Who knew shipping freight from Vietnam to Tunisia could be more complex than a Phở’s recipe! But yes, figuring out the intricacies of freight rates, transit times and negotiating the labyrinth of customs regulations can twist your brain more than a Rubik’s cube. This guide here, aims to be your compass through the foggy seas of international freight. Covering all major types of freight options - air, sea, road, or rail, it offers a step-by-step walkthrough of the customs clearance process, details about duties and taxes, along with expert advice tailored just for your business. If the process still feels overwhelming, let FNM Vietnam handle it for you! As your international freight forwarder, we turn these challenges into success stories, by taking care of every step in the shipping process.

Which are the different modes of transportation between Vietnam and Tunisia?

Selecting the optimal shipping method from Vietnam to Tunisia isn't as simple as ordering a takeout. Imagine doing a puzzle - certain pieces like distance, geography, and shipping costs must smoothly fit together. Sure, our planet spins on an axis, but air and sea are the primary paths in this tale. The road to Tunisia isn't a straight, landlocked line; it's peppered with seas, mountains, and varying customs laws. With factors like these, it's not just about fast delivery, but also about finding a route that sails smoothly through these logistical waves. It's journey planning on a global scale.

How can FNM Vietnam help?

At FNM Vietnam, we smooth the way for your goods to travel from Vietnam to Tunisia. From handling customs clearance to administrative duties, we've got you covered. Want an easy, efficient shipping experience? Let us handle the details. Get your free estimate in less than 24 hours or call our consultants for free advice. Your international shipment is just a call away.

![]()

FNM Vietnam Tip: Sea freight might be the best solution for you if:

- You're moving big loads or large items. Sea freight offers roomy, cost-effective solutions.

- Your shipment isn't time-critical. Ocean routes take longer but are often more reliable.

- Your supply chain links major ports, tapping into a broad network of sea lanes.

Sea freight between Vietnam and Tunisia

Ocean freight is a corridor of commerce between Vietnam and Tunisia, linking key industrial powerhouses via bustling ports like Saigon in Vietnam and Rades in Tunisia. Whether you're shipping machinery, textiles, or any other high-volume goods, there's no beating the cost-effectiveness offered by sea freight. However, it's the tortoise in our global transport race - slow but steadily delivering your shipment.

The real choppy waters for most businesses come not from the sea voyage, but navigating the complex practices of this trade route. Picture it as a puzzle that, once mastered, can put you on an express lane in the world of international shipping. Errors are often costly and grave, like misjudged customs duties or overlooked legal stipulations. But fear not, because you're not alone. This section of our guide will throw you a lifeline, equipped with cogent tips and practices to help you steer clear of common mistakes and ensure smooth sailing for your freight.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Situated in the northeast region of Vietnam, the Port of Hai Phong is a large maritime gateway for Northern Vietnam. It processes a volume of over 100 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: The Port of Hai Phong primarily serves the regional economic zones of Hanoi-Red River Delta. It has significant trade connections with Southeast Asia, Northeast Asia, America, and Europe.

Context for Businesses: If you're aiming to engage in import/export operations in North Vietnam, especially with its industrious regions such as Hanoi, Hai Phong can serve as your key maritime gateway given its vast network of trade routes and robust cargo handling capacity.

Port of Da Nang

Location and Volume: Occupying a central position on Vietnam's east coast, the Port of Da Nang is critical for the Central and Western Highlands. It handles about 12 million tonnes of goods annually.

Key Trading Partners and Strategic Importance: The port has a world wire network, serving all major international shipping lines. Its key trade partners include other Asian countries, Europe, and the Americas.

Context for Businesses: If you're exploring opportunities in Central Vietnam or manufacturing industries of the Western Highlands, Da Nang provides an optimal shipping solution, boasting a strategic location and diverse shipping routes.

Port of Ho Chi Minh

Location and Volume: Anchored in South Vietnam, the Port of Ho Chi Minh is the largest port in the country, with an annual volume of roughly 8 million TEUs.

Key Trading Partners and Strategic Importance: A main trading portal for the countries in the Pacific and Indian Ocean regions, it also caters to western regions of North America and Europe, accounting for nearly 70% of Vietnam's container traffic

Context for Businesses: If you're expanding to southern regions or require extensive international shipping reach, the Port of Ho Chi Minh can be instrumental in swiftly integrating your supply chain given its vast capacity and broad range of trade networks.

Port of Quy Nhon

Location and Volume: Situated in the Binh Dinh province, Port of Quy Nhon is a pivotal point for the Central Highlands region. It manages about 7 million tonnes of goods annually.

Key Trading Partners and Strategic Importance: Its trading partners primarily consist of Asian, European, and American trading lines, serving both the domestic and international freight forwarding sectors.

Context for Businesses: If your business is stepping into agrarian products of the highland regions, Quy Nhon can offer comprehensive shipping resolutions due to its capacity and access to international highland markets.

Port of Cai Lan

Location and Volume: Located in the Ha Long City, Port of Cai Lan is one of the leading container terminals in Northern Vietnam, handling over 7 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: The port mostly serves the Northeast Asia region along with the USA, making it an essential offshore trading location for these regions.

Context for Businesses: For companies interested in the Northeast Asian market or transpacific trade, Cai Lan can be a vital part of their shipping strategy due to its robust container handling capabilities and strategic location.

Port of Can Tho

Location and Volume: Nestled in the Mekong Delta, the Can Tho port has a throughput of approximately 15 million tons per year.

Key Trading Partners and Strategic Importance: The port primarily serves national and regional shipping lines while also maintaining good level of trade with other Asian and European countries.

Context for Businesses: If you're targeting the Mekong Delta's surging agrarian and fishery market, Can Tho port may be your optimal choice due to its convenient access to the fertile Mekong region and reliable trade relations.

Main shipping ports in Tunisia

Port of Rades

Location and Volume: The Port of Rades, located just a few miles east of the capital, Tunis, is the main port for container handling in Tunisia, handling over 85% of the country's shipping volume.

Key Trading Partners and Strategic Importance: This port regularly services shipping to and from key trading partners such as Italy, France, Germany, China, and the United States. The strategic significance of the Port of Rades lies in its central Mediterranean location, making it a commercial hub connecting North Africa with Europe and Asia.

Context for Businesses: Given its high container throughput and superb rail and road linkages, the Port of Rades could serve as a critical part of your logistics strategy if your business is seeking to break into or expand in the European or North African markets.

Port of Sfax

Location and Volume: Located on Tunisia's central-eastern coastline, the Port of Sfax is the country's second-largest port and a cornerstone of its maritime transport, handling about 7,000 vessels each year.

Key Trading Partners and Strategic Importance: The port's commercial activities primarily revolve around oil and phosphate exports, making its key trading partners include countries rich in these resources like Russia, Malaysia, and countries in the Gulf region.

Context for Businesses: If your business deals in natural resources, particularly phosphates and crude oil, the Port of Sfax may prove to be a significant portion of your logistics plan due to its robust infrastructure and established trade channels revolving around these commodities.

Port of Bizerte

Location and Volume: Located on the northern point of the Africa continent, the Port of Bizerte is one of Tunisia's main maritime facilities handling a diverse range of cargoes, including bulk, general and rolling cargo.

Key Trading Partners and Strategic Importance: Dealing with roughly 5,000 vessels every year, Bizerte has a vast range of trading partners, including those from the European Union, China, and the Americas. Its strategic location makes it an important shipping point between Europe and Africa, especially for handling bulk cargo.

Context for Businesses: If you're operating in industries such as agriculture, construction, or automotive that require the shipment of bulk or rolling cargo, the Port of Bizerte, with its superior handling facilities and strategic geographic position at the crossroads of major shipping lanes, could play a vital role in your shipping strategy.

Should I choose FCL or LCL when shipping between Vietnam and Tunisia?

Choosing between Full Container Load (FCL) and Less than Container Load (LCL, also known as consolidation) is a strategic decision when shipping goods from Vietnam to Tunisia. This choice can make a significant difference in cost, delivery timelines, and ultimately, successful freight forwarding. In the upcoming section, you'll learn about these two sea freight options. We'll clear the fog of confusion, outlining the advantages and trade-offs of each, so you can better align your shipping strategy with your business objectives. Let's dive in and make sea freight an asset rather than an obstacle.

LCL: Less than Container Load

Definition:

LCL, or Less than Container Load, refers to a method of shipping that consolidates goods from multiple parties into a single container. This option is utilized when freight doesn't require a full container.

When to Use:

Transitioning to LCL shipping is sensible when your cargo volume falls short of filling up a complete container, often less than 13/14/15 CBM. This strategy brings heightened flexibility and cost-effectiveness for low volume shipments.

Example:

Imagine you're a Vietnamese furniture manufacturer shipping 10 CBM of chairs to a client in Tunisia. Instead of paying for an underutilized full container, you'd share a container with other shippers, thereby leveraging LCL freight, ensuring your shipment doesn't rack up unnecessary costs.

Cost Implications:

Going the LCL route often provides a more economical lcl shipping quote, particularly for smaller businesses, by only charging for the space your shipment occupies. However, note that while the overall cost might be cheaper, the price per unit space in the container could be higher compared to full container load (FCL) shipping. This means that LCL shipment could escalate in cost quicker as volume increases.

FCL: Full Container Load

Definition: FCL, or Full Container Load, refers to a standard form of shipping freight that involves renting an entire container, whether a 20ft or 40ft.

When to Use: FCL shipping becomes a viable option when your cargo volume exceeds 13 to 15 cubic meters. Its uniformity and safety make FCL shipping appealing, as the container remains sealed from point of origin to destination, reducing the potential for damage.

Example: Suppose a Vietnamese furniture manufacturer has a 16 CBM shipment of dining tables and chairs for a Tunisian retailer. Given the volume, FCL shipping, utilizing either a 20’ft container or a 40'ft container, would be the most economical and secure means of transportation.

Cost Implications: Since FCL shipping entails renting the complete container, the cost per unit generally decreases the larger your shipment, making it cost-effective for mass shipments. It's worth requesting an FCL shipping quote early to budget accordingly. However, FCL container rental charges, loading costs, and the fees for the shipping line need to be factored into the total cost.

Say goodbye to shipping headaches!

Conquer the complexities of shipping with FNM Vietnam - your trusted, professional freight forwarder. Our top-notch ocean freight experts aid in making the best choice between consolidation and full container options. They consider your specific needs, such as cargo type, shipment size, speed, and cost-efficiency. Give your business the hassle-free shipping experience it deserves. Kickstart your successful journey between Vietnam and Tunisia today. Connect with us now for your free estimation. Let us make shipping easier.

How long does sea freight take between Vietnam and Tunisia?

On average, sea freight shipping between Vietnam and Tunisia takes between 30 to 50 days. These transit times are influenced by various conditions such as the specific ports used in both countries, the weight, and nature of the goods being shipped. To get a more precise and tailor-made quote for your unique needs, reaching out to a freight forwarder like FNM Vietnam is highly recommended.

Now let's look at some port-to-port sea freight transit times. Keep in mind, these are average timeframes and can vary:

| Vietnam Port | Tunisia Port | Average Transit Time |

| Hai Phong | Port of La Goulette | 30 |

| Ho Chi Minh | Port of Rades | 33 |

| Cai Lan | Port of Sousse | 39 |

| Da Nang | Port of Bizerte | 41 |

*Remember, these times are estimates, and actual times may vary significantly depending on numerous factors.

How much does it cost to ship a container between Vietnam and Tunisia?

Shipping a container from Vietnam to Tunisia? You might be wondering about the ocean freight rates. Well, they can broadly range anywhere from $40 to $100 per CBM. Pinning down an exact shipping cost can be tricky due to the numerous factors at play such as Point of Loading, Point of Destination, the chosen carrier, the nature of your goods, and inevitable monthly market fluctuations. But fret not, our shipping specialists are experts at getting you the best possible rates, providing quotes on a case-by-case basis. You can lean on us for a cost-effective solution tailored to your specific needs.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) Container refers to cargo that exceeds the standard dimensions of a container and therefore requires a special OOG container for transportation.

Suitable for: It's ideal for oversized items, equipment, or machinery which cannot fit into standard containers.

Examples: Large factory components, construction equipment, and oversized machinery.

Why it might be the best choice for you: If your goods are too large for standard containers, OOG shipping offers flexibility and scalability, allowing for secure and efficient transportation of your out of gauge cargo.

Break Bulk

Definition: Break bulk shipping involves individually loading each piece of cargo onto the ship, not using containers, but rather pallets, slings, or nets.

Suitable for: It's suitable for items that are too large or heavy to fit into a container and aren't suitable for bulk cargo.

Examples: Vehicles, large reels of cable, timber, or metal beams.

Why it might be the best choice for you: With break bulk transportation, each piece of your cargo will be handled individually, offering more flexibility for uncontrollable dimensions and weights.

Dry Bulk

Definition: Dry bulk shipping refers to the transportation of homogenous, unpackaged commodities in large volumes, directly loaded into the ship's hold.

Suitable for: Commodities such as grains, coal, or sand.

Examples: Shipping bulk agricultural products (rice, coffee beans), construction materials like gravel or minerals.

Why it might be the best choice for you: If you're shipping loose cargo load in large quantities that do not require packaging, dry bulk is an economical and efficient option.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off shipping, is a specialized type of shipping involving wheeled cargo which is driven on and off the ro-ro vessel.

Suitable for: Cars, trucks, trailers, machines, or any rolling stock.

Examples: Shipping vehicles or machinery from manufacturing plants to overseas marketplaces.

Why it might be the best choice for you: Ro-Ro offers simplicity and cost-effective transportation for your wheeled goods, maintaining their ready-to-use status upon arrival.

Reefer Containers

Definition: Reefer containers are refrigerated containers used to transport temperature-sensitive goods.

Suitable for: Perishable products such as fruits, vegetables, seafood, or pharmaceuticals.

Examples: Shipping seafood from Vietnam or fresh fruits and vegetables to Tunisia.

Why it might be the best choice for you: If you're shipping perishable goods that require a certain temperature, reefer containers ensure your product reaches its destination in optimal condition.

FNM Vietnam understands the advantages and complexities of each of these sea freight options. We are here to help you navigate these choices. Contact us for a free, no-obligation shipping quote in less than 24 hours!

FNM Vietnam Tip: Air freight might be the best solution for you if:

- You're on a tight schedule. Air freight delivers speed unmatched by other modes.

- Your cargo is under 2 CBM, a good fit for air's smaller capacity.

- Your destination is off the usual routes, making air's global network a key asset.

Air freight between Vietnam and Tunisia

When you're shipping from Vietnam to Tunisia, air freight proves to be a fast, reliable, and effective choice, especially for smaller packages with high value. Think pharmaceuticals or electronics - the aircraft speed ensures prompt delivery, and the heightened security minimizes any damage risk. Yet, many shippers stumble over hidden stones on the smooth runway of air freight. It's not uncommon to see blunders like incorrect weight estimations leading to soaring costs. Similar to ordering a tailored suit without proper measurements, misjudging your shipment's weight can result in a hefty bill. In the next section, we'll unpack these challenges and arm you with some top-notch industry practices to ensure your freight journey isn't flying blindly.

Air Cargo vs Express Air Freight: How should I ship?

Cracking the code of freight forwarding between Vietnam and Tunisia, aren't we? Let's compare two key options: air cargo, which books our goods a comfy seat in a commercial airline just like a passengers flight, versus express air freight, which is more like chartering your own private jet for your goods. Choosing the right one comes down to your business needs and the urgency of your shipment. Let's explore these options further.

Should I choose Air Cargo between Vietnam and Tunisia?

Delivering goods between Vietnam and Tunisia? Air cargo might be pivotal for your business. Operating at high frequency, airlines such as Vietnam Airlines' cargo services , and Tunisair provide maximal reliability for urgent and high-value shipments. Slower transit times are a drawback due to seasonal schedules, but cost-effectiveness is noteworthy. Indeed, your budget may greatly benefit, especially when shipping cargo weighing between 100/150 kg (220/330 lbs). Ultimately, your decision hinges on balancing business needs with operational costs.

Should I choose Express Air Freight between Vietnam and Tunisia?

Express Air Freight, exemplified by services like FedEx, UPS, and DHL, utilizes dedicated cargo planes without passengers, speeding up global shipping considerably. Ideal for shipments under 1 CBM or weighing 100/150 kg (220/330 lbs), this service may be the perfect fit for your urgent or lower-volume shipments from Vietnam to Tunisia. For instance, sample products, important documents, or urgent equipment replacements can reach their destination significantly faster. If speed outweighs cost in your shipping requirements, this expedited service might be your preferred choice.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: With a cargo volume exceeding 400,000 tonnes annually, this airport is the busiest in Vietnam.

Key Trading Partners: Predominantly trades with China, Japan, the USA, Singapore, and South Korea.

Strategic Importance: Located in Vietnam's largest city, Ho Chi Minh, its central location makes it vital for domestic and international shipments.

Notable Features: Boasts a dedicated cargo terminal and has plans for continued expansion to accommodate growing cargo demand.

For Your Business: If you require a high-frequency, high-volume shipping partner across various countries, this airport’s robust cargo handling capabilities and central location could be an optimal choice.

Noi Bai International Airport

Cargo Volume: Handles over 600,000 metric tonnes of cargo yearly, making it the second busiest cargo hub in the country.

Key Trading Partners: Primarily trades with China, Singapore, South Korea, Japan, and the USA.

Strategic Importance: Situated in Vietnam's capital, Hanoi, the Noi Bai International Airport is instrumental for shipments in north Vietnam.

Notable Features: Contains state-of-the-art logistics facilities with two cargo terminals to ensure efficient handling.

For Your Business: The airport's modern facilities and big cargo handling capacity could be particularly beneficial if you're looking to expand business or streamline logistics in North Vietnam.

Da Nang International Airport

Cargo Volume: Handles over 50,000 metric tonnes of cargo each year.

Key Trading Partners: Mainly trades with China, Japan, South Korea, the USA, and Singapore.

Strategic Importance: Positioned in the region's commercial and educational centre, the Da Nang airport plays a critical role in Central Vietnam's logistics.

Notable Features: The airport underwent a major expansion in 2017, enhancing its cargo handling facilities.

For Your Business: With a strategic location in Central Vietnam, it could be an ideal logistical hub if your business partners are in this region or across the broader Asia Pacific region.

Cần Thơ International Airport

Cargo Volume: Handles thousands of tonnes of cargo annually.

Key Trading Partners: Most trades are with countries like Japan, Thailand, Taiwan, and Malaysia.

Strategic Importance: Situated in the Mekong Delta region, it's pivotal for the shipping of seafood, agricultural and aqua-cultural products.

Notable Features: The airport specializes in perishable cargo, with cold storage facilities suitable for agricultural exports.

For Your Business: If you are in the seafood or agricultural sectors, this airport’s facilities and strategic geographic location provide a competitive edge in ensuring your goods reach markets in optimum condition.

Phu Quoc International Airport

Cargo Volume: Handles a smaller volume compared to other international airports, but is rapidly increasing.

Key Trading Partners: Predominantly trades with China, South Korea, and Russia.

Strategic Importance: Situated on Phu Quoc Island, the largest island in Vietnam, it is vital for shipping seafood products and promoting local tourism.

Notable Features: Being an island-based airport, it has modern facilities with a focus on perishable cargo.

For Your Business: If you deal with seafood or island-based products, this airport offers efficient handling and transit of your goods, supported by facilities specifically designed for perishable goods.

Main international airports in Tunisia

Tunis Carthage International Airport

Cargo Volume: Roughly 60,000 tons of cargo handle per year.

Key Trading Partners: Primarily handles cargo exchange with European nations particularly France, Italy, and Germany.

Strategic Importance: As the busiest airport in Tunisia corresponding to 60% of all Tunisian air traffic, this airport is integral to the country's exports and imports.

Notable Features: Its location near the capital, Tunis, provides a logistical hub capable of quick customs processing and a robust connection to all major Tunisian cities.

For Your Business: If your trading partners are in Europe, Tunis Carthage International Airport's extensive network could prove invaluable. Its location near the capital means less transit time and quicker delivery to your destinations within Tunisia.

Monastir Habib Bourguiba International Airport

Cargo Volume: Handling over 2,000 tons of cargo annually.

Key Trading Partners: Primarily serves Europe with stronger trade connections with Germany, France, and the UK.

Strategic Importance: The airport's location allows access to the southeast region of the country and the port city of Monastir, known for fisheries and textile industries.

Notable Features: The airport is equipped to handle a variety of cargo, including perishables, owing to Monastir's active fishery industry.

For Your Business: If your goods include perishables or you deal in the textile sector, utilizing this airport's specialized facilities could streamline your freight forwarding process.

Djerba Zarzis International Airport

Cargo Volume: The airport handles around 1,000 tons of cargo annually.

Key Trading Partners: Regular cargo flights to European destinations, particularly France, Switzerland, and Italy.

Strategic Importance: Located on Djerba Island, the airport serves as a key link for southern Tunisia and the Mediterranean.

Notable Features: The airport is known for its efficient cargo handling and high level of security.

For Your Business: The noteworthy security and direct shipping routes to Europe make this airport an especially reliable choice for shipping valuable goods.

Sfax-Thyna International Airport

Cargo Volume: Handles approximately 500 tons of cargo annually.

Key Trading Partners: Primarily Europe, focusing significantly on Italy, France, and Germany.

Strategic Importance: It's the main gateway to Tunisia's second-largest city, Sfax, known for its thriving olive oil industry.

Notable Features: The airport, with its connections to olive oil rich regions, has facilities for handling specialty goods.

For Your Business: If your business is involved in the olive oil trade or any specialty goods, this airport serves as an important strategic access point to Sfax's prominent markets.

Tozeur–Nefta International Airport

Cargo Volume: Handles cargo in smaller volumes compared to other Tunisian airports.

Key Trading Partners: Mainly services Paris, France and Jeddah, Saudi Arabia.

Strategic Importance: Located in the south-west of Tunisia, providing vital connection to the region's significant date production.

Notable Features: Transports specialty goods, particularly dates and other perishable agricultural products.

For Your Business: For businesses involved in perishable goods, the specialized cargo handling capabilities of Tozeur-Nefta would be a substantial advantage, particularly if your trade partners are in France or Saudi Arabia.

How long does air freight take between Vietnam and Tunisia?

Shipping goods by air freight between Vietnam and Tunisia typically takes around 6-10 days. However, the actual transit time can vary based on a multitude of factors such as the specific airports involved, the weight of the cargo, and the nature of the goods being shipped. For precise, customized estimates, it's recommended to consult a freight forwarder like FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and Tunisia with air freight?

Typical air shipping rates from Vietnam to Tunisia range widely between $3 to $10 per kg. However, pinpointing an exact rate isn't quite feasible due to factors such as distance from departure and arrival airports, parcel dimensions, weight, and the nature of the goods. No worries though–for each shipment, our dedicated team scrutinizes these aspects to provide you with the most competitive rate. Dealing with us means that you always receive bespoke service and transparent quotations, tailored to your distinctive needs. Eager to get started? Contact us and get a free, no-obligation quote within just 24 hours!

What is the difference between volumetric and gross weight?

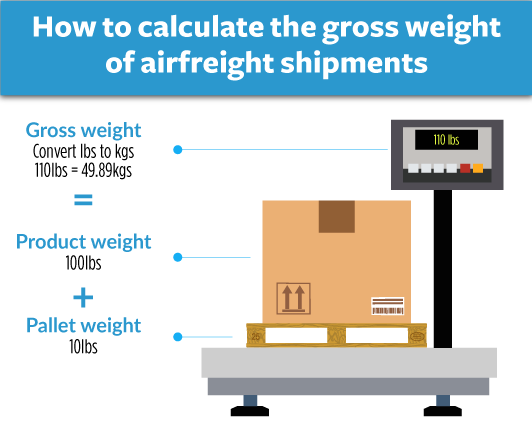

Gross weight refers to the actual weight of a shipment, including all packaging. On the other hand, volumetric weight (also known as dimensional weight) takes into account the size of the shipment along with its weight.

Now, let's explore how these are calculated in the context of air cargo and express air freight services. For air cargo, the gross weight is measured in kilos (kg), just put your shipment on a scale and you got an instant number.

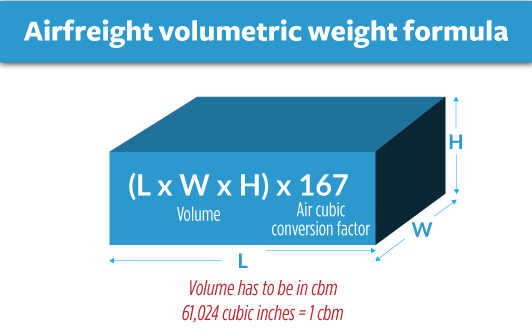

The volumetric weight calculation is a bit different. For air cargo, it follows the formula: length (in cm) x width (in cm) x height (in cm) / 6000. Here's an example: suppose you're sending a shipment with dimensions of 100cm x 50cm x 40cm. To calculate the volumetric weight, you would do: 100 x 50 x 40 / 6000, which equals 33.3kg, or around 73.4 lbs.

However, for express air freight, you use a similar but slightly different formula: length (in cm) x width (in cm) x height (in cm) / 5000. Using our previous example, the volumetric weight calculation would go: 100 x 50 x 40 / 5000, which equals 40kg, or approximately 88.2 lbs.

But, why is it necessary to know both weights? Here's why: when it comes to freight charges, companies will charge based on the higher of the two weights. This implies that a package might weigh less, but if it's taking up a lot of space, it might be charged at a higher rate. Thus, it's important to efficiently package your shipments to minimize unnecessary costs.

![]()

FNM Vietnam Tip: Door to Door might be the best solution for you if:

- You seek hassle-free shipping. Door-to-door manages the entire process for you.

- You like one go-to contact. A dedicated agent oversees your door-to-door shipment.

- You aim to limit cargo handling. Fewer transitions mean less risk of damage or loss.

Door to door between Vietnam and Tunisia

Navigating the lofty waves of international shipment, Door to Door shipping is your trusted lighthouse between Vietnam and Tunisia. It’s a complete, hassle-free package of dispatching goods from one exact location to another, saving you time and effort. Considering your route, the convenience and cost-effectiveness simply shine. Fancy a closer look? Let's dive in!

Overview – Door to Door

Relieving your logistics headaches, door-to-door shipping between Vietnam and Tunisia is our most popular client request at FNM Vietnam. This stress-free service swiftly handles complex customs, cuts out intermediaries, and ensures your cargo moves seamlessly from origin to final destination. However, convenience comes with a premium cost and potential delays due to all-inclusive nature of the service. Yet, despite these trade-offs, it's the perfect antidote to shipping complexities.

Why should I use a Door to Door service between Vietnam and Tunisia?

Ever wished shipping could be as easy as ordering pizza? Well, with Door to Door service from Vietnam to Tunisia, it's pretty darn close! Here are five compelling reasons why this might be just the slice you need.

1. Stress-free logistics: Say goodbye to complicated schedules and fretting over transport plans. Door to Door service takes charge of the whole flow for you.

2. Timely delivery: The punctuality of your shipment is our business. Urgent delivery needs? No sweat. We're on it like white on rice!

3. Specialized care for complex cargo: Got something unusual to ship? We handle it with kid gloves, from the trickiest medical equipment to the largest machinery.

4. End-to-End convenience: The true luxury of this service? Not lifting a finger. We handle everything, from pickup in Vietnam to delivery in Tunisia. Sit back and sip that coffee!

5. Trucking to Final Destination: From customs clearance to navigating Tunisian roads, we’re behind the wheel so you can stay in your comfort zone.

So, if you're seeking a simpler, more streamlined shipping solution, Door to Door service is a strong contender. After all, who doesn't love pizza at their door?

FNM Vietnam – Door to Door specialist between Vietnam and Tunisia

Experience seamless, hassle-free 'door-to-door' shipping between Vietnam and Tunisia with FNM Vietnam. Rely on us for comprehensive shipping solutions as we expertly navigate through all stages of freight forwarding - packing, transportation, customs clearance across any ship method. Rest easy, knowing a dedicated Account Executive is at your service, ensuring smooth handling of your shipment. For a no-obligation, free estimate within 24 hours, reach out to us. Alternatively, you can connect with our friendly consultants at your convenience. Let us transform your shipping process into a worry-free experience.

Customs clearance in Tunisia for goods imported from Vietnam

Customs clearance, the critical process of getting goods approved to enter a country, can be complex and fraught with potential pitfalls such as unexpected fees when shipping from Vietnam to Tunisia. Undervaluing customs duties, misinterpreting tax regulations, quotas, and licenses, could mean your goods languishing in customs limbo. But take heart! In the following sections, we'll demystify these important issues to prevent your goods from getting stuck in customs. Good news - FNM Vietnam is your ultimate customs partner, ready to assist you anywhere in the world. Don't gamble with unpredictable charges; contact our team with the origin, value, and HS Code of your goods. These are vital elements for a reliable project estimation and a smooth freight journey between Vietnam and Tunisia.

How to calculate duties & taxes when importing from Vietnam to Tunisia?

As you navigate the complexity of shipping goods from Vietnam to Tunisia, one essential step to consider is accurately estimating duties and taxes. You may wonder how these charges are determined. It primarily hinges on five key elements – the country of origin, the HS Code or Harmonized System Code that classifies the product, the Customs Value which is the complete cost of the goods, the Applicable Tariff Rate, and an understanding of any additional taxes and fees applicable to your specific product type.

Let's start with the heart of the matter – pinpointing the country where your goods originated, in this case, Vietnam. This is the first step as it's an inherent component in determining the tariff classification. Remember that 'origin' refers to where your goods were either produced or manufactured, not just where they were purchased or shipped. This origin information is vital in the overall calculation and can have a significant impact on your final duty and tax cost. Therefore, correctly identifying the country of origin is an integral part of this process.

Step 1 - Identify the Country of Origin

Knowing the country of origin, in this case Vietnam, lays the foundation for your importing process. This simple yet critical information unravels five main benefits:

1. Unveils Trade Agreements: Vietnam and Tunisia are members of several international trade agreements that could render your goods duty-free or lower your tariff.

2. Deciphers HS Codes: Each product's Harmonized System (HS) code varies depending on where it originates. These codes determine the relevant customs duties.

3. Highlights Import Restrictions: Tunisia maintains certain limitations on imports from Vietnam; specificity is the key to avoiding unwanted surprises at customs.

4. Ensures Compliance: Country of origin-related errors can result in penalties and delays. Stay compliant to get your goods cleared quickly.

5. Gives Clarity on Duty Drawbacks: Yes, import duties can be refunded under certain conditions. Knowing the origin country helps to figure out if you qualify.

It's all tied to your bottom line: the cost-effectiveness of your trade. Don't overlook the base - identify your country of origin first, then navigate your way through customs codes and prerequisites, with peace of mind. And remember, our expert teams are always here to help, ensuring you make the most informed decisions in your import journey.

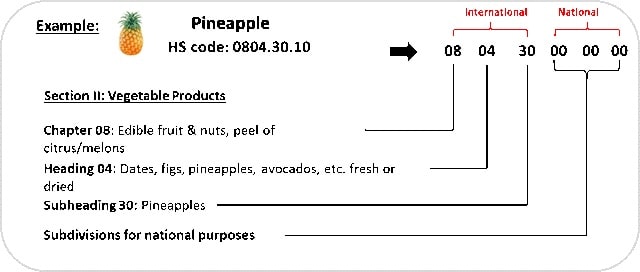

Step 2 - Find the HS Code of your product

The Harmonized System (HS) code is a standardized system of names and numbers used by countries worldwide to classify traded products. It's six digits long and helps customs officers identify the type, origin, and destination of the product. It also assists in determining the amount of duty to be paid on the goods.

Normally, the most straightforward way to find your product's HS Code is to ask your supplier. They're often well-versed in understanding what they're shipping and the corresponding customs regulations.

However, if asking your supplier isn't an option, don't worry. We'll guide you through a simple step-by-step process to find your HS Code.

First, you'll need to use an HS lookup tool, for instance, the Harmonized Tariff Schedule.

Next, type the name of your product into the search bar and hit enter.

Finally, look at the Heading/Subheading column—this is where you'll find your product's HS Code.

Remember, accuracy is vital when it comes to assigning the HS Code. Mislabelling or using an incorrect code could result in shipment delays and, in some cases, hefty fines. So, it's essential to double-check that your code accurately represents your goods.

Here's an infographic showing you how to read an HS code.

Step 3 - Calculate the Customs Value

You're eager to send goods from Vietnam to Tunisia, but those intimidating customs fees are clouding your plans. Welcome to Step 3: Calculate the Customs Value. This is where the mystery unfolds. The 'Customs Value' is quite different from the commercial invoice value — it's the CIF (Cost, Insurance, Freight) value. Imagine you've bought a stylish Vietnamese silk shirt for $20. It cycles all the way to Tunisia with shipping costing $10, and a $5 insurance charge slapped on top. Your Custom's Value isn't $20, it's $35. That’s the magic behind CIF value; it adds your goods' price, the shipping cost, and the insurance fee. So, to avoid those quesadilla-sized customs surprises, remember - your calculation should be in USD and include: Goods' Price ($20) + Shipping Cost ($10) + Insurance ($5) = Customs Value ($35). Now you're ready to sail through Step 3!

Step 4 - Figure out the applicable Import Tariff

An import tariff, also known as a customs duty, is a tax imposed on imported goods. For goods imported into Tunisia from Vietnam, these tariffs can vary based on factors such as the type of product and its country of origin.

Tunisia operates under a Harmonized System (HS) code-based Tariff system. To identify the applicable tariff, you first need to know the HS code of your product. Let's assume the HS code for your product is 1006.30 (for semi-milled or wholly milled rice from Vietnam).

Once you have determined this code, the next step is to consult the customs authority or an online customs database to obtain your specific tariff rate.

For instance, let's say the tariff rate for HS code 1006.30 is 10%. If your Cost, Insurance, and Freight (CIF) value for the goods is $10,000 USD, you can calculate the import duty by applying the tariff rate to the CIF value. Here's the calculation for your situation:

Import Duty = 10% x $10,000 (CIF) = $1,000 USD

This means you would need to pay $1,000 USD in import duties to clear your shipment of rice through Tunisian customs.

Remember that obtaining the correct tariff rate and doing accurate calculations are critical steps in avoiding issues during the customs clearance process.

Step 5 - Consider other Import Duties and Taxes

Besides the standard tariff rate for your goods imported to Tunisia from Vietnam, there are often additional duties depending on the item and its origin. For instance, excise duty, distinct from customs duty, applies to specific goods like alcohol or luxury items. Another extra cost is anti-dumping tax, mainly levied on imports priced below their domestic value to protect local industries. Plus, don't overlook the essential Value Added Tax (VAT).

Now, let's consider VAT. In Tunisia, the standard VAT rate is approximately 19%, but could vary depending on your commodity. To calculate, consider the following formula - VAT = (CIF Value + Duty) x VAT Rate. If the CIF value of your goods is $10,000 with a duty of $2,000, the VAT works out to $2,280 with a 19% rate. However, this serves only as an example, and actual rates may differ.

Remember, overlooking these extra charges might disrupt your budget and operational efficiency. Hence, accurate calculation of all probable costs will ensure a smoother import process.

Step 6 - Calculate the Customs Duties

Determining customs duties in Tunisia when importing goods from Vietnam can be challenging, given the multiple charges to consider. Initially, the customs duty is calculated on the customs value of your goods - a sum of the goods' invoice value plus shipping and insurance costs.

Example 1: For instance, if the customs value is $10,000 and the duty rate is 10%, the payable customs duty is $1,000 ($10,000 x 10%).

If VAT is applicable, it is computed on the customs value plus the customs duty.

Example 2: With a customs value as above, a customs duty of $1,000, and a VAT rate of 19%, the calculated VAT is $2,090 (($10,000 + $1,000) x 19%).

Some goods might face anti-dumping taxes and Excise Duty.

Example 3: For a customs value of $10,000, customs duty of $1,000, vat of $2,090, an anti-dumping tax at 12% amounts to $1,413.2 (($10,000 + $1,000+$2,090) x 12%). If there's Excise Duty at 10%, that would add $1,350 (($10,000 + $1,000+$2,090+$1,413.2) x 10%).

These complexities can be overwhelming, which is why at FNM, we specialize in taking care of every step of the customs clearance process, anywhere in the world. Contact us today for a free quote in less than 24 hours, ensuring you don't overpay.

Does FNM Vietnam charge customs fees?

Understanding charges linked to international shipping can often be confusing. As a customs broker, FNM Vietnam certainly facilitates customs procedures, however, it doesn't charge you any customs duties. These duties are separate from customs clearance fees and are paid directly to the government. To ensure transparency, we provide documents from the customs office verifying that you've only paid mandatory government fees. So when you see an additional charge from FNM Vietnam, remember, it's for the customs clearance service, not a customs duty. Think of it as a small fee for a big weight off your shoulders!

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs

Official website: https://www.customs.gov.vn/

Tunisia Customs

Official name: Tunisian Customs Administration

Official website: http://www.douane.gov.tn/

Required documents for customs clearance

Understanding customs paperwork can be a headache, right? Confused about Bill of Lading, Packing List, or the Certificate of Origin? In this section, we'll make sense of these vital documents - adding clarity to your importing/exporting journey! Let's simplify the nitty-gritty of Customs Clearance. Are you ready? Let’s dive in!

Bill of Lading

Navigating customs from Vietnam to Tunisia? Your Bill of Lading is an essential document, affirming the handover from shipper to carrier. Think of it as a receipt—it outlines what's in the load, who owns it, and where it's going. Remember, for speedy transactions, consider the electronic version (telex) option. It not only saves paper, but also speeds up release times. Think efficiency! Moving stuff by air? That's where the Air Waybill (AWB) comes in. Regardless, always keep your Bill of Lading handy, and consider electronic solutions like telex to streamline your shipping process. That's your ticket for a smoother ride through customs!

Packing List

When it comes to shipping goods from Vietnam to Tunisia, your Packing List is on the A-list of crucial documents. It's like the identity card of your shipment, featuring detailed information such as the quantity, description, and weight of your goods. Imagine the challenges if goods couldn't be matched against their descriptions at the Tunisian port! This degree of precision isn't bureaucratic fuss - it's the backbone that makes both sea and air freight function smoothly. And who’s responsible for this? You are, as the shipper. A small error in the Packing List can lead to customs clearance delays. So, don’t rush it; ensure you're as accurate as a well-tuned scale to avert potential hiccups. Remember, a coffee bag isn't the same as a bag of rice, and the customs authorities definitely know the difference!

Commercial Invoice

When shipping goods from Vietnam to Tunisia, a Commercial Invoice is your best friend. This document, detailing the value, origin, and description of your goods, is critical for smooth customs clearance. Ensure it aligns with details on the Bill of Lading, especially the Harmonized System (HS) codes. A mismatch? It spells trouble and delays. For example, if you're shipping ceramics, use the accurate code 6914 for 'Ceramic articles nesoi.' Be specific and accurate - if you're not, things might get sticky at Tunisian customs. Thorough documentation upfront saves you time and headaches down the line, making your shipping endeavor a smooth sail.

Certificate of Origin

A Certificate of Origin is crucial when shipping goods from Vietnam to Tunisia, signifying your product was manufactured in Vietnam. This document can unlock benefits like lower customs duty rates under trade agreements. For instance, if you're exporting Vietnamese textiles, a Certificate of Origin declaring Vietnam as the manufacturing country allows you to take advantage of preferential rates, reducing your shipping costs. Don't underestimate its value, as missing or incorrect information can lead to delays at the customs, extra costs, or even re-routing of your shipment. So, always ensure accuracy while mentioning the country of manufacture. The right documents smooth your freight journey, save money, and avoid surprises.

Get Started with FNM Vietnam

Overwhelmed by the complexity of customs clearance between Vietnam and Tunisia? Let FNM Vietnam lighten your load. We're experts at navigating these intricate procedures, ensuring everything runs smoothly while you focus on your core business. Reach out to us today for a free, no-obligation quote and experience stress-free international shipping. We promise a response in less than 24 hours!

Prohibited and Restricted items when importing into Tunisia

When taking steps to import goods into Tunisia, knowing the country's list of prohibited and restricted items can save your business from dealing with surprise delays, unexpected fines, or enforcement actions. This guide is tailored just for you, to shed light on the complexities and potential stumbling blocks of importing into Tunisia.

Restricted Products

- Pharmaceuticals: You'll need to secure a Pharmaceutical permit from the Ministry of Public Health website.

- Firearms and Explosives: These are specialties you'll have to get a license for from the Ministry of Interior website.

- Radioactive Materials: For this sensitive stuff, there's a regulatory permit waiting for you at the National Centre for Nuclear Sciences and Technologies website.

- Fine Art: You're going to have to show a Fine Arts license which you can get from the Ministry of Cultural Affairs website.

- Plants and Plant Products: Better get a Phytosanitary Permit from the Ministry of Agriculture, Water Resources and Fisheries website.

- Animals and Animal Products: You'll have to adhere to regulations and get an Animal Health Certificate from the Ministry of Agriculture, Water Resources and Fisheries website.

- Tobacco Products: If you're keen on these, get your Tobacco license from the Ministry of Finance website.

Remember, before shipping restricted goods to Tunisia, it's essential to double-check the rules as per the government bodies. They may change over time and we wouldn't want you to face any unexpected issues.

Prohibited products

- Narcotics and illegal drugs

- Counterfeit money and goods

- Pornographic material

- All products containing the pork

- Alcohol in some types and quantities

- Live animals, unless with special permission

- Hazardous and radioactive materials

- Weaponry and ammunition, including firearms and knives

- Cultural artefacts and antiques

- Any printed material or media that is offensive to Islam or public morals

- Unauthorized medicine

- Precious metals and stones without declarations and special permission

- Items infringing intellectual property rights

- Endangered species of flora and fauna, including their by-products. This is as per the regulations of the Convention on International Trade in Endangered Species of Fauna and Flora.

- Any other item whose import is prohibited as per the laws of Tunisia.

Are there any trade agreements between Vietnam and Tunisia

Currently, there are no specific Free Trade Agreements (FTAs) or Economic Partnership Agreements (EPAs) between Vietnam and Tunisia. However, both countries are part of the Global System of Trade Preferences (GSTP), potentially making certain goods less expensive to import or export. Additionally, discussions for an Asia-Africa trade corridor could pave the way for improved trade conditions in the future. Keep an eye on developments as this could present new growth opportunities for your business.

Vietnam - Tunisia trade and economic relationship

Vietnam and Tunisia's economic relationship, dating back to 1960s, carries a rich fusion of cultural exchange and mutual advancements. Traditionally centered on agriculture and textiles, this bond has expanded into areas like technology and manufacturing. Vietnam's renowned coffee and rubber exports find eager markets in Tunisia, whilst Tunisia's olive oil and phosphate rock are prized goods in Vietnam. The 2001 Free Trade Agreement marked a significant milestone in this partnership, boosting bilateral trade to an estimated 68 dollars million in 2023. Vietnamese investments in Tunisia are slowly but steadily rising, illustrating a striking confidence in this economic relationship. Shaping the world of global trade, this unique Vietnam-Tunisia union stands as a powerful symbol of economic resilience.

Your Next Step with FNM Vietnam

Breaking into the Vietnam-Tunisia trade route? It can be overwhelming handling the unique customs processes, shipping methods, and regulatory requirements. Let FNM Vietnam smoothly sail you through these complexities. With our unrivaled expertise, we turn shipping hassles into effortless transactions. Ready for a hassle-free trade journey? Contact us. Your first successful shipment awaits.

Additional logistics services

Dive into our bevy of extra services beyond plain shipping and customs - we've got your whole supply chain covered, from factory to doorstep. FNM Vietnam - your one-stop logistics solution.

Warehousing and storage

Longing for reliable warehousing in Vietnam or Tunisia? Temperature-controlled storage for sensitive goods like chocolates or electronics? Your quest ends here, as we understand storage isn't just about space. It’s having peace of mind that your products are in safe and capable hands. Craving more savvy warehousing solutions? Discover more on our dedicated page: Warehousing.

Packaging and repackaging

When shipping goods between Vietnam and Tunisia, proper packaging is vital. Whether you're sending handicrafts or hi-tech hardware, getting your items repackaged by a reliable agent ensures they arrive safely and securely. Imagine you're shipping delicate ceramics, sturdy repackaging keeps your precious cargo intact, avoiding damage. At the same time, industrial equipment benefits from specialized packaging, preventing corrosion during ocean transit. More info on our dedicated page: Freight packaging

Cargo insurance

Cargo insurance, unlike fire insurance, defends your goods against the unpredictability of global shipping – mishandling, rough seas, or even theft. An example? If your goods catch a severe case of 'container rain' onboard, insurance will have you covered. Prevention is key, and it empowers you to mitigate these oceanic vagaries. Dive deeper into the ins and outs on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Looking to simplify your procurement process? We're here to help! At FNM Vietnam, we assist businesses in finding top-notch suppliers in Asia, East Europe, and beyond. We handle everything - from pinpointing reliable sources to masterfully maneuvering through language barriers and procurement procedures. Just think of us as your personal guide through the bewildering maze of global sourcing. Get all the details - visit our dedicated page: Sourcing services.

Personal effects shipping

Moving your most prized possessions from Vietnam to Tunisia? With our Personal Effects Shipping, we handle delicate or oversized items with utmost professionalism, just as carefully as if you were moving a family heirloom. For example, that bulky grand piano or irreplaceable vase will be in safe hands. For further details, dive into Shipping Personal Belongings.

Quality Control

Ensuring your goods are up to the mark before shipping from Vietnam to Tunisia can save enormous costs and hassles. Imagine your batch of ceramic dinnerware has uneven glazes; it's better to spot those now than upon arrival in Tunisia, right? Our Quality Control service tightly inspects product standards at the manufacturing stage, catching any lapses early. It's like having your own guard dog, but for your products. More info on our dedicated page: Quality Inspection.

Product compliance services

Shipping goods across borders? It's crucial that your product passes all regulatory checks to avoid hiccups. That's where our Product Compliance Services come into play. We handle laboratory tests to ensure your goods meet every standard waiting at your final port. Think of it like a ticket that grants your product smooth, trouble-free admission. It’s the difference between an impounded shipment and timely delivery.

FAQ | For 1st-time importers between Vietnam and Tunisia

What is the necessary paperwork during shipping between Vietnam and Tunisia?

When shipping from Vietnam to Tunisia, we at FNM Vietnam will handle the mandatory documentation which includes the bill of lading for sea freight or an air waybill for air freight. What we require from you is the packing list and the commercial invoice. In certain cases, depending on the nature of your goods, additional documents like MSDS or certifications may be needed. Our main aim is to make the process seamless for you. Be assured, we're here to assist you throughout and ensure that all documentation is in the correct order.

Do I need a customs broker while importing in Tunisia?

Yes, we strongly advise utilizing the services of a customs broker when importing goods into Tunisia. Navigating customs can be a labyrinthine task, with numerous mandatory details, documents, and procedures to follow. This complexity often makes the role of a customs broker indispensable. As part of our comprehensive services at FNM Vietnam, we take on the responsibility of representing your cargo at customs for the majority of shipments. This way, we can streamline the process and help ensure that your freight clears customs without any unnecessary complications or delays. Ultimately, a customs broker can help keep your shipping operations efficient and compliant.

Can air freight be cheaper than sea freight between Vietnam and Tunisia?

While it's challenging to generalize, the cost between air and sea freight hinges on many factors, including the route, weight, and volume of the cargo. Typically, if your shipment is less than 1.5 cubic meters or around 300 kg (660 lbs), air freight becomes a viable option. At FNM Vietnam, we prioritize finding the most competitive and cost-effective shipping solutions. Our dedicated account executives can guide you through the process, ensuring the most suitable freight option for your specific needs.

Do I need to pay insurance while importing my goods to Tunisia?

While insurance isn't a compulsory requirement for shipping goods, we at FNM Vietnam strongly advise getting your shipments covered. This is due to potential risks such as damage, loss, or theft that could occur during transit. Regardless of whether your consignment is domestic or international, ensuring your goods offers an extra layer of protection and peace of mind. Please note that it's the responsibility of the shipper to organize this. So, when you're planning to import goods to Tunisia or any other country, investing in insurance might be a prudent choice.

What is the cheapest way to ship to Tunisia from Vietnam?

Given the significant geographic distance between Vietnam and Tunisia, sea freight is typically the most cost-effective shipping option. While it may take longer than air freight, it allows for larger shipment volumes at comparatively lower prices. Keep in mind that various factors could influence the final cost, like the nature and size of your cargo, time frame, and specific customs regulations. We at FNM Vietnam can help you navigate through these considerations to ensure the most efficient shipping decision.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF largely hinges on your relationship with your supplier. Remember your supplier may not be a logistics expert, which is where we come in. At FNM Vietnam, we are equipped to handle international freight and processes at destination. Often, suppliers choose to sell under EXW (from their factory door) or FOB (including all local charges up to the origin terminal). Regardless of the option selected, we are poised to offer a comprehensive door-to-door service for your peace of mind. Simply put, we smoothly bridge the logistics gap between your supplier and you, while ensuring efficiency and reliability throughout the process. Trust FNM Vietnam for your shipping needs.

Goods have arrived at my port in Tunisia, how do I get them delivered to the final destination?

When we manage your cargo under CIF/CFR incoterms, you'll need a customs broker or a freight forwarder to clear the goods, cover import fees, and ensure delivery. Alternatively, our expert team is available to manage a DAP incoterms process, handling all steps for you. Reach out to your dedicated account executive for more details.

Does your quotation include all cost?

Indeed, we at FNM Vietnam ensure our quotations cover all costs except for duties and taxes at the destination. We believe in transparency and no hidden charges for a smooth shipping experience. Don't hesitate to have your dedicated account executive estimate your duties & taxes for a complete cost overview. We're here to avoid unexpected surprises for you.