Ever tried fitting an elephant into a shipping container? Ha, us neither! Far less intense, but no less tricky, is getting to grip with freight transport between Vietnam and South Korea. Unpacking intricate matters like rates, transit times, and the maze of customs regulations can feel like a daunting task.

That’s where this guide swoops in. Equipped to demystify all of these, it lays out different freight options for you, shines a light on the somewhat murky process of customs clearance, and decodes baffling duties and taxes. Plus, it’s designed with businesses in mind, offering targeted advice to make your shipping experience smoother and less stressful.

If the process still feels overwhelming, let FNM Vietnam handle it for you! As your international freight forwarding buddy, we thrive on turning the complexities of shipping into knockout success stories for businesses, every step of the way!

Which are the different modes of transportation between Vietnam and South Korea?

When choosing how to ship goods between Vietnam and South Korea, think about the differences between driving or taking a flight. While road transport might seem direct, it's not an option here due to the large sea standing in the way. Air freight offers speed but can be expensive, like paying for a last-minute plane ticket. Sea freight, on the other hand, is slower but more cost-effective, like ticket prices for an early bird cruise. Maintaining a balance between speed, budget, and the nature of your goods is key. It's all about picking the right vehicle for your journey.

How can FNM Vietnam help?

Whether you're shipping small parcels or vast volumes, FNM Vietnam makes transporting goods between Vietnam to South Korea easy. Our expertise in customs handling and efficient logistics ensures your cargo reaches safely in no time. Have queries? Our consultants are just a call away. Need a quick estimate? Contact us and get one in less than 24 hours.

![]()

FNM Vietnam Tip: Sea freight might be the best solution for you if:

- You're moving big loads or large items. Sea freight offers roomy, cost-effective solutions.

- Your shipment isn't time-critical. Ocean routes take longer but are often more reliable.

- Your supply chain links major ports, tapping into a broad network of sea lanes.

Sea freight between Vietnam and South Korea

Trade between Vietnam and South Korea is an engine of growth in Asia, linked by bustling seafaring routes. Da Nang, Hai Phong, and Ho Chi Minh are key Vietnamese ports that connect to South Korea's Busan and Incheon, vital hubs in the heartland of the Miracle on the Han River. Ocean freight, although slower, is a financially wise choice for high-volume goods often traded between these Asian tigers.

Yet the sea lanes between these two countries aren't always smooth sailing for shippers and businesses. They often encounter choppy waters of confusing procedures, costly errors, and a sea of paperwork. It's like planning a road trip without a GPS - the journey is fraught with wrong turns. But fear not! Just as a seasoned sailor reads the ocean current, understanding shipping's best practices can be a guiding lighthouse. In this section, we'll unfurl useful insights and smart shortcuts to help you navigate these often stormy seas, making your voyage between Vietnam and South Korea less intimidating and more efficient. You'll be equipped to brave the challenges, just like a wise sea captain at the helm.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Situated in the northern part of Vietnam, Hai Phong port is the leading gateway for Northern provinces with a shipping volume of about 32.2 million metric tons a year.

Key Trading Partners and Strategic Importance: Major trading partners include China, South Korea, and the USA. Notably, it’s among the world’s top large-volume container ports and plays a strategic role in import-export activities in the Northern region of Vietnam.

Context for Businesses: If you're working to expand your business reach within Asia and to North America, the Port of Hai Phong serves as a vital bridge due to its comprehensive services and strategic location.

Port of Ho Chi Minh

Location and Volume: Located in the southern part of Vietnam, Ho Chi Minh port is an integral part of trade activities in southern provinces, with a shipping volume of over 6 million TEUs.

Key Trading Partners and Strategic Importance: It mainly engages with trading partners such as China, the USA, and Japan. The port’s proximity to the economic hub of the country further strengthens its strategic importance.

Context for Businesses: If you're planning to penetrate key economic zones in Vietnam, then the Port of Ho Chi Minh, with its ease of access to the country's economic hub, may be a key component of your shipping strategy.

Port of Da Nang

Location and Volume: The Port of Da Nang, situated in central Vietnam, is the third-largest port in the country, with a cargo throughput of over 8.5 million metric tons.

Key Trading Partners and Strategic Importance: The port regularly exchanges goods with key trading partners such as China, Thailand, and South Korea. Besides, it holds strategic importance due to its location in the East-West Economic Corridor connecting Myanmar, Laos, Thailand, and Vietnam.

Context for Businesses: If your business is concentrated in the heart of Vietnam or within the East-West Economic Corridor, then the Port of Da Nang, due to its strategic location, might be significant for your logistics planning.

Port of Quy Nhon

Location and Volume: Situated in Binh Dinh province of Central Vietnam, Quy Nhon port handles a cargo volume of around 9 million metric tons annually.

Key Trading Partners and Strategic Importance: Key trading partners primarily include ASEAN countries, China, and Japan. This port is crucial for the development of Central Highlands and Central Coastal provinces of Vietnam.

Context for Businesses: If your trading interest revolves around the ASEAN region, Port of Quy Nhon is an essential part of your logistics due to its trading relations and geographical position.

Port of Cai Mep

Location and Volume: Located in the South East of Vietnam, the Cai Mep port has a remarkable shipping volume of about 3.4 million TEUs per year.

Key Trading Partners and Strategic Importance: Port of Cai Mep is a popular choice for businesses trading with the USA, Europe, and Asia. This port acts as Vietnam’s gateway to the South East Asian market.

Context for Businesses: If you’re exploring opportunities to connect with the South East Asian region, the Port of Cai Mep, providing a direct shipping line to the area, should feature in your shipping operations.

Port of Nghi Sơn

Location and Volume: Located in the Thanh Hoa province, Nghi Son port orbits a volume of about 10 million metric tons per year.

Key Trading Partners and Strategic Importance: Its primary trading partners include ASEAN countries, China, and Japan. Nghi Son port also serves as an important access point for the Nghi Son Economic Zone.

Context for Businesses: If you’re looking to connect with the vibrant economies in the ASEAN region, then the Port of Nghi Son can play a vital role in your trading activities given its trading relations and accessibility to the Nghi Son Economic Zone.

Main shipping ports in South Korea

Port of Busan

Location and Volume: Located on the main trade routes in the Southeast and East Asia region, Port of Busan is crucial for these thriving economic regions, with a shipping volume of over 21.46 million TEUs.

Key Trading Partners and Strategic Importance: The main trading partners for this port include China, the United States, Japan, and several other Southeast Asian countries. Its strategic location provides a clear path to bustling Asian economies and beyond, making it indispensable for global trade.

Context for Businesses: If you're seeking to establish your presence in East and Southeast Asia, the Port of Busan, known for its efficiency and state-of-the-art facilities, could be a valuable component in your shipping strategy.

Gwangyang Port

Location and Volume: Positioned in the southwestern corner of the Korean Peninsula, Gwangyang Port is an essential gateway to the Pacific Ocean, with a shipping volume surpassing 2.95 million TEUs.

Key Trading Partners and Strategic Importance: Its primary trading partners encompass neighboring China, the United States, and other Pacific nations. The port's notable feature is its large-scale steelworks, which contribute significantly to its cargo volume.

Context for Businesses: Utilizing Gwangyang Port could be advantageous if your operation involves heavy industries, given its significant steel-related cargo, or if you seek a reliable connection to primary Pacific markets.

Incheon Port

Location and Volume: Situated in the northwest corner of South Korea, Incheon Port serves as a pivotal hub for transportation and trade with North China, with a shipping volume of over 3 million TEUs.

Key Trading Partners and Strategic Importance: Incheon's major trading partners comprise China, the United States, and Vietnam. Besides, it is well-integrated into the country's inland distribution networks, making it a strategic point for trade.

Context for Businesses: Incheon could be at the heart of your shipping proceeder if you're planning to penetrate the northern Chinese market, considering its optimal position and expansive inland network.

Ulsan Port

Location and Volume: Nestled in the southeast part of the Korean Peninsula, Ulsan Port is key to the petrochemical industry due to its close proximity to various industrial complexes, exhibiting a shipping volume of over 1.89 million TEUs.

Key Trading Partners and Strategic Importance: The port mainly trades with China, Singapore, and Japan. It boasts a direct connection to Ulsan's major industrial areas, revealing its strategic importance.

Context for Businesses: If your enterprise is deeply engaged in the petrochemical or automotive sectors, Ulsan Port may be a crucial piece in your shipping puzzle, spotlighting its substantial petrochemical and automotive complex nearby.

Pyeongtaek Dangjin Port

Location and Volume: Positioned in the midwestern region of South Korea, Pyeongtaek Dangjin Port is an essential player in the domestic distribution network, boasting a shipping volume of around 2.5 million TEUs.

Key Trading Partners and Strategic Importance: Its crucial trading partners include China, Vietnam, and the United States. The port is equipped with advanced facilities to handle various types of cargo, which underlines its notable feature.

Context for Businesses: If you are attempting to access South Korea's domestic markets or need diverse cargo handling, selecting Pyeongtaek Dangjin Port could streamline your logistics backbone, due to its versatility and local connectivity.

Mokpo Newport

Location and Volume: Located on the southwestern tip of the Korean Peninsula, Mokpo Newport acts as a crucial juncture between international and domestic shipping routes, with its shipping volume not publicly listed.

Key Trading Partners and Strategic Importance: Mokpo Newport mainly trades with China, Japan, and several Southeast Asian nations. It plays a central role in the regional ferry services, adding to its strategic value.

Context for Businesses: Should your business model favor a seamless blend of domestic and international logistical needs, Mokpo Newport provides a unique advantage with its balanced services spanning both spheres.

Should I choose FCL or LCL when shipping between Vietnam and South Korea?

Deciding how to ship goods between Vietnam and South Korea? It's all about strategy! Get to know Full Container Load (FCL) and Less than Container Load (LCL) - your prime sea freight options. The best choice can steer the course of cost, delivery time, and overall success. Don't spin the globe and blindly pick an option; learn the differences, weigh your specific shipping needs, and dial-in on a decision that rewards your bottom line. Let's set sail on this voyage of maritime knowledge! Buckle up, we're diving in deep to help you make an informed decision.

LCL: Less than Container Load

Definition: Less than Container Load (LCL) shipping consolidates multiple shippers’ goods into a single container for efficient freight transport.

When to Use: LCL shipment is a practical solution when the cargo volume is less than the full capacity of a standard container (less than 13/14/15 CBM).

Example: Suppose an electronics manufacturer in Vietnam needs to export 10 CBM of circuit boards to South Korea, which doesn't justify the cost of a Full Container Load (FCL). They choose LCL freight; their goods are consolidated with others, optimizing cost and space.

Cost Implications: LCL shipping offers flexible pricing — you only pay for the space used inside the container. This cost efficiency suits small businesses and low-volume shipments. However, keep in mind that shared space comes with the likelihood of additional handling and potential delays at customs due to the multiple consignees involved.

FCL: Full Container Load

Definition: FCL, or Full Container Load, is a type of shipping mode where a freight container is solely dedicated to a single consignment, ensuring the container's seal remains intact from origin to destination.

When to Use: FCL shipping is the most cost-effective and secure option when transporting significant volumes, especially when your cargo is more than 13/14/15 CBM. The extra space and security offered by the dedicated FCL container are essential for larger shipments.

Example: Consider a Vietnamese furniture exporter sending bulk shipments to South Korea. FCL is the best selection as the load would likely fill a 20'ft or 40'ft container. The items stay safe, and the cost of shipping per unit is lower due to the high volume.

Cost Implications: An FCL shipping quote often presents better value for higher volume shipping. While the overall cost might be higher than LCL (Less Container Load), the cost per cubic meter is typically lower with FCL. It's recommended to compare FCL and LCL quotes to make the right shipping decision. Remember, though, FCL also reduces the risk of damage to goods, an important cost-saving aspect to factor in when considering the overall cost impact.

Say goodbye to shipping headaches!

Explore the vast sea of trade possibilities with FNM Vietnam! As a seasoned freight forwarder, we aim to simplify and streamline your cargo shipping experiences. Our ocean freight experts can guide you through factors such as cost, shipment size, schedule flexibility and the nature of your goods to chart the best course, be it consolidation or full container shipping. Don't ride the waves of uncertainty, tap into our expertise today. Get your free estimation and experience a smooth sail from Vietnam to South Korea!

How long does sea freight take between Vietnam and South Korea?

On average, freight shipping from Vietnam to South Korea can take between 5 to 10 days under normal conditions. However, it's important to understand that these transit times are subject to fluctuation due to various factors. Details such as the specific ports involved, the weight of the cargo, and the nature of the goods can affect the overall timeframe. For a precise estimate and tailored advice, your best course of action would be to get in touch with a reliable freight forwarder like FNM Vietnam.

Regarding the transport times between the major freight ports in both countries, please find the details below. Again, remember that these are estimates and actual transit times may vary:

| Vietnam Port | South Korea Port | Average Transit Time (days) |

| Port of Hai Phong | Port of Busan | 7 |

| Port of Da Nang | Port of Incheon | 8 |

| Port of Ho Chi Minh | Port of Ulsan | 9 |

| Port of Qui Nhon | Port of Pyeongtaek-Dangjin | 10 |

How much does it cost to ship a container between Vietnam and South Korea?

Transporting a container from Vietnam to South Korea? With ocean freight rates, anticipate a ballpark figure that widely spans from 15 to 30 dollars per cubic meter (CBM). While we'd love to offer an exact quote upfront, shipping costs hinge upon numerous factors. These include your chosen Points of Loading and Destination, the carrier, the type of goods, and the fluctuating market. Fret not! Our seasoned shipping specialists are ready to dive into the details for you, tailoring a quote to your specific needs, ensuring you get the most for your money. Remember, every shipment is unique - just like your business. Let's embark on this shipping journey together.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is a special shipping method designed for oversized or irregularly shaped cargo that doesn't fit within standard shipping containers.

Suitable for: Extra-large machinery, industrial equipment, and construction materials.

Examples: Heavy equipment like tractors, construction cranes, or wind turbine blades.

Why it might be the best choice for you: If your shipment doesn't fit into standard containers, out of gauge cargo options ensure your goods reach their destination safely without compromising on the cargo space.

Break Bulk

Definition: Break bulk shipping involves cargo that's loaded individually onto the vessel, rather than in a container. This loose cargo load is often secured onto pallets or in crates.

Suitable for: Unique or large items such as timber, steel, pipes, or project cargo.

Examples: Machinery parts, construction materials, facilities equipment.

Why it might be the best choice for you: If your goods don't fit into standard containers and cannot be disassembled, break bulk shipping can offer more flexibility while ensuring safety and compliance.

Dry Bulk

Definition: Dry bulk is a transportation method designed to ferry unpackaged dry material in large quantities.

Suitable for: Commodities that are shipped in mass like grain, coal, or iron ore.

Examples: Agricultural products, minerals, and building materials like sand or gravel.

Why it might be the best choice for you: If you're shipping large quantities of loose, dry goods, this method provides cost and logistical efficiency.

Roll-on/Roll-off (Ro-Ro)

Definition: A Ro-ro vessel is a special type of ship with built-in ramps which allow vehicles to be driven directly on and off the ship, largely used for the transportation of cars, trucks, and heavy machinery.

Suitable for: Any wheeled cargo, such as automobiles or trailers.

Examples: Cars, trucks, tractors, or heavy machinery.

Why it might be the best choice for you: If your cargo includes vehicles or other rolling stock, then the roll-on/roll-off method simplifies the loading and unloading process and reduces handling costs.

Reefer Containers

Definition: Refrigerated containers, known as 'reefers,' are a method of shipping temperature-sensitive goods.

Suitable for: Perishable items that require a controlled environment like fruits, vegetables, or other food items, and pharmaceutical products.

Examples: Pharmaceuticals, meat, dairy, fruits, and vegetables.

Why it might be the best choice for you: If your goods need a constant temperature throughout the transportation process, this method offers excellent temperature control, ensuring your products arrive in perfect condition.

At FNM Vietnam, we understand every shipment is unique and choosing the correct method is crucial. We invite you to contact us to discuss your specific shipping needs and get a free shipping quote in less than 24 hours.

FNM Vietnam Tip: Air freight might be the best solution for you if:

- You're on a tight schedule. Air freight delivers speed unmatched by other modes.

- Your cargo is under 2 CBM, a good fit for air's smaller capacity.

- Your destination is off the usual routes, making air's global network a key asset.

Air freight between Vietnam and South Korea

Jetting goods between Vietnam and South Korea? Here's the low-down: Air freight soars above other modes of transport when it comes to speed and reliability. Think about it, intricate electronic components or high-fashion garments don't do slow. For these small, high-value shipments, it's both swift and cost-effective. Now, we can't glide past one crucial point - many shipper's wallets are taking a nosedive due to common mistakes. Just like you'd miscalculate ingredients in a recipe, they aren't using the right weight formula when estimating costs. It's like tossing money into a headwind. But don't fret, we're here to save the day. Up ahead, we'll delve into avoiding these hidden costs and best shipping practices - ensuring your dollars aren't lost in transit.

Air Cargo vs Express Air Freight: How should I ship?

Choosing the right shipping strategy is key for businesses trading between Vietnam and South Korea. But here's the rub: Air Cargo takes your goods on a regular commercial airline, while Express Air Freight whisks them away on a dedicated plane, no other cargo in sight. Your selections can be the game-changer between efficiency and delay in delivery. Let's dive deeper to create your perfect roadmap to success.

Should I choose Air Cargo between Vietnam and South Korea?

Air cargo between Vietnam and South Korea can be a cost-effective and reliable choice, ideal for managing your budget. It provides a balance between cost and speed, though you might face slightly longer transit times due to fixed flight schedules. Notable airlines like Korean Air and Vietnam Airlines handle significant air freight across these routes. Importantly, air cargo becomes an increasingly attractive option when shipping cargo weighing over 100-150 kg (220-330 lbs). Trust in the proven track records of these prestigious carriers to meet your shipping needs reliably between these two nations.

Should I choose Express Air Freight between Vietnam and South Korea?

Express air freight, a service provided by renowned courier firms like FedEx, UPS, and DHL, uses dedicated cargo planes, transporting goods speedily without passenger disruptions. If your shipment to or from Vietnam and South Korea weighs less than 100/150 kg (220/330 lbs) or is under 1 CBM, this could be your ideal solution. You stand to gain from swift deliveries and straightforward customs clearance, making express air freight particularly attractive for your time-critical consignments. By choosing this, you effectively expedite your shipping process, ensuring your business operations run smoothly.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: As Vietnam's busiest airport, Tan Son Nhat handled over 1.4 million tons of cargo in 2020.

Key Trading Partners: The primary trading partners are China, Japan, and the U.S.

Strategic Importance: Tan Son Nhat holds a strategic spot in the Ho Chi Minh City, facilitating access to the vast economic and financial territory of Southern Vietnam.

Notable Features: It features world-class facilities and a 24/7 operational capability, allowing round-the-clock cargo transport.

For Your Business: If your business operates primarily in the southern provinces of Vietnam or values quick access to Vietnam's commercial hub, Tan Son Nhat might be your preferred choice.

Noi Bai International Airport

Cargo Volume: Noi Bai processed over 700,000 tons of cargo in 2020.

Key Trading Partners: The main trading partners include China, South Korea, and Japan.

Strategic Importance: Situated in Hanoi, the country's capital, Noi Bai is a crucial connecting node for Northern Vietnam.

Notable Features: A dedicated cargo terminal and advanced digital logistics solutions to ensure seamless freight handling.

For Your Business: If you need to stay connected with venture clusters in Hanoi or northern industrial zones, Noi Bai is an excellent gateway.

Da Nang International Airport

Cargo Volume: Da Nang accommodated nearly 170,000 tons of cargo in 2020.

Key Trading Partners: Major goods trading occurs with China, South Korea, and Japan.

Strategic Importance: Located in Central Vietnam, Da Nang bridges the North and South, providing easy accessibility to various industrial hubs.

Notable Features: Modern infrastructure, efficient operations, and faster customs processing due to less congestion than larger hubs.

For Your Business: If your operations span across both North and South Vietnam, Da Nang's central location could give you the logistical advantage you need.

Cần Thơ International Airport

Cargo Volume: In 2020, Can Tho International Airport handled over 5,000 tons of goods.

Key Trading Partners: Key trading countries include China, Taiwan, and South Korea.

Strategic Importance: As the largest airport in the Mekong Delta, Can Tho plays an essential role in freight transport for Vietnam's agricultural heartland.

Notable Features: Despite its smaller size, Can Tho offers direct international flights and flexible cargo solutions.

For Your Business: If your business involves agricultural goods or targets the Mekong Delta's vibrant market, Can Tho could be a viable option.

Cẩm Ranh International Airport

Cargo Volume: In 2020, Cam Ranh handled approximately 180,000 tons of cargo.

Key Trading Partners: The airport primarily trades with South Korea, China, and Russia.

Strategic Importance: Positioned in Khanh Hoa Province, Cam Ranh is a pivotal gateway to Vietnam's East Sea economic zone.

Notable Features: Offers a dedicated cargo handling solution and a wide range of direct international flights.

For Your Business: If your business is looking to tap into markets around the East Sea or values streamlined cargo handling, Cam Ranh Airport may well serve your shipping objectives.

Main international airports in South Korea

Incheon International Airport

Cargo Volume: Handled 2.998 million tons of cargo as of 2019, the airport is busiest in South Korea for cargo traffic.

Key Trading Partners: Primarily trades with China, United States, Vietnam, Hong Kong, and Japan.

Strategic Importance: Serves as a key transit point between Asia and North America, which is an ideal hub because of its location.

Notable Features: Features advanced cargo facilities including a Cargo Terminal and Free Trade Zone.

For Your Business: Its extensive network and modernised facilities mean faster, reliable shipping of your goods, making it an ideal choice if you're shipping to the aforementioned trading partners.

Gimpo International Airport

Cargo Volume: Handled 23,010 tons of cargo in 2019.

Key Trading Partners: Primarily trades with Japan and China.

Strategic Importance: Acts as a secondary airport for Seoul and is geographically closer to the city compared to Incheon.

Notable Features: Despite its smaller scale, it maintains significant traffic from vibrant economic hubs like Tokyo and Beijing.

For Your Business: Given its proximity to Seoul, particularly helpful if you are constantly shipping smaller volumes to and from the South Korean capital for quicker deliveries.

Jeju International Airport

Cargo Volume: Handled 43,460 tons of cargo in 2019.

Key Trading Partners: Primarily trades with China, Japan, and the Philippines.

Strategic Importance: This is South Korea's second largest airport, serving as a domestic hub with limited but important international connections.

Notable Features: Known for its comprehensive airport features including cargo handling.

For Your Business: A key point if you are concentrating on domestic South Korean markets with occasional shipments to its trading partners.

Busan Gimhae International Airport

Cargo Volume: Handled 332,899 tons of cargo in 2019.

Key Trading Partners: Primarily trades with Japan, China, and Russia.

Strategic Importance: The airport is the main gateway for South Korea's second largest city, Busan.

Notable Features: It features an extensive list of both passenger and cargo airlines.

For Your Business: The airport's strong connection to Busan's industrial area can optimise your supply chain if your business is involved with industries established in this city.

Daegu International Airport

Cargo Volume: Handled 15,582 tons of cargo in 2019.

Key Trading Partners: Primarily trades with China and Vietnam.

Strategic Importance: Located in the industrious city of Daegu, serving primarily domestic freight and limited international cargo.

Notable Features: Despite being relatively small, Daegu airport maintains a diverse range of cargo handling services.

For Your Business: It could be a suitable choice for your business if you need to freight smaller, frequent shipments domestically within South Korea or to Daegu's primary international trading partners.

How long does air freight take between Vietnam and South Korea?

Typically, air freight shipping from Vietnam to South Korea takes anywhere from 4 to 6 days. However, keep in mind that these timeframes are just estimates; the total transit time can vary depending on various factors like the departure and arrival airports, the dimensions and weight of the goods, and their nature. If you're looking for precise shipping times tailored to your unique needs, it's advisable to seek the expertise of a freight forwarder such as FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and South Korea with air freight?

Air freight costs between Vietnam and South Korea can range widely, typically from $3 to $10 per kilogram. However, providing a precise amount is challenging, as the cost varies based on factors such as the distance from departure and arrival airports, package dimensions, weight, and the type of goods. Our dedicated team personalizes each quote, ensuring that we deliver the most cost-effective and efficient service tailored to your unique shipping requirements. Get in touch with us to receive a free, no-obligation quote within 24 hours.

What is the difference between volumetric and gross weight?

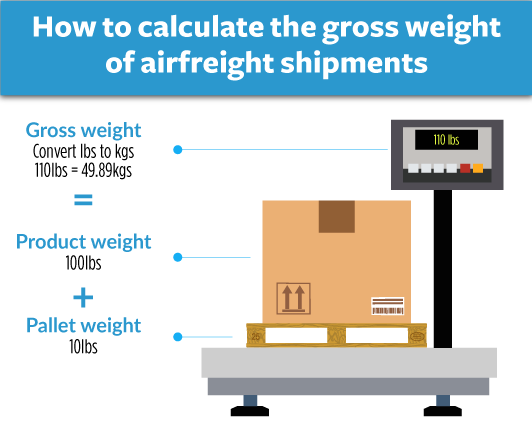

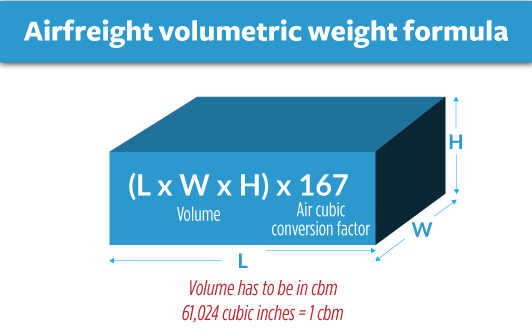

Gross weight refers to the actual weight of your shipment including packaging and pallets. On the other hand, volumetric weight considers the size of your shipment, accounting for how much space it occupies in the cargo plane.

In Air Cargo, the volumetric weight is derived by multiplying the shipment’s length, width, and height (all in cm) and dividing the result by 6000. For Express Air Freight, that number changes to 5000.

To illustrate, let’s take a shipment with a gross weight of 120 kg, which is approximately 264.6 lbs. The parcel's dimensions are 50cm x 60cm x 70cm. For Air Cargo, your volumetric calculation would be (506070)/6000 equals to 35 kg (approx. ~77.2 lbs). For Express Air Freight, it would be (506070)/5000, giving you a volumetric weight of 42 kg (approx. ~92.6 lbs).

Why does this matter? Freight charges are calculated based on either gross weight or volumetric weight, whichever is higher. This approach accounts for both the weight and size of the shipment, ensuring freight carriers are adequately compensated for their resources. Understanding this helps you manage your shipping costs efficiently.

![]()

FNM Vietnam Tip: Door to Door might be the best solution for you if:

- You seek hassle-free shipping. Door-to-door manages the entire process for you.

- You like one go-to contact. A dedicated agent oversees your door-to-door shipment.

- You aim to limit cargo handling. Fewer transitions mean less risk of damage or loss.

Door to door between Vietnam and South Korea

Unsure about shipping goods from Vietnam to South Korea? Door to Door shipping might be your magic carpet! This method, often a stress-reliever, includes comprehensive services from pick-up to final destination delivery. With benefits like quick customs handling, secure cargo movement, and streamlined logistics, it's worth considering. So, buckle up, let's dive into Door to Door shipping and how it could shape your business' logistics future.

Overview – Door to Door

Facing logistics challenges between Vietnam and South Korea? You’re not alone. Door to Door shipping is a holistic, stress-free solution that caters to your every need. It simplifies complexities, handles all administrative procedures, and clears customs on your behalf. While a bit pricey, it ensures shipping is a smooth sail. No wonder it steals the spotlight among our FNM Vietnam clients. Still, understanding all aspects is key, so it's time to uncover the perks and drawbacks of this all-inclusive service. Dive in to pave the way for your next smooth shipping experience.

Why should I use a Door to Door service between Vietnam and South Korea?

Ever wished for your cargo to just sprout legs and walk itself from Vietnam to South Korea? While we're still working on that technology, Door to Door service is the next best thing. It's your all-in-one solution for international shipping that drastically simplifies logistics. Here are five compelling reasons why you should consider this service:

1. Stress Reduction: Say goodbye to coordinating multiple agencies and conflicting schedules. With Door to Door service, your goods are picked up directly from your premises in Vietnam and delivered right to your desired location in South Korea. A harmonized process leads to less stress and more productivity for your business.

2. Timely Delivery: Urgent shipments need not be a nightmare anymore! Door to Door service is designed to keep tight schedules, ensuring your cargo reaches on time, every time. It's like having a personal logistics concierge, keeping the clock for your cargo.

3. Specialized Cargo Handling: Got complex freight? No worries! Door to Door service comes with experts who understand the intricacies of handling diverse cargo types. Whether it's delicate artwork or hefty machinery, your cargo receives the exact care it needs.

4. End-to-End Responsibility: Door to Door service remains accountable for your cargo throughout its journey. This single point of responsibility reduces the risk of miscommunication and loss, adding extra assurance that your goods are in safe hands.

5. Convenience: Lastly, and most importantly, the convenience is unparalleled. The service handles every element of the journey, from trucking in Vietnam through customs clearance until delivery in South Korea. It's as easy as shipping ought to be.

With Door to Door service, your logistics is less of a chore and more a smooth sail across the sea. Looking for a hassle-free, reliable, and punctual shipping method between Vietnam and South Korea? Door to Door service might just be your ticket!

FNM Vietnam – Door to Door specialist between Vietnam and South Korea

Experience a stress-free, door-to-door service with FNM Vietnam for your shipments from Vietnam to South Korea. Our expert team handles everything from packaging goods securely to organizing all necessary transportation and handling any customs procedures in both countries. Avail of the guidance from a dedicated Account Executive tailored to your specific needs. Want a free estimate? Contact us and receive a response within 24 hours. Even better, our trained consultants are just a call away for any advice you might need. Rely on our proficiency and relax as we manage your shipping needs from A to Z.

Customs clearance in South Korea for goods imported from Vietnam

Managing customs clearance – the process of importing goods across international borders – can be rather complex when moving goods from Vietnam to South Korea. The system is laden with hidden obstacles, like unexpected fees and potential delays. It's crucial to fully comprehend the ins and outs of customs duties, taxes, quotas, and licenses. Failing to understand these can risk your goods getting stuck in customs. Our guide will explore these issues in detail, helping you navigate the choppy waters of international trade successfully. Remember, FNM Vietnam is always here to assist throughout the entire customs clearance lifecycle, no matter the good or location. For an estimate, simply provide us with the origin, value, and HS Code of your goods. Don't embark on this journey alone – let us help you sail through.

How to calculate duties & taxes when importing from Vietnam to South Korea?

Navigating the maze of duties and taxes when importing goods from Vietnam to South Korea may seem like a daunting task, but it can be simplified by understanding the crucial components involved in the calculation process. The primary factors to consider are the country of origin or where the goods were produced, the Harmonized System (HS) code related to your product, the customs value of your goods, and the applicable tariff rate. Additionally, you should be aware of any other taxes and fees that might apply to your specific products.

Getting started on this, the first piece of the puzzle is identifying the country where your goods were actually manufactured or produced. This factor plays an integral role in determining the amount of duties imposed on your imports. In these globalized times, 'Made in...' tags hold more than just manufacturing pride – they can critically influence your imports’ final landed cost.

Step 1 - Identify the Country of Origin

Taking the first step, yes, it is pinpointing the country of origin. This seemingly obvious action is pivotal for five primary reasons:

1. Trade Agreements: Vietnam and South Korea partake in several trade agreements, negotiated to establish reduced tariffs and improved access to each other's markets. A little homework on these can save you a lot.

2. Tariffs: Customs duties vary enormously based on the origin. Identify it right, and you're a step ahead in the calculation game.

3. Import Restrictions: Both countries enforce restrictions on certain types of goods. So, knowing the origin helps you steer clear of legal hiccups.

4. Customs Duties: Specific duties get levied based on where the goods originate.

5. Documentation: Country of origin affects the required documentation, leading to smoother customs clearance.

Seize the advantages of the Asian Trade Agreement (ATA) and the Vietnam-Korea Free Trade Agreement (VKFTA). Their strategic benefits could result in significant cost savings on duties. Watch out for the variety of import restrictions applicable, which can be anything from textile quotas to bans on certain materials.

Take this first step seriously - it could pave the way to a smoother, more cost-effective shipping experience.

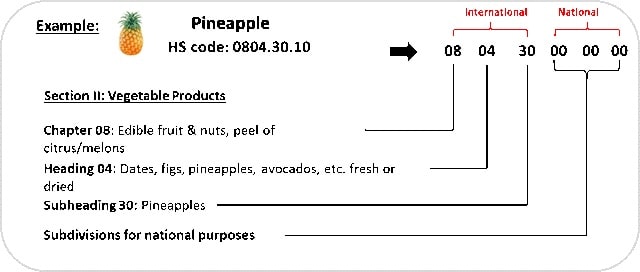

Step 2 - Find the HS Code of your product

The Harmonized System Code, or HS Code, is a standardized system of names and numbers to classify traded products. Internationally recognized, these codes are used by customs authorities around the world to identify products for the application of duties and taxes. It's essentially the language of international commerce.

Acquiring this code is crucial and often, the simplest way to get it is by reaching out to your supplier. As they are already involved in international trade, they would be familiar with the relevant regulations and the correct HS code for the products.

If getting the HS code from your supplier is not an option, don't worry! We have a user-friendly process to help you find it:

Step 1: Use an online HS lookup tool. Feel free to use the Harmonized Tariff Schedule for this purpose.

Step 2: Insert the name of your product in the search bar of the HS lookup tool.

Step 3: The HS code can be found in the Heading/Subheading column of the search results.

Remember, accuracy is vital when identifying your HS code. A minor error could lead to your shipment being held up at customs, which could result in delays and potential fines. Make sure you choose the HS code that most accurately represents your goods.

To wrap up, here's an infographic showing you how to read an HS code. This will make your shipping process more efficient and hassle-free.

Step 3 - Calculate the Customs Value

When shipping goods from Vietnam to South Korea, calculating the Customs Value is a decisive phase. Don't confuse this with your shipment's market value. The Customs Value, in fact, is the CIF value: cost of goods + international shipping expenses + insurance fees, all converted into USD. Let’s say your product costs $1000, shipping charges are $200, and insurance costs $50. In that case, your Customs Value equals $1250. This one-two-three calculation helps determine the customs duties you'd need to pay in South Korea. Remember, a comprehensive understanding of the Customs Value is crucial to avoid unexpected costs or delays in the clearance process. Enjoy the journey of taking your business global, armed with the right knowledge!

Step 4 - Figure out the applicable Import Tariff

An import tariff, simply put, is a tax imposed by a country on a product imported from another country. For goods imported from Vietnam to South Korea, the tariff used is the Most Favoured-Nation (MFN) tariff, which is decided by the World Trade Organization.

To determine the applicable Import Tariff:

1. Recognize the HS code obtained previously.

2. Refer to South Korea’s Customs Service's tariff database or trusted international trade databases.

For instance, let's say you're importing coffee (HS code 0901.21) to South Korea from Vietnam. The tariff rate for this specific product is currently around 8%. Now suppose you have a Cost, Insurance and Freight (CIF) value of $10,000 USD for your coffee shipment. Your import duty would be 8% of $10,000, which equals $800 USD.

Remember, these figures might vary based on several factors including the sensitivity of the product, bilateral agreements, or seasonal factors. Always cross-check your figures for up-to-date rates.

Note: This tariff is simply an example and may differ from the actual rate. Please ensure the correctness of tariffs before proceeding with your operation.

Step 5 - Consider other Import Duties and Taxes

Moving on from the standard tariff rate, let's get down to the nitty-gritty of other import duties and taxes. Depending on the product's nature and its country of origin, South Korea might impose additional fiscal charges.

Excise duty, for instance, is valid on some particular goods, like luxury items or those that have environmental impacts. Antidumping taxes enter the scene if a product is offered at incredibly low prices, disrupting the local market.

The real head-turner here is the Value Added Tax (VAT). In South Korea, the standard VAT rate is around 10%. So, if your cargo is worth $5,000, you'll owe customs around $500 in VAT - this is a simplified formula and the actual value may vary.

But let's imagine you're importing a Vietnamese coffee brand. If Vietnam happens to be under a specialized trade agreement, you may enjoy lower rates. But the existence of 'Dumping' taxes may mean an additional financial burden if it's seen as affecting local competitors.

Remember, these are rough figures and real-world examples to bring you closer to the realities of the import process. Rates will fluctuate, and specific circumstances can greatly affect costs. Making accurate estimates is a crucial step in successful import planning.

Step 6 - Calculate the Customs Duties

Calculating customs duties might seem complex at first, but let's demystify it together. Essentially, there are three potential charges: Customs Duties, VAT, and Anti-Dumping Taxes, with the addition of Excise Duty in certain cases.

Suppose you're importing shoes from Vietnam valued at $5,000. Imagine, there are no taxes or VAT, so your total expense is only the customs duty, say 10%, which makes it $500.

For an example where VAT is applied, let's consider machinery valued at $10,000 with a customs duty of 8% and VAT at 10%. Your customs duty would be $800, and the VAT, calculated on the sum of the customs value and the customs duty ($10,000 + $800 = $10,800), resulting in a tax of $1,080. Your total expense becomes $11,880.

For a more complex scenario, let’s imagine you’re importing wine costing $20,000. Wine attracts customs duty of 5% ($1,000), VAT of 10% on $21,000 ($2,100), an anti-dumping tax of 4% on $23,100 ($924), and Excise Duty of 15% on $24,024 ($3,603.60), resulting in total expenses of $27,627.60.

Don't get overwhelmed! At FNM Vietnam, we handle these intricate calculations and stages of customs clearance for you. You'll never be unfairly charged, and we can even offer you a free quote within 24 hours. Let us navigate these complexities for you.

Does FNM Vietnam charge customs fees?

FNM Vietnam, your trusted customs broker, only charges for the customs clearance service, ensuring your goods navigate the complex customs procedures seamlessly. The actual government-imposed customs duties and taxes are separate. We provide you with official documentation from the customs office to transparently show that you only pay what's legally required. It's just like buying groceries; you pay for the items and a separate charge for delivery. Think of us as the delivery service for your international freight, with customs duties akin to the cost of the grocery items. Honesty, transparency, and smooth navigation are our core values.

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs.

Official website: http://www.customs.gov.vn/.

South Korea Customs

Official name: Korea Customs Service

Official website: http://www.customs.go.kr/

Required documents for customs clearance

Customs clearance can seem like an endless maze of paperwork and legal jargon. We break it down for you, focusing on the Bill of Lading, Packing List, Certificate of Origin, and Documents of conformity - smoothing the route towards logistics success.

Bill of Lading

The Bill of Lading, a critical piece in your shipping puzzle, underscores the ownership shift of your goods. Imagine it as the baton in a relay race, signifying your goods have been handed off for shipment from Vietnam to South Korea. In an era of cloud-based convenience, you can opt for an 'electronic' or 'telex' release. It's faster, easier to manage, and reduces the chance of losing or misplacing the document. For air cargos, think AWB or Air Waybill - it's the sky-version of the Bill of Lading. Let's get practical: make these documents impeccable to ensure your goods fly through customs and reach their destination without hitches. Know thy terms, embrace electronic options, and your shipping journey will glide smoother than a well-oiled machine.

Packing List

Your Packing List – it's more than a casual inventory, it's a must-have document when shipping between Vietnam and South Korea. Picture this: you're shipping a stack of smartphone parts from Hanoi to Seoul. Your Packing List acts as a detailed inventory, mentioning every tiny detail from components like circuits to bolts. Accuracy here is king - any discrepancy could invite unwelcome shipment delays and even penalties. Whether you choose air or sea, the shipping line won't blink twice asking for it. They use this list for safety checks and transport planning, while customs officials in both countries use it to verify the declared cargo. So, your care in preparing an exact Packing List paves the way for a smooth transportation journey.

Commercial Invoice

When shipping goods from Vietnam to South Korea, you'll find the Commercial Invoice indispensable. It's more than just a bill; it's a document that customs officers use to assess the value of your goods for duty calculation. This crucial paper should detail key information like the seller and buyer's names, descriptions of the goods, quantity, and price. Sounds simple? Not quite. To breeze through customs, ensure that your information aligns across all documents, cutting down on potential issues like consignment delays. Say you've listed an item as 'ceramic vase' here, it should also appear as 'ceramic vase' in your Packing List and Bill of Lading. An inconsistency as minor as 'ceramics vase' could trigger a red flag. Clever alignment across your documents eases your customs experience, enhancing your trade relations between Vietnam and South Korea.

Certificate of Origin

Navigating shipping from Vietnam to South Korea? Key to your journey is the Certificate of Origin. A document declaring your merchandise's birthplace, this paper could be a game-changer, potentially unlocking preferential customs duty rates. Imagine this - you're shipping electronics manufactured in Vietnam. By mentioning Vietnam as the country of manufacture on the Certificate, you could save on customs duties, courtesy of the ASEAN-Korea Free Trade Agreement. Don't gloss over this paperwork; it could be your business's ticket to cost-effective and smooth cargo transit between Vietnam and South Korea!

Get Started with FNM Vietnam

Dealing with customs can be complicated, but not when you're with FNM Vietnam! Our team is well-versed with every step of customs clearance, from documentation to duty calculation. Sit back and let us handle the intricacies for your shipments between Vietnam and South Korea. Need assistance? Contact us today, and we promise to get back with a free quote within 24 hours!

Prohibited and Restricted items when importing into South Korea

Handling imports to South Korea? It's crucial to know what you can't ship. Some items are completely banned, while others come with specific restrictions. We'll decode this complex process for you, ensuring a smooth, unhindered shipping experience. Let's avoid any unwanted surprises and expensive penalties, shall we?

Restricted Products

1. Pharmaceuticals: You'll need a permit from the South Korean Food and Drug Administration (MFDS) to import any medical supplies, drugs, or causalities.

2. Food Products: Bring in processed food items? You should obtain a quarantine certificate from the Animal and Plant Quarantine Agency (APQA).

3. Cosmetics: To ship any cosmetic products, secure approval from the South Korean Food and Drug Administration (MFDS).

4. Electrical Items: Get the Korea Electro-technology Research Institute's (KERI) certification to import any electrical goods.

5. Radio equipment and wireless products: You need a license from the National Radio Research Agency (RRA).

6. Alcohol and Tobacco Products: To send any alcoholic or tobacco products, get permission from the Korea Customs Service (KCS).

Prohibited products

- Narcotics and psychotropic substances

- Obscene and immoral materials, including pornographic content

- Counterfeit, altered or imitated coins, banknotes, bonds and securities

- Weapons such as guns, swords, knives (with the blade exceeding a certain length) and explosives

- Radioactive materials

- Goods infringing on intellectual property rights

- Unauthorized medicines and medical devices

- Products that originate from endangered species, in violation of the Convention on International Trade in Endangered Species (CITES)

- Counterfeit, altered or imitated postage stamps and government certificates

- Agricultural and livestock products from specific countries that pose a risk of spreading diseases such as Mad Cow Disease

- Plants, fruits, and vegetables without the necessary quarantine certificates

- Articles of cultural heritage that are obtained illegally.

Are there any trade agreements between Vietnam and South Korea

Indeed, Vietnam and South Korea have a robust Free Trade Agreement (FTA) in place since 2015, benefiting your import/export operations with lower tariffs and increased market accessibility. Ongoing plans like connecting the two nations via the Eastern Economic Corridor railway line offer promising potential for smoother logistics in the future. Navigate these opportunities wisely, enhancing your business potential.

Vietnam - South Korea trade and economic relationship

Vietnam and South Korea share a dynamic trade and economic partnership. This bond was first forged in 1992 when diplomatic relations were established. Economic ties have since deepened significantly. In 2024, South Korea was Vietnam's second-largest investor with $87.5 billion into nearly 10,000 projects. Key sectors include electronics, textiles, and automobiles, with notable names like Samsung and Lotte setting up shop in Vietnam. This ongoing investment has paved the way for exports to flourish. As of 2024, bilateral trade hit a remarkable $79.4 billion, with Vietnam's main exports being wireless telephones, textiles, and footwear, while they import electronics, machinery, and, interestingly, cosmetics from South Korea. This robust and symbiotic economic relationship has undoubtedly set a strong foundation for future collaboration and growth.

Your Next Step with FNM Vietnam

Tangle of paperwork got you down? Frustrated over complicated customs regulations? Expert help is just a click away! With FNM Vietnam, rest assured your import/export needs between Vietnam and South Korea are in good hands. Let us make your shipping process seamless and hassle-free. Decode the complexities of international shipping today. Contact us now!

Additional logistics services

Discover how FNM Vietnam takes the load off your shoulders, managing your entire supply chain beyond mere shipping. We’re your one-stop logistics solution, from warehousing to distribution and beyond - seamless, efficient and all around the globe.

Warehousing and storage

Discovering dependable warehousing in Vietnam or South Korea is no easy task! Add the challenge of maintaining perfect temperature control for sensitive goods and things can get overwhelming. Good news – We've got you covered with our top-notch warehousing solutions that keep your goods safe and sound under optimal conditions. For the inside scoop on our warehousing

Packaging and repackaging

Shipping between Vietnam and South Korea demands careful attention to packaging and repackaging. A reliable agent is key, ensuring your ceramic pottery or tech gadget stays secure in transit. Ever seen a cracked vase on delivery? It's avoidable with thoughtful packing. More info on our dedicated page: Freight Packaging.

Cargo insurance

When you're shipping goods, it's not just about avoiding fires; transport insurance covers much more. It's like your goods' safety net from various potential risks during transit, such as damage, theft or loss. Imagine, a storm hits and your container filled with electronics ends up in the sea. With cargo insurance, such financial risks are mitigated. Check out more about these safeguards on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Stuck juggling suppliers and procurement processes in Asia or East Europe? Let FNM Vietnam take the reins. We specialize in finding reliable suppliers, overcoming language hurdles, and steering you smoothly through overall procurement. Think of us as a trusted friend helping you find your path in the complex world of international sourcing. More details? Visit our Sourcing services page.

Personal effects shipping

Moving between Vietnam and South Korea with large or fragile belongings? Trust in our Professional Effects Shipping service. We excel at ensuring your objects, bulky or delicate, reach their destination unscathed. Take Mrs. Nguyen's antique vase - it traveled securely from Hanoi to Seoul, no fuss. Curious about how we do it? More info on our dedicated page: Shipping Personal Belongings.

Quality Control

Ensuring quality isn't just about product satisfaction, it's essential for seamless shipping too, particularly between Vietnam and South Korea. Picture this: a batch of manufactured cell phone parts all rejected at customs because they didn't meet South Korean standards, causing costly delays. Our comprehensive quality inspections can eliminate this risk, making sure your goods satisfy all requirements before shipping. visit ou page for Quality control services

Product compliance services

Shipping goods cross-border comes with stringent regulatory compliance. Opt for our Product Compliance Services to eliminate uncertainties. We test your products in certified laboratories, ensuring they meet all destination regulations. Imagine sending off your consignment stress-free, knowing it won't get hung up on a technicality at the destination customs!

FAQ | Freight Forwarder in Vietnam and South Korea

What is the necessary paperwork during shipping between Vietnam and South Korea?

As we handle your shipment from Vietnam to South Korea, the primary document we'll require is the bill of lading for sea freight or air way bill for air freight. You don't need to worry, we'll manage these for you. To ensure the smoothest process, it's essential that you provide us with a packing list and a commercial invoice. Depending on the specific content of your shipment, additional documents could be necessary. For example, Material Safety Data Sheets (MSDS) and other certifications may be required for certain goods. Therefore, it's always recommended to check beforehand for any unique requirements tied to your goods.

Do I need a customs broker while importing in South Korea?

While it's not mandatory to use a customs broker for imports in South Korea, we highly recommend it due to the complexity of customs procedures and the need to provide detailed documentation. As part of our service at FNM Vietnam, we represent your cargo at customs for most shipments, meaning our expert team handles all required exchanges with customs authorities. This way, you can focus on your core business while we streamline the import process for you.

Can air freight be cheaper than sea freight between Vietnam and South Korea?

Indeed, many factors can influence which form of freight is cheaper, such as route, weight, and volume. In general, if your cargo is less than 1.5 Cubic Meters or weighs less than 300 kg (660 lbs), air freight might be an economical choice which you should consider. However, every case is unique and at FNM Vietnam, we ensure to provide recommendations tailored to your specific needs. Your dedicated account executive will investigate and present you with the most competitive option. We're not just about handing over prices, we're about offering solutions that fit your business.

Do I need to pay insurance while importing my goods to South Korea?

While shipping to South Korea, it's not necessary to pay insurance. However, we at FNM Vietnam highly suggest considering it. Even though it's not a compulsory part of the shipping process, insurance offers protection against unforeseen incidents that can lead to loss, damage, or theft of your goods. Remember, taking preventive measures can save you from potential financial loss in the long run.

What is the cheapest way to ship to South Korea from Vietnam?

Given the close geographical proximity between Vietnam and South Korea, sea freight is typically the cheapest option. By containerizing your goods and shipping them on a cargo ship, you can substantially save on costs, especially for heavier items. However, keep in mind that sea freight can be slower, so if speed is important, you may want to consider another method. We at FNM Vietnam can guide you through the process to ensure the best balance of cost and efficiency for your shipment.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF terms depends largely on your relationship with your supplier. More often than not, suppliers tend to sell under EXW (at the door of their factory) or FOB (inclusive of all local charges up to the origin terminal) terms. However, remember that suppliers may not always be logistics experts, so it could be more beneficial for you to let a specialized agent like us at FNM Vietnam handle the intricacies of international freight and destination procedures. We are here to simplify the process for you by providing door-to-door services that cater to your specific shipping needs.

Goods have arrived at my port in South Korea, how do I get them delivered to the final destination?

If your goods have reached a South Korean port under CIF/CFR incoterms, you'll need to hire a custom broker or a freight forwarder for customs clearance, import charge payment, and final delivery. Alternatively, our team at FNM Vietnam can handle it all under DAP incoterms. To confirm these details, please contact your dedicated account executive.

Does your quotation include all cost?

We, at FNM Vietnam, include all costs in our quotation except for duties and taxes at the destination. To avoid any unexpected surprises, we maintain transparency with no hidden fees. You can always connect with your dedicated account executive for an estimate of duties and taxes.