nomenclature regulates trade tariffs.

2. Trade Agreements: Romania and Vietnam are part of the EU-Vietnam Free Trade Agreement (EVFTA). That means preferential duties, making your shipment often more economical.

3. Duty Rates: The origin decides the rate of duties or taxes you’ll pay upon entry into Romania.

4. Country-Specific Restrictions: Certain products fall under Romania’s import restrictions. Knowing Vietnam’s output helps you anticipate and prevent potential hold-ups.

5. Clear Documentation: With your country of origin visible on all documents, you accelerate clearance procedures.

With EVFTA in place, goods of Vietnamese origin receive a progressive reduction of import duties. Ensure you adhere to the rules of origin criteria to benefit. Keep an eye on Romania’s restrictions on goods like certain textiles, electronic devices, and specific agricultural products.

Committed to mastering this import process? A reliable freight forwarder can navigate these complex waters with you, saving time and money. Stay informed, stay ahead.

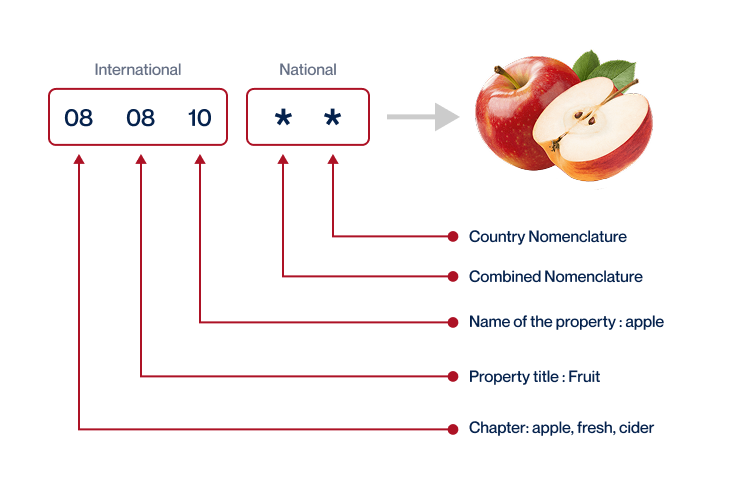

Step 2 – Find the HS Code of your product

The Harmonized System Code, widely known as HS Code, is a globally standardized system of names and numbers to classify traded products and it plays a key role in international trade. Every item that’s traded internationally has a unique HS code which helps in identifying its nature, measuring customs duties, collecting international trade statistics, and formulating tariff quotas.

Obtaining this code is a critical step in the import process, with the simplest way often being to acquire it directly from your supplier.

These industry professionals are typically well acquainted with the items they’re dealing with and the associated regulations, making it a straightforward process.

However, if supplier assistance is not an option, fear not. We’re here to guide you step by step on how to find the HS code for your product:

1. Visit the Harmonized Tariff Schedule

2. Use the search bar to type in the name of your product.

3. Check the Heading/Subheading column to locate your product’s HS code.

Please note: Accuracy is key when choosing your HS Code. A wrong code can lead to delays in customs, increased inspections, and even potential fines. It’s vital that the HS code you select aligns exactly with the commodity you are shipping.

Here’s an infographic showing you how to read an HS code. Note each sequence and what they represent to ensure you have the right code for your export or import.

Step 3 – Calculate the Customs Value

Understanding the customs value for your goods imported from Vietnam to Romania might seem like a tough task, but it’s less complicated than you might think. Think of customs value not as the simple price-tag of your goods, but rather, it encompasses the CIF value.

So, what’s this CIF Value? Cost, Insurance, and Freight (CIF) is the total amount that you spend to actually get the product ready to pass through customs.

Let’s say you have footwear valued at $5000 USD. If the cost of shipping is $1000 USD, and insurance $100 USD, the CIF value, hence your customs value, would be $6100 USD ($5000 + $1000 + $100).

This concept helps the customs authority determine any potential duties and helps you plan for total costs beyond just the purchasing price of your goods. Simple, right?

Step 4 – Figure out the applicable Import Tariff

An import tariff, commonly known as a customs duty, is a tax levied on goods imported into a country. In Romania, like most European Union countries, this is calculated based on the Common Customs Tariff classification.

To find the specific tariffs for your products, navigate to the TARIC System – European Customs. Here, enter the Harmonized System (HS) code of your product – let’s say the HS code is 0901 11 (coffee, not decaffeinated) for our example – and Vietnam as your country of origin. The system will show the duties and taxes applied to coffee beans imported from Vietnam.

Let’s assume the system provides a tariff rate of 7.5% and you can calculate your Import Duty. If your insurance and freight (CIF) cost is, say, $10,000 USD, then your Import Duties will be 7.5% of $10,000, which is $750.

Remember, understanding tariff structure and how to calculate your duty is crucial to accurately estimate your shipment’s cost and help your business avoid surprising expenses upon arrival. So make sure to include this calculation in your import cost planning.

Step 5 – Consider other Import Duties and Taxes

In addition to the standard tariff, be aware of further charges that might apply based on the goods’ nature and origin. For instance, you might encounter an excise duty, an internal tax applicable to certain products like alcohol, tobacco, or fuels.

Perhaps your goods are subject to anti-dumping duties, levied on products deemed to be sold below ‘fair market value’—common for manufacturing materials imported from Vietnam.

Most crucial, however, is the Value-Added Tax (VAT). Romania’s standard VAT rate is 19%, but this can vary depending on the product category. Calculated on the customs value plus any duties, this figure can considerably impact your final costs.

For instance, if you’re importing furniture valued at $10,000 with a duty rate of 5%, the payable duty would be $500. The calculated VAT would then be 19% of ($10,000+$500) = $1,995. This brings your total payable amount to $12,495, excluding any other charges.

Remember, these examples are illustrative, actual rates may vary, and all values are in USD. An updated understanding of these charges will help mitigate unexpected costs, keeping your import operations smooth and profitable. Review your product’s harmonized system (HS) code and consult with a local customs broker for accurate deductions.

Step 6 – Calculate the Customs Duties

The calculation of customs duties is critical when importing goods from Vietnam to Romania. The formula involves adding the customs value of your goods (price paid in USD), transport costs, and any insurance before multiplying by a set tariff rate.

For example, supposing you’re importing goods worth $200,000 with transport and insurance fees totaling $20,000. If your tariff rate is 10%, your customs duty will be $22,000.

Now let’s consider VAT. In Romania, it’s 19%. If your imported goods worth $200,000 have a 10% tariff (equating to $22,000), the total customs base would be $222,000. Then, applying the 19% VAT results in a $42,180 tax.

However, if there are also anti-dumping and excise duties, the calculation gets trickier. For instance, suppose your $200,000 product attracts a 10% tariff, a 5% anti-dumping tax, and a 15% excise duty. Your combined duty becomes $32,000, the total customs base is then $232,000, and the 19% VAT on this sum would result in a $44,080 tax.

Balancing all these percentages and numbers can be daunting! At FNM Vietnam, our customs clearance services are designed to take this complexity off your hands. We operate globally, ensuring you’re never overcharged. Reach out today for a free and fast quote.

Does FNM Vietnam charge customs fees?

Navigating the customs landscape can feel like a trek. FNM Vietnam eases this journey as your customs broker, handling procedural intricacies. Not to be mistaken with customs duties heading straight to government coffers, FNM Vietnam’s charges are for the clearance process.

Demystifying your costs, we’ll share official customs documentation, assuring you only pay the legitimate fees. Think of this as a transparency bridge, helping you cross any murky duty waters and stepping into clear trade horizons. Welcome to a smoother shipping experience!

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs Official website: https://www.customs.gov.vn/

Romania Customs

Official name: National Agency for Fiscal Administration (ANAF) Official website: www.anaf.ro/

Required documents for customs clearance

Drowning in paperwork can cloud the thrill of international trading, especially when customs clearance gets involved. In this section, we’ll demystify the key documents you’ll need: Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Knowledge is power – let’s get you ready for smooth sailing!

Bill of Lading

Doing business between Vietnam and Romania? Let’s talk about the Bill of Lading (BOL) – your golden ticket in the world of freight forwarding. This key document marks the shift of ownership and ensures the cargo’s safe journey.

Once your goods set sail from Haiphong or Ho Chi Minh City, this document is your proof of shipment. Plus, using the electronic (telex) release can make your life easier by speeding up the process.

For air cargo, you’ll deal with the Airway Bill (AWB). Just like BOL but for the skies, linking Tan Son Nhat International Airport and Henri Coandă International Airport.

Here’s a tip: keep your BOL or AWB safe. Losing them can lead to delays, headaches, and extra costs. Successful shipping is all about playing it right with your BOL – from Vietnam’s bustling ports to the heart of Romania. So, get that document safe and secure, and let’s keep your cargo rolling.

Packing List

The Packing List will be your best friend in the shipping process between Vietnam and Romania. Picture this: your cargo is an exciting book, and the packing list? It’s the detailed table of contents.

It’s up to you, the shipper, to ensure its accuracy, detailing every item, its count, and description. Misrepresent a digit? Your container could get delayed for reinspection. In both sea and air freight, it’s what customs officers skim through first.

Think of the Packing List like your quick pass at an amusement park, guiding your goods through customs smoothly to their thrilling destination. So remember, a trustworthy packing list helps ensure your freight’s on-time arrival. No twists, no unexpected hold-ups. Just an enjoyable, stress-free ride.

Commercial Invoice

When shipping goods from Vietnam to Romania, your Commercial Invoice is more than just a tally of costs. It’s a critical customs passport for your shipment.

This document outlines product details, terms of trade (Incoterms), buyer and seller info, and total value, all of which influence duty rates and possible inspections. Take, for example, you’re exporting furniture.

Your invoice must clearly specify the type, source material, quantity, and value. Inaccurate or incomplete information can lead to hefty fines or shipment delays. It’s also crucial to ensure your Commercial Invoice aligns with other shipping documents like the Bill of Lading.

Pro tip: use an Electronic Data Interchange (EDI) or a similar system to eliminate data-entry errors. Every successful cross-border transaction begins with a meticulously crafted Commercial Invoice. It’s your first step towards a seamless clearance process.

Certificate of Origin

When shipping goods from Vietnam to Romania, don’t forget your Certificate of Origin. It’s not just another piece of paper – it’s your golden ticket to preferential customs duty rates. Remember, it’s essentially a declaration of where your goods were manufactured and can lead to serious cost savings. For example, a Vietnam-based shirt manufacturer exporting to Romania could enjoy lowered duties due to their locally-sourced cotton. So, write down ‘Vietnam’ under the ‘manufacture country’ column and brace for smoother sailing through customs. It’s a simple step, but it might make a huge difference to your bottom line. Keep that pen handy and save on those shipping costs!

Certificate of Conformity (CE standard)

As you venture into shipping goods from Vietnam to Romania, a key document you’ll need is the Certificate of Conformity (CoC), bearing the CE mark. This is crucial in the European market, including Romania. Unlike basic quality assurance, the CE Marking certifies that your goods meet the EU’s high safety, health, and environmental protection standards. It’s comparable to the ‘UL’ standards in the U.S. For instance, think of it this way; you’re shipping electronics from Vietnam, the CE standard ensures your gadgets aren’t just functioning, but also safe for consumer use. Action point? Always ensure your goods have a valid CoC – it’s your access ticket to the Romanian market.

Your EORI number (Economic Operator Registration Identification)

Your EORI number is your golden ticket when it comes to shipping goods from Vietnam to Romania. Not only is it mandatory for all businesses and individuals importing or exporting within the European Union—which Romania is a part of—but it also streamlines tracking of your shipments across borders.

In essence, it’s your unique shipping ID, letting customs authorities know exactly who’s behind each transaction. Registering for an EORI number is a simple process, usually done online through your national customs website.

Once you have it, your imports and exports within the EU become much smoother. Without it, your goods could end up stuck in customs limbo. So, don’t miss this crucial step in preparing for your shipment!

Get Started with FNM Vietnam

Prohibited and Restricted items when importing into Romania

Knowing what’s off-limits is a make-or-break when shipping goods to Romania. Avoid costly penalties or shipment delays by understanding Romania’s import restrictions. Let’s put confusing jargon aside and dive straight into the essentials.

Vietnam – Romania trade and economic relationship

Vietnam and Romania’s economic affair traces back to the 1950s, with notable advancements in the past few years. Though traditionally rooted in sectors like machinery, chemical products, and raw materials, recent years witnessed a shift towards tech, clothing, and furniture.

In 2022, Romania’s investments in Vietnam saw an appreciative trend with a cross-border capital flow exceeding $7 million. Conversely, Vietnam’s key imports from Romania included electronics and machinery, amounting to over $22 million in the same year.

This bilateral trade growth translated into a significant increase in traded goods, hitting around $425 million in 2023, promising a vibrant trade future. Delving deeper into this economic synergy could potentially open promising horizons for your business.

Your Next Step with FNM Vietnam

Additional logistics services

Warehousing

Struggling to find dependable warehousing in Vietnam for your goods heading to Romania? Specific conditions, like temperature control for chocolate or wine, can be a headache. Don’t sweat it - we’ve got it covered. More info on our dedicated page: Warehousing. It’s all about making logistics easy.

Packing

Packaging and repackaging plays a pivotal role in establishing a smooth shipping journey between Vietnam and Romania. Each item's shape, weight, and fragility necessitate unique packaging solutions - even a porcelain vase and industrial machinery. Guide your product journey with a trustworthy partner ensuring optimal packing. Imagine precious Saigon cinnamon bundled safely or Romanian glassware reach intact. More info on our dedicated page: Freight Packaging

Transport Insurance

Cargo insurance isn't your standard fire coverage. It's the superhero within the logistics realm, swooping in to mitigate shipping mishaps, from water damage to theft. Picture this: your batch of electronic goods falls overboard during a storm. Stressful, right? Here, cargo insurance is your financial safety net. So why risk it when you can prevent it? Read more about it on our dedicated page: Cargo Insurance.

Household goods shipping

Shifting your cherished possessions between Vietnam and Romania? We're your ideal choice for secure, flexible personal effects shipping. Our experts handle everything from Grandma's precious Ming vase to those bulky bedroom sets, ensuring they arrive safely at your new place. Real-world example? Your 3m-high Romanian pine cabinet traveling via sea freight, protected as well as handled with utmost precision. More info on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Looking to manufacture in Asia or East Europe? With FNM Vietnam, we help find suppliers, executing the procurement process start-to-finish. No more language barriers, as we're your translators and tour guides through it all. A real-world example - we brought a Romanian fashion brand to success, connecting them with a high-quality textile factory in Hanoi. Exciting, isn't it? Dive deeper into this at Sourcing services.

Quality Control

Quality Control isn't a luxury, it's a necessity. Think of it as that keen-eyed umpire ensuring fair play in your Vietnam-Romania shipping game, catching faults before they impact your business. Recall the 2018 toy manufacturing glitch, costing firms big bucks due to faulty paint jobs detected too late? Our service spotlights similar issues early, ensuring your products meet standards. Stay ahead of the curve. More info on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Ensuring your goods meet all regulatory requirements is crucial when shipping internationally. Our Product Compliance Services take this daunting task off your hands. We run numerous laboratory tests, securing necessary certifications to guarantee that your shipment ticks all legal boxes. Think of it as dodging an avalanche of fines and administrative headaches – quite handy in an ever-changing business landscape, isn't it?