Why did the crate end up in Greece instead of Vietnam? Because it didn't consult a freight guide! Truth be told, getting a handle on shipping rates, transit times, and customs regulations can feel like deciphering an ancient Greek scroll. This guide is designed to change that. You can expect to find in-depth information about various freight options – from air to sea, from road to rail. We'll also clear the fog surrounding customs clearance, demystify duties and taxes, and provide tailored advice to help your business conquer these complex procedures. If the process still feels overwhelming, let FNM Vietnam handle it for you! As an international freight forwarder, we transform intricate challenges into tangible success, ensuring your goods reach their destination as smoothly and swiftly as possible.

Which are the different modes of transportation between Vietnam and Greece?

Deciding on the best transport method for shipping goods from bustling Vietnam to the serene landscapes of Greece depends largely on your cargo and timelines. Geography is a key player here. Let's imagine the journey - sea transport is a popular choice, given the available ports in both locations. However, the journey is lengthy, crossing multiple sea routes and time zones. Air shipping, on the other hand, is quicker but could be pricier. Both have their benefits and drawbacks, and your choice will hinge on your unique needs and shipment specifics. Let's take a closer look.

How can FNM Vietnam help?

Seeking expert assistance for shipping goods from Vietnam to Greece? FNM Vietnam is here to simplify your journey. We take care of your transport arrangements, handle customs clearance, and sort out administrative procedures. Got queries? Talk to our consultants - it costs nothing! Act now and get a free shipping estimate within 24 hours. Get in touch today.

![]()

FNM Vietnam Tip: Sea freight might be the best solution for you if:

- You're moving big loads or large items. Sea freight offers roomy, cost-effective solutions.

- Your shipment isn't time-critical. Ocean routes take longer but are often more reliable.

- Your supply chain links major ports, tapping into a broad network of sea lanes.

Sea freight between Vietnam and Greece

Sea freight offers a cost-effective avenue for trade between Vietnam and Greece, two nations enriched with bustling industrial centers. With goods sailing across thousands of miles, key ports like the Port of Piraeus in Greece and the Port of Ho Chi Minh in Vietnam stand as trusted junctions. Despite being a slow coach, ocean shipping wins the race carrying high volume goods, costing less per unit than other shipping methods.

Yet, the journey from Vietnam to Greece isn't always smooth sailing. The daunting ocean of paperwork and detailed customs specifications can make businesses feel lost at sea. Miscommunication, miscalculation or simple unawareness can turn your shipment from a breezy sailboat to a sinking ship. But fret not! Much like the compass for a sailor, best practices and specifications can guide you through these turbulent waters. In the following sections, let us embark on this journey unraveling trade secrets that will turn shippers into seasoned captains navigating the seas of global trade.

Main shipping ports in Vietnam

Port of Hai Phong:

- Located in the northern part of Vietnam, Hai Phong is the country's third-largest city and houses its busiest sea port, handling approximately 50 million tons of cargo annually.

- Key trading partners primarily include China, South Korea, and Japan, with a strategic value due to its proximity to these affluent markets.

- If you're looking to expand your business operations towards East Asia, the Port of Hai Phong may be a crucial part of your strategy due to its well-established trading links and high handling capacity.

Port of Da Nang:

- Situated in Central Vietnam, Da Nang port plays a strategic role in the region's maritime network, with a shipping volume reaching around 9 million tons of cargo annually.

- Key trading partners encompass the United States, Japan, and the Philippines, making it an important access point for the Pacific.

- The Port of Da Nang could well suit your operations if you intend to penetrate Pacific markets, owing to its equipped handling capacity and versatile trading routes.

Port of Ho Chi Minh City:

- Located in the most populous city in Vietnam, Ho Chi Minh City Port is the largest maritime facility in the country with an annual shipping volume of about 55 million tons.

- Key trading partners include the United States, China, and Singapore. This port is a choice gateway for goods entering or exiting mainland Southeast Asia.

- The Port of Ho Chi Minh City strengthens your logistics if your business aims for mass distribution or sourcing throughout the Southeast Asia region due to its location and large volume handling capacity.

Port of Quy Nhon:

- Quy Nhon port is situated on the eastern coast of Vietnam and can handle shipping volumes of about 8 million tons per year.

- Its goods are typically shipped domestically or to neighboring Southeast Asian countries like Cambodia and Laos.

- Choosing Port of Quy Nhon would be beneficial if you're seeking to expand your business domestically or tap into the potential of emerging Southeast Asian markets due to its regional connections.

Port of Nha Trang:

- Located in the Khanh Hoa Province, Nha Trang port handles about 2 million tons per annum, mostly due to its geographical location.

- Key trading partners majorly involve countries within Southeast Asia such as Thailand and Myanmar.

- The Port of Nha Trang may be the perfect fit for companies with a focus on Southeast Asia, attributable to its region-specific trading links.

Port of Can Tho:

- Can Tho Port is located in the deepest part of the Hau River and has a shipping volume of about 15 million tons annually.

- Its primary trading partners include Asian countries like Malaysia and South Korea.

- If your enterprise aims to reach South Korean or Malaysian markets, the Port of Can Tho can be an integral part of your distribution strategy due to its extensive East Asian trading relations.

Main shipping ports in Greece

Port of Piraeus

Location and Volume: As the largest port in Greece and one of the largest passenger ports in Europe, the Port of Piraeus is located in the city of Piraeus, 12 kilometers southwest of the Athens city center. It handled 5.65 million TEUs in 2019.

Key Trading Partners and Strategic Importance: The port has significant trade flows with major economic powerhouses such as China, Germany, Italy, Turkey, Russia, and the United States. It serves as a strategic transshipment hub in the Mediterranean, forming part of China's Belt and Road Initiative.

Context for Businesses: If you're expanding your business to Southern Europe or North Africa, the Port of Piraeus is particularly advantageous due to its central location in the Mediterranean and high-capacity infrastructure, making it an attractive option for large volume traffic.

Port of Thessaloniki

Location and Volume: Situated in Northern Greece, the Port of Thessaloniki is the second-largest port in Greece. As a gateway to the Balkans and Southeastern Europe, it managed a shipping volume of 424,000 TEUs in 2019.

Key Trading Partners and Strategic Importance: Thessaloniki handles a diverse range of cargo from partners such as Bulgaria, Cyprus, Germany, Italy, and Turkey. Its strategic importance lies in its proximity to the Balkan countries, making it a vital link for international trade routes.

Context for Businesses: For businesses venturing into the Eastern European markets, the Port of Thessaloniki, with its vast hinterland and advantageous position, is crucial for all logistics and shipping operations.

Port of Patras

Location and Volume: Positioned in the western part of the country, the Port of Patras is notably Greece's gateway to Italy and Western Europe. While it's primarily a passenger port, it also handles some freight, with a volume of 1.4 million tons in 2019.

Key Trading Partners and Strategic Importance: Almost all cargo operations are with Italy, but there are also connections with other European ports, making it suitable for businesses targeting European markets.

Context for Businesses: If you're eyeing Western European markets, especially Italy, the Port of Patras with its ferry line can facilitate your transport and logistics operations, given its seamless connections.

Port of Heraklion

Location and Volume: The Port of Heraklion, located on the island of Crete, is another important port in Greece, known primarily for passenger and conventional cargo. It handled around 1.35 million passengers in 2019.

Key Trading Partners and Strategic Importance: It serves as a crucial gateway for goods moving to and from Greece's largest island, Crete, handling goods mainly from Europe and Africa.

Context for Businesses: If your business caters to the island markets of Greece or the countries bordering the eastern Mediterranean, the Port of Heraklion can be an integral part of your logistics due to its geographical importance and connectivity.

Volos Port

Location and Volume: Situated in the city of Volos, midway between Athens and Thessaloniki, the Volos Port is one of the leading industrial ports in Greece, handling a volume of nearly 4 million tons in 2020.

Key Trading Partners and Strategic Importance: Primarily engaged with the United Kingdom, this port is a vital location for cargo related to construction, specifically cement and metals.

Context for Businesses: If your operation involves heavy industry or construction materials, especially for the UK, the Port of Volos offers a dedicated and efficient point of entry and exit.

Port of Igoumenitsa

Location and Volume: On the northwestern coast of Greece, the Port of Igoumenitsa is an integral link between Greece and Italy. Though primarily a ferry port, it also handles freight.

Key Trading Partners and Strategic Importance: This port has ferry connections to numerous Italian ports, making it strategically important for businesses with strong connections to Italy.

Context for Businesses: The Port of Igoumenitsa serves as a crucial node for businesses focusing on Italy or Western European markets, providing efficient transport and logistics solutions particularly for businesses that rely on ro-ro shipping.

Should I choose FCL or LCL when shipping between Vietnam and Greece?

Choosing between FCL and LCL, also known as consolidation, when shipping by sea from Vietnam to Greece is a vital decision that affects not just cost but delivery time too. This breakdown will help your business understand the differences and strategic advantages of each, arming you with the knowledge to make an informed choice that suits your specific shipping requirements. Let's dive in and unravel the intricacies of these two primary sea freight options.

LCL: Less than Container Load

Definition: Less than Container Load (LCL) shipping is a practical solution for businesses that need to transport limited quantities of goods. This option involves sharing a container with other shippers, which makes it cost-efficient and flexible.

When to Use: LCL freight is an ideal choice when the cargo volume is less than 13, 14, or 15 cubic meters (CBM). Since your freight does not fill a whole container, it is combined with other shipments.

Example: Imagine a business in Vietnam sells artisan pottery, with an average monthly shipment quantity equivalent to 10 CBMs. Instead of paying for unused space in a full container, they choose LCL freight. Their products are then consolidated with other goods in the same container bound for Greece.

Cost Implications: While LCL shipping quote per CBM may be higher compared to Full Container Load (FCL), the overall spend is generally less if your shipment does not exceed the recommended volume. One should, however, be prepared for potential delays in delivery time due to the consolidation and deconsolidation processes, affecting the total lead time.

FCL: Full Container Load

Definition: FCL or 'Full Container Load' is a term in fcl shipping where a shipment occupies an entire container, be it a 20'ft container or a 40'ft container.

When to Use: FCL is a practical option when your cargo volume exceeds 13-15 CBM. It ensures the safety of your goods as your container is sealed at origin and opened only at the destination.

Example: Suppose you're a furniture dealer, planning to ship 16 CBM of chairs and tables from Vietnam to Greece. Opting for an FCL container guarantees that your goods will stay in the same, untouched space from pickup to delivery, eliminating the chances of damage during transit.

Cost Implications: Though the upfront fcl shipping quote might seem steep compared to LCL or 'Less than Container Load', FCL becomes more cost-effective when shipping larger volumes. It also ensures fewer handling charges as the goods are not consolidated or deconsolidated along the path. Thus, the direct correlation between high volumes and reduced costs makes FCL a go-to option for shipments exceeding the mentioned volume threshold.

Say goodbye to shipping headaches!

Looking to export from Vietnam to Greece? FNM Vietnam, your trusted freight forwarder, can make it easy. Our ocean freight specialists will assist you in deciding between consolidation or full container shipping, based on factors like your budget, shipment size, and delivery speed. We're here to democratize shipping and help businesses send cargo with simplicity and peace of mind. Ready to take the plunge? Contact us for a no-obligation, free cost estimation. Your hassle-free shipping journey starts with us.

How long does sea freight take between Vietnam and Greece?

Sea freight between Vietnam and Greece typically takes around 20-30 days on average. However, it's key to remember that these transit times are determined by factors such as the specific ports used, the weight, and type of goods shipped. Therefore, for a quotation accurate to your requirements, it's highly recommended to consult with a freight forwarder, such as FNM Vietnam.

| Freight Port in Vietnam | Freight Port in Greece | Average Transit Time (Days) |

| Port of Ho Chi Minh | Port of Piraeus | 24 |

| Port of Da Nang | Port of Piraeus | 28 |

| Port of Hai Phong | Port of Piraeus | 24 |

| Port of Quy Nhon | Port of Piraeus | 26 |

*Considering the context and variables involved in shipping times, these figures serve as estimated averages and may vary significantly based on the factors mentioned earlier. To make sure you get the most accurate information, reach out to your preferred freight forwarder.

How much does it cost to ship a container between Vietnam and Greece?

Casting a net over ocean freight rates, the cost to ship a container between Vietnam and Greece can vary broadly - anywhere from $50 to $1000 per CBM. But hang on, defining an exact price is a bit tricky. Elements like Point of Loading, Destination, the carrier, nature of your goods, and even monthly market fluctuations can cause the scales to tip. Still caught up? Don't worry. Our skilled shipping specialists are on deck to be your navigators in this sea of variables. We focus on your specific needs, providing tailored, competitive quotes instead of a one-size-fits-all shipping cost. Your optimal route and rate await!

Special transportation services

Out of Gauge (OOG) Container

Definition: OOG Containers are special shipping containers designed for cargo that doesn't fit the standard container dimensions. They have open tops or flat racks to accommodate the Out of gauge cargo.

Suitable for: OOG Containers are ideal for cargo with dimensions that surpass the standard container size like heavy machinery, industrial equipment, or large vehicles.

Examples: Construction equipment, windmills, yachts, industrial parts.

Why it might be the best choice for you: If your business involves shipping items that are too tall, wide, or long for a typical container, this is the right option. An OOG container ensures your cargo reaches from Vietnam to Greece safely and intact.

Break Bulk

Definition: Break bulk refers to goods that need to be loaded individually rather than in shipping containers, often on pallets, sacks, drums, or bags.

Suitable for: Those shipping goods that are too bulky or heavy to be transported in a container.

Examples: Steel plates, timber, large cables or construction materials.

Why it might be the best choice for you: If your cargo is too bulky or large for a shipping container, choosing the break bulk option guarantees successful shipment from Vietnam to Greece.

Dry Bulk

Definition: Dry bulk shipping involves transporting unpackaged goods in large quantities, otherwise known as loose cargo load. This method traditionally involves using ships designed for handling bulk commodities.

Suitable for: Commodities like grains, coal, minerals, or metals that can be loaded directly into the ship's hold.

Examples: Rice, iron ore, coal, cement, grains.

Why it might be the best choice for you: If your cargo consists of homogenous, un-packaged products in large quantities, then dry bulk shipping offers efficient and cost-effective transportation.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-ro vessels are designed to transport vehicles that roll on and off the ship on their own wheels or on a flatbed trailer.

Suitable for: Motorcycles, cars, trucks, trailers, and boats, as well as heavy machinery and oversized cargo.

Examples: New or used cars, trucks, buses, motorhomes, construction vehicles.

Why it might be the best choice for you: If your business is involved in transporting vehicles or wheeled cargo, this method is ideal. Ro-ro vessels provide an excellent combination of convenience and security from Vietnam to Greece.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers that control the temperature to transport temperature-sensitive goods.

Suitable for: Products such as food, pharmaceutical products, or any other goods requiring temperature control.

Examples: Seafood, fruits, vegetables, meat, dairy, or medicines.

Why it might be the best choice for you: If your commodities need a specific temperature range during transport, reefer containers are essential in preserving their quality all the way to Greece.

Interested in shipping goods from Vietnam to Greece? FNM Vietnam can provide an appropriate shipping solution tailored to your specific needs. Reach out to us for a free shipping quote in less than 24h. We're here to make your shipping experience seamless and efficient.

FNM Vietnam Tip: Air freight might be the best solution for you if:

- You're on a tight schedule. Air freight delivers speed unmatched by other modes.

- Your cargo is under 2 CBM, a good fit for air's smaller capacity.

- Your destination is off the usual routes, making air's global network a key asset.

Air freight between Vietnam and Greece

Air freight between Vietnam and Greece is like a speedboat: it's quick, reliable, and perfect for transporting small, high-value cargo. Think of electronics or designer garments - things that pack a lot of value in minimal space.

But it's not all smooth sailing. Shippers often trip over hidden hurdles. They may miscalculate costs by overlooking the weight-volume ratio, leading to bill shocks. Time can also sneak up, with rushed decisions causing expensive errors. It's like a math test - one wrong step and the whole problem collapses! Let's untangle these frequencies, helping you make air freight work for your needs. Stay tuned for actionable tips to ship smarter.

Air Cargo vs Express Air Freight: How should I ship?

Footing the bill for international shipping can feel like a juggling act. You're deciding between shipping your goods from Vietnam to Greece via air cargo - meaning they'll fly in an airline along with other causes - vs express air freight, which promises a dedicated plane and speedy delivery. But which option suits your business needs best? Let's get you some clarity.

Should I choose Air Cargo between Vietnam and Greece?

Considering your shipping requirements, air cargo may be an optimal choice between Vietnam and Greece. Airlines such as Vietnam Airlines and Aegean Airlines, two reputed carriers, play a significant role in making this possible. They not only provide cost-effective solutions but also boast a reputation for reliable service, despite the longer transit times due to fixed schedules. Particularly, if your cargo weighs between 100/150 kg (220/330 lbs), air cargo becomes an even more enticing option for its economical comparative advantages. Remember, every business' shipping needs are different, so consider all factors before selecting your method.

Should I choose Express Air Freight between Vietnam and Greece?

Express Air Freight is a dedicated service for urgent and lightweight shipments, typically up to 1 CBM or 100/150 kg (220/330 lbs). Renowned courier firms like FedEx, UPS, and DHL specialize in this quick transport, offering benefits of fast customs clearance, and premium door-to-door deliveries. If your cargo fits within these specifications then this might be the optimum solution for your Vietnam-Greece freight needs, ensuring your goods reach their destination swiftly and safely.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: As Vietnam's busiest airport, Tan Son Nhat handles over 1.2 million tons of cargo annually.

Key Trading Partners: China, Japan, South Korea, and the United States form the major trade alliances.

Strategic Importance: Located in Ho Chi Minh City, the economic hub of Vietnam, it plays a vital role in the transport of goods in and out of the southern region.

Notable Features: Equipped with state-of-the-art facilities, this airport can manage a wide range of freight including perishable goods, pharmaceuticals, machinery, textiles, and more.

For Your Business: If your trade routes involve South-East Asia and your goods relate to the industries above, Tan Son Nhat might be a crucial part of your logistics chain to guarantee timely and efficient deliveries.

Noi Bai International Airport

Cargo Volume: Handling over 700,000 tons annually, Noi Bai stands as the second busiest airport in terms of freight volume in Vietnam.

Key Trading Partners: Key trading relations include China, South Korea, Japan, and Singapore.

Strategic Importance: Being the international gateway to Hanoi and the rest of northern Vietnam, this airport is strategic for businesses trading in this region.

Notable Features: The airport boasts dedicated cargo terminals and modern facilities to handle all types of freight.

For Your Business: If your suppliers or customers are based in North Vietnam, Noi Bai could assist with connecting your supply chain effectively and executing quick turnarounds.

Cam Ranh International Airport

Cargo Volume: This is a growing hub, with cargo volumes increasing significantly each year.

Key Trading Partners: Trades mainly with Russia, South Korea, and China.

Strategic Importance: Situated in central Vietnam, it forms a vital link for cargo transportation in and out of this region.

Notable Features: Though smaller than the first two, this airport has modern facilities and efficient service, particularly for smaller and medium-sized freight shipments.

For Your Business: If you conduct frequent small-to-medium scale cargo operations in Central Vietnam, considering Cam Ranh into your logistics planning could provide significant cost and time efficiencies.

Da Nang International Airport

Cargo Volume: Handling over 150,000 tons annually, Da Nang is a significant player within the central region and Vietnam as a whole.

Key Trading Partners: The airport frequently trades with Asian countries, primarily South Korea, China, and Japan.

Strategic Importance: As the third largest airport, it connects central Vietnam to international markets particularly in Asia.

Notable Features: It houses dedicated cargo terminals that possess cold storage facilities for special freight purposes.

For Your Business: If your cargo needs involve central Vietnam and requires special storage facilities (e.g., for perishable goods), Da Nang could be a crucial part of your shipping strategy.

Cat Bi International Airport

Cargo Volume: Smaller in size, this airport handles a significant amount of cargo specific to the northern coastal region.

Key Trading Partners: Its main partners are China and other Southeast Asian countries.

Strategic Importance: Situates in Hai Phong city, the major port city in northern Vietnam, it plays a key role in the handling of goods for northern coastal region.

Notable Features: Cat Bi provides facilities for handling regular freight along with special cargo and smaller shipments.

For Your Business: If your shipping needs involve the Northern Coastal belt of Vietnam and involves smaller or specialized shipments, looping in Cat Bi Airport could optimize your logistics operations.

Main international airports in Greece

Athens International Airport Eleftherios Venizelos

Cargo Volume: In 2020, it handled 84,000 tons of cargo.

Key Trading Partners: Primary international trading partners include Germany, Italy, and Turkey.

Strategic Importance: As the largest and busiest airport in Greece, Athens International Airport is a focal point for trade in Southern Europe. It's well-connected to Europe, Asia, and the Americas.

Notable Features: The airport offers extensive freight services, including specialized cargo like perishables, pharmaceuticals, and dangerous goods. 24/7 customs operations facilitate smooth operations.

For Your Business: Given its strategic location and extensive connectivity, integrating Athens International into your shipping strategy could help minimize transit times, especially for shipments to or from Southern Europe.

Thessaloniki Airport Makedonia

Cargo Volume: The airport handles an estimated 15,000 tons of cargo annually.

Key Trading Partners: Top trading countries include Cyprus, Germany, and the UK.

Strategic Importance: It's the third-largest airport in Greece and a critical transport hub for Northern Greece and southeastern Europe.

Notable Features: Well-equipped to handle all types of cargo, 24/7 customs services guarantee uninterrupted freight operations.

For Your Business: If your business operates in southeastern Europe, using the Thessaloniki airport for your shipments could cater to your needs, given its round-the-clock customs service and connectivity.

Heraklion Airport Nikos Kazantzakis

Cargo Volume: Heraklion Airport processes up to 7,500 tons of cargo per year.

Key Trading Partners: Primary destinations for cargo export include the UK, Germany, and Russia.

Strategic Importance: As the second busiest airport in Greece, Heraklion Airport is an essential gateway for goods moving in and out of Crete and nearby islands.

Notable Features: The airport can handle a range of cargo, including perishables and hazmat items, with round-the-clock customs services.

For Your Business: If your market includes Crete and its surrounding islands or regions in Southeast Europe, incorporating Heraklion Airport into your logistics plan could make your shipment cycles more efficient.

Rhodes International Airport Diagoras

Cargo Volume: Annually handles an estimated 3,000 tons of cargo.

Key Trading Partners: The main trading partners are Italy, Germany, and France.

Strategic Importance: As one of the four main international airports in Greece, it plays a vital role in serving the Dodecanese islands in the southeastern Aegean sea.

Notable Features: With facilities to handle diverse kinds of freight, including perishables, the airport runs full-time customs operations.

For Your Business: If you're shipping to and from the Southeast Aegean, Rhodes International could be an effective component of your supply chain, given its ability to handle diverse freight and continuous customs operations.

Chania International Airport Ioannis Daskalogiannis

Cargo Volume: It processes more than 2,500 tons of cargo annually.

Key Trading Partners: It has strong ties with countries like Cyprus, Germany, and Russia.

Strategic Importance: Chania airport is an important hub for the island of Crete, linking the region with several European cities.

Notable Features: The airport is equipped to handle a wide range of goods and operates customs services 24/7.

For Your Business: If Crete forms a part of your trading radius, utilizing Chania International would help ensure smooth, timely delivery of your goods owing to its round-the-clock customs service and good connectivity.

How long does air freight take between Vietnam and Greece?

Typically, air freight shipping between Vietnam and Greece has an average transit time of 6-8 days. However, the actual duration could vary depending on several factors. The primary airport of origin and destination, the weight of the shipment, and the nature of goods being transported all contribute to these variations in shipping time. If you’re after a more precise estimate, it’s best to consult professionals such as FNM Vietnam who can provide detailed timeline breakdowns.

How much does it cost to ship a parcel between Vietnam and Greece with air freight?

The cost of shipping air freight from Vietnam to Greece averages around $3 to $10 per kilogram. However, it's important to note that various factors such as the distance between the departure and arrival airports, dimensions and weight of the parcel, as well as the nature of the goods, can affect the final price. Rest assured, our team tailors each quote to your specific needs to ensure you receive the best possible rates. So, reach out and let us help with your shipping needs. Get your free quote in less than 24 hours - Contact us now!

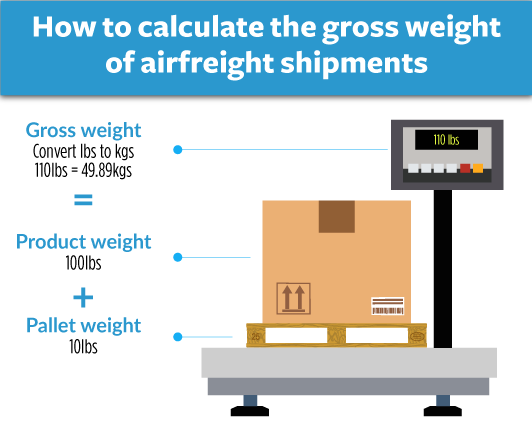

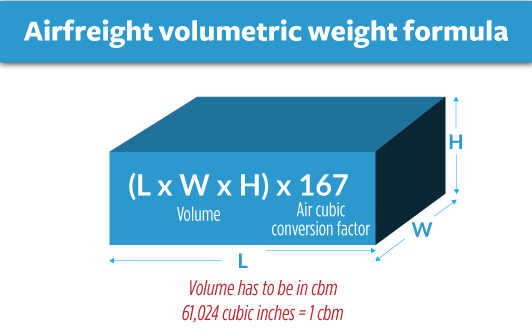

What is the difference between volumetric and gross weight?

Gross weight is the actual physical weight of your shipment, including the product, packaging, pallet, or container. On the other hand, volumetric weight, also known as dimensional weight, is a pricing technique for commercial freight transport, which uses an estimated weight that is calculated from the length, width, and height of a package.

Gross weight is simple to calculate. It's the total weight of the goods, including packaging and all. If your shipment weighs 100 kg, that's your gross weight (roughly 220 lbs when converted).

Volumetric weight might need a bit more head-scratching. In Air cargo, you determine the volumetric weight by multiplying the length, width, and height (in centimeters) of the package, then dividing by 6,000. For Express Air services, it's similar, but the divisor used is 5,000 instead.

So, let's consider you have a package that measures 100cm by 100cm by 100cm. The volume would be 1,000,000 cubic cm. For an Air cargo shipment, the volumetric weight would be around 167 kg (approximately 368 lbs). For Express Air service, the volumetric weight would be roughly 200 kg (around 440 lbs).

As a shipper, the key reason to focus on these weights is that freight charges are often determined based on whichever is higher between the gross and the volumetric weight. That’s because space on an aircraft is just as valuable as the weight a plane can carry, directly affecting the shipping costs. Thus, understanding and planning your shipment around these measurement methods could potentially save your company a significant amount.

![]()

FNM Vietnam Tip: Door to Door might be the best solution for you if:

- You seek hassle-free shipping. Door-to-door manages the entire process for you.

- You like one go-to contact. A dedicated agent oversees your door-to-door shipment.

- You aim to limit cargo handling. Fewer transitions mean less risk of damage or loss.

Door to door between Vietnam and Greece

Door to Door shipping paints a full-cycle solution for businesses, transporting goods straight from Vietnam to Greece with no fuss for you. Imagine skipping the logistics nightmare and swiftly reaching your Greek client's doorstep! From timely delivery to customs clearance, this shipping method has it all. Intrigued by the prospect? Let's dive in!

Overview – Door to Door

Sweating over the complex shipping process between Vietnam and Greece? Door-to-door shipping is here to ease your troubles. This stress-free option covers everything, from initial pickup in Vietnam to final delivery in Greece, tackling customs clearance, paperwork, and even transportation struggles. While a bit costlier, its comprehensive coverage ranks it as FNM Vietnam's most popular service. As for drawbacks, shipping times can vary due to numerous factors. But weigh it against the peace of mind you'll enjoy, and you'll see why numerous businesses trust this method. Crack open the secret to stress-free shipping with our complete guide below.

Why should I use a Door to Door service between Vietnam and Greece?

Ever thought shipping goods was as tricky as threading a camel through a needle's eye? Think again! With Door to Door service between Vietnam and Greece, it's a walk in the park! Here are five compelling reasons why you might want this service on speed dial:

1. Ease Stress in Logistics: Shipping isn't just trading seals and signatures; it's logistics on steroids! A door to door service conducts the pickup, transport, and delivery seamlessly, navigating through all complex procedures and paperwork. That's a major load off your business mind!

2. Timely Delivery for Urgent Shipments: If your shipment is as urgent as 'a groom running late for his wedding,' this service is your knight in shiny armor! It guarantees time-efficient transport, leaving no room for behemoth delays.

3. Specialized Care for Complex Cargo: Got fragile or specialty items? No worries! Door to Door services are like 'nannies for your goods,' providing expert care and handling, ensuring they reach in mint condition.

4. Complete Handling of Trucking: Imagine your goods being chauffeured straight to the final destination without you lifting a finger. Appealing, right? This service takes care of every mile, making trucking a no-brainer for you.

5. Sheer Convenience: The sum of these perks equals undisputed convenience. You wouldn't turn down a chauffeured ride in a top-notch limo, so why refuse the equivalent for your precious goods?

In essence, door to door service is your trustworthy ally in the wild world of shipping, offering a fuss-free, efficient, and precise solution tailored for your needs.

FNM Vietnam – Door to Door specialist between Vietnam and Greece

FNM Vietnam offers a comprehensive, door-to-door shipping solution from Vietnam to Greece. We tackle the complexities of freight forwarding so you don't have to; managing everything from packaging and transit to customs processes. Choose from a variety of shipping methods based on your unique requirements, all overseen by a dedicated Account Executive. With our commitment to efficiency, expect a free estimate within 24 hours or instant consultation over the phone. Lean back and let FNM Vietnam seamlessly move your goods across borders.

Customs clearance in Greece for goods imported from Vietnam

Understanding the customs clearance protocol in Greece for goods imported from Vietnam can feel like navigating a labyrinth. This process, fraught with complexities, brings along the risk of unforeseen fees and charges. Missing a fine detail could result in expensive penalties or even your shipment being stuck in customs limbo. It's paramount to grasp concepts like customs duties, taxes, quotas, and licensing rules to prevent such scenarios. Rest assured, in the subsequent sections, we'll give you a deep dive into these areas. Moreover, our trusted partner, FNM Vietnam, is always ready to assist you in this process, for all types of goods, anywhere across the globe. To get an estimate and plan your budget, reach out to our team with three key details: your goods' origin, their value, and the HS Code. With these, we can help make your shipping project smoother.

How to calculate duties & taxes when importing from Vietnam to Greece?

Navigating the complexities of customs duties and taxes requires a strong understanding of various factors, from the country of origin and the Harmonized System (HS) Code, to the customs value and the applicable tariff rate; and not to overlook any additional taxes and fees that might be relevant to your products. Initiating this process towards a seamless export experience from Vietnam to Greece begins with clearly identifying where exactly your goods have been manufactured or produced.

Step 1 - Identify the Country of Origin

Unearthing the trade origin of your goods is paramount, and here's why:

1. Clarity in Customs: Knowing your goods' origin provides clarity in customs documentation, smoothing out the clearance process.

2. Accurate Duty Calculation: It guides precise customs duty estimation, thereby saving unnecessary expenditure.

3. Trade Agreement Perks: Greece and Vietnam share dynamic bilateral trade agreements. Preferential tariff treatments may apply to your goods, reducing your costs.

4. Navigating Import Regulations: Certain goods face import restrains due to their country of origin. Understanding this could help you avoid unexpected hiccups.

5. Authenticity Assurance: Establishing the country of origin affirms your authenticity and compliance with international trade laws.

Now, let's dive into the specific trade relationships Greece and Vietnam share:

1. The EU-Vietnam Free Trade Agreement established in August 2020 opens doors for massive import tax redemptions.

2. Vietnam agrees to eliminate 99% of its import duties over a 10-year period, spelling lower costs or even exemptions for your imports.

For specific import inhibitions, check the European Commission's Import Conditions database. This valuable tool keeps you aware of restrictions and helps you make an informed decision. Remember, knowledge is power in successful importation!

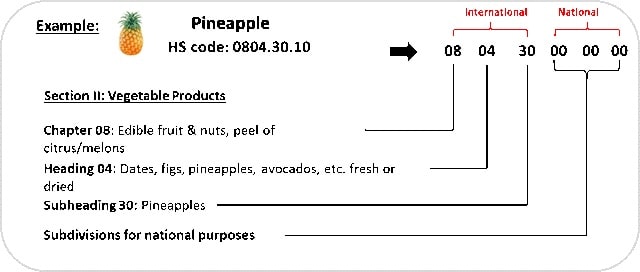

Step 2 - Find the HS Code of your product

Understanding the Harmonized System Code (HS Code) of your product is key to successfully shipping your goods internationally. The HS Code is a universal classification system for products created by the World Customs Organization. Each product has a unique HS Code that helps customs officials to recognize what the products are, what tariffs apply, and if there are any import/export restrictions.

Ordinarily, your supplier would be able to provide you with the HS Code since they are thoroughly familiar with their products and the corresponding regulations. However, if that's not possible, don't worry. There's an easy step-by-step way to find the HS Code of your goods.

Your first step is to utilize an HS lookup tool. One reliable online option is the Harmonized Tariff Schedule.

Next, enter the name of your product into the search bar provided on the website.

Following that, look through the Heading/Subheading column where you'll find the HS Code associated with your product.

A point of caution though - the choice of an HS Code requires precision. Inaccurate coding can lead to unwanted delays and potentially even fines due to misdeclaration. Hence, you must make sure that the HS Code you choose absolutely corresponds with your product.

Wrapping up, for a clearer understanding of HS codes, here's an infographic showing you how to read an HS code. Learning this will smooth your journey in shipping goods internationally.

Step 3 - Calculate the Customs Value

Sure, you might be wondering if the customs value is just the product's cost. It's a little more complex, yet fully navigable. This represents your imported goods’ value, including the product price, international shipping cost, and insurance cost – charmingly acronymized to CIF value. Here's how it works: if your product from Vietnam costs $1000, the shipping charges are $200 and insurance is $50, then your customs value for the Greek Customs Authority is $1250 (not just the $1000 product cost). This value is pivotal while determining import duties, so getting this right helps avoid any surprises with your shipment. It's like getting a full price tag for your imported goods, no hidden charges!

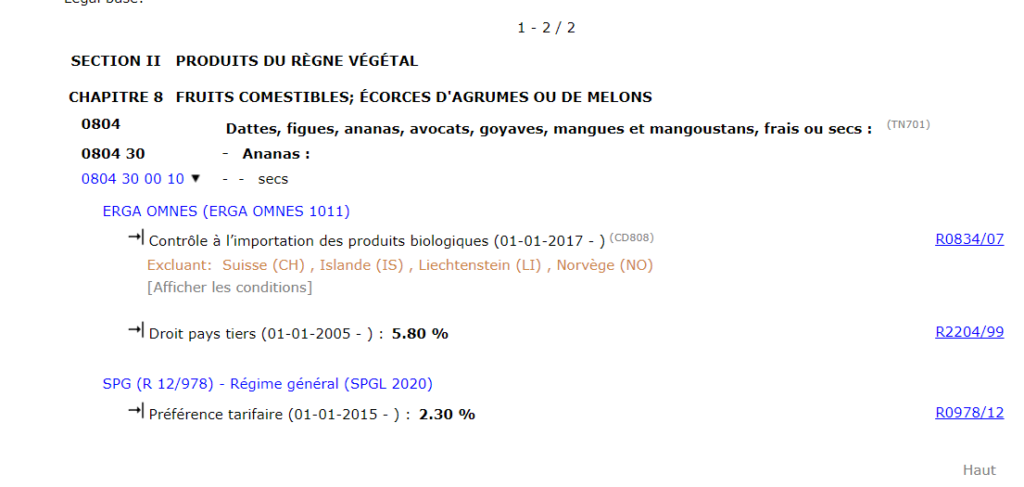

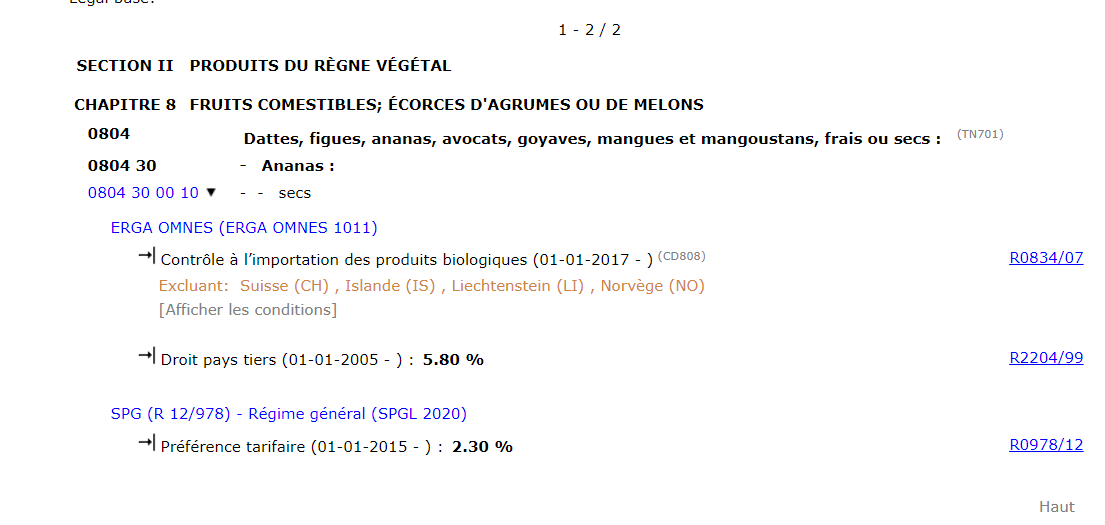

Step 4 - Figure out the applicable Import Tariff

Import tariffs are fees that importing countries levy on foreign goods to protect their local industries from competition or generate revenue. In Greece, which, as part of the European Union, follows the Common Customs Tariff (CCT).

To identify the applicable import tariff for goods imported from Vietnam, one needs to use the TARIC System - European Customs. By entering the Harmonized System (HS) code - a standardised coding system for commodities - and specifying the country of origin, you can check the duties and taxes applied to your product.

For instance, if you're importing footwear from Vietnam with an HS code of 640399, you might observe a tariff rate of 10%. If the Cost, Insurance, and Freight (CIF) values sum up to $1000, your import duty would be $100 (10% of $1000), excluding other taxes.

These steps and the TARIC tool provide valuable insights into your potential outlays, empowering you with the ability to plan appropriately and efficiently while staying compliant with customs regulations. However, be aware that rates can change as part of trade agreement negotiations or other changes in regulations. Keep your research up to date to ensure a smooth importing process.

Step 5 - Consider other Import Duties and Taxes

Beyond standard tariffs, you'll often find additional import duties determined by the nature of the product and its country of origin. For instance, products like tobacco or alcoholic beverages manufactured in Vietnam may attract an excise duty, a tax levied on certain goods considered harmful or linked to health issues.

Anti-dumping duties are another cost, imposed to protect domestic industries from foreign goods priced below fair market value. For example, if Vietnamese steel is being sold at incredibly low prices in Greece, an anti-dumping duty might be applied to level the playing field.

However, the most significant additional duty you'll likely encounter is the Value Added Tax (VAT). In Greece, the standard VAT rate is 24%, applicable to the CIF price (Cost, Insurance, Freight) plus duty. So, if your shipment's CIF price is $1,000 and the duty is $100, your VAT would be $264 ($1,100 24%).

Keep in mind, these are illustrative figures; actual rates may vary. It's crucial to accurately calculate these duties to avoid pitfalls in your import process and ensure your venture remains profitable. A trusted freight forwarder can aid in navigating these complexities, ensuring your goods arrive safely and cost-effectively.

Step 6 - Calculate the Customs Duties

Calculating the Customs Duties for your goods from Vietnam to Greece involves three potential components: Customs Value, VAT, and anti-dumping taxes. Let's clarify each with examples.

Example 1 (Customs Duties only): If your consignment has a customs value of $10,000, and the duty rate is 5%, the customs duty payable would be $500.

Example 2 (Customs Duties and VAT): If your shipment worth $20,000 attracts a 5% duty rate and 24% VAT, first calculate the duty ($20,0005% = $1,000), then VAT is charged on the customs value plus duty ($21,00024%= $5,040). Total amount payable is $1,000 (Duty) + $5,040 (VAT) = $6,040.

Example 3 (Customs Duties, VAT, anti-dumping taxes, Excise Duty): For a parcel valued at $30,000 with a duty rate of 5%, VAT 24%, anti-dumping tax 12%, and Excise Duty of 3%, calculate duty and Vat as above, add the anti-dumping tax ($30,00012%= $3,600), and calculate Excise duty on the total of customs value, duty, VAT and anti-dump ($34,2003%=$1,026). Total payable is $10,666.

Remember, FNM Vietnam's customs clearance services ensure you're never overcharged. Let us handle all your customs obligations everywhere. Contact us to receive a free quote within 24 hours.

Does FNM Vietnam charge customs fees?

As a customs broker in Vietnam and Greece, FNM Vietnam manages the tedious process of customs clearance, not duties or taxes. Those are separate fees paid directly to the government. We charge for our brokerage services, using our expertise to navigate import/export regulations on your behalf. You'll receive official documents from customs, guaranteeing transparency that you only paid government-mandated charges. For example, think of it as hiring a tour guide: you pay for their guidance and knowledge, not the cost of museum tickets or local taxes - those costs are separate!

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs

Official website: https://www.customs.gov.vn/

Greece Customs

Official name: Hellenic Republic Ministry of Finance - Customs and Excise Service

Official website: https://www.gov.gr/en/

Required documents for customs clearance

Managing paperwork for customs can be daunting. This section will make things easier by demystifying essential documents such as the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Let's unlock a smooth customs clearance process together.

Bill of Lading

The Bill of Lading is your cargo travel buddy, marking the exact moment your shipment becomes legally yours upon arrival in Greece from Vietnam. Think of it as a baton in a relay race, smoothly transitioning ownership. Accompanied with an electronic or 'telex' release, you're ready to jump the customs queues, saving you time in that race against the clock. But hey, don't confuse it with the AWB, that's reserved for your air shipments. So, before you pop the champagne to celebrate your goods' arrival, make sure you've got your Bill of Lading sorted. Time for hassle-free customs, right?

Packing List

The Packing List is your safety net in the shipping world, especially when navigating the trade waters between Vietnam and Greece. Think of it as the roll call for your goods. It accurately lists what you're shipping, the quantity, a description, and often the weight. For instance, are you shipping 100 handmade bamboo lanterns? Your Packing List gets down to the nitty-gritty: size, material, net and gross weight, package count, etc.

Creating an accurate Packing List might seem daunting, but it's the key to a smooth customs clearance, whether you've opted for sea or air freight. Customs officers rely on this document for their vital checks. Remember, a superficial or incorrect Packing List can cause delays or even penalties. So, accuracy is paramount. Don't rush and double-check your list, whether you're exporting souvenirs from Hoi An or importing Greek olive oil. A well-prepared Packing List can pave the way for smooth, hassle-free shipping between Vietnam and Greece.

Commercial Invoice

Ready to send your goods from Vietnam to Greece? An accurate Commercial Invoice is key. It should detail vital information like the exact nature and quantity of goods, their value, and terms of delivery, all written in English. Here's a tip: align your invoice information with other shipping documents. Any mismatch can cause delays during customs clearance. Let's say 10 cartons of silk garments on Bill of Lading must reflect in the invoice too. Keep in mind, the Greek customs refer to this invoice for calculating duties. Therefore, ensure your invoice is meticulously filled. A flawless Commercial Invoice is your license for a smooth logistical journey. Happy Shipping!

Certificate of Origin

Getting goods from Vietnam to Greece isn't as easy as packing a box and sending it off. That shipment must have a valid Certificate of Origin. This document clarifies where your goods were manufactured—it's like a passport for your products. It verifies the 'birthplace' of your imports or exports and is crucial for obtaining preferential customs duty rates. For instance, suppose your shipment includes furniture handcrafted in Ho Chi Minh City. Without the Certificate stating Vietnam as its country of origin, you might lose out on reduced tariffs under trade agreements. Remember, every penny counts in business—don't let oversight cost you. Thus, ensure that your Certificate of Origin is in order to streamline your shipping process from Vietnam to Greece.

Certificate of Conformity (CE standard)

Shipping products from Vietnam to Greece? Here's the skinny on the Certificate of Conformity (CE standard). This vital document demonstrates your goods meet the health, safety, and environmental standards set by the European Union. Unlike general quality assurance that confirms your goods meet your company's internal standards, a CE mark is like a passport for your products in Europe. The U.S. equivalent would be the FCC Declaration of Conformity. Do note that if you're dealing with certain high-risk goods, you might need an independent conformity assessment from a Notified Body. Make sure to review the Official Journal of the European Union to check if your products require this.

Your EORI number (Economic Operator Registration Identification)

Securing an EORI number is paramount to your shipping operations between Vietnam and Greece. This unique identifier enables seamless tracking of imports and exports within the EU. Think of it as your company's ID in international trade, ensuring hassle-free transactions every step of the way. Registering for an EORI number is not a strenuous process. It's a straightforward online procedure, handled within your home EU country, streamlining your future international exchanges. For instance, if you're a Greek olive oil producer exporting to Vietnam, handling customs procedures becomes much smoother with your EORI number. Remember, it's not optional but an essential part of doing business abroad within the EU. Don't let your shipments hit a snag - register for your EORI number ASAP and keep your trade moving smoothly.

Get Started with FNM Vietnam

Tired of dealing with complex customs paperwork? Let FNM Vietnam ease your worries. Our experienced team will streamline every step of the customs clearance process for your Greece-Vietnam shipping needs. Say goodbye to customs delays and hello to hassle-free transport. Don't hesitate-contact us now for a free, no-obligation quote within just 24 hours!

Prohibited and Restricted items when importing into Greece

Mastering the peculiarities of import restrictions to Greece can be a tough task. Whether it's machinery or olive oil, rules apply and tripwires abound. It's not just about legality but possible penalties too. Let's help you avoid any unpleasant surprises.

Restricted Products

- Pharmaceuticals and Cosmetic Products: These require a license from the National Organization for Medicines.

- Food Products and Beverages: You'll need a permit from the Hellenic Food Authority (EFET).

- Tobacco Products: If you're dealing with these, the competent authority is the Ministry of Finance.

- Live Animals and Animal Products: You'll need to grab a license from the Hellenic Ministry of Rural Development and Food.

- Weapons and Ammunition: This one's a bit tricky, you'd need to secure a permit from the Hellenic Police.

- Alcoholic Products: You need a permit from the General Chemical State Laboratory.

- Artworks and Antiquities: These require a license from the Ministry of Culture and Sports.

- Radiocommunication Equipment: These require a specific authorization by the EETT.

Prohibited products

- Narcotics and Illegal Drugs: All types of narcotics, including marijuana, cocaine, heroin, and methamphetamine are prohibited. Prescription drugs without a proper prescription are also not allowed.

- Offensive Material: Any form of material seen as offensive to Greek customs, culture, or traditions is disallowed. This can include literature, visual media, and products with offensive religious, political, or social symbols or messages.

- Counterfeit Currency and Goods: Counterfeit money and products replicating any Greek or global brands, regardless of their origin, are strictly prohibited.

- Endangered Species Products: Any products made from endangered species, including their body parts or derivatives, are banned. This includes products made from ivory, tortoise shell, rhinoceros horn, etc.

- Explosive and Hazardous Material: Freight containing explosive, hazardous, or radioactive materials cannot be imported. Certain fireworks and pyrotechnic products are also disbarred.

- Firearms and Ammunition: The import of firearms, ammunition, and certain types of weapons is strictly controlled, and without correct permits, these are also considered prohibited.

- Unauthorised Communication Devices: Certain types of communication devices that aren't authorised by Greek telecommunications authorities are not allowed for import, such as certain types of radios, telecommunication devices, etc.

- Human Remains or Ashes: Import of these is strictly prohibited unless necessary legal permissions and paperwork are in place.

- Cultural Artefacts: Greek law prohibits the import of antiquities and cultural artefacts, unless accompanied by appropriate documentation.

- Certain Foods: Various types of meat, poultry, dairy, and their products from certain countries are also on the prohibited list.

Are there any trade agreements between Vietnam and Greece

While no direct Free Trade Agreements (FTAs) between Vietnam and Greece exist currently, both countries have ties through the EU-Vietnam FTA. As a Greek business, you could enjoy low tariffs and other advantages when shipping to Vietnam under this agreement. Additionally, commercial discussions and shared infrastructural investments are in motion, suggesting a positive future for your Vietnam-Greece business and transportation endeavors. Keep an eye on developments to gain competitive edges!

Vietnam - Greece trade and economic relationship

Vietnam and Greece established diplomatic relations on 15 April 1975. The two countries share many similarities in terms of long history, culture and important geopolitical positions. In March 2007, Greece opened an embassy in Hanoi. On 26 March 2012, Vietnam officially opened its embassy in Athens. At present, economic relations between Vietnam and Greece are still modest, but bilateral trade has grown quite rapidly over the last five years. In particular, Vietnam's exports to Greece have risen sharply and Vietnam has consistently posted a high trade surplus. In 2021, the value of bilateral trade reached more than USD 446 million, up 33% year-on-year.As of June 2022, Vietnam's exports reached a value of US$23.6 billion, whereas imports from the EU totaled US$8.1 billion. This resulted in a trade surplus of US$15.5 billion, marking a 39 percent increase compared to the corresponding period in 2021.

Your Next Step with FNM Vietnam

Ever felt overwhelmed by the complexities of international shipping? At FNM Vietnam, we understand these challenges. Let us streamline your shipping experience from Vietnam to Greece. With skilled expertise in customs clearance, logistics, and transportation, we make the journey straightforward. Take the first step towards hassle-free shipping today - get in touch with us!

Additional logistics services

Dive into our wide-ranging logistics lineup - FNM Vietnam handles everything, from warehousing to supply chain management. Here’s your chance to streamline operations with a single trusted partner. Let us untangle the complexity so you can get on with business.

Warehousing and storage

Discovering reliable warehousing can seem like scaling Mt. Olympus. Especially when goods require specific conditions, like temperature control for your Vietnamese coffee beans. No need to sweat it, we've got you covered with a network of dependable warehousing solutions across Vietnam and Greece. Get sorted at our one-stop shop Warehousing.

Packaging and repackaging

The right packaging determines if your goods arrive safe at Greek ports from Vietnam. Getting a reliable partner who nails down the specifics, from palletizing to using crates for fragile items, is key. Just imagine avoiding those costly product damages and delays. Check out our dedicated page, Freight Packaging, for the full scoop.

Cargo insurance

Think of cargo insurance as your lifeline when unpredictable events strike during shipping. It's different from fire insurance, which only protects against, well, fire. Imagine this, your shipment gets caught in tempestuous seas resulting in damage or loss, cargo insurance got you covered. Or suppose it's pilfered during transit; again, cargo insurance steps in. This is proactive risk management, ensuring your goods arrive safely regardless. To safeguard your business interests further, visit our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Looking to manufacture in Asia or East Europe? FNM Vietnam simplifies the entire sourcing journey for you. We hunt down the perfect suppliers and streamline the procurement process, all whilst breaking down language barriers. Imagine your business expanding globally with ease and confidence. More info on our dedicated page: Sourcing services

Personal effects shipping

If you're moving from Vietnam to Greece (or vice versa) and have fragile or bulky items to ship, you'll need some extra care. We specialize in Personal Effects Shipping, expertly handling your valuable possessions - from Grandma's delicate china to that bulky but essential dining table. Rest easy knowing we've got it covered. Want in-depth information? Visit our dedicated page: Shipping Personal Belongings.

Quality Control

Keeping your goods in check before shipping from Vietnam to Greece is invaluable! Quality inspections eliminate nasty surprises like faulty items or non-compliance issues. Just imagine, a batch of bespoke ceramic vases arriving, unblemished and meeting EU standards, all thanks to meticulous inspections before their sea voyage. Dodge loss, gain peace of mind! More info on our dedicated page: Quality Inspection

Product compliance services

Recognizing the labyrinth of regulations during international shipping is crucial. Our Product Compliance Services go the extra mile to ensure your goods adhere to stringent rules. We employ advanced lab testing to gain imperative certifications, ensuring a smooth journey for your goods and zero hiccups at the customs check. A real-world example? Consider a toy manufacturer shipping their goods: without the correct safety compliance, delays could emerge. With our services, rest easy knowing stability is at the heart of your operations.

FAQ | For 1st-time importers between Vietnam and Greece

What is the necessary paperwork during shipping between Vietnam and Greece?

For a smooth shipping experience from Vietnam to Greece, we handle most of the paperwork. The essential documents you'll be entrusted with are the packing list and the commercial invoice. We take care of the bill of lading if you choose sea freight, or the air way bill for air freight. Do note that additional documentation like Material Safety Data Sheets (MSDS) or certifications may be necessary, depending on the nature of your goods. Rest assured, we'll guide you through any extra requirements. Your journey from Vietnam to Greece can be a breeze with us at FNM Vietnam.

Do I need a customs broker while importing in Greece?

Yes, a customs broker is generally recommended when importing goods into Greece. This is largely due to the complexity of the process and the required documentation. We at FNM Vietnam often step in and represent your cargo during customs procedures for most shipments. Leveraging the expertise of a customs broker like us can help navigate the intricate details, ensure the appropriate documents are in order, and ultimately make the import process smoother and more efficient.

Can air freight be cheaper than sea freight between Vietnam and Greece?

Indeed, we can't provide a generic answer as it relies on factors like route, weight, and volume. However, if your cargo is under 1.5 Cubic Meters or weighs less than 300 kg (660 lbs), air freight can become a competitive option when shipping from Vietnam to Greece. Rest assured, your dedicated account executive at FNM Vietnam will always offer you the most cost-effective and suitable shipping method tailored to your specific needs. We're here to simplify the complexity of international logistics for you.

Do I need to pay insurance while importing my goods to Greece?

While importing your goods to Greece, you're not obligated to pay for insurance. Nevertheless, we at FNM Vietnam strongly advise considering it. The world of freight forwarding can be unpredictable with scenarios such as damage, loss, or theft potentially meeting your cargo. When you insure your goods, you're basically securing your investment against these unforeseen circumstances, offering a safety net to navigate international shipping stress-free. Having said that, the decision ultimately rests on you. Take your business needs, budget, and risk tolerance into account before making this choice.

What is the cheapest way to ship to Greece from Vietnam?

Cost-effective shipping from Vietnam to Greece usually involves choosing sea freight, particularly for heavier and less time-sensitive cargo. However, travelling such a distance could take a considerable amount of time, usually around 3-4 weeks. For urgent or lightweight goods, you may have to consider air freight, which, although more expensive, offers speedy delivery in about 6-7 days. We at FNM Vietnam will help select the best option based on your needs and budget.

EXW, FOB, or CIF?

We understand the confusion that comes with choosing between EXW, FOB, or CIF. The ideal option mainly depends on your relationship with your supplier. However, bear in mind that most suppliers are not logistics experts. That's why at FNM Vietnam, we suggest letting a professional agent handle the international freight and the destination process. Quite often, suppliers sell under EXW (at their factories' door) or FOB (including all local charges up to the origin terminal). Regardless, our team offers a comprehensive door-to-door service to streamline your shipping needs and ensure a smooth process. So whether it's EXW, FOB, or CIF, FNM Vietnam is here to assist.

Goods have arrived at my port in Greece, how do I get them delivered to the final destination?

After your goods arrive at the Greece port, if they're under CIF/CFR incoterms, you'll need a custom broker or freight forwarder for clearance and final delivery. Import charges will be your responsibility. However, if you want an all-in-one service, we offer DAP incoterms; we handle everything. To confirm these details, check with your dedicated account executive at FNM Vietnam.