Freight Vietnam – USA | Rates – Transit Times – Duties & Taxes

Fancy a jaunt in the world of international freight transport? We know the journey from Vietnam to the U.S can seem intimidating with complexities in understanding rates, transit times, and customs regulations. Fear not, we have crafted this comprehensive guide to ease your concerns. From the nitty-gritty of different freight options (be it air, sea, road, or rail) to the exhaustive customs clearance procedure, we've got everything covered. We will also help you decipher those puzzling duties and taxes, and tailor advice for your business's specific needs. If the process still feels overwhelming, let FNM Vietnam handle it for you! We are the international freight forwarder that transforms shipping complexities into success stories for businesses.

Which are the different modes of transportation between Vietnam and US?

Which are the different modes of transportation between Vietnam and US? Discovering the ideal way to ship goods from Vietnam to the US can feel like untangling a very big ball of yarn—it's confusing, but not impossible! It's critical to make a choice that ticks the boxes for speed, cost, and reliability. Can you slide your cargo on the back of a speedy plane or should it sail atop the deep blue sea? Rest assured, geography matters but doesn't limit your options. Whether your priority is fast air freight or economical ocean shipping, each carries its own set of benefits perfectly suited to your unique shipping needs.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can FNM Vietnam help?

Sea freight between Vietnam and US

Unravel the complexities of ocean freight between Vietnam and the United States, two nations with a bustling trade relationship. Keep in mind the major lifelines connecting their key industrial areas – the towering cranes of the Port of Los Angeles and the bustling docks of Ho Chi Minh City. Let’s face it, sea freight can feel like watching paint dry. Still, when dealing with high-volume cargo, it’s the cost-effective tortoise winning the race against the quick yet costly hare of air freight.

Now, let’s cast a lifeline amid the choppy waters of international shipping. Like threading a needle in the pitch black, businesses often stumble, making mistakes in customs clearance, documentation, and container selection. But don’t sweat, we’ve got the right map for you, away from one-size-fits-all answers to tailor-made solutions. Stay tuned, as we decode the shipping nitty-gritty between these two nations, unbox the quintessentials of efficient freight management, and sail smoothly through a sea of shipping specifications.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Situated on the Cam River, near the sea, the Port of Hai Phong is one of Vietnam’s primary maritime gateways. It handles a shipping volume of over 40 million tons each year.

Key Trading Partners and Strategic Importance: This port plays a key role in trade with China, Korea, and Japan. It has a strategic location, allowing easy access to the Northern industrial zone of the country.

Context for Businesses: The Port of Hai Phong could be a valuable asset in your logistics chain if you’re considering Northern Vietnam or Mainland Southeast Asia for your trade expansion. Its advanced infrastructure and diverse services offer reliability.

Port of Da Nang

Location and Volume: This port is strategically located in central Vietnam and caters to the shipping volume of more than 12 million tons annually.

Key Trading Partners and Strategic Importance: It forms a significant trading link with several Southeast Asian countries, with Taiwan and Malaysia as its leading trading partners.

Context for Businesses: The Port of Da Nang may serve as an ideal logistics route for expanding your business in Central Vietnam or targeting the markets of Taiwan and Malaysia due to its bustling trading activities and central location.

Cai Mep International Terminal

Location and Volume: Located along the Cai Mep–Thi Vai river system in the southern province of Ba Ria–Vung Tau, this port handles a shipping volume of over 15 million TEUs yearly.

Key Trading Partners and Strategic Importance: Key trading partners include the United States, the European Union, and Japan. The strategic importance lies in its close proximity to Ho Chi Minh City and its deep-water capabilities.

Context for Businesses: If your enterprise aims to strengthen its exposure to major Western and Japanese markets, using Cai Mep International Terminal in your logistics plan might be beneficial due to direct services to these key regions.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Situated on the Cam River, near the sea, the Port of Hai Phong is one of Vietnam’s primary maritime gateways. It handles a shipping volume of over 40 million tons each year.

Key Trading Partners and Strategic Importance: This port plays a key role in trade with China, Korea, and Japan. It has a strategic location, allowing easy access to the Northern industrial zone of the country.

Context for Businesses: The Port of Hai Phong could be a valuable asset in your logistics chain if you’re considering Northern Vietnam or Mainland Southeast Asia for your trade expansion. Its advanced infrastructure and diverse services offer reliability.

Port of Da Nang

Location and Volume: This port is strategically located in central Vietnam and caters to the shipping volume of more than 12 million tons annually.

Key Trading Partners and Strategic Importance: It forms a significant trading link with several Southeast Asian countries, with Taiwan and Malaysia as its leading trading partners.

Context for Businesses: The Port of Da Nang may serve as an ideal logistics route for expanding your business in Central Vietnam or targeting the markets of Taiwan and Malaysia due to its bustling trading activities and central location.

Cai Mep International Terminal

Location and Volume: Located along the Cai Mep–Thi Vai river system in the southern province of Ba Ria–Vung Tau, this port handles a shipping volume of over 15 million TEUs yearly.

Key Trading Partners and Strategic Importance: Key trading partners include the United States, the European Union, and Japan. The strategic importance lies in its close proximity to Ho Chi Minh City and its deep-water capabilities.

Context for Businesses: If your enterprise aims to strengthen its exposure to major Western and Japanese markets, using Cai Mep International Terminal in your logistics plan might be beneficial due to direct services to these key regions.

Main shipping ports in US

Port of Los Angeles

Location and Volume: Located in the Southern part of California, the Port of Los Angeles is crucial for its connectivity to the Pacific and beyond, boasting a shipping volume of over 8.6 million TEU.

Key Trading Partners and Strategic Importance: Important trade partners include China, Vietnam, and Japan. It’s known as America’s Port® and has remarkable economic output.

Context for Businesses: If you’re targeting expansion or trade within the Pacific Rim, the Port of Los Angeles, with its robust infrastructure and extensive connectivity, can be a vital cog in your shipping strategy.

Port of Long Beach

Location and Volume: Nestled in the heart of Southern California, the Port of Long Beach handles a volume of approximately 9.1 million TEU.

Key Trading Partners and Strategic Importance: Its dominant trading partners are China, worth mentioning is its Green Port Policy for sustainability.

Context for Businesses: The Port of Long Beach may fit perfectly into your logistics if you’re considering sustainable shipping options, thanks to its commitment to environmental stewardship.

Port of New York and New Jersey

Location and Volume: Positioned on the East Coast, the Port of New York and New Jersey is responsible for almost 20% of the US’s total trade volume, approximately 9.4 million TEU.

Key Trading Partners and Strategic Importance: Their key partners range from China to Germany. Strategic importance lies in its comprehensive rail network and ExpressRail service.

Context for Businesses: If your business requires efficient connectivity to the Midwest, the extensive rail services from this port might be your best choice.

Port of Savannah

Location and Volume: Located in Georgia, the Port of Savannah has a shipping volume of about 5.4 million TEU.

Key Trading Partners and Strategic Importance: Key partners include China and India, known for its impressive infrastructural growth.

Context for Businesses: With the port’s ongoing expansion and modernization projects, choosing Savannah can future-proof your logistics strategy if you’re novating to growing economies.

Port of Seattle

Location and Volume: Nestled in Washington State, the Port of Seattle handles over 1.5 million TEU.

Key Trading Partners and Strategic Importance: Major trading partners are China, Japan and South Korea. It’s known for its clean air program and cargo handling diversification.

Context for Businesses: If your trade covers a variety of goods or if you prioritize environmental initiatives, the diverse cargo handling ability and clean practices of Seattle Port might align with your needs.

Port of Houston

Location and Volume: Positioned in Texas, the Port of Houston handles roughly 4 million TEU.

Key Trading Partners and Strategic Importance: Its key partners are China and Mexico, with strategic importance coming from its position as a leading breakbulk port.

Context for Businesses: The Port of Houston is ideal if your shipping strategy includes breakbulk cargo as it’s one of the leading ports in handling such cargo in America.

Should I choose FCL or LCL when shipping between Vietnam and US?

Deciding whether to ship your goods through Full Container Load (FCL) or Less than Container Load (LCL), also known as consolidation, can feel like an intricate puzzle. The choice you make can directly influence the cost, delivery time, and overall success of your shipping process from Vietnam to the US, transforming a once complex decision into a strategic advantage. Get ready to dive in and understand the differences between these two shipping methods, and which one will align perfectly with your particular business needs. Let’s streamline your shipping process.

Full container load (FCL)

Definition: FCL, or Full Container Load, refers to the shipping method where a full container is exclusively used by a single consignee. It offers cost-effectiveness for high-volume cargoes and ensures safety as the container remains sealed from the origin to the destination.

When to Use: Utilize FCL shipping when your cargo volume exceeds the 13 to 15 CBM range, as the cost per unit volume significantly drops.

Example: Say, you're a furniture exporter from Vietnam. If you have a large order and can fully utilize a 20'ft or 40'ft FCL container, it allows secure, untampered transit of your merchandise to various US locations.

Cost Implications: Cost considerations associated with FCL shipping are often determined by the size of the shipment and the distance traveled. Hence, for high volumes, an FCL shipping quote typically provides greater savings than opting for LCL or Less than Container Load shipping. Although the upfront cost of an FCL agreement is more than its LCL counterpart, the cost per unit is substantially lower, rendering FCL as the most cost-effective option for sizable shipments. Thus, planning your business needs in advance and opting for FCL, when feasible, can significantly help in cutting down shipping costs.

Less container load (LCL)

Definition: LCL (Less than Container Load) shipping represents the transport of goods that don't require the full capacity of a standard container. In other words, it's a shared-container system, helping businesses ship smaller volumes of cargo.

When to Use: LCL is the perfect choice when your cargo volume is relatively low, around less than 13-15 CBM. Its flexibility and cost-effectiveness make it the go-to option for low-volume shipments.

Example: Suppose you're a furniture seller shipping 10 CBM of chairs from Ho Chi Minh City to Los Angeles. With an LCL shipment, your goods would be consolidated with other shippers' goods, filling up a single container, and you would only pay for the space your freight uses.

Cost Implications: One key advantage of LCL freight is pricing. Rather than paying for a full container's space (that you're not utilizing completely), you're only billed for the space your goods occupy in the shared container. It's a budget-friendly option for smaller shippers, but remember, the cost per CBM is higher than Full Container Load (FCL).

Hassle-free shipping

Confused about consolidation or full container shipping from Vietnam to the US? FNM Vietnam is here to simplify your freight forwarding needs! Our ocean freight experts evaluate crucial factors like cargo volume, budget, and delivery timelines, to help find your ideal shipping method. Don't get bogged down by logistics; instead, let us make your shipping process hassle-free. Ready to streamline your global trade? Contact us for a free estimate now!

Sea freight shipping between Vietnam and the US typically takes around 30-36 days. However, keep in mind that these transit times can vary based on several factors. The specific ports used, weight, and nature of the goods all have impacts on the total shipping time. For a more accurate estimate tailored to your specific shipment, reaching out to a freight forwarder like FNM Vietnam is advisable.

Let’s look at average transit times in sea freight between the main freight ports in both countries:

| Vietnam Ports | USA Ports | Average Transit Time (in days) |

| Port of Haiphong | Port of Los Angeles | 25-30 |

| Port of Haiphong | Port of Long Beach | 25-30 |

| Port of Haiphong | Port of Houston | 30-35 |

| Port of Haiphong | Port of New York | 35-40 |

| Port of Ho Chi Minh City | Port of Los Angeles | 20-25 |

| Port of Ho Chi Minh City | Port of Long Beach | 20-25 |

| Port of Ho Chi Minh City | Port of Houston | 25-30 |

| Port of Ho Chi Minh City | Port of New York | 35-40 |

*Remember, these are estimated times and it’s always best to get a custom quote from your freight forwarder.

How much does it cost to ship a container between Vietnam and US?

Unpacking the cost of shipping a container between Vietnam and the US can indeed seem tricky; there’s a spread of rates to consider. Ocean freight rates can generally range from $40 to $100 per CBM, broadly speaking. However, pinpointing an exact shipping cost isn’t straightforward, with factors like Point of Loading, Point of Destination, carrier selection, nature of goods, and ever-fluctuating market trends at play. But don’t let the numbers intimidate you. Our shipping specialists employ a case-by-case approach, leveraging their savvy to secure you the best feasible rates. Your shipping needs meet our customized solutions.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) containers are designed to carry oversized or over-dimensional cargo that won’t fit inside standard containers due to their size or weight. Also known as OOG cargo, they can be loaded from the top or sides.

Suitable for: Large, heavy equipment such as machinery or large spare parts.

Examples: Construction equipment, factory parts, large pipes, windmill blades.

Why it might be the best choice for you: If your goods are larger or heavier than standard, an OOG container could be your solution. They provide protection and ensure your cargo reaches the destination securely and safely.

Break Bulk

Definition: Break bulk involves shipping goods individually, utilizing special equipment to load and unload the cargo.

Suitable for: Medium to large goods that can’t fit in standard containers but aren’t suited for bulk shipping.

Examples: Construction equipment, steel beams, wood products, paper products.

Why it might be the best choice for you: Break bulk can provide a cost-effective solution for your loose cargo loads that aren’t suitable for other methods.

Dry Bulk

Definition: Dry bulk refers to goods transported unpackaged in large quantities. The cargo is directly loaded into the hull of a ship in its raw form.

Suitable for: Commodities which are shipped and used in large amounts such as coal, grain, or minerals.

Examples: Rice, coal, grains, cement, minerals.

Why it might be the best choice for you: If your shipment consists of large quantities of a single commodity, dry bulk shipping could be an efficient method.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) vessels have built-in ramps allowing cargo, usually wheeled, to be easily loaded and unloaded.

Suitable for: Wheeled cargo such as cars, trucks, trailers, semi-trailer trucks, lorries, motorbikes.

Examples: Cars, trucks, buses, agricultural machinery.

Why it might be the best choice for you: If you’re dealing with wheeled goods, Ro-Ro vessel shipping offers a smooth and cost-effective solution.

Reefer Containers

Definition: Reefer containers are temperature-controlled shipping containers. They can maintain a range of temperatures to ensure the freshness of goods.

Suitable for: Goods that require a specific temperature during transport.

Examples: Fresh or frozen produce, pharmaceuticals, dairy products.

Why it might be the best choice for you: If you need to maintain a specific temperature for your goods during transit, reefer containers give you that capacity, ensuring your products reach the market in optimal condition.

Not sure which option best suits your needs? We’re here to help. Feel free to contact FNM Vietnam for a free shipping quote in less than 24 hours.

Air freight between Vietnam and US

When it comes to shipping between Vietnam and the United States, air freight swoops in as a superhero. Imagine: You’ve got small, super precious goods – let’s say, a batch of top-tier electronics or boutique coffee beans. Time is of the essence and quality is paramount. Getting them to Uncle Sam’s land fast and intact is your fortress to conquer. Here’s where air freight shines: It’s faster than Speedy Gonzales and as reliable as your favorite superhero.

But gear up, because choosing air freight over sea or land transport is just the start of your adventure. Now, here’s the twist: a lot of shippers trip over their own feet by not considering hidden factors, leading to sky-high costs in air freight. It’s like playing a chess game blindfolded. You might be calculating costs based on actual weight, but did you consider volumetric weight? It’s a critical step many overlook, and that’s just the tip of the iceberg in this high-stakes game of logistics. Stay tuned as we delve into best practices and how to side-step costly pitfalls in air freight.

Air Cargo vs Express Air Freight: How should I ship?

Choosing between Express Air Freight and Air Cargo for your Vietnam to US shipments can feel like a maze. Simply put, while air cargo tags along on regular flights, express air freight grabs a dedicated plane, hitting the throttle to fulfill your fast-paced business demands. Let’s dive into these two options to figure out which might propel your business towards greater efficiency and cost-effectiveness.

Should I choose Air Cargo between Vietnam and US?

Selecting air cargo for your shipment from Vietnam to the US can prove cost-effective and reliable. Several key players offer this service. For instance, airlines such as Vietnam Airlines and American Airlines have proven to be dependable. While transit times may be longer due to fixed schedules, the reliability and cost benefits cannot be overlooked. Importantly, air cargo becomes even more attractive for goods weighing 100/150 kg (220/330 lbs) or more, aligning well with your budgetary needs. Ensure to balance shipping time with cost, choosing the option that best suits your business requirements.

Should I choose Express Air Freight between Vietnam and US?

Express Air Freight, relying on cargo-only planes like those from FedEx, UPS, or DHL, is your go-to option for speedy deliveries from Vietnam to the US. If your cargo is below 1 CBM or between 100-150 kg (220-330 lbs), this method’s your best bet. Why? Cost-effectiveness is one reason. With low-volume, weight shipments, express might be cheaper than traditional air freight. Plus, couriers manage from door to door, mitigating hassle and ensuring expedient transport. So, when you have important, time-sensitive cargo, Express Air Freight can be your efficient solution.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Tops Vietnam’s chart with over 1 million tons of cargo annually.

Key Trading Partners: Primary markets include China, USA, Japan, and South Korea.

Strategic Importance: Located in Ho Chi Minh City, the largest city in Vietnam, gives it access to significant domestic and international routes.

Notable Features: Features the most advanced technologies, including modern cargo handling and storage facilities.

For Your Business: As the busiest airport in Vietnam, Tan Son Nhat provides extensive connectivity and frequent flight schedules that can accommodate your diverse shipping needs.

Noi Bai International Airport

Cargo Volume: Handles approximately 700,000 tons of cargo annually.

Key Trading Partners: Main trading partners include China, South Korea, Japan, and Taiwan.

Strategic Importance: Serves as the main gateway to the northern regions of Vietnam, including the capital, Hanoi.

Notable Features: Offers state-of-the-art facilities, including a dedicated cargo terminal and direct road links to key industrial zones.

For Your Business: High capacity and excellent infrastructure can accommodate large cargo shipments, providing your business with assurance of smooth and timely transport of goods.

Da Nang International Airport

Cargo Volume: Moves around 50,000 tons of cargo annually.

Key Trading Partners: Mainly serves exchanges with China, South Korea, and Japan.

Strategic Importance: Strategically placed in the central part of Vietnam, it connects the north and south and opens the region to global trade.

Notable Features: Expanding facilities and the recent addition of a new terminal to cater to increased cargo demand.

For Your Business: If your business caters to central Vietnam or requires a strategic transit point, Da Nang airport is an ideal choice due to its growing facilities and strategic location.

Cam Ranh International Airport

Cargo Volume: Transports over 30,000 tons of cargo every year.

Key Trading Partners: Major markets are China, Russia, and South Korea.

Strategic Importance: Located in Khanh Hoa Province, it provides direct access to the central coastal region.

Notable Features: Notably efficient in handling of perishable goods, with efficient cold storage facilities.

For Your Business: If your trade involves perishable goods, Cam Ranh airport offers efficient cold chain logistics, ensuring the freshness of your goods upon arrival.

Cat Bi International Airport

Cargo Volume: Manages approximately 15,000 tons of cargo every year.

Key Trading Partners: Primarily trades with domestic markets, China, and Thailand.

Strategic Importance: Situated at the port city of Hai Phong, northern Vietnam’s main seaport, allowing for flexible multi-modal transport operations.

Notable Features: Known for its compact yet efficient cargo handling facilities.

For Your Business: Its proximity to major seaports offers the flexibility of multimodal transport options, potentially reducing your shipping time and costs.

Main international airports in USA

Los Angeles International Airport (LAX)

Cargo Volume: Handles over 2.7 million metric tonnes of air cargo each year.

Key Trading Partners: Mainly engages with Asia, Europe, and Latin America.

Strategic Importance: Located on the U.S. West Coast, it provides direct access to multiple regional markets and benefits from its location in a city of high economic output.

Notable Features: Boasts of extensive cargo handling facilities and services, including cold storage for perishable goods.

For Your Business: Its substantial cargo handling capacity and broad geographic reach make it a prominent choice for your exports and imports, particularly if your business operates in the aforementioned regions.

John F. Kennedy International Airport (JFK)

Cargo Volume: Processes over 950.000 metric tonnes of cargo annually.

Key Trading Partners: Major trading partners span across Europe, Asia, and South America.

Strategic Importance: It’s based in New York, a major international trade hub, and features extensive worldwide connectivity.

Notable Features: Offers a complete range of cargo handling services, including for oversized and specialized cargo.

For Your Business: This airport’s wide international network and first-rate facilities can accommodate a diverse array of shipments, making it a versatile choice for your business’s shipping needs.

Miami International Airport (MIA)

Cargo Volume: Manages around 2.7 million tonnes of freight annually.

Key Trading Partners: Predominantly trades with Latin America and the Caribbean.

Strategic Importance: It’s the main Gateway between U.S and Latin America.

Notable Features: It’s equipped with an expansive cargo area which includes the world’s largest refrigerated cargo hold for perishable goods.

For Your Business: If your shipments involve trade with Latin America, incorporating this airport into your shipping strategy can help streamline your operations.

Chicago O’Hare International Airport (ORD)

Cargo Volume: Handles nearly 2.5 million metric tonnes of cargo per year.

Key Trading Partners: Engages substantially with Europe and Asia.

Strategic Importance: Ranked among the most connected airports globally, it provides extensive reach for businesses.

Notable Features: It provides a full range of cargo handling services, including specialized facilities for animals and dangerous goods.

For Your Business: The broad trading network and robust cargo handling facilities might make O’Hare a viable option if your business handles specialized shipments.

Hartsfield-Jackson Atlanta International Airport

Cargo Volume: Oversees more than 600.000 metric tons of cargo each year.

Key Trading Partners: Major trading partners include the EU, Asia, and Central America.

Strategic Importance: World’s busiest airport by passenger traffic, it’s a major logistics hub due to its efficient processes.

Notable Features: Known for its fast cargo clearance times and comprehensive cargo services.

For Your Business: The airport’s emphasis on efficiency might cater to your needs if speed is a critical aspect of your shipping strategy.

How long does air freight take between Vietnam and US?

The average shipping time between Vietnam and the United States via air freight is typically around 3-6 days. However, these timelines can change due to various factors, such as the departure and arrival airports, the weight of the goods, and their nature. Therefore, for precise and dependable timelines, it’s recommended to consult with a freight forwarder like FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and US with air freight?

The cost of shipping an air freight parcel from Vietnam to the US can range widely, averaging anywhere between $3 to $6 per kg. This variation is due to numerous factors, including the distance from departure and arrival airports, package dimensions and weight, and the nature of the goods. Providing a concrete price isn’t feasible because each shipment is unique. However, our team is dedicated to offering you the best rates possible, quoting each shipment on a case-by-case basis. This ensures you receive a tailored service, fit for your specific needs. Contact us to receive a free quote in less than 24 hours!

What is the difference between volumetric and gross weight?

In air freight shipping, Gross Weight refers to the actual weight of a shipment, including packaging. Simply put, it’s the weight you would get if you placed your cargo on a scale. On the other hand, Volumetric Weight, sometimes called dimensional weight, isn’t about mass. It’s about how much space a package occupies on the aircraft.

Calculating each varies slightly between Air cargo services and Express Air Freight services. In Air cargo, gross weight and volumetric weight are calculated as follows: gross weight is simply the weight of the goods including packing in kilograms (1 kg = 2.2 lbs), while the volumetric weight is determined by multiplying the dimensions of the shipment (length, width, height in cm) and dividing it by a standard industry factor, which typically is 6000 for air freight.

Consider this example: you have a package that weighs 30 kg (66 lbs) with dimensions 60cm x 50cm x 40cm. The volumetric weight would be calculated as (605040)/6000 = 20 kg (44 lbs). In this situation, the gross weight is higher.

Express Air Freight, however, typically uses a smaller factor, like 5000 instead of 6000. Taking the same package as above, the calculation for this service would be (605040)/5000 = 24 kg (52.8 lbs). This doesn’t change our billable weight since the gross weight is still higher.

Understanding these calculations is critical because they impact your freight charges. Carriers will bill based on the higher of the two weights. Specification, it means if your shipment takes up more space than its actual weight suggests, you might end up paying for that extra space. So, the art and science of packing your cargo effectively can save you money.

Door to door between Vietnam and US

Navigating the world of international shipping can be complex, but here’s an avenue that simplifies it all – door to door shipping. Particularly between Vietnam and the US, this method proves extremely beneficial, encompassing efficiency, reliability, and ease. It integrates every step of your shipping journey, leaving no stone unturned. So without further ado, let’s dive into the world of door to door shipping on this well-traveled route!

Overview – Door to Door

The complexities of shipping from Vietnam to the US can be daunting. Don’t fret! Door-to-door shipping service simplifies the process, handling everything from pick up at the origin to delivery at the destination, offering stress-free logistics. Though costs may be higher and transit times potentially longer, the peace of mind you’ll experience is priceless. Most FNM Vietnam’s clients opt for this service due to its convenience and reliability. Let’s delve into why it’s becoming a logistics trend!

Why should I use a Door to Door service between Vietnam and US?

Ever tried juggling flaming swords while tightrope walking over a pit of hungry crocodiles? Well, managing your raw goods shipment from Vietnam to the US can feel a lot like that, and that’s where Door to Door service struts onto the stage!

1. Stress-Free Logistics: You’ve got plenty on your plate without worrying about logistics. This service picks up your goods directly from the source in Vietnam, navigates the labyrinth of customs, and delivers them to the desired destination in the US. Peace of mind, served right to your door!

2. Timely Deliveries: Like a film hero defusing a bomb with seconds to spare, Door to Door service glides through headaches, ensuring that your urgent shipments deliver on time. Goodbye, nail-biting waits!

3. Specialized Care: Got fragile or complex cargo? Not to worry. The Door to Door service handles your goods with tractor-beam precision, ensuring they reach their destination in prime condition. Sensitive cargo is no longer a sensitive subject!

4. Convenience Queen: No more coordinating between multiple carriers! Door to Door service plays ringmaster, managing every step from pickup, via trucking, to final delivery. And voila, convenience redefined!

5. Reliability: Trust is key, and reliability is this service’s middle name. With a clear chain of responsibility, you have a single contact point for all your shipment queries. Trust us, it’s a game-changer!

So, drop those juggling swords, step off the tightrope, and choose Door to Door service for your Vietnam-US shipment. It’s logistics made laughably easy!

FNM Vietnam – Door to Door specialist between Vietnam and US

Experience stress-free shipping from Vietnam to the US with FNM Vietnam’s seamless door-to-door service. By managing everything from packing to transportation, customs and all forms of shipping, we provide turnkey solutions that leave you worry-free. Our dedicated Account Executives are proficient in international logistics, ensuring smooth transit of your goods. Visit us for a swift, free estimate within 24 hours or save time by directly dialing our consultants for a toll-free conversation. Kick back and let FNM Vietnam take care of your cross-border shipping needs.

Customs clearance in US for goods imported from Vietnam

Customs clearance: it’s more than just a phrase – it’s an intricate dance of procedures that can unravel due to hidden fees, surprise charges or even your goods held hostage at the border. Understanding U.S. customs, duties, taxes, quotas and licenses is crucial to ensure the smooth import of goods from Vietnam. And yes, it’s complex, but don’t fret! Our upcoming sections will take you step-by-step through this process. Remember, FNM Vietnam is at your service, simplifying this complexity globally for all kinds of goods. If you’re ready to plan your budget, reach out to our team with your goods’ origin, value, and HS Code for a comprehensive estimate – it’s the first step to avoid any import hiccups.

How to calculate duties & taxes when importing from Vietnam to US?

When importing goods from Vietnam to the US, it’s essential to accurately estimate the customs duties and taxes involved. The calculation hinges on several key elements including the country of origin, HS Code, Customs Value, the applicable tariff rate, and any other potential taxes and fees associated with your specific items. The very first step in this process is to confirm the country where the goods were manufactured or produced; in this case, that would be Vietnam. With that detail squared away, we can delve further into the other elements required to yield an accurate estimate.

Step 1 – Identify the Country of Origin

Knowing the country of origin is not just a procedural step. It’s a key foundation to establishing your shipment’s journey. Firstly, slap on that detective hat! The origin country directly affects the Harmonized System (HS) code, the global standard for classifying traded products. Misidentification can flip your tax diagram upside down.

Secondly, trade agreements. US shares the Generalized System of Preferences (GSP) with Vietnam, a program that makes you eligible for lower or zero tariffs on several goods. Knowing your origin can help you bag these benefits.

Third, a keen understanding of the origin country is your map to avoid potential legal quagmires. Every country presents unique import restrictions. Is your product on that list? An initial look will save you much heartache later.

Fourth, batting for origin helps you play by the rules. Misdeclaration can result in significant penalties. Proceed with caution.

Lastly, it’s all about transparency. Clear declarations foster trust within your supply chain, keeping you in everyone’s good books.

There you have it. Five concrete reasons that pitch a solid case for ‘Step 1 – Identify the Country of Origin’. You’re now one stride closer to navigating your way to a smooth shipment. Let’s rock your logistics!

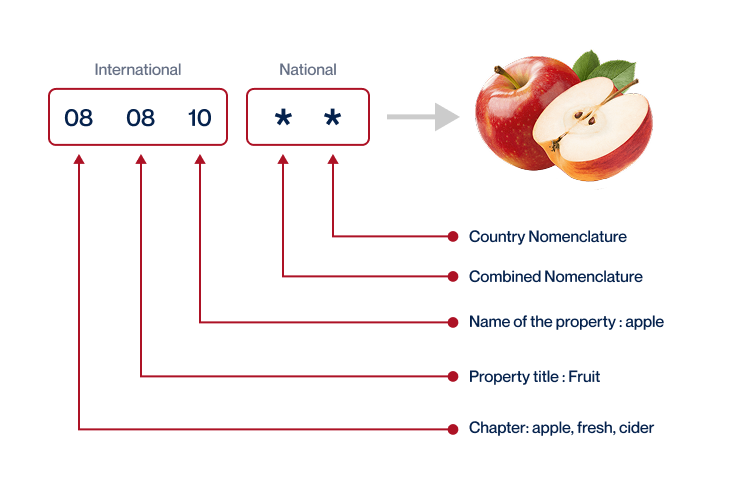

Step 2 – Find the HS Code of your product

The Harmonized System code, or HS code, is a universal economic language and code for goods. It’s an internationally standardized system of names and numbers to classify traded products. The primary use of the HS code is to allow every participating country to classify traded goods on a common basis for customs purposes.

In most cases, the most straightforward way to determine the HS code for your product is to ask your supplier. They’re likely to be familiar with the goods they’re importing and the associated regulatory requirements.

However, if this option is out of reach, fear not. There’s an easy step-by-step process you can follow to find the HS code.

First off, use an HS lookup tool like the Harmonized Tariff Schedule.

Next, simply enter the name of your product into the provided search bar.

Finally, check the Heading/Subheading column – this is where you’ll find the HS code for your product.

It’s crucial to remember that being accurate with your HS code is of utmost importance. An incorrect code can lead to delays in shipping, potential fines, or even a refusal of entry into the country. Precision is key!

Now that you’ve understood how to find your HS code, here’s an infographic showing you how to read an HS code. Keep these steps in mind, and you’ll navigate international freight forwarding like a pro.

Step 3 – Calculate the Customs Value

Grasping the concept of customs value can be quite complex, but it’s essential when importing goods from Vietnam to the US. Unlike the value of the products, the customs value considers other components to offer a comprehensive view of the actual import cost. This includes the price of the goods, the cost of shipping internationally, and the insurance cost. Combined, this gives us the Cost, Insurance, and Freight (CIF) value.

Here’s an example: Let’s say you bought goods for $1000 from your Vietnamese supplier. The shipping cost is $200, and your international shipping insurance is $150. Your CIF value and thus the customs value is $1350 ($1000 + $200 + $150).

Understanding this calculation helps you foresee expenses, ensuring smooth customs clearance in the US. Always base these calculations in USD to align with US customs regulations.

Step 4 – Figure out the applicable Import Tariff

An import tariff, simply put, is a tax imposed on goods imported into a country. The United States typically applies a number of tariffs, such as ad valorem, specific, or compound tariffs. To identify the applicability of these tariffs for your goods imported from Vietnam, follow the steps below:

1. Start with the Harmonized System (HS) code of your product. Let’s say, for example, you’re importing coffee beans, and their HS code is 0901.11.

2. Visit the United States International Trade Commission (USITC) website here – USITC Official Website.

3. Enter the HS code (0901.11) into the search field, then click on ‘Search’.

4. The portal will provide you with the prevailing tariff rate. For instance, coffee beans might currently attract a rate of 1.3%.

Once you have the tariff rate, you’ll want to calculate the total import duties payable. Add your insurance and freight (CIF) costs to the cost of the goods. For example, if your goods cost $10,000 and your CIF is $1000, the total comes to $11,000. Multiply this by the tariff rate, so $12,000 1.3% = $143. This is the import duty you would pay. Remember, currency should always be in USD.

Determining the right tariffs and doing these calculations can be tricky, so understanding this process can save you potential stress and unexpected costs! Plus, doing it right keeps your shipments moving smoothly.

Step 5 – Consider other Import Duties and Taxes

Beyond standard tariffs, various import duties could come into play when shipping from Vietnam to the US.

For instance, excise duty is a tax levied on certain goods like alcohol or tobacco. The exact rate can vary widely, so it’s essential to check specific goods classifications.

Anti-dumping duties may also apply if your goods have been sold at a lower price in the US than in Vietnam, in a way that harms local businesses. Federal agencies determine these rates, so it’s crucial to be prepared for this potential cost.

Lastly, while the US doesn’t have a typical VAT (Value-Added Tax), there’s the Sales and Use Tax that varies by state, ranging from 2.9% to 7.25%. To calculate potential costs, you’ll multiply the tax rate by the customs value of your goods.

Remember that these are examples and actual costs may differ. It’s critical that shippers consult with a Customs Broker or legal expert to ensure accurate costing and full compliance with all import regulations and taxes. This step can add complexity to the process, but also provide clarity in projecting your complete import cost. Be proactive and informed to avoid any surprise expenses.

Step 6 – Calculate the Customs Duties

In ‘Step 6 – Calculate the Customs Duties, you’ll uncover how to determine what you owe in customs fees when shipping from Vietnam to the US. The calculation is based on three elements: the customs value of your goods, the Value-Added Tax (VAT), and potential anti-dumping taxes.

For customs duties, use the following formula:

Customs Value x Customs Duty Rate = Customs Duty

In a scenario where only customs duties apply, let’s assume the customs value of your shipment is $5,000 and the customs duty rate is 15%. The customs duty you’d pay is $750 ($5,000 x 15%).

When VAT gets involved, you have:

(Customs Value + Customs Duty) x VAT Rate = VAT

Suppose your goods have the same customs value and duty rate, and the VAT rate is 10%. Your VAT would be $575 (($5000 + $750) x 10%).

Lastly, if anti-dumping taxes and Excise Duty apply, you’ll add these to your total costs. If the anti-dumping tax rate is 12% and Excise Duty is 5%,

Customs Value + Customs Duty + Anti-dumping Tax x Excise Duty Rate = Excise Duty

For our example:

($5000 + $750 + $600) x 5% = $267.5

These calculations can be complex, and errors cost money. Avoid overcharges with FNM Vietnam’s customs clearance services. We handle every step, including ensuring your customs duties are precise. Contact us for a free quote in less than 24 hours.

Does FNM Vietnam charge customs fees?

Yes, FNM Vietnam charges a customs clearance fee but remember, this isn’t the same as customs duties. Imagine seeing an itemized restaurant bill; the clearance fee could be likened to the service charge, while customs duties and taxes are more like VAT, directly paid to the government. Don’t fret about hidden costs; FNM Vietnam provides documentation from customs so you’ll see exactly what your payment covers–just like getting a receipt for your dinner!

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs Official website: http://www.customs.gov.vn/

US Customs

Official name: U.S. Customs and Border Protection (CBP) Official website: https://www.cbp.gov/

Required documents for customs clearance

Wrangling with customs clearance paperwork can be daunting. Dive into the essentials here; we’ll unbox the Bill of Lading, dig into the Packing List, certify the Certificate of Origin, and decode those cryptic Documents of Conformity (CE standard). A simplified overview to face the customs officials with confidence, let’s get started!

Bill of Lading

The moment your goods embark on their journey from Vietnam to the US, the Bill of Lading acts as their passport, marking transfer of ownership. Think of it as a receipt – it certifies that your cargo has been loaded on a particular ship at a particular location. And its digital sibling, the Telex release? It’s your fast-track pass, offering digital convenience in a traditional paper-based system, allowing a quicker cargo release once it reaches American shores. For air freight, don’t forget your Air Waybill (AWB) too! For a smoother shipping process, always make sure to have these documents well-prepared and correctly filled. It saves you from potential headaches at customs. The devil is in the details.

Packing List

Navigating the world of customs can feel like a labyrinth, right? But, no worries, that’s where your trusty Packing List steps in. Think of it as your captain when sailing goods from Vietnam to the US. So, whether it’s designer handbags or a fresh batch of Vietnamese coffee beans, the Packing List records every detail of your shipment – weight, quantity, description, you name it. And yes, this applies to sea and air freight alike. Misplace a digit and bam, your cargo could end up in Miami, instead of Manhattan. So, accuracy isn’t just nice, it’s a must. Imagine explaining to Uncle Sam why your crates differed from your Packing List. Not much fun, huh? So, be meticulous. After all, precision ensures a smooth voyage, helping you evade unnecessary customs hiccups.

Commercial Invoice

When you’re shipping from Vietnam to the US, the Commercial Invoice is vital. This everyday shipping document carries all essential information about your goods – everything from a detailed description, harmonized system codes, to the cost and terms of delivery. But attention to detail is everything. Errors in the Commercial Invoice can cause frustrating hold-ups at customs. To prevent this, align your Commercial Invoice with other shipping documents like the packing list and bill of lading. Think of it as a reflection of your shipment, any inconsistency can raise a red flag. So, be thorough, precise, and transparent about what you’re shipping. It might just be the difference between a seamless clearance and a customs headache. Remember, it’s not just a paper – it’s your ticket to swift shipping from Vietnam to the US.

Certificate of Origin

When shipping from Vietnam to the US, don’t overlook the Certificate of Origin. This vital document verifies your goods’ manufacturing country, which can bag you preferential customs duty rates, sweetening your bottom line. If your shipping container is brimming with clothing items made in Vietnam, including a Certificate of Origin could land you in the good graces of US customs. Why? Because tariff rates can be lower for goods made in certain countries, thanks to various trade agreements.

But remember, accuracy is paramount. Misrepresenting the manufacturing country might lead you to a customs clearance maze you’d rather avoid. Just think of it as your goods’ passport, going along for the ride. There’s nothing like smooth sailing through customs to set the stage for successful international trade. So, keep that Certificate of Origin close – it’s the boarding pass for your freight.

Get Started with FNM Vietnam

Prohibited and Restricted items when importing into US

Understanding what’s off-limits is crucial to avoid unexpected shipment hold-ups. Imagine your goods seizing at US customs just because you overlooked the forbidden items rule! Let’s help you sidestep that hurdle. Here’s a brief on items you must cross off your list right away.

Restricted Products

– Chemicals: To ship chemicals in the US, you’ll need to secure a license from the Bureau of Industry and Security.

– Animal and Animal Products: To import or ship animals and animal products in the US, the Animal and Plant Health Inspection Service (APHIS) mandates a permit.

– Prescription Drugs: You’ll need authorization from the Food and Drug Administration (FDA) if you have a shipment containing prescription drugs.

– Alcoholic Beverages: If you’re shipping alcoholic beverages, you’re required to secure a permit from the Alcohol and Tobacco Tax and Trade Bureau (TTB).

– Tobacco: A permit from the Alcohol and Tobacco Tax and Trade Bureau (TTB) is needed to ship tobacco.

– Firearms and Ammunition: You have to get a permit from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) to ship firearms and ammunition.

– Plants and Plant Products: To ship plants and plant products, you’ll need a permit from the Animal and Plant Health Inspection Service (APHIS).

– Fish and Wildlife: For shipments that include fish and wildlife, you’ll need to apply for a permit from the U.S. Fish and Wildlife Service.

Remember, these regulations may change, and other products may be restricted as well. Be sure to check with your shipping provider or a knowledgeable freight forwarder for the most accurate and up-to-date information.

Prohibited products

– Absinthe and accessories associated with it

– Dog and cat fur

– Drug paraphernalia

– Haitian animal hide drums

– Products made from dog or cat fur

– Various flora and fauna species

– Items made from elephant ivory

– Large capacity ammunition devices

– Goods from embargoed or prohibited countries

– Merchandise from embargoed countries

– Iranian carpets and foodstuffs

– Most products containing material from endangered species

– Unauthorized medical devices

– Unauthorized copyrighted or recorded materials

– Lottery tickets from foreign countries

– Soil and geological samples.

Vietnam – US trade and economic relationship

The Vietnam-US trade relationship, dating back to 1995, has bloomed into a dynamic partnership. The journey commenced with the Bilateral Trade Agreement in 2001, easing trade restrictions and opening the sectors of telecommunications, energy, and consumer goods.

By 2024, bilateral goods and services trade had soared to nearly $150 billion, representing a dramatic escalation from a humble $450 million in 1995. Both nations mutually prize sectors like electronics, footwear, textiles, and petroleum, with Vietnam’s leading exports being electrical machinery and footwear, and the US selling mostly cotton, aircraft, plastics. As of 2023, US foreign direct investment stood robust at a $23 billion mark, reaffirming faith in Vietnam’s economic promise. Embrace this context when planning your logistics strategy; understanding the past can streamline your future shipping needs.

Your Next Step with FNM Vietnam

Additional logistics services

Warehousing

Finding the right warehouse in Vietnam or the US isn't easy - you need a reliable one that can handle your goods, especially if they require controlled temperatures. Think chocolates melting or pharmaceuticals degrading. Trust us to handle those challenges for you. Want to learn more? Check our Warehousing page for details.

Packing

Selecting the right packaging for your goods is critical when shipping from Vietnam to the US. You don't want your designer handbags or artisanal products getting damaged, right? Having a reliable agent for packaging and repackaging ensures your items reach their destination in perfect condition. Here's the kicker - it can cater to anything - from ceramic cups to heavy machinery parts! Get all the details on our dedicated page: Freight packaging

Transport Insurance

Sailing through stormy seas or soaring above menacing clouds—imagine the perilous journeys your goods traverse. Now imagine having peace of mind! This is what Cargo Insurance brings. It's quite different from fire insurance which primarily secures property against fire accidents. With our coverage, not only do you insure against calamity but also the unexpected hiccups of transit. Picture this: your container is accidentally dropped. Boom! We've got you covered. Eliminate your shipping worries and trust our freight insurance to safeguard your valuable goods. More info on our dedicated page: Cargo Insurance

Household goods shipping

Moving between Vietnam and the US can be more than a hassle, especially when it commodifies your cherished personal items. Whether it's grandma's fragile porcelain or that outsize bulky recliner you just can't let go, we get it! Rest assured, our team handles these with care and tact, ensuring they reach your new address seamlessly. Want peace of mind? Learn how we do it on our dedicated page: Shipping Personal Belongings

Procurement in Thailand

Looking to manufacture in Asia or East Europe? FNM Vietnam is your reliable ally who locates suitable suppliers and oversees your entire procurement process. We cut through the language barriers, demystifying the complex manufacturing world. Picture us as your steadfast guide, making procurement as easy as ordering a cup of coffee. Curious to know more? Check everything out on our Sourcing services page.

Quality Control

When shipping from Vietnam to the US, those top-notch quality inspections become your secret weapon. Saving you from poor workmanship or last-minute changes that could cost your business dearly. Picture this: Imagine discovering a whole batch of handmade crafts, lovingly produced, but unfortunately, off-color due to a supplier mix-up. Wouldn't it be a lifesaver having quality control on-site to catch such costly errors before the shipment flies? Learn more on our dedicated page: Quality Inspection

Conformité des produits aux normes

Ensuring your goods meet relevant standards is crucial for seamless shipping. Our Product Compliance Services meticulously test your items in our advanced labs, securing necessary certifications, streamlining the journey, and preventing any regulatory hiccups at the destination. It's like a green light for your shipments, signifying all is good to go.