Freight Shipping between Vietnam and Mexico | Rates – Transit times – Duties and Taxes

Ever tried deciphering hieroglyphics? Well, international shipping isn't that difficult, but it certainly comes with its challenges. Shipping goods between Vietnam and Mexico can be intricate due to factors like varying rates, understanding transit times, and navigating through complex customs regulations.

This comprehensive guide is designed to shed light on these issues by providing you with in-depth information on different freight options - be it by air or sea. You'll also learn about the specifics of customs clearance, duties, taxes, and get a host of tailored advice beneficial for businesses shipping between these two regions.

If the process still feels overwhelming, let FNM Vietnam handle it for you! Our seasoned professionals are committed to simplifying every step of the shipping process, turning these challenges into success stories for your business. With us, you’re not just shipping - you're growing.

Which are the different modes of transportation between Vietnam and Mexico?

Traveling almost halfway around the globe from Vietnam to Mexico means choosing the right transport is crucial for a smooth logistics journey. Your goods will traverse multiple countries, oceans, and possible roadblocks. Will they soar above clouds via air, or chart a course through Pacific waters by sea? This guide sheds light on the most practical options and factors at play, to align with your unique shipping demands. After all, successful global shipping is not just about getting from point A to B, it's about plotting the most efficient and effective route. Let's simplify and demystify this journey together.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can FNM Vietnam help?

Sea freight between Vietnam and Mexico

Shipping goods between Mexico and Vietnam is like a grand, multi-layer chess game, full of strategic moves. Trade flows abundantly between these vibrant economies, all thanks to maritime might. The ports playing pivotal roles in this capacious sea-network are Manzanillo and Lazaro Cardenas in Mexico and Haiphong and Cat Lai in Vietnam.

Ocean freight fits small budgets like a glove, especially when goods go by volume. Imagine it like a marathon; it’s slow-paced but endurance wins the day. However, the route isn’t without hurdles. Shippers often hit snags—complex customs regulations, unexpected fees, magnifying technical glitches—that can turn the process into a tightrope walk.

But remember, knowledge is power. Decked out in best practices and precision, businesses can ditch the pitfall circus and cruise smoothly through logistics. If sending goods across the Pacific gives you cold sweats, fear not. This guide promises step-by-step insights to grease your shipping wheels between Vietnam and Mexico. Get ready to move from confusion to clarity!

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: The Port of Hai Phong is located at the North East coast of Vietnam, by the Red River delta. It is the busiest port in North Vietnam, with a shipping volume of over 1,1 million TEUs annually.

Key Trading Partners and Strategic Importance: This port is a gateway to Hanoi and is vital for trade with China and other ASEAN countries. It’s also one of the largest maritime service providers in the region.

Context for Businesses: If you’re considering expanding your export activity in North Vietnam, the Port of Hai Phong should be part of your strategy given its high volume capabilities and excellent connection to major roads and railways.

Port of Ho Chi Minh City

Location and Volume: Located along the southeastern Binh Thanh District, the Port of Ho Chi Minh City is the largest maritime port in Vietnam, handling over 70% of the country’s import and export volume.

Key Trading Partners and Strategic Importance: It is a significant commercial hub in Southeast Asia, processing shipments to partners like China, South Korea, and the USA. The port contributes substantially to the country’s economy, providing job opportunities and attracting foreign investment.

Context for Businesses: For businesses planning to penetrate the South Vietnam market, especially in widely consumed goods, the Port of Ho Chi Minh City can offer the busiest and most connected shipping channel in the country.

Port of Da Nang

Location and Volume: The Port of Da Nang, situated in central Vietnam, is the third-largest port in Vietnam. It handles over 800 000 TEUs each year.

Key Trading Partners and Strategic Importance: This port caters to domestic shipping and international trading partners like Japan, India, and Singapore. Its strategic importance lies in its central location and proximity to East-West shipping routes.

Context for Businesses: If your shipping strategy includes heavy goods like machinery, bulk commodities, or desires a central distribution point in Vietnam, the Port of Da Nang presents a convenient option with its excellent infrastructure and deep-water access.

Port of Quy Nhon

Location and Volume: Situated on the South Central Coast of Vietnam, the Port of Quy Nhon handles around 100 000 TEUs annually.

Key Trading Partners and Strategic Importance: This port serves as a significant trade point for South Central Vietnam, connected to partners such as Cambodia, Thailand, and South Korea.

Context for Businesses: Quy Nhon is a great choice for businesses focusing on exporting agricultural products or other goods native to South Central Vietnam, as it connects with many international ports and has various handy facilities.

Port of Vung Tau

Location and Volume: Near the mouth of the Saigon river, the Port of Vung Tau serves as a critical hub for the maritime industry, handling over 80 million tons of cargo annually.

Key Trading Partners and Strategic Importance: It’s a leading hub for oil and gas exports, with strong ties to Japan, the Middle East, and Australia.

Context for Businesses: If your business is in the oil and gas sector, Vung Tau’s comprehensive facilities and strategic location for oil exports make it a valuable staple in your logistic plan.

Port of Cam Ranh

Location and Volume: The Cam Ranh Port, located in South-Central Vietnam, deals with a volume of around 6 million tons annually.

Key Trading Partners and Strategic Importance: It’s a preferred stopover for military and commercial vessels, notably facilitating trade with partners like China and Russia.

Context for Businesses: If your enterprise focuses on commodities like crude oil, processed goods, or needs a reliable port for military shipments, Cam Ranh can be a viable solution due to its flexible capabilities and secure operations.

Port of Quy Nhon

Location and Volume: Situated on the South Central Coast of Vietnam, the Port of Quy Nhon handles around 100 000 TEUs annually.

Key Trading Partners and Strategic Importance: This port serves as a significant trade point for South Central Vietnam, connected to partners such as Cambodia, Thailand, and South Korea.

Context for Businesses: Quy Nhon is a great choice for businesses focusing on exporting agricultural products or other goods native to South Central Vietnam, as it connects with many international ports and has various handy facilities.

Port of Vung Tau

Location and Volume: Near the mouth of the Saigon river, the Port of Vung Tau serves as a critical hub for the maritime industry, handling over 80 million tons of cargo annually.

Key Trading Partners and Strategic Importance: It’s a leading hub for oil and gas exports, with strong ties to Japan, the Middle East, and Australia.

Context for Businesses: If your business is in the oil and gas sector, Vung Tau’s comprehensive facilities and strategic location for oil exports make it a valuable staple in your logistic plan.

Port of Cam Ranh

Location and Volume: The Cam Ranh Port, located in South-Central Vietnam, deals with a volume of around 6 million tons annually.

Key Trading Partners and Strategic Importance: It’s a preferred stopover for military and commercial vessels, notably facilitating trade with partners like China and Russia.

Context for Businesses: If your enterprise focuses on commodities like crude oil, processed goods, or needs a reliable port for military shipments, Cam Ranh can be a viable solution due to its flexible capabilities and secure operations.

Should I choose FCL or LCL when shipping between Vietnam and Mexico?

When shipping goods sea-bound between Vietnam and Mexico, you’re met with a crucial strategic decision: Full Container Load (FCL) or Less than Container Load (LCL) – also known as consolidation? This is no small choice. It could be the make-or-break factor impacting cost, delivery time, and overall shipping success.

In the following guide, we’ll break down these options, helping you choose sensibly to suit your particular shipping needs. After all, knowledge powers decisions – better arm yourself! Let’s crack the code of FCL and LCL together.

Full container load (FCL)

Definition: FCL, or Full Container Load, is a type of fcl shipping in which you rent the entire fcl container, be it a 20'ft container or a 40'ft container, rather than sharing space with other shippers.

When to Use: FCL is an ideal choice when your shipment volume is more than 13/14/15 CBM (cubic meters) - it's cost-efficient for higher volumes and offers enhanced safety, as the container is sealed at origin and stays intact till it reaches Mexico.

Example: For instance, a furniture company in Vietnam exporting multiple orders to Mexico would opt for FCL, ensuring protection and cost-savings on their bulk shipment.

Cost Implications: With FCL, you pay a flat rate for the container, regardless of whether it's fully loaded or not. So, the volume of the cargo is a significant cost determinant. If your cargo is high volume, an fcl shipping quote will likely be cheaper compared to LCL (Less than Container Load). This strategy capitalizes on cost-saving opportunities, especially when shipping a large amount of goods from Vietnam to Mexico.

Less container load (LCL)

Definition: LCL (Less than Container Load) shipping is a cost-effective method of transporting smaller volumes of cargo. Under LCL, your goods share container space with other shipments - hence the term 'consolidation'.

When to Use: LCL shipping is ideal when your cargo volume is between 1 CBM (Cubic Meter) and around 14 CBM. This configuration adapts to your needs, allowing for cost-effectiveness and flexibility in handling smaller volumes.

Example: Consider a clothing retailer sourcing blouses from Vietnam to sell in Mexico. If they only need to ship 200 blouses, using LCL would avoid the unnecessary cost and wastage of a full container for such a low volume.

Cost Implications: As LCL shipment allows your cargo to share container space with others, the freight costs get distributed among multiple shippers. Therefore, you only pay for the actual space your goods occupy, not the whole container. Please be aware, however, that LCL freight often attracts higher handling charges on a per-unit basis due to the need to consolidate and deconsolidate shipments compared to Full Container Load (FCL) shipping.

Hassle-free shipping

Discover seamlessly smooth shipping with FNM Vietnam! Our freight forwarding team eliminates the complexities of cargo transfer, delivering tailored solutions for your shipping needs. Whether you're juggling variables like budget, timings, safety, or load size, our ocean freight experts can guide you through choosing between consolidation and full-container services. Why guess when you can trust us with an informed decision? Dive into a hassle-free cargo experience. Get your free shipping estimation today!

The average time it takes for sea freight to ship between Vietnam and Mexico is about 35 days. Transit times, however, can vary depending on certain factors such as the specific ports used, the weight, and the nature of the commodities being shipped. For a precise, tailored quote based on your specific shipping needs, it is advantageous to contact a freight forwarder, such as FNM Vietnam.

Below is a table reflecting average transit times in days for sea freight between the main freight ports in both countries:

| Vietnam Ports | Mexico Ports | Average Transit Time (Days) |

| Ho Chi Minh | Manzanillo | 35 |

| Da Nang | Lazaro Cardenas | 31 |

| Haiphong | Veracruz | 35 |

| Qui Nhon | Altamira | 34 |

*Remember, these are approximations and the exact transit times can fluctuate due to various factors.

How much does it cost to ship a container between Vietnam and Mexico?

Knowing the cost of container shipment from Vietnam to Mexico is crucial, but understandably, pinning down an exact shipping cost is tricky. Ocean freight rates fluctuate based on factors such as loading and destination points, the shipping carrier, the nature of your goods, and monthly market dynamics.

Although we can provide a broad estimate, real rates range dramatically. Assuredly, our expert shipping specialists work closely with clients on a case-by-case basis, analyzing each unique situation to give you the most competitive rates in-line with market conditions. This thorough process ensures you always get value, enhancing your shipping experience.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (or OOG container) refers to cargo that exceeds the standard dimensions of a typical shipping container in either length, width or height.

Suitable for: This method caters to your unique shipping needs when transporting oversized items that don’t fit into standard shipping containers.

Examples: Items typically shipped using an OOG container might include machinery, vehicles, construction equipment, or large appliances.

Why it might be the best choice for you: If you’re dealing with larger than usual products, the Out of gauge cargo method ensures safety and efficiency allowing for smooth transportation from Vietnam to Mexico.

Break Bulk

Definition: Break bulk refers to the shipping of goods that are packaged individually and loaded separately onto a vessel, rather than being cargoed together in one container.

Suitable for: This is an ideal choice for goods that are too large or heavy to fit into containers.

Examples: Commonly transported break bulk goods are timber, steel slabs, or large machinery.

Why it might be the best choice for you: Translation of loose cargo load into such shipments can be streamlined, allowing you to transport bulk items seamlessly.

Dry Bulk

Definition: Dry bulk refers to shipping raw materials that are packaged in large quantities and are loose in nature. Typically, dry bulk consists of goods that are packed directly into a ship’s hold, without any packaging.

Suitable for: Businesses looking to transport dry, granular, and loose commodities.

Examples: Dry bulks can include sand, fertilizers, grains, or coal.

Why it might be the best choice for you: Your operation model or product type can greatly benefit from this shipping method if it involves unprocessed raw materials.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro shipping, named for the roll-on/roll-off method, ships wheeled cargo like cars, trucks, semi-trailer trucks, trailers, or railroad cars that are driven on and off the ro-ro vessel.

Suitable for: Ideal for importers and exporters of multi-modal cargoes, heavy equipment, or auto-vehicles.

Examples: Perfect for transporting cars, buses, trucks, or machinery on wheels.

Why it might be the best choice for you: If your cargo has wheels, this could be a perfect match offering easy transportation and robust protection for your goods.

Reefer Containers

Definition: Reefer containers refer to refrigerated shipping containers used to transport temperature-sensitive cargo. They are climate-controlled from pickup to delivery.

Suitable for: Ideal for any business transporting perishable items or goods that require a specific, controlled temperature.

Examples: Typical contents include fruits, vegetables, dairy products, or meat.

Why it might be the best choice for you: If your shipment includes perishable goods, this is the best fit to ensure that quality and freshness are maintained throughout shipping.

With FNM Vietnam, we’re here to simplify your international shipping. To help you navigate these options and identify your unique needs, feel free to contact us for a free shipping quote in under 24 hours!

Air freight between Vietnam and Mexico

Fast and predictable, the air freight between Vietnam and Mexico is a cycle designed for small-scale, high-value treasures like electronics, garments, and seafood. It’s a journey where your goods ride shotgun, speedily cutting across the skies.

However, quite a number of shippers are tripping over invisible hurdles, like the infamous weight puzzle – choosing the actual or volumetric weight incorrectly could leave a bigger hole in your pocket. And while many think air freight is just ‘pack and send,’ valuable shipping customs are often misunderstood or ignored, ratcheting up surprise costs – more on this soon. Don’t worry, we’re here to guide you; no navigator required.

Air Cargo vs Express Air Freight: How should I ship?

Choosing between air cargo and express air freight for your Vietnam-Mexico business needs might seem daunting. Think of it this way: air cargo’s like booking a seat on a commercial airline, while express air freight’s like having your very own dedicated plane. With air cargo, your goods get packed with others’, and with express, it’s all about speed, as your items hitch an exclusive ride. In the next section, we’ll delve into the nitty-gritty of these two options to help you make the best decision.

Should I choose Air Cargo between Vietnam and Mexico?

If you’re shipping goods between Vietnam and Mexico, opting for Air cargo might be the right move for you. Prominent airlines like Vietnam Airlines and Aeromexico offer renowned freight services for efficiency and reliability.

Keep in mind, these airlines operate on fixed schedules, leading to potentially longer transit times. However, the cost-effectiveness can outweigh this downside, especially when you’re shipping 100/150 kg (220/330 lbs) or above. Visit the Vietnam Airlines and Aeromexico websites to explore their offerings. Weighing your cargo and budget requirements will help you make an informed decision.

Should I choose Express Air Freight between Vietnam and Mexico?

If you’re handling shipments under 1 CBM or around 100/150 kg (220/330 lbs), express air freight can be an efficient choice. This service relies on dedicated cargo planes, without passengers, ensuring prompt and reliable delivery.

Renowned international courier firms such as FedEx, UPS, or DHL are leaders in this field, providing exceptional service and tracking capabilities. So, whether you have urgent documents or small volume goods, express air freight between Vietnam and Mexico might be the most suitable solution for your business due to its speed and reliability. Weigh your options and consider if the faster transit times can justify the higher cost.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Tan Son Nhat airport is Vietnam’s largest cargo handling airport, handling around 700,000 metric tons in recent years.

Key Trading Partners: Key trading partners include China, the USA, Japan, and important EU nations such as Germany and France.

Strategic Importance: Located in southern Vietnam, the airport is perfectly positioned to support operations bound for Asia, North America, and Europe.

Notable Features: The airport features a dedicated cargo terminal and has plans for further expansion to increase capacity.

For Your Business: If your business regularly ships to or from Asia, North America, or Europe, Tan Son Nhat International Airport is an excellent hub due to its strategic location and considerable cargo handling capacity.

Noi Bai International Airport

Cargo Volume: Handling over 750,000 metric tons of cargo annually, it is the second largest freight airport in the country.

Key Trading Partners: Notable trading partners are major Asian economies such as China, South Korea, and Japan, along with the United States and Germany.

Strategic Importance: Sited near the capital city of Hanoi, in Northern Vietnam, it serves as a vital gateway for goods moving in and out of the region.

Notable Features: As the 2nd largest cargo airport in Vietnam, Noi Bai boasts robust handling facilities and has a wide range of cargo airlines operating on its tarmac.

For Your Business: If your operations require swift access to Northern Vietnam, consider Noi Bai International Airport. It serves many leading cargo airlines, providing your business with numerous shipping options.

Da Nang International Airport

Cargo Volume: Da Nang handles a modest volume of cargo, estimated at upwards of 100,000 metric tons per year.

Key Trading Partners: Key partners include China, Singapore, South Korea, and the United States.

Strategic Importance: Ideally located in Central Vietnam, Da Nang is an excellent option for shipments that need to cover most regions of Vietnam.

Notable Features: Da Nang airport boasts a new cargo terminal that significantly upgrades its freight handling capabilities.

For Your Business: If your shipping needs span across multiple regions in Vietnam, Da Nang International Airport with its central location may offer an efficient solution.

Cam Ranh International Airport

Cargo Volume: Cam Ranh handles a smaller volume of cargo, but show steady growth over the years.

Key Trading Partners: Major trading partners are besides Vietnam, Russia, South Korea, China, and Malaysia.

Strategic Importance: As a deep-water bay, Cam Ranh offers a double advantage from air and sea routes, making it strategically important for shipments requiring multimodal transport.

Notable Features: The airport, originally built as a strategic military airbase, now supports commercial freight operations with an advantageous navigational location.

For Your Business: If your logistics needs involve multi-modal shipment methods or you are involved in trade with Russia, Cam Ranh International presents a promising option.

Cat Bi International Airport

Cargo Volume: While Cat Bi handles a smaller cargo volume relative to Vietnam’s major airports, it is an essential player in supporting regional logistics.

Key Trading Partners: Key trading partners primarily include China, Thailand, and Singapore.

Strategic Importance: Situated in Hai Phong City, it serves as a critical logistics link for the northern coastal areas of Vietnam.

Notable Features: Its location within proximity to Hai Phong Port is advantageous for multi-modal freight transport.

For Your Business: If your niche involves the northern coastal areas of Vietnam or your strategies incorporate sea-air transport, Cat Bi’s strategic location could significantly aid your operations.

Main international airports in Mexico

Aeropuerto Internacional de la Ciudad de México (AICM)

Cargo Volume: Approximately 550,000 metric tons annually.

Key Trading Partners: United States, China, Canada, Germany, Japan.

Strategic Importance: As Mexico’s primary airport, AICM is a vital hub for both domestic and international freight.

Notable Features: State-of-the-art cargo terminal, dedicated cargo airlines, advanced logistics services.

For Your Business: AICM’s comprehensive services and seamless connectivity can help amplify your shipping efficiency and broaden your trading horizons.

Guadalajara International Airport

Cargo Volume: 180,000 metric tons annually.

Key Trading Partners: United States, Germany, China, Canada, Japan.

Strategic Importance: Key location in central Mexico, making it a preferred hub for airfreight shippers targeting North America.

Notable Features: Specializes in handling high-tech goods and perishable commodities.

For Your Business: If your products need quick transit times and robust handling, Guadalajara’s capabilities may be a sensible choice for your cargo.

Cancún International Airport

Cargo Volume: Not as high as the other airports, but consistent cargo handling nonetheless.

Key Trading Partners: United States, Canada, United Kingdom, Argentina, Colombia.

Strategic Importance: As the second busiest airport in Mexico, it acts as a primary gateway to the Caribbean region.

Notable Features: Focus on tourism-related freight including souvenirs, textiles, and local produce.

For Your Business: If your business specializes in tourism-oriented goods, Cancún’s frequent flights to major tourism markets might be what you need.

Querétaro Intercontinental Airport

Cargo Volume: Over 22,000 metric tons annually.

Key Trading Partners: United States, Germany, China, Canada, Japan.

Strategic Importance: Located in one of Mexico’s fastest-growing industrial regions, ideal for high-tech and automotive industry freight.

Notable Features: State of the art facilities, specialist handling for automotive parts and high-tech goods.

For Your Business: Excellent choice if you are involved in high-tech or automotive sectors, due to specialized handling facilities and proximity to industry hubs.

Toluca International Airport

Cargo Volume: Around 20,000 metric tons annually.

Key Trading Partners: United States, China, Germany, Canada, Japan.

Strategic Importance: Serves as a secondary airport for Mexico City and handles overflow traffic and cargo from AICM.

Notable Features: Custom warehouse, focus on express services.

For Your Business: With its focus on express services, Toluca could be crucial for your time-sensitive shipments while avoiding the congestion at more busy airports.

How long does air freight take between Vietnam and Mexico?

On average, air freight shipping between Vietnam and Mexico takes between 3 to 5 days. However, this transit time can fluctuate depending on a range of factors. The specific airports involved, the weight of your cargo, and the nature of the goods can all significantly impact the duration of the trip. It’s crucial, therefore, to get an exact estimate from professionals – a freight forwarding service such as FNM Vietnam can provide an accurate and personalized time frame.

How much does it cost to ship a parcel between Vietnam and Mexico with air freight?

Estimating a broad average, air freight shipping rates between Vietnam and Mexico could range from $3 – $7 per kilogram. Since every shipment is unique, it’s tough to pinpoint a precise cost, as rates fluctuate based on factors such as distance between airports, parcel dimensions and weight, and the nature of goods.

But don’t worry! Our team specializes in customizing quotes to suit your specific needs, ensuring you receive the best possible rate. Contact us to obtain a free, no-obligation quote tailored to your shipment, typically delivered within 24 hours.

What is the difference between volumetric and gross weight?

Gross weight is the total weight of the goods, their packaging, plus any load securing material. Volumetric weight measures the package’s space utilization, calculating length, width, and height.

In air cargo, gross weight is straightforward; put the shipment on a scale to get the actual weight in kilograms. However, volumetric weight is calculated differently.

You measure the package dimensions in centimeters, multiplying length by width by height, then divide by 6000. The reason for this is air cargo uses a volumetric divisor of 6000, reflecting the dimensions of standard containers/pallets for aircraft.

By contrast, express air freight uses a different divisor: 5000. Their containers are smaller in size, thus the volumetric calculation varies slightly.

Let’s illustrate with an example. Suppose you’re shipping a 25kg package with dimensions 40cm x 30cm x 20cm. In air cargo, the volumetric weight is (40 30 20) / 6000, approximately 4 KG. In express air freight, it would be (40 30 20) / 5000, around 5 KG. Remember, these are approximations and would be 55 lbs and 66 lbs respectively in imperial measurements.

These calculations matter as freight charges depend on them. Whichever is higher between the gross and volumetric weight is used for billing. This way, whether your shipment is heavy or takes up a lot of space, the carrier’s cost is covered. This information helps you anticipate shipping costs and choose the most economical button on your calculator.

Door to door between Vietnam and Mexico

Navigating the shipping maze from Vietnam to Mexico? Let’s take the headaches away with door-to-door shipping – a simple, seamless solution that handles everything from pickup in Vietnam to delivery in Mexico. It comes packed with benefits, like reduced handling and decreased delivery times. Exciting, isn’t it? So, without further ado, let’s dive into the nitty-gritty of door-to-door shipping!

Overview – Door to Door

Overwhelmed by the complexity of shipping goods from Vietnam to Mexico? Breath easy – door to door shipping is the stress-free solution many FNM Vietnam’s clients prefer due to its simplicity and efficiency, bundling transportation, customs clearance, and everything in between. However, while eliminating the burden of monitoring various shipping stages, this service may come at an elevated cost.

The key is knowing when the convenience outweighs the cost. Are you ready for a hassle-free logistics experience? Let’s discuss the many facets of door to door shipping and find out if it’s the right fit for your business.

Why should I use a Door to Door service between Vietnam and Mexico?

Ever tried herding cats while walking on a tightrope? Well, managing international shipping can feel just as tricky! That’s where Door to Door service steps in, turning a potential circus into a smooth ride from Vietnam to Mexico. We’ll delve into the five top reasons this service might be your transport lifesaver.

1. Stress-less logistics: Wave goodbye to the headaches of coordinating multiple transport stages! From pickup in Vietnam all the way to your doors in Mexico, one service handles the journey. You’ll be free to focus on growing your business, not unraveling shipping schedules.

2. Timely Delivery: Chasing deadlines? Door to Door sends your cargoes sprinting. Streamlining the process, this service ensures quicker and more reliable delivery times. It’s like having express global couriers in your corner.

3. Specialized Cargo Handling: Delicate, oversized or complex goods? No problem! The beauty of Door to Door lies in its adept handling of specialized cargo. Each piece is treated with the utmost care and expertise, ensuring your goods reach Mexico in perfect condition.

4. Total Convenience: Convenience is king with Door to Door service. No need to fret about finding a local trucking service or coordinating last-mile delivery once your goods are in Mexico. It’s all taken care of – sit back, relax and wait for the delivery truck.

5. Final Destination Flexibility: Whether your goods are headed to bustling Mexico City or serene Tulum, Door to Door service caters to diverse locales. Delivery isn’t limited to port cities, opening up endless possibilities for your business reach.

Deciding on a shipping method is more than checking boxes, it’s about finding the right fit for your business. If simplicity, speed, specialized handling, convenience, and broad delivery range are what you seek, Door to Door transport service has got you covered.

FNM Vietnam – Door to Door specialist between Vietnam and Mexico

Experience seamless door-to-door shipping from Vietnam to Mexico with FNM Vietnam! We are experts at managing every detail of your shipping needs, including packing, transportation, customs processing, and choosing the best shipping method. You don’t have to lift a finger, as we have a dedicated Account Executive ready to tailor and oversee your shipping process.

Reach out for a free estimate within 24 hours or take advantage of our complimentary consultation with our shipping experts. We’re here to make international shipping painless for you!

Customs clearance in Mexico for goods imported from Vietnam

Shipping goods from Vietnam to Mexico? Then brace for a rollercoaster through customs clearance. It’s a beast, an intricate labyrinth rife with unexpected charges and potential snags, such as your goods getting stuck in no-man’s land. Taxes, duties, quotas, licenses may seem like a foreign language, but understanding it can save you time, money, and headaches.

Rest assured, further sections will decipher this code and provide practical advice on how to avoid typical pitfalls. If anxiety pangs persist, FNM Vietnam is ready to jump in and help you handle the process for goods of any type, anywhere, and any time. For a detailed estimate, simply reach out to our team with the origin of your goods, their value, and HS Code. Armed with those, we’ll get you an estimate faster than your coffee brews!

How to calculate duties & taxes when importing from Vietnam to Mexico?

Estimating duties and taxes for products imported from Vietnam to Mexico involves various factors. The country of origin, the Harmonized System (HS) code, the customs value of the goods, and the prevailing tariff rate are primary determinants in this calculation, along with other applicable taxes and fees specific to the product type.

Launch your import adventure on the right note by first identifying the country where the goods were actually manufactured or produced. This not only paves the way for smoother customs procedures but also helps avoid unexpected cost surprises.

Step 1 – Identify the Country of Origin

Determining the country of origin – in this case, Vietnam – is crucial and lays the foundation for your entire import process. Here’s why:

1. It defines what trade agreements apply, if any.

2. It’s key to identifying import restrictions in Mexico.

3. It informs about potential anti-dumping duties.

4. It helps to find out whether you can claim preferential duty rates.

5. It’s needed to get an accurate HS code.

Vietnam and Mexico are signatories to the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), which strongly influences duty rates. Familiarize yourself with this agreement to better navigate your import costs.

Remember that Mexico enforces import regulations. Some goods from Vietnam may face restrictions or even bans. Before shipping, check Mexican guidelines to keep your import process smooth. Follow these details and you’ll set your cargo on a clear path from Vietnam to Mexico, right from the start.

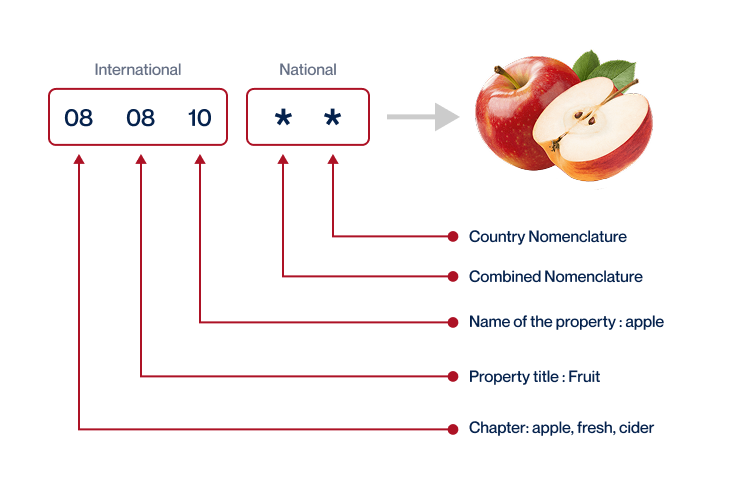

Step 2 – Find the HS Code of your product

The Harmonized System (HS) Code, which defines your product for the purpose of international trade, is a universal economic language and code for goods. It’s a major tool for smooth customs clearance as it allows you to classify your product, estimate the cost of customs, and fulfill the customs declaration.

One of the simplest ways to find out the HS Code of your product is by asking your supplier. They are intimately familiar with the products they export and the associated regulations, so they should be able to provide you with this vital piece of information.

However, if this isn’t an option for you, fear not! You can take matters into your own hands by following this straightforward process. Visit the Harmonized Tariff Schedule and plug the product’s name into the search bar. Then, just look under the ‘Heading/Subheading’ column – you’ll find the HS Code there.

Keep in mind that accuracy is paramount when it comes to HS Codes. A misstep here can lead to delays in shipping and, more worryingly, potential fines. You definitely don’t want a seemingly minor detail to derail your shipping process, so take the time to get it right.

To help you understand this better, here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Let’s dive into calculating the Customs Value, a tricky but crucial part of your shipping process. It’s easy to mix this up with the product value, but they’re not the same thing. Think of the Customs Value as the total cost for your goods to reach their new home in Mexico from Vietnam. It includes your goods’ price, international shipping costs, and insurance too – it’s the CIF Value!

For instance, if your goods cost $1,000, and you add $200 for shipping and $50 for insurance – your Customs Value, in this case, will be $1,250. It’s this combined amount you’ll use to discern duties payable for Mexico’s customs clearance. And remember, the devil is in these details, so always ensure accurate calculation for a smooth shipping experience!

Step 4 – Figure out the applicable Import Tariff

Import tariffs, often referred to as customs duties, are taxes collected on imported goods. The type of tariff used in Mexico functions on a system known as the Harmonized System, a globally recognized system for naming and classifying traded products.

To identify the exact import tariff applicable for your goods, you’ll firstly need your product’s Harmonized System (HS) code. For our example, we’ll consider office furniture – HS Code 9403.

Next, head over to Mexico’s Tax Administration Service (SAT) website and utilize their tariff-checking tool. Key in your product’s HS code and country of origin. The website will then provide you with the tariff rate applicable for your product.

For instance, let’s assume the SAT tool reflects a tariff rate of 20% for your office furniture exported from Vietnam. Now, say your insurance and freight (CIF) costs amount to $5000 USD. The import duty can thus be calculated as 20% of the CIF value, which would amount to $1000 USD.

This clear understanding of the import tariff system will help your business budget accurately for import costs and make informed decisions on the profitability of shipping specific products.

Step 5 – Consider other Import Duties and Taxes

When importing goods from Vietnam to Mexico, beyond the standard tariff rates, you might encounter additional import duties and taxes based on the product and its origin.

Take excise duty, for instance. Let’s say you’re importing luxury vehicles to Mexico. As per hypothetical rates, you could be taxed an excise duty of 30% on the value of this specific class of goods. Remember, actual rates vary, so check the precise duty percentage.

Then there’s an anti-dumping tax. Assuming Mexico determined that these same vehicles from Vietnam were being sold at a dumping margin of 20%, your imports could be slapped with a 20% anti-dumping tax. Again, this is an illustrative figure.

Perhaps the crucial cost to be aware of is the Value Added Tax (VAT), levied on imports in most countries. In Mexico, the standard VAT rate is 16%. So if your imported goods cost 100,000 USD, you’ll pay a VAT of 16,000 USD.

Though this can seem overwhelming, being proactive about understanding these taxes can save you headaches down the line. Reach out to tax professionals or customs brokers to validate and clarify any doubts. As they say, forewarned is forearmed.

Step 6 – Calculate the Customs Duties

Calculating customs duties for your imports from Vietnam to Mexico involves incorporating various factors such as Customs Value, VAT, anti-dumping taxes, and sometimes Excise Duty.

Consider a cargo with a customs value of $5000, and a duty rate at 10%. Without VAT, your customs duties would be $5000 10% = $500.

When VAT is involved, it’s assessed on the sum of the customs value and the customs duties. With a VAT rate at 16%, the calculation becomes ($5000 + $500) 16% = $880.

If anti-dumping taxes and Excise Duty are combined with VAT and customs duties, things may get a little more complicated. For example, a 15% anti-dumping tax and a 7% Excise Duty on top of the previous charges would look like this: ($5000 + $500 + $880) 15% = $981 for anti-dumping tax and ($5000 + $500 + $880 + $981) 7% = $493 for Excise Duty.

Bear in mind that these calculations can be intricate, especially when dealing with large shipments or specialized cargo. For peace of mind and cost-effectiveness, FNM customs clearance services ensure every step of the customs clearance is taken care of around the world. Reach out to us for a free quote within 24 hours, and make sure you’re not overcharged.

Does FNM Vietnam charge customs fees?

FNM Vietnam, your trusted custom broker across borders, assists you in navigating customs without any hidden fees. We don’t levy customs duties, but rather are involved in the clearance process, helping you in dealing with customs duties and taxes that go directly to the government.

Misconceptions often arise between broker fees and governmental charges. Remember, we ensure transparency providing you with the official documents from the customs office, so you’re only paying what’s mandatory, not a cent more.

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs Official website: https://www.customs.gov.vn/

Mexico Customs

Official name: Mexico’s General Administration of Customs (Administración General de Aduanas) Official website: https://anam.gob.mx/

Required documents for customs clearance

Unlocking the mysteries of customs paperwork isn’t easy. We’ll break down four key elements: Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE Standard) so that international shipping for your business won’t feel like an uphill battle.

Bill of Lading

Navigating your shipping journey from Vietnam to Mexico requires a solid grasp of key documents, and the Bill of Lading (BOL) tops that list. Serving as your proof of ownership, the BOL swiftly swings the pendulum of possession from your supplier to you once your goods hit the sea, unlocking a critical step in your logistics process.

Having a digital ally in your corner, such as the telex release, can fast-track the process, saving you valuable resources. It digitally transmits the BOL, ditching traditional courier services, and reducing wait times. Consider it your virtual jet stream in the vast ocean of freight forwarding.

If the skies are more your speed, the Air Waybill (AWB) is the air cargo equivalent of your BOL, keeping your goods in a regulatory smooth sail from Ho Chi Minh City to Mexico City. Stay aware, stay prepared, and you’ll turn potential customs hurdles into smooth straits. Your swift success in international trading hinges on mastering these intricacies.

Packing List

Imagine you’re shipping a batch of splendid Vietnamese lacquerware to Mexico. The Packing List is your sworn ally in this journey. This humble spreadsheet must detail the content, weight, and dimensions of every item you’re shipping. Incorrect or incomplete information on this document can lead to delays or penalties, tossing a wrench into your smooth shipping pipeline.

Just picture being asked to account for a mysteriously unlisted 50-pound package at the customs! As crucial for sea freight as for air, it serves as a bible for various parties to verify the shipment. Your task as a shipper? Ensure accuracy down to the last decimal and include all necessary details. Fill in the Packing List painstakingly. It’s your compass guiding your precious cargo from the heart of Vietnam to sunny Mexico.

Commercial Invoice

When shipping from Vietnam to Mexico, your Commercial Invoice is your best friend. It’s more than just a record of transaction, it lays the foundation for successful customs clearance. Make sure it includes your business details, buyer’s information, exact description of goods, Harmonized System codes, country of origin, and total value of shipment.

Misalignment between this invoice and other documents can trigger red flags resulting in delays. For instance, if you’re shipping wooden furniture, the invoice must match the description on your Bill of Lading. No vague terms! ‘Handcrafted oak dining table’ is better than ‘furniture’. Clear and consistent information paves the way for smoother, faster customs clearance, letting you focus on what matters – growing your business.

Certificate of Origin

Shipping between Vietnam and Mexico? Don’t underrate the Certificate of Origin. It’s an essential document that evidences where your goods were manufactured. Say you’ve got a batch of Vietnamese bamboo furniture heading for Cancún. This certificate verifies their Vietnamese origin, potentially qualifying you for preferential duty rates under free trade agreements.

Remember, it’s not just a formality; it’s a ticket to savings. So, avoid errors and ensure it accurately mentions the country of manufacture—Vietnam in our case. This small piece of paper can make your business’s shipping process smoother and cost-efficient. It’s like your passport in the world of international trade, connecting you from Đà Nẵng to Durango!

Get Started with FNM Vietnam

Prohibited and Restricted items when importing into Mexico

Shipping to Mexico? Great! But be aware, not everything can make the trip. Some items are outright banned, while others have strict restrictions. To avoid unwanted surprises and costly hold-ups, let’s dive right in and discuss these crucial details.

Vietnam – Mexico trade and economic relationship

Vietnam and Mexico share a prosperous trade and economic relationship that dates back to 1975 when diplomatic relations were established. Over the years, this relationship has blossomed, and bilateral trade between the two countries surpassed $8 billion in 2023. Favorable tariff policies have further enhanced the bilateral trade landscape. Key sectors driving this impressive exchange include electronics, textiles, and seafood from Vietnam while Mexico’s major commodities include machinery, steel, and agricultural products.

Today, Mexico remains Vietnam’s second-largest Latin American trading partner. In 2022, Vietnam exported $2.91B to Mexico. The flow of investments has also been considerable. For instance, Mexican investments in Vietnam were valued at $31 million across 19 projects as of 2021. These strong trade and economic ties showcase the robust relationship between the nations and the lucrative opportunities within their respective markets.

Your Next Step with FNM Vietnam

Additional logistics services

Warehousing

Struggling to find reliable warehousing in Vietnam or Mexico? You're not alone. Maintaining optimal conditions, like temperate control for perishable goods, can be daunting. But don't fret! We've got solutions to alleviate your woes.

Packing

Shipping treasures from Vietnam to Mexico requires the right packaging touch! Whether it's delicate ceramics or robust machinery, your goods deserve the best protection. A reliable partner like us can help navigate the complexities of proper packaging and repackaging, ensuring safe transit for diverse products. If you're shipping lacquerware or mechanical equipment, we've got it wrapped! Let us be your shield against mishaps.

Transport Insurance

Picture this: Your delicate consignment is sharing sea space with risky cargo. Suddenly, a fire breaks out! Fire insurance won't cover all potential losses here. That's where Cargo Insurance steps in, cushioning your business against such unexpected risks. Our dedicated policies extend protection well beyond standard fire insurance, safeguarding your valuable goods on all fronts.

Household goods shipping

Relocating from Vietnam to Mexico or vice versa? We understand your worries about protecting precious, fragile, or outsized items. With our Personal Effects Shipping service, rest easy as we treat your belongings with respect and finesse, ensuring a smooth transit. Pianos, grandfather clocks, or family heirlooms? Covered!

Procurement in Thailand

Seeking ways to expand your manufacturing in Asia or East Europe? At FNM Vietnam, we spearhead your global sourcing efforts. We scout pro suppliers, manage the entire acquisition process, and even break down language hurdles. Think of us as your compass, making the complex procurement world accessible.

Quality Control

Ensuring top-notch quality is paramount when shipping goods from Vietnam to Mexico. Regular inspections throughout the manufacturing or customization process help certify your products meet standards. Just imagine finding a full shipment of handcrafted Vietnamese lacquerware compromised due to overlooked manufacturing imperfections - that's a nightmare, right? Quality Control is your safeguard.

Conformité des produits aux normes

Ensuring product compliance can be a real headache. Failed inspections can lead to shipping delays or even rejections at customs. That's where our compliance services come in, offering lab tests to certify your items meet all regulations at their end destination. Avoid the stress and keep your business moving smoothly on the global stage.