Sure, shipping goods from Vietnam to Saudi Arabia might seem about as complex as trying to teach your dog how to take selfies - at first! But then again, challenges like understanding rates, transit times, and customs regulations can make it quite a daunting task. This is where our detailed guide comes to the rescue. We'll delve deep into all possible freight options - be it air, sea, road, or rail. From tackling customs clearance to untangling the web of duties and taxes, we've got all the information you need. Plus, we've packed in plenty of advice tailored for your business's unique shipping requirements. If the process still feels overwhelming, let FNM Vietnam handle it for you! We are your experienced ally that takes care of every step, turning any logistic challenges your business faces into resounding success stories.

Which are the different modes of transportation between Vietnam and Saudi Arabia?

Choosing the ideal transport method for shipping goods from Vietnam to Saudi Arabia is a bit like selecting the best vehicle for a road trip. Why drive a regular car through a desert when a rugged 4x4 is a better match for the terrain? Same principle applies here as both countries are quite far apart and have various international boundaries in-between. So, air and sea become our 4x4s of freight transport. The right choice truly depends on your specific shipping needs, the type of cargo, and how quickly you need it delivered. Stick around to uncover your perfect shipping 'vehicle'.

How can FNM Vietnam help?

Sailing the sea of international shipping? Fear not, FNM Vietnam handles all logistics, customs, and admin headaches for you. We’re experts in transporting goods between Vietnam and Saudi Arabia. Ready for a smoother shipping journey? Get a free estimate in under 24 hours or chat with our consultants at no cost. Contact us now!

![]()

FNM Vietnam Tip: Sea freight might be the best solution for you if:

- You're moving big loads or large items. Sea freight offers roomy, cost-effective solutions.

- Your shipment isn't time-critical. Ocean routes take longer but are often more reliable.

- Your supply chain links major ports, tapping into a broad network of sea lanes.

Sea freight between Vietnam and Saudi Arabia

Bridging the trade gap between Vietnam and Saudi Arabia, ocean shipping weaves an essential path of commerce. Spot the bustling ports of Ho Chi Minh City in Vietnam and the sprawling port of Jeddah in Saudi Arabia - they are living testimonies of this bustling business relationship. Yet, transporting your high-volume goods across these waters might feel like threading a needle in the dark. Although sea freight offers a budget-friendly lifeline, its slower pace often tests patience and planning.

Think of it as planning a family road trip. The longer duration means more chances of unexpected detours and breakdowns. This is exactly what many businesses face when they voyage from Vietnam to Saudi Arabia. Missteps and misunderstandings in customs procedures, regulatory compliance, and documentation come up frequently. Yet, the trip can turn from dreadfully daunting to smoothly sailing with the right guidance which we unpack in this section. With our best practices and specifications at your disposal, unlock the potential of a headache-free shipping experience.

Main shipping ports in Vietnam

Location and Volume: Situated in Ho Chi Minh City, the Port of Saigon is crucial for trade in Southeast Asia, boasting a shipping volume of over 5 million TEUs.

Key Trading Partners and Strategic Importance: The port's major trading partners include countries like China, South Korea, and the United States. It serves as the main commercial gateway for the Southern region of Vietnam, with significant strategic importance due to its proximity to the Mekong Delta.

Context for Businesses: If you're exploring potential in Asian markets or looking at cost-efficient routes to the US, the Port of Saigon could prove advantageous given its bustling trade routes and extensive network.

Location and Volume: Located in Da Nang, central Vietnam, this port is recognized as the third largest port in the country, with a shipping volume of approximately 500,000 TEUs.

Key Trading Partners and Strategic Importance: Da Nang Port maintains strong trade relationships with countries in Asia, particularly China, South Korea, and Japan, and is noted for its multi-modal links, including railway networks extending throughout Vietnam.

Context for Businesses: If your business is looking to gain a strong foothold in the markets of Central Vietnam or aims to enhance seamless transport chains, considering the Port of Da Nang in your logistics strategy could be beneficial.

Location and Volume: The Port of Hai Phong, based in the northern city of Hai Phong, is the second largest port in Vietnam, facilitating a shipping volume of over two million TEUs.

Key Trading Partners and Strategic Importance: Key trading partners include China, Japan, and South Korea. Its strategic importance is underlined by its function as a major hub, not only for maritime transport but also for rail and road transport systems.

Context for Businesses: If your trade needs revolve around northeast Asian markets, utilizing the Port of Hai Phong could streamline your logistics, with its impressive multi-modal connectivity.

Port of Quy Nhon:

Location and Volume: Quy Nhon Port is in Binh Dinh province, central Vietnam. It's an up-and-coming port with a shipping volume exceeding 400,000 TEUs.

Key Trading Partners and Strategic Importance: Its main trading partners are China and South Korea. Quy Nhon's potential as a developing port regionally is increasingly recognized.

Context for Businesses: If your business is seeking emerging markets within Southeast Asia or exploring under-served areas, the Port of Quy Nhon offers interesting opportunities, given its growing prominence.

Port of Cam Ranh:

Location and Volume: Located in Khanh Hoa province, southern Vietnam, Cam Ranh is primarily a naval port, with limited commercial shipping volumes but potential for growth.

Key Trading Partners and Strategic Importance: It currently serves regional maritime domestic needs but aims to grow its international reach, potentially emerging as a key player in logistics.

Context for Businesses: For businesses that anticipate a long-term presence and growth in Vietnam, watching the development of the Port of Cam Ranh could present future opportunities leveraging its strategic geographic position.

Port of Vung Tau:

Location and Volume: Based in Ba Ria–Vung Tau province, southern Vietnam, Vung Tau is a medium-sized port handling close to a million TEUs.

Key Trading Partners and Strategic Importance: Vung Tau has its principal trading partnerships with Australia, the US, and China. As an important shipping point for export-related industries, it gains strategic relevance.

Context for Businesses: If your company is engaged in industries like manufacturing or heavy industries with direct exports, integrating the Port of Vung Tau into your shipping strategy could present distinct advantages.

Main shipping ports in Saudi Arabia

King Abdullah Port

Location and Volume: Located in King Abdullah Economic City along the central Red Sea coast, King Abdullah Port is critical for trade and economic growth in Saudi Arabia. The port boasts a shipping volume of over 2.3 million TEU annually.

Key Trading Partners and Strategic Importance: China, the United States, and India are the port’s major trading partners. Furthermore, King Abdullah Port is considered the second fastest-growing port globally, indicating its strategic importance and potential.

Context for Businesses: If your business is aiming to tap into the high-growth markets of the Middle East, King Abdullah Port, with its advanced technology and rapid growth, offers you an impressive logistical edge.

Location and Volume: Situated on the Red Sea in Jeddah, Jeddah Islamic Port is the busiest port in the Kingdom and handles over 59% of Saudi Arabia’s sea imports, with a shipping volume of approximately 4.3 million TEU.

Key Trading Partners and Strategic Importance: The port's key trading partners include China, India, and the United States. As the largest seaport on the Red Sea, Jeddah Islamic Port is strategically important for access to European and African markets.

Context for Businesses: If your business is focused on maximizing import efficiency into Saudi Arabia, then you should consider tapping into Jeddah Islamic Port due to its significant import handling capability.

Location and Volume: Situated on the Arabia Gulf in the Eastern Province of the Saudi Arabia, Dammam Port is critical for facilitating trade between the Gulf countries and the Eastern region of the Kingdom, with a shipping volume of about 1.5 million TEU.

Key Trading Partners and Strategic Importance: Dammam Port key trading partners include India, China, and Singapore. The port's strategic location and its proximity to the Kingdom’s central and Eastern provinces make it a critical logistics hub.

Context for Businesses: If your goal is to facilitate trade with the Gulf countries or the far eastern region, Dammam Port, with its strategic location and access, can be a robust part of your logistics planning.

Ras Tanura Port

Location and Volume: Located along the Persian Gulf in the Eastern Province, Ras Tanura Port specializes in oil shipping, serving as the oldest and largest oil port in Saudi Arabia. It handles the majority of the country's petroleum exports.

Key Trading Partners and Strategic Importance: The U.S., Japan, and South Korea are major trading partners, accounting for most oil export. Ras Tanura's strategic importance arises from its role as a leading global oil shipping hub.

Context for Businesses: If you're involved in the petroleum industry and require a reliable and effective shipping partner, Ras Tanura Port, boasting a significant petroleum handling mechanism, can be a critical component of your supply chain.

Jazan Port

Location and Volume: Located on the southwestern coast of Saudi Arabia, near the border with Yemen, Jazan Port primarily focuses on agricultural imports and exports and has a shipping volume of around 500,000 TEU.

Key Trading Partners and Strategic Importance: Its main trading partners are within the GCC countries and around the Red Sea region. The strategic importance of Jazan Port lies in its proximity to Africa and its role in facilitating the Kingdom's agricultural trade.

Context for Businesses: If your interest lies in agricultural products and you aim to exploit markets in the African region and the GCC, then Jazan Port, with its dedicated agricultural facilities, is another route worth considering.

Yanbu Commercial Port

Location and Volume: Yanbu Commercial Port, located on the Red Sea coast in the Al Madinah Province, is a key shipping point for industries such as petrochemicals and minerals, with a shipping volume of about 200,000 TEU.

Key Trading Partners and Strategic Importance: China, the United States, and Singapore are some of its top trading partners. Yanbu Commercial Port is strategically important due to its petrochemical and mineral industries.

Context for Businesses: If your ambition is to trade in petrochemicals or minerals, then Yanbu Commercial Port, with its booming petrochemical industry, could be an optimal platform for you.

Should I choose FCL or LCL when shipping between Vietnam and Saudi Arabia?

Choosing between full container load (FCL) and less than container load (LCL), also known as consolidation, can make a world of difference to your import-export business. This choice impacts not only your bottom line but also the speed of delivery and the success of your shipping from Vietnam to Saudi Arabia. Knowing the difference and choosing wisely can empower your business to thrive in the global competitive landscape. Get ready to gain insights to facilitate your decision process, and remember - the right choice can redefine your shipping strategy!

LCL: Less than Container Load

Definition: LCL, Less than Container Load, is the choice of shipment when your cargo doesn't completely fill a standard-sized container. It means sharing a container with others, grouping smaller shipments together.

When to Use: LCL is ideal when your freight's volume is less than 13 to 15 CBM (cubic meters). It's more flexible for low-volume shipments because you don't have to wait until you have enough cargo to fill a container.

Example: For instance, a furniture manufacturer in Vietnam may need to send a small batch of chairs to a distributor in Saudi Arabia. The shipment is too large for express air freight but too small to justify a full container. This is where LCL shipment shines—it can get the cargo delivered cost-effectively and on time.

Cost Implications: LCL freight can be more cost-effective compared to other options. You only pay for the exact volume of space utilised by your cargo in the shared container. But, it's important to note that LCL often has more handling involved, which can translate to additional charges. Hence, it's vital to factor in all costs to get a comprehensive LCL shipping quote.

FCL: Full Container Load

Definition: FCL (Full Container Load) shipping refers to when a single container is used solely for your goods, providing exclusivity and privacy. This is a common choice for larger shipment volumes.

When to Use: Typically, FCL becomes the go-to choice when the volume of the cargo is more than 13/14/15 CBM. This is primarily due to economics of scale as FCL shipping can be more affordable for heavier cargo. Also, FCL container guarantees extra safety as the container is sealed off from origin to destination, reducing the risk of goods damage.

Example: Let's say you own a business supplying home appliances. Your demand in Saudi Arabia suddenly spikes, so you decide to export a large number of goods from your warehouse in Vietnam. The total volume is say, 25 CBM. In this case, a 20'ft container or even a 40'ft container would be your ideal options to ensure the safety and affordability of transportation.

Cost Implications: The expenses can slightly fluctuate given the nature of the goods and the required shipping journey. However, keep in mind that the higher the volume of your shipment, the less your cost per unit will be. For budget, ensure to request an FCL shipping quote from your freight forwarder for accuracy.

Say goodbye to shipping headaches!

With international shipping complexities, making the right choice can be tough. Let FNM Vietnam, your dependable freight forwarder, make cargo shipping effortless. Our ocean freight experts evaluate critical factors- such as cargo size, shipping costs, and time sensitivity- to advise whether consolidation or full container is your best bet between Vietnam and Saudi Arabia. Ready to make shipping a breeze? Contact us now for a free estimation.

How long does sea freight take between Vietnam and Saudi Arabia?

Typically, sea freight from Vietnam to Saudi Arabia takes roughly 18 to 32 days. Keep in mind, however, these transit times are influenced by a number of factors including the specific ports used, the weight of the cargo, and the nature of goods being shipped. For a more personalised quote that suits your requirements, it might make sense to reach out to freight forwarders like FNM Vietnam.

Here's a quick glance at the average transit times between the major freight ports of both countries:

| Vietnam Ports | Saudi Arabia Ports | Average Transit Time (Days) |

| Ho Chi Minh | Jeddah | 20 |

| Hai Phong | King Abdullah | 23 |

| Da Nang | Dammam | 19 |

| Qui Nhon | Yanbu | 21 |

*Please keep in mind these are only averages, actual times may vary.

How much does it cost to ship a container between Vietnam and Saudi Arabia?

The cost of shipping a container from Vietnam to Saudi Arabia varies widely due to factors like point of loading, destination, carrier, nature of goods, and monthly market fluctuations. Therefore, exact ocean freight rates are tricky to pin down. For instance, you may be looking at anywhere between $50 to $500 per CBM. But don't fret over the uncertainty of shipping cost! Our team of skilled shipping specialists are on hand to work closely with you, ensuring we deliver tailored, cost-effective quotes on a case-by-case basis. Your convenience is our priority, and we're committed to providing the best possible rates for your unique needs.

Special transportation services

Out of Gauge (OOG) Container

Definition: OOG containers are oversized shipping boxes designed for out of gauge cargo, pieces too large to fit in standard containers.

Suitable for: Large machinery, industrial equipment, oversized spare parts, construction materials and other loose cargo loads.

Examples: Shipping a large machinery component from a factory in Vietnam to an industrial site in Saudi Arabia.

Why it might be the best choice for you: An OOG container is an excellent choice if your cargo cannot be disassembled and exceeds the dimensions of regular shipping containers.

Break Bulk

Definition: Break bulk refers to the transportation method where goods are packed individually, palletized or bagged, before being loaded directly onto the vessel.

Suitable for: Diverse, non-containerized goods including machinery, construction materials, or bagged or palletized cargo.

Examples: Shipping a collection of mixed goods, such as furniture pieces and household goods from Vietnam to Saudi Arabia.

Why it might be the best choice for you: Without the size restrictions of containers, break bulk can be utilized for large, awkwardly shaped, or varied sets of goods. It offers flexibility that's ideal for atypical shipments.

Dry Bulk

Definition: Dry bulk invoices transporting unpackaged goods in large quantities in the cargo hold of a ship, such as coal, grain, or metal ores.

Suitable for: Transporting raw material including grains, coal, ores, cement and more.

Examples: A mining company shipping a mass amount of bauxite from Vietnam to Saudi Arabia.

Why it might be the best choice for you: Opt for dry bulk when dealing with loose, raw materials that can be scooped or poured directly into a vessel's hold.

Roll-on/Roll-off (Ro-Ro)

Definition: A Roll-on/Roll-off (Ro-Ro) vessel is designed to carry wheeled cargo such as cars, trucks, trailers, and railroad cars that are driven on and off the ship on their own wheels.

Suitable for: All types of mobilized goods including cars, trucks, semi-trailer trucks, trailers, and railroad cars.

Examples: A Vietnamese manufacturer shipping an order of motorbikes to a distributor in Saudi Arabia.

Why it might be the best choice for you: If your cargo is self-mobilizing or can be rolled onto the Ro-Ro vessel, this method is a seamless, cost-effective and safe means of transport.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used to transport goods requiring temperature-controlled conditions.

Suitable for: Perishables including fruits, vegetables, dairy products, medicines, and other items that need a controlled temperature environment.

Examples: An exporter sending a shipment of temperature-sensitive pharmaceuticals from Vietnam to Saudi Arabia.

Why it might be the best choice for you: If maintaining the temperature of your goods is critical to their quality or safety, reefer containers are indispensable. They offer reliable climate control, ensuring your product reaches its destination at its peak.

Your business's shipping needs are unique and require personal attention to detail. Please feel free to reach out to our team at FNM Vietnam for a tailored solution. Simply provide us with your shipping details, and we will provide a free shipping quote in less than 24 hours.

FNM Vietnam Tip: Air freight might be the best solution for you if:

- You're on a tight schedule. Air freight delivers speed unmatched by other modes.

- Your cargo is under 2 CBM, a good fit for air's smaller capacity.

- Your destination is off the usual routes, making air's global network a key asset.

Air freight between Vietnam and Saudi Arabia

Shipping goods from Vietnam to Saudi Arabia? Air freight offers a speedy and reliable solution, particularly for smaller, high-value consignments. Imagine sending off compact electronic parts or designer fashion items; it's like jet-setting them to their destination. You get the products there faster without breaking the bank.

However, the air freight game isn't without its pitfalls. Numerous shippers unknowingly dig themselves into costly holes due to oversights like incorrect weight calculations. Think of it like baking a cake with the wrong ingredient measures – it will not turn out as expected, and you'll pay more for it. We'll explore these costly mistakes and share best practices to avoid getting your fingers burnt in this aspect of international trade.

Air Cargo vs Express Air Freight: How should I ship?

Wondering whether to choose Air Cargo or Express Air Freight for your Vietnam-Saudi Arabia shipping needs? Here's the skinny: Air Cargo uses space in commercial airliners, while Express dashes your goods to their destination in a dedicated aircraft. Let's dive into these options to uncover which suits your business best.

Should I choose Air Cargo between Vietnam and Saudi Arabia?

Air cargo could be a smart choice if you're shipping goods from Vietnam to Saudi Arabia. Notable airlines such as Vietnam Airlines and Saudia offer regular cargo services, known for their reliability and cost-effectiveness. However, remember, fixed schedules might lead to longer transit times. If your cargo exceeds 100/150 kg(220/330 lbs), this option becomes more intriguing due to its economic and logistic advantages. Check the routes and services on the Vietnam Airlines and Saudia websites for more specifics. Your budget and shipment urgency should drive this decision.

Should I choose Express Air Freight between Vietnam and Saudi Arabia?

Considering shipping goods between Vietnam and Saudi Arabia? Express air freight might be your perfect match, particularly for cargo under 1 CBM or between 100 and 150 kg (220 - 330 lbs). It's a coveted service, used by major international courier firms like FedEx, UPS, and DHL. Practically, express air freight uses specialized cargo planes, exclusive of passengers. This provides a quicker, more direct route for your products, ensuring a fast delivery. If speed is your top priority and your shipment isn't too bulky, this could be your golden ticket. Remember, contacting these courier firms directly can offer valuable insights and streamline your freight forwarding process!

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: With around 1.4 million tons annually, this airport is the busiest in terms of cargo handling among all airports in Vietnam.

Key Trading Partners: China, USA, Japan, and South Korea are among the major trading partners.

Strategic Importance: Located in Ho Chi Minh city, the economic hub of Vietnam, it serves as a vital connection to the dynamic economies of Southeast Asia.

Notable Features: With two passenger terminals and one cargo terminal, Tan Son Nhat International Airport is the best equipped for handling high volumes of goods.

For Your Business: Its high cargo handling capacity and strategic location can ensure your goods reach Southeast Asian markets efficiently and quickly.

Noi Bai International Airport

Cargo Volume: Handling about 700,000 tons of cargo annually, Noi Bai airport is a significant cargo link.

Key Trading Partners: Important trading connections include China, USA, and European Union countries.

Strategic Importance: Being the largest airport in northern Vietnam, Noi Bai facilitates trade with China and other northern Asian countries.

Notable Features: The airport has both domestic and international cargo terminal facilities equipped with comprehensive logistics services.

For Your Business: If your shipping operations are focused on north Asian countries or the EU, using Noi Bai International Airport can be a strategic choice.

Da Nang International Airport

Cargo Volume: Da Nang is a smaller player, with annual cargo volumes of around 50,000 tons.

Key Trading Partners: Key partners include Southeast Asian countries and the USA.

Strategic Importance: As the largest airport in Central Vietnam, the Da Nang airport is vital for businesses looking to ship to the central parts of the country.

Notable Features: The airport is in a strategic position, located on the east–west economic corridor.

For Your Business: Particularly suitable if you need to ship goods to or from the Central and Highland regions of Vietnam.

Cam Ranh International Airport

Cargo Volume: Cam Ranh handles smaller volumes of international cargo, with approximately 10,000 tons of cargo per year.

Key Trading Partners: The major trading routes include Southeast Asian countries and Russia.

Strategic Importance: Located in a tourist hotspot, the airport mainly facilitates import/export of goods related to tourism and seafood.

Notable Features: Providing modern cargo-handling equipment, the airport can ensure secure transport of your goods.

For Your Business: This airport could be beneficial if you're into the tourism and seafood sectors, serving both Russian and local markets.

Can Tho International Airport

Cargo Volume: Handling 15,000 tons of cargo each year, Can Tho is an emerging international cargo player in Vietnam.

Key Trading Partners: Primarily connected with Asian markets such as Taiwan, South Korea, and Thailand.

Strategic Importance: As a hub in the Mekong Delta region, it's crucial for agricultural exports.

Notable Features: The airport is planning expansions to increase its cargo capacity and attract more international airlines.

For Your Business: Can Tho Airport may be your top choice if your business involves agricultural products or is looking to tap into markets in the Mekong Delta region.

Main international airports in Saudi Arabia

King Khalid International Airport

Cargo Volume: Handles over 500,000 metric tons of cargo per year.

Key Trading Partners: Major trading partners include the UAE, Qatar, and China.

Strategic Importance: It is the main entrance to Saudi Arabia's capital, Riyadh, and serves as a prominent transit hub for various Asia-Europe routes.

Notable Features: Boasts dedicated cargo terminals, modern infrastructure, and efficient cargo handling services.

For Your Business: As one of Saudi Arabia's busiest cargo handlers, King Khalid International Airport could be the perfect choice for your Riyadh-bound goods, offering a combination of high cargo volume capacity and robust connections to key partners.

King Abdulaziz International Airport

Cargo Volume: Manages around 290,000 metric tons of cargo annually.

Key Trading Partners: Primary trading partners include India, Egypt, and Germany.

Strategic Importance: Being located in Jeddah, it serves as a gateway to the western region of Saudi Arabia.

Notable Features: Right at the sea, it is perfect for sea-air cargo transfers. It also hosts modern cargo facilities.

For Your Business: If your shipping strategy involves a sea-air combo or targets the western region, including Mecca and Medina, consider routing your cargo through King Abdulaziz International Airport.

King Fahd International Airport

Cargo Volume: Processes over 250,000 metric tons of cargo per year.

Key Trading Partners: Trade flows mainly to Saudi Arabia's Gulf neighbors, as well as to China and Indonesia.

Strategic Importance: As the main airport of Saudi Arabia's Eastern Province, it serves the cargo needs of the region's oil-rich industries and connects to many global locations.

Notable Features: Houses one of the largest airline cargo terminals globally due to its innovative and vast cargo village.

For Your Business: King Fahd International Airport's location and specialization in bulk cargo may enable operational efficiencies for businesses in the oil and gas industry, or those looking to reach Gulf markets.

Prince Mohammad bin Abdulaziz International Airport

Cargo Volume: Handles about 100,000 metric tons of cargo annually.

Key Trading Partners: Key trade connections with the UAE, Egypt, and Turkey.

Strategic Importance: Located in Medina, it serves the large number of Muslim pilgrims during Hajj and Umrah seasons, and is central to the Red Sea region.

Notable Features: New cargo terminal to handle increased cargo capacity and ensure seamless shipping.

For Your Business: Reach North African markets or take advantage of seasonal increases in passenger and consequent cargo traffic through Prince Mohammad bin Abdulaziz International Airport.

Abha International Airport

Cargo Volume: Handles about 50,000 metric tons of cargo per year.

Key Trading Partners: Primarily caters to the UAE and other Middle East countries.

Strategic Importance: Located in Asir Province, it services southern Saudi and Yemen.

Notable Features: While smaller compared to other airports, Abha maintains efficient and simpler cargo operations.

For Your Business: Abha International Airport may be your ideal choice if smaller volumes and simpler processes align with your business needs, especially if your goods are destined for Southern Saudi Arabia and Yemen.

How long does air freight take between Vietnam and Saudi Arabia?

Typically, air freight shipping from Vietnam to Saudi Arabia averages around 6-8 days. However, keep in mind that this time span is not a one-size-fits-all. Factors such as specific departure and arrival airports, the weight of your shipment, and the nature of the items you're shipping can significantly influence these timelines. For accurate and precise transit times tailored to your unique shipping needs, it would be most beneficial to consult with seasoned freight forwarders like FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and Saudi Arabia with air freight?

Shipping an air freight parcel from Vietnam to Saudi Arabia typically falls within a wide bracket of $3 - $8 per kg. The exact rates can vary substantially depending on several factors, including dispatch and arrival airport proximity, package dimensions & weight, and nature of goods. Rest assured, our team prides itself on delivering optimal solutions tailored to your shipping needs, providing bespoke quotations for each requirement. Together, we can navigate the complexities and ensure that you receive the best possible rates. To explore further, contact us and receive your free quote in less than 24 hours.

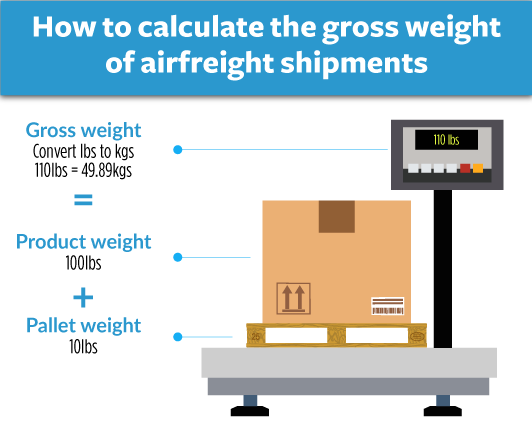

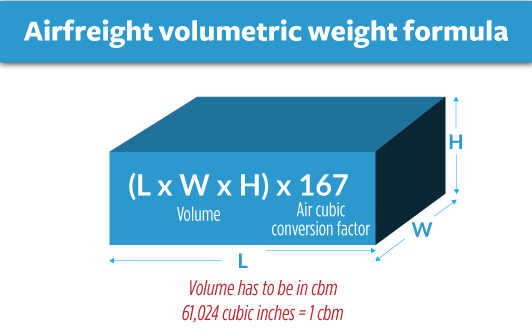

What is the difference between volumetric and gross weight?

In air freight shipping, gross weight refers to the actual weight of your shipment, including packaging. Meanwhile, volumetric weight, also known as dimensional weight, accounts for the size of your shipment along with its weight.

To calculate gross weight in air cargo, cargo is weighed as is and the total is reported. If you have a box of electronics that weighs 20kg, that's your gross weight. In lbs, that's approximately 44 lbs.

Now, volumetric weight is a bit more sophisticated. It's calculated in air cargo by multiplying the dimensions of the package (length, width, height in cm) and then dividing the result by a standard factor, generally 6000. So consider you have a box with dimensions 50cm by 40cm by 30cm. The volumetric weight here is (504030) / 6000, equating to 10kg or approximately 22 lbs.

Express Air Freight uses a similar calculation, with a smaller standard divisor, often 5000. The same box under Express would have a volumetric weight of (504030) / 5000, translating to 12kg or about 26.5 lbs.

These calculations matter because your freight charges hinge on them. Freight companies, whether air or express, determine your billable weight by comparing gross weight with volumetric weight, charging for whichever is greater. This ensures the carrier covers the cost for both the actual weight and the space it takes up on the aircraft.

![]()

FNM Vietnam Tip: Door to Door might be the best solution for you if:

- You seek hassle-free shipping. Door-to-door manages the entire process for you.

- You like one go-to contact. A dedicated agent oversees your door-to-door shipment.

- You aim to limit cargo handling. Fewer transitions mean less risk of damage or loss.

Door to door between Vietnam and Saudi Arabia

Consider Door to Door shipping as your personal courier from Vietnam to Saudi Arabia. It removes the logistical headache, handling everything from pickup to delivery, making it a top option for simplicity and efficiency. Trading between Ho Chi Minh and Riyadh just got easier. Now, let's dive in and unpack the benefits of this all-inclusive service.

Overview – Door to Door

Understanding the hurdles of shipping goods from Vietnam to Saudi Arabia can be a daunting process. Door to Door shipping service proves to be a lifesaver, offering a stress-free solution by managing every step, from pickup to delivery. Although slightly higher in cost, the ease and complete control make it a preferred option for most of FNM Vietnam's clients. It requires minimum input, mitigating complexities of transport modes and customs clearance. However, be mindful of potential delays due to unforeseen issues. By leveraging this service, you can focus on your core business while your goods traverse borders effortlessly.

Why should I use a Door to Door service between Vietnam and Saudi Arabia?

Why wrangle with the logistics nightmares when a Door to Door service can do it for you? Here are five compelling reasons for choosing this service for shipping goods between Vietnam and Saudi Arabia:

1. Stress-Free Logistics: With Door to Door service, you won't have to split hairs over paperwork, customs, or transport arrangements. The freight forwarder handles everything for you, from pickup to destination delivery, which massively simplifies your shipping journey.

2. Accelerated Delivery Speed: In business, time is money. If you have an urgent shipment, this service can ensure timely delivery. Your goods won't be lying around in the warehouse waiting for the next transport; instead, they'll be on the move as soon as possible.

3. Specialized Care for Niche Cargo: If your cargo is complex - say, delicate machinery or medical equipment - it will receive the TLC it needs throughout the journey. Your provider's specialized care can make all the difference in maintaining the integrity of these valuable goods.

4. Enhanced Convenience: Think about the convenience of having someone professional handle everything for you, right from your door in Vietnam to your customer's door in Saudi Arabia. No more trucking aspects to figure out or confusing customs clearance procedures at the destination to understand.

5. Seamless Final Mile Delivery: Once the goods reach Saudi Arabia, the provider's local expertise ensures a smooth, final leg of delivery. This reduces the risk of delays, additional costs, or potential complications just when the shipment is so close to its endpoint.

In essence, Door to Door service lets you take the backseat in operational hassles, so you can focus on what really matters - growing your business!

FNM Vietnam – Door to Door specialist between Vietnam and Saudi Arabia

Navigate seamlessly through the intricacies of international shipping with FNM Vietnam. Offering complete door-to-door solutions, we handle every aspect from packing to customs clearance, across air, sea, road, and rail. With dedicated Account Executives at your service, we make shipping between Vietnam and Saudi Arabia a stress-free experience. Request a free estimate in less than 24 hours or connect with our experienced consultants. Transform your logistic challenges into business power today.

Customs clearance in Saudi Arabia for goods imported from Vietnam

Customs clearance refers to the necessary procedures performed to legally import goods from one country to another, in this case, from Vietnam to Saudi Arabia. Navigating through this complex process is daunting - the threat of unexpected expenses, misunderstood laws, or goods getting stuck in customs is very real. Understanding the nuances involved, including knowledge on customs duties, taxes, quotas, and licenses is essential to avoid such pitfalls. Fear not, the following sections will delve into these aspects in detail, giving a clearer picture of these complexities. If this seems overwhelming, remember FNM Vietnam can lend a helping hand. Anywhere in the world, for any type of good, just provide the origin, value and HS code for an estimated budget. Reach out to our team to make your navigation through this complex process smoother.

How to calculate duties & taxes when importing from Vietnam to Saudi Arabia?

Estimating duties and taxes when importing doesn't have to be complex. In fact, a few key pieces of information can help you calculate this cost with relative ease. Most importantly, you need to know the country of origin, the Harmonized System (HS) Code, the Customs Value of the goods, the Applicable Tariff Rate, and any additional taxes or fees that may apply to your products.

Now, where do you start? Your first port of call is to identify the exact geographical location where your goods were manufactured or produced. This information forms the basis from which all further calculations will spring and is essential in determining the applicable customs duties and taxes for your shipment.

Step 1 - Identify the Country of Origin

Identifying your goods' country of origin, in this case, Vietnam, is a critical first step and here's why:

1. Accurate information: It lays a solid foundation for accurate HS code generation.

2. Trade agreements: Vietnam and Saudi Arabia share numerous trade agreements. Correctly pinpointing the origin can unlock duty reductions or exemptions.

3. Import restrictions: Certain goods imported from Vietnam may face restrictions. Identifying your product's origin helps prevent any regulatory snags.

4. Customs compliance: Customs agencies employ stringent rules. Correct country of origin reduces the risk of non-compliance.

5. Precise duties & taxes calculation: Knowing the origin can ensure precise duty and tax calculations.

To tap into the trade agreements between Vietnam and Saudi Arabia, familiarise with the ASEAN-GCC Free Trade Agreement. It contains specifications that can lead to financial benefits. Always cross-check restrictions for your type of merchandise on Saudi customs' official website. Prioritising due diligence in this step is likely the difference between a smooth transit and a lengthy holdup at customs.

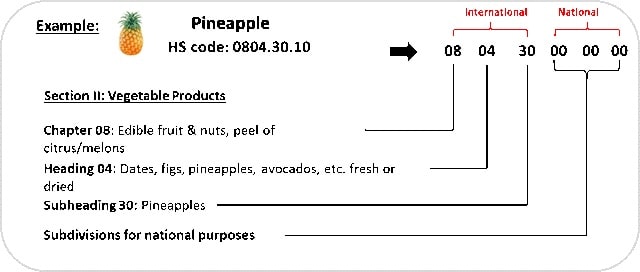

Step 2 - Find the HS Code of your product

The Harmonized System (HS) code is a standardized numerical method of classifying traded products. It's employed by customs authorities worldwide to identify products for duty assessment and data gathering. Essentially, the HS code is your product's personal passport, allowing it to clear customs smoothly.

If you want to locate your product's HS code, you could start by asking your supplier. They are typically well-acquainted with the products they're importing and the relevant regulations.

But what if you cannot acquire the HS code this way? Don't worry, we've got you covered with a straightforward, step-by-step process.

1. Visit this Harmonized Tariff Schedule where you can use the HS lookup tool.

2. Punch in the name of your product in the search bar and hit enter.

3. Scroll down and look at the Heading/Subheading column - this is where you'll find your HS code.

One thing to bear in mind when identifying your HS code is the importance of precision. Failing to choose the correct code can lead to delays in product delivery and potential fines. So be cautious and diligent with your search.

Here's an infographic showing you how to read an HS code. The clarity that this visual provides will simplify the process and aid you with future HS code identification.

Step 3 - Calculate the Customs Value

In exporting your goods from Vietnam to Saudi Arabia, you might be curious about the term 'customs value'. It's not simply the price of the product you're dealing with. Think of it like this: the customs value is a bigger picture which includes more than just your goods' price. It's defined as the CIF (Cost, Insurance, and Freight) value - the total cost of your goods, the insurance, and the freight charges combined.

For instance, if you're shipping machinery priced at $20,000, with insurance costing $500 and freight charges at $1,500, the customs value isn't the $20,000 price tag of the machinery. Instead, it's the total cost which is $22,000 (your product cost + freight + insurance). This can dramatically impact the cost of duties upon arrival in Saudi Arabia. So, understanding and calculating this correctly can make your trading smooth and keep your business profitable.

Step 4 - Figure out the applicable Import Tariff

Import tariffs represent a type of tax levied by a government on goods entering the country from abroad. These tariffs vary depending on the type of product, usually classified by an HS code, and the country of origin. In the context of bringing goods from Vietnam to Saudi Arabia, the Generalized System of Preferences (GSP) tariff applies.

Find the relevant tariff rate using the following steps:

1. Visit the Saudi Arabia Customs website or a credible international trade resource site.

2. Locate the tariff finder tool and enter the HS code identified earlier along with Vietnam as the country of origin.

For instance, suppose you're importing ceramic mugs (HS Code: 691110) from Vietnam with a total cost of insurance and freight (CIF) at $10,000. After entering this in the tariff tool, let's say it shows a GSP tariff rate of 5%. In this case, your import tariff will be 5% of $10,000, which equals $500.

Remember, this is a simplistic example only to guide you. The actual process might involve more complexities depending on the goods and other associated fees. Be sure to consult with a local customs agent for accurate calculations.

Step 5 - Consider other Import Duties and Taxes

Understanding import duties and taxes is crucial for a successful shipping operation from Vietnam to Saudi Arabia. Besides the standard tariff rate, other duties may apply depending on the product's nature and origin.

For instance, excise duty is often charged on goods harmful to health like tobacco, with rates that can reach up to 100%. Anti-dumping taxes, on the other hand, are imposed to protect domestic industries from unfairly low-priced imports. These could inflate your product cost significantly if it falls under this category.

Most importantly, be aware of the VAT. In Saudi Arabia, importing goods often attracts 15% VAT. So, for a good worth $100 with a standard tariff of $5, the VAT payment would look like: $100 (good's worth) + $5 (tariff) = $105. Now, apply the VAT rate: $105 15% = $15.75. As a result, you'd need to budget for $120.75 total.

Please note, these figures are just examples and may not represent the current rates, it's important to double-check with the Saudi customs or logistics expert. Nevertheless, considering such taxes can help avoid unexpected costs and keep your shipping operations smooth.

Step 6 - Calculate the Customs Duties

Calculating customs duties while shipping from Vietnam to Saudi Arabia involves understanding the customs value of your goods. The first scenario, suppose you're importing goods valued at $10,000 with a customs duty of 5%. The custom duty to be paid is $500 ($10,000 x 0.05).

In the second scenario, if VAT of 15% is applied, add this to the customs duty. For the same value of goods, your customs duty remains $500. The VAT is calculated on the Goods + Customs Value, here, $10,500. So, you'll pay $1,575 ($10,500 x 0.15) in VAT. The total taxes will be $2,075 ($500 customs + $1,575 VAT).

Lastly, if anti-dumping taxes of 10% and excise duty of 20% apply, these are added to the previous total. The anti-dumping duty on $10,000 will be $1,000 ($10,000 x 0.10). The excise duty on the value plus all taxes ($10,000 + $500 (customs duty) + $1,575 (VAT) + $1,000 (anti-dumping)) equals to $560.5 (($10,000 + $500 + $1,575 + $1,000) x 0.20). The total taxes now become $4,635.5 encompassing all applied tariffs.

Unsure about handling these complexities? FNM Vietnam can professionally manage your customs clearances globally, ensuring no extra charges. Reach out for a free quote within 24h, and let us streamline your international shipping.

Does FNM Vietnam charge customs fees?

FNM Vietnam, as your customs broker, charges for the service of customs clearance, not the actual customs duties and taxes—those go directly to the government. It's crucial to differentiate between these charges: think of it like paying a guide to navigate a complex forest—you pay for their expertise, not the trees! We provide all customs office documentation when completed, verifying you only pay government-required charges.

Contact Details for Customs Authorities

Vietnam Customs

Official name: General Department of Vietnam Customs.

Official website: https://www.customs.gov.vn/

Required documents for customs clearance

Sorting through customs paperwork can be frustrating, especially if you're unsure about the necessary documents. Here, we'll unravel the complexities of four key forms: Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Get ready to trade confusion for confidence!

Bill of Lading

Navigating your shipment from Vietnam to Saudi Arabia? The Bill of Lading (BoL) is your ally. It is pivotal in global trade - acting as a receipt, a contract, and a title document. BoL not only confirms the carrier has received your goods but also triggers the transfer of ownership, all in one compact piece.

Wondering about speedy transactions and avoiding a paper chase? The electronic or 'telex' release is your answer. It's quicker, reduces paperwork, and eliminates the fear of lost documents.

If you're shipping via air, the Air Waybill (AWB) plays a similar role to the BoL.

Tip to remember: Ensure correctness of every detail in these documents; a tiny error could delay your shipment or ramp up charges. Now, conquer the trade lanes with your newfound knowledge.

Packing List

Whether you're shipping durian fruit or electronics from Vietnam to Saudi Arabia, your Packing List is a kingpin document. Consider it the biography of your cargo – it lays out the exact contents and weight of your shipment, making it easier for the Saudi Arabian customs to identify and inspect. Having an accurate Packing List isn't just due diligence, it's your lifeline to a seamless customs clearance. Sea or air freight, doesn't matter. Think about it like this: you ship 1000 Made in Vietnam cronuts without declaring them accurately. Boom! Your shipment gets held up by customs for discrepancies. Not a great place to be. Get your Packing List right, and you'll avoid these frustrating and costly delays. All in all, an accurate Packing List is more than just a formality; it's your ticket to successful shipping.

Commercial Invoice

Navigating customs between Vietnam and Saudi Arabia? Your Commercial Invoice is key. This vital document lists the details of your goods, like description, value, country of origin, and delivery terms, aligning crucially with your other shipping documents such as the Bill of Lading. When filling it out, consistency is paramount. For instance, the declared item value should tally with your sales contract or proforma invoice, to avoid customs snags in either Hanoi or Riyadh. Remember, Saudi customs use this invoice for both duty calculation and goods control. So, incorrect information could lead to delays, excessive duties, or even cargo confiscation. Ensuring your Commercial Invoice is accurate and thorough may seem a hassle but it's a gamechanger for hassle-free shipping between these nations. Be meticulous, it's worth the effort!

Certificate of Origin

When shipping from Vietnam to Saudi Arabia, the Certificate of Origin (CoO) can be your friendliest paperwork. This document verifies where your goods were manufactured, whether it's a Hanoi factory or a Ho Chi Minh City workshop. The twist? It can unlock preferential customs duty rates. Picture your cargo of Vietnamese bamboo furniture; a CoO issued by a Vietnamese Chamber of Commerce could bring a smile to your purse strings by reducing the import duty. Remember, however, this only holds water if the CoO accurately states Vietnam as the country of manufacture. It's all about authenticating where your goods were born. So make sure your CoO is precise to enjoy smooth sailing for your shipments.

Get Started with FNM Vietnam

Overwhelmed with customs clearance? We understand. At FNM Vietnam, we streamline the process, handling every intricate step for you. Our experts ensure a secure, hassle-free passage of your goods from Vietnam to Saudi Arabia. Why navigate this path of complexity alone? Reach out for a free quote today, and we'll respond in less than 24 hours. Let's simplify shipping together.

Prohibited and Restricted items when importing into Saudi Arabia

Understanding what you can and can't ship to Saudi Arabia is crucial for your business. Regulations can be complex, with severe penalties for non-compliance. Let's clear up the confusion on prohibited items - it could save you a big headache and costly mistakes.

Restricted Products

- Pharmaceutical Products: To import pharmaceutical products, you will need to secure a permit from the Saudi Food and Drug Authority (SFDA). Here is the link to their official website: SFDA

- Live Animals and Animal Products: Live animals and certain animal products require a special permit from the Ministry of Environment, Water and Agriculture. Visit their official website for more details: MEWA

- Cosmetic Products: Importation of cosmetic products into Saudi Arabia requires you to apply for a permit from the Saudi FDA. Go to their official website: SFDA

- Radioactive Materials: You will need to apply for a license from the Saudi Arabian Atomic Energy Regulation Authority for shipping radioactive materials. Here is where you can find more information: AEA

- Wireless Equipment and Devices: Importing wireless equipment and devices will require you to have a permit from the Communications and Information Technology Commission. Go to their webpage: CITC

- Tobacco Products: To ship tobacco products, you have to apply for a permit from the Saudi Arabian General Authority of Zakat and Tax. This is where to apply: GAZT

- Certain Food Products: For some specific food products, you have to secure a permit from the SFDA. This is the link to their official webpage: SFDA

Remember to always check for updates as these regulations are subject to change.

Prohibited products

- Alcoholic beverages or products containing alcohol

- Narcotics and Psychoactive substances

- Non-Islamic religious materials and publications

- Pornographic materials

- Pork and pork products

- Animal products not slaughtered according to Islamic rites

- Antiques and artifacts of national importance for Saudi Arabia

- Hazardous and radioactive materials

- Endangered wildlife and products derived from them

- Any items violating trademarks and copyrights

- Items that undermine or devalue the Saudi Arabian royal family, the national flag or other national symbols

- Weapons, ammunition, and explosives, including replicas and imitation firearms

- Lottery tickets and gambling devices

- Israeli currency or products from Israel

- Certain types of encrypted communication devices

- Some types of plant and seeds.

Are there any trade agreements between Vietnam and Saudi Arabia

Currently, there exist no Free Trade Agreements (FTAs) or Economic Partnership Agreements (EPAs) between Vietnam and Saudi Arabia. However, both countries share a commitment to boosting bilateral trade and are constantly exploring avenues for deeper partnership. Notably, active discussions are ongoing regarding cooperative sectors like investment, tourism, and transport. Navigating trade without specific agreements might seem daunting, but with proper knowledge of customs regulations, your shipping can run smoothly. Keep an eye on new developments, as these could provide significant opportunities that can boost your business.

Vietnam - Saudi Arabia trade and economic relationship

Historically, Vietnam - Saudi Arabia trade relationships have made notable strides. As diplomatic links were established in 1999, bilateral cooperation has grown across key sectors like oil, agriculture, and labor resources. Rice and seafood have become key exports from Vietnam, while Saudi Arabia answers to Vietnam's oil needs. Recent years saw expanding cooperation, with Saudi Arabian investors showing interest in large infrastructure projects in Vietnam. The cross-investment value marks significant milestones in this bilateral economic relationship. According to the General Statistics Office of Vietnam, the total trade turnover between the two countries in 2023 stood at USD564.3 million. However, this largely represented Vietnam's exports at USD424 million, underlining a tangible trade imbalance. Balancing the trade scales and addressing challenges lies at the heart of future opportunities in this relationship.

Your Next Step with FNM Vietnam

Unsure about the ins-and-outs of overseas shipping between Vietnam and Saudi Arabia? FNM Vietnam makes it simple. We handle all the complexities of freight forwarding for you, from customs clearance to document handling. Leave the complicated logistics to us. Reach out now for effective, stress-free shipping solutions tailored to your needs. Let's make your global trade effortless.

Additional logistics services

Beyond just shipping and customs, explore how FNM Vietnam can streamline your entire supply chain, from warehousing to distribution, tailoring solutions for your unique needs.

Warehousing and storage

Discovering trustworthy warehousing in Vietnam or Saudi Arabia can feel like a tall order, especially when your goods demand specific conditions like temperature control. Avoid the stress and uncertainty - we've got your storage needs covered. For every detail on our dedicated solutions, dive into our informative page on Warehousing. Consistent, reliable, and perfectly suited to your products.

Packaging and repackaging

For your shipment from Vietnam to Saudi Arabia, never underestimate the role of flawless packaging and repackaging. It's more than just stuffing goods in a box, it's about safeguarding them. From delicate ceramics to bulky machinery, employing a reliable agent ensures proper packing to meet international standards, reducing potential damages. For a diverse range of products, this is invaluable. More info on our dedicated page: Freight packaging.

Cargo insurance

Ever experienced unexpected incidents during ocean freight transit? Cargo insurance is your safety net! Unlike standard fire insurance, which only covers specific fire-related losses, cargo insurance becomes your one-stop solution to tackle broad spectrum shipping risks - theft, damage, or loss. Imagine safeguarding your precious Vietnamese coffee beans or electronic components against such uncertainties. Tap into worry-free trading with our Cargo Insurance. More info on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Looking to source goods from East Europe, Asia, or elsewhere? FNM Vietnam can be your guide. We'll find quality suppliers, handle the procurement process, and even break down language barriers. If questions like Where do I start? or How do I communicate? are on your mind, you're in the right place. Let's make sourcing less daunting and more rewarding. Learn how on our dedicated page: Sourcing services.

Personal effects shipping

Relocating between Vietnam and Saudi Arabia? Safeguard your fragile or bulky belongings with our expertise in Personal Effects Shipping. Empathetic and flexible, our credible handlers ensure your objects are dealt with utmost care. Picture your grand piano or delicate china set delivered unscathed. Want to learn more? Visit our dedicated page: Shipping Personal Belongings.

Quality Control

Ensuring the quality of your goods before they journey from Vietnam to Saudi Arabia can save you headaches and unnecessary costs down the line. Imagine you're shipping saffron from Vietnam; a pre-shipment inspection can certify your product's quality, ensuring your Saudi buyers receive the rich, vibrant spice they expect. Don't let subpar goods tarnish your business reputation. Discover more with our Quality Inspection guide.

Product compliance services

Compliance with international standards is a non-negotiable requirement for shipping goods across borders. Tailored to your needs, our Product Compliance Services undertake detailed laboratory testing to ensure your cargo meets the strictest regulations. Whether shipping textiles or tech gadgets, gain peace of mind knowing your goods adhere to the destination's norms, avoiding costly misunderstandings or setbacks. Real-world example: A food manufacturer streamlined the export process and prevented potential fines by utilizing our service to verify adherence to importing nation's strict guidelines.

FAQ | For 1st-time importers between Vietnam and Saudi Arabia

What is the necessary paperwork during shipping between Vietnam and Saudi Arabia?

For shipping from Vietnam to Saudi Arabia, we at FNM Vietnam handle most of the paperwork, like the bill of lading for sea freight or air waybill for air freight. What we require from you is the packing list and commercial invoice. Depending on the nature of your goods, additional documents like the Material Safety Data Sheet (MSDS) or certain certifications may be necessary. Our team will guide you through the process, ensuring you have the necessary documents for a seamless shipping operation.

Do I need a customs broker while importing in Saudi Arabia?

Yes, it's highly advisable. In Saudi Arabia, the customs process can be quite intricate, with numerous mandatory documents and specifics to be provided. Given our expertise at FNM Vietnam, we typically represent your cargo at customs for the majority of shipments. This way, we can streamline the whole process, handling all the complex details while you focus on other essential areas of your business. So, leveraging a customs broker, especially in a complex import environment like Saudi Arabia, can save you significant time and prevent potential costly errors.

Can air freight be cheaper than sea freight between Vietnam and Saudi Arabia?

While we can't provide a definitive answer due to factors like route, weight, and volume, we can certainly provide some guidance. Generally, if your cargo is under 1.5 Cubic Meters or 300kg (660lbs), air freight might be a more cost-effective option. At FNM Vietnam, we're committed to always presenting you with the most competitive shipping options. Your dedicated account executive will help you weigh your options and make the best decision based on your specific needs. In some instances, air freight could indeed be cheaper than sea freight. It ultimately depends on the specifics of your shipment.

Do I need to pay insurance while importing my goods to Saudi Arabia?

Absolutely, when it comes to importing goods to Saudi Arabia, it's worth noting that insurance isn't a requirement, neither for domestic nor international shipping. However, we at FNM Vietnam strongly advocate for securing an insurance policy. This is simply due to the unpredictability of shipping processes. Multiple incidents can occur, including damage, loss, or theft of goods. Having insurance provides a safeguard against potential financial losses from such situations. It's always a smart strategy to be prepared for unforeseen circumstances, quite like carrying an umbrella on a cloudy day.

What is the cheapest way to ship to Saudi Arabia from Vietnam?

Given the geographical proximity, the most cost-effective method to ship goods from Vietnam to Saudi Arabia is by sea freight. Naturally, this depends on the type, size, and weight of your shipment. We at FNM Vietnam choose reliable shipping lines and negotiate competitive rates. Please note, while sea freight rates are typically less expensive, it does take longer than air freight. Therefore, planning and scheduling are key to this operation.

EXW, FOB, or CIF?

Your choice between EXW, FOB, or CIF depends on the relationship with your supplier, who may not be knowledgeable about logistics. At FNM Vietnam, we recommend handling the international freight and destination processes for you. Often, suppliers tend to sell under EXW (right from their factory) or FOB terms (which include all local charges up to the origin terminal). Regardless of these terms, we offer a comprehensive door-to-door service to ensure your goods reach their destination efficiently and safely. Trust us to provide expert logistics solutions tailored to your needs.

Goods have arrived at my port in Saudi Arabia, how do I get them delivered to the final destination?

When your goods reach the Saudi Arabian destination port and we're handling your cargo under CIF/CFR incoterms, you'll need a customs broker or a freight forwarder to assist with clearing the goods, paying the import charges, and organizing delivery. Alternatively, our team offers a DAP incoterms service, where we manage the entire process. Please consult your dedicated account executive to confirm these details.

Does your quotation include all cost?

Yes, we at FNM Vietnam make a point of including all costs in our quote, with the exception of duties and taxes at your goods' destination. If needed, your dedicated account executive can provide an estimate for those. We're committed to maintaining transparency and eliminating hidden fees to avoid unpleasant surprises.