Before a shipment of products may be imported or exported, it must first clear customs. For export businesses, custom clearance is a complicated and time-consuming process that every exporter must go through. Physical inspection of each consignment is still the basis of customs clearance, where several types of export levies are imposed. High import taxes and a plethora of exclusions and export promotion schemes add to the documentation and procedures’ complexity. As a result, the exporter’s understanding of customs rules and regulations is important.

The filing of a shipping bill and the activities that follow are the first steps in the customs clearance of goods. However, a few requirements must be met before you (as an exporter) attempt to obtain customs clearance for your goods. The most important requirements are the import-export code, authorized foreign exchange dealer code, current account for duty drawback credit, and authorization for export under the export promotion scheme. Our comprehensive guide on customs clearance can assist you in understanding the process and completing your next overseas cargo with confidence.

What is Customs Clearance, and how does it work?

When choosing to do export business, the export clearance procedure is necessary. Customs clearance is the process of the Customs Department authorizing the entry of a person or commodities. The authorization is granted after presenting the necessary customs clearance paperwork and completing the process.

A shipper may ask what customs clearance entails and how it relates to their shipping alternatives before delivering various goods. Every international ocean freight shipment must meet each country’s customs clearance quota.

Knowledge of the rules and regulations governing the import and export of goods, correct documentation, fast execution, and follow-up with customs authorities are just a few of the parts of the clearing process that will allow the cargo to be transported quickly. Amazon has the local know-how and global resources to provide complete clearing and forwarding services for shipments to locations around the world and quick final delivery to clients.

Customs clearance is required to allow goods to enter a country via an authorized customs broker. There is also information about shipments, imports, exports, and parties involved in the process within this procedure.

Make a Customs Success Plan in Advance

You’ll need to take a few extra steps to prepare your package for customs clearance every time you ship overseas. Customs, the government agency in charge of enforcing international trade laws, inspects and regulates every shipment to ensure that the contents meet the importing country’s requirements or territory.

Time required to clear customs

After you’ve completed the customs clearance procedure, how long does it take to get clear-headed? The answer is that, depending on the circumstances, customs clearance can take anything from 20 minutes to several days. It takes about 20 minutes for your Customs Broker to make your customs entry and submit the data. Now that your entry has been received, an administrator must analyze it and either authorize or deny the shipment. This phase can take a few minutes to several hours, depending on the number of Customs officials available and excess at the crossing port.

However, your package may be taken for inspection prior to its release. If a shipment is subject to inspection, it will be stored in a bonded warehouse and checked by Customs officers as soon as possible. Customs officials typically visit several locations throughout the day and prepare their releases in the afternoon. The procedure can take anywhere from 12 to 48 hours, and even longer during periods of high demand. Customs releases are not covered by insurance.

FNM Vietnam Tip

Astuce FNM : If you need a logistics partner in Vietnam, don’t hesitate to contact us, our experts will answer you within 24 hours

What is the procedure for Customs Clearance Services?

A team of experts oversees Customs Clearance Services. To accelerate cargo clearance, the team ensures that all standards are completed. This skilled team can provide real-time free guidance and tailor-made services to meet any need when needed.

This process aims to provide an efficient, competent, and fast service that is tailored to the needs of companies and individuals. The crew also keeps a careful eye on the arrival and departure of shipments and responds to any questions about the clearance process. They also assist in ensuring that your shipments pass through customs quickly and efficiently.

In addition, the team assists in completing the needed legal formalities within the timespan indicated. Documentation that is simple to complete, customs documentation and brokering, domestic clearance for trouble-free consignment transportation, warehouse coordination, and other services are available.

Why is it important to go through the Customs Clearance process?

Customs clearance is required because it allows commodities or products to be imported or exported into a country through a licensed customs broker. A customs broker is an agent licensed by tariff rules to assist importers with their customs business transactions.

Some documentation is required for export customs clearance and must be provided by the importer or exporter. This paperwork can be cleared with the help of your freight forwarder.

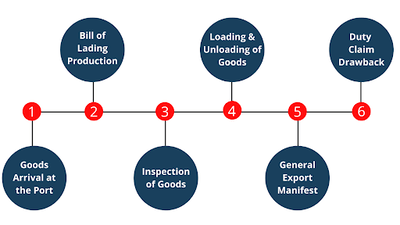

The Customs Clearing Process begins when the exporter meets all of the requirements to export and obtains a shipping order to reserve a spot on the ship. The following are the steps involved in the customs clearance process for products to export.

Goods Arrival at the Port

The clearing and forwarding agent submit the documentation to the Custom House for additional processing after the goods arrive at the port packing list, invoice, letter of credit, certificate of origin, and other essential documents are included in the document’s checklist. Additionally, the shipping bill should note any duty drawback or MEIS benefit applicable to that commodity.

Bill of Lading Production

When the relevant paperwork is received, the customs officer verifies them against the physical quantity of goods received. He or she prepares the shipping bill for goods to be exported and sends a copy to the dock appraiser.

Inspection of Goods

The products are examined by the dock appraiser in accordance with the examination order. They create a ‘Let Export’ order if the products are found to be as described in the documentation. The products may be returned to the export department if there is a mismatch in the order. Otherwise, products are delivered to the preventative superintendent, who loads them into the allocated vessel under supervision. In this instance, the customs clearance process for products exported from India will be delayed.

FNM Vietnam Tip

Astuce FNM : In order to have more information and take the right steps for importing and/or exporting, please check our customs clearance page!

Loading and Unloading of Goods

The steamship agent receives the ‘Let export’ marked bill from the clearing and forwarding agent. The cargo is loaded under the watchful eye of the preventative officer. If the preventative officer is pleased with loading cargo aboard the vessel, the officer signs the shipping bill with the ‘Shipped on Board’ endorsement. In addition, the ship’s commanding officer gives a “Mate receipt” certifying the shipment of commodities. At this point, the customs clearing process is practically complete.

General Export Manifest

Within seven days of the vessel’s sailing date, shipping agents must submit a shipment-by-shipping Export General Manifest to the Customs Department, both electronically and manually.

Duty Claim Drawback

The exporter might claim duty drawback on their exports with the help of a shipping bill. Once the exporter determines the status of the shipping bill and drawback claim from the query counter, the drawback branch officer processes the drawback electronically. After the procedure is completed, the claim is credited to the exporter’s bank account.

The customs clearance process for goods is now finished. A GST refund is commenced after filing GSTR-1 before the 10th of the corresponding month and GSTR-3B before the 20th of the relevant month. If all figures and dates in GSTR-1, GSTR-3B, and the shipping bill match, the refund will be processed within 15-20 days of the GSTR-3B being filed.

Before the exchange process occurs between the countries, every importer and exporter must complete the customs clearance procedure. Both the importer and the exporter should ensure that they have all of the relevant documentation that will be assessed at the time of the bill of entry.

FNM Vietnam Info

Astuce FNM : Customs clearance is a requirement when shipping abroad, whether by air or marine freight. Before the goods leave the port or airport of origin, the shipper must get export clearance. Upon arrival in the destination country, import clearance is necessary before the freight may be delivered to the consignee.

Because there is no single global standard, customs clearance can be difficult for rookie and experienced shippers. This guide will address your primary customs clearance queries and provide you with a general grasp of the procedures.

Conclusion

Customs Clearance plays a significant part in the import-export company, or more precisely, in the import-export process. To choose the right company to handle logistics, customs, and companies that can make your shipment documents easier, one must fully understand the process involved, the documentation required, the risks-factors in the shipment, and overall choosing the right company to handle logistics, customs, and companies that can make your shipment documents easier.

In general, the import-export operation is profitable. Earning a good living and increasing earnings are two elements that make an international business appear appealing. The importance of customs clearance is reflected in the job description for customs clearance. As a result, a customs clearance department plays a critical role in ensuring the seamless operation of your organization.

Author Bio

Kirtika Rao writes articles for Amazon businesses, that are helpful for MSMEs and many entrepreneurs. Her articles focus on balancing information with verified facts. Also being an amazon seller, she knows the details about exports from India. Sharing her experience and insights, she seeks to help all big and small businesses with accurate information about exports.

FAQ | The Role of Customs Clearance in Export Process

Read more

Looking for more? These articles might interest you:

DocShipper info: Did you like this article? You may also like the following:

Need Help with Logistics

or Sourcing in Vietnam ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us