Ever tried to teach a cat to swim? It's about as challenging as shipping goods from Vietnam to China without the right guidance! Jokes aside, understanding rates, transit times, and customs regulations can feel like a mammoth task. But fret not, with our destination guide, we aim to demystify the complexities of freight transportation between these two dynamic countries. You'll gain insights on diverse freight options, from sea and air to road and rail. We'll also delve into crucial details like customs clearance, duties, taxes, and essential tips tailored to help businesses thrive. If the process still feels overwhelming, let FNM Vietnam handle it for you! Our expertise lies in turning freight forwarding challenges into successes, by taking care of every step of the shipping journey. Efficiency, clarity, and stress-free shipping - that's what we at FNM Vietnam offer!

Which are the different modes of transportation between Vietnam and China?

Vietnam to China, or the reverse, it's not just about seeing your shipment across the map but about picking the perfect mode of transit. Given the common border, trucking could be your go-to, ensuring short travel times and lower costs. However, for larger goods, rail or sea transport might fit the bill. With rail, you get a speedier yet eco-friendly choice, while sea freight opens up routes for massive cargo. Like choosing a perfect dance partner, aligning your transport method with your unique shipping demands can turn this international samba into a breeze.

How can FNM Vietnam help?

Shipping between Vietnam and China? FNM Vietnam makes it convenient! Our team handles logistics, customs clearance, and administrative tasks, ensuring your freight arrives on time. To understand more about how we streamline the shipping process, reach out to our consultants. And remember, we offer a free estimate in less than 24 hours. Connect with us now!

![]()

FNM Vietnam Tip: Sea freight might be the best solution for you if:

- You're moving big loads or large items. Sea freight offers roomy, cost-effective solutions.

- Your shipment isn't time-critical. Ocean routes take longer but are often more reliable.

- Your supply chain links major ports, tapping into a broad network of sea lanes.

Sea freight between Vietnam and China

China and Vietnam, two powerhouses of Asia, share a thriving trade relationship, with oceans serving as their primary passage for high-volume goods. Key industrial centers connect via bustling cargo ports such as Hai Phong in Vietnam and Shenzhen in China. Though ocean shipping may trail behind in speed, it triumphs as a cost-effective solution for extensive consignments.

Yet, it's not all smooth sailing. Businesses frequently encounter choppy waters navigating the complex shipping procedures between Vietnam and China, often facing unexpected obstacles and mishaps. Think of it like a puzzle - daunting at first glance, but manageably solved with the right pieces. From handling paperwork to customs clearance, the practical devil lurks in the intricate details. This section will throw you the lifebuoy, guiding you through best practices and eliminating common mistakes. With necessary precautions, ocean shipping between Vietnam and China transforms from a daunting task into a streamlined process.

Main shipping ports in Vietnam

Port of Hai Phong

Location and Volume: Positioned in Northern Vietnam in Hai Phong City, this is one of the country's most significant ports due to its conductive geographic position and proximity to industrial zones. The port handles around 47 million tons annually, demonstrating its substantial capacity.

Key Trading Partners and Strategic Importance: Major trading nations include China, South Korea, and the USA. Due to its proximity to the East Sea and Yangtze River, it holds strategic importance in the import/export industry across various sectors.

Context for Businesses: If you aim to reach markets in North Vietnam or want swift access to China, the Port of Hai Phong, with its modern infrastructure and connectivity, could play an integral part in your logistics plan.

Port of Da Nang

Location and Volume: Located in Central Vietnam at the mouth of Han River, the Port of Da Nang is the third largest port in Vietnam. It has an annual shipping volume of roughly 7 million tons.

Key Trading Partners and Strategic Importance: Along with domestic consignments, imports, and exports, the port also handles transit goods for Laos, China, and Northeastern Thailand. Its strategic position and connection to central inland provinces make it a critical port.

Context for Businesses: If your operation involves transporting goods to or from the Central or Highland provinces of Vietnam, the Port of Da Nang is resourcefully located and well-choreographed for your logistics chain.

Port of Saigon

Location and Volume: Situated in Ho Chi Minh City in southern Vietnam, the Port of Saigon is one of the busiest ports in terms of container traffic with an annual volume of over 6 million TEU.

Key Trading Partners and Strategic Importance: It serves as a critical gateway for trade to and from ASEAN nations, the US, Europe, and beyond. The port's strategic importance derives from its proximity to major industrial and manufacturing hubs.

Context for Businesses: If you're aiming to reach southern markets or extend your network throughout Southeast Asia, the Port of Saigon's modernized facilities and vast network make it an optimum choice.

Cai Mep International Port

Location and Volume: Located in Ba Ria-Vung Tau Province, this deep sea port accommodates large vessels and handles around 3.8 million TEU each year.

Key Trading Partners and Strategic Importance: Its major trading partners include the US and Europe. With the ability to receive large capacity vessels, it has become a transportation hub serving the Southeast region and the world.

Context for Businesses: Cai Mep International Port is a smart pick if you're dealing with high-volume transactions, especially to or from the US and Europe, as it decreases the need for transshipment and may reduce your logistics costs.

Quy Nhon Port

Location and Volume: Quy Nhon Port is located in the central province of Binh Dinh and has an annual shipping volume of over 8 million tons.

Key Trading Partners and Strategic Importance: With major operations involving Laos and Cambodia, it serves as a primary transshipment point for these countries, playing a significant role in regional trade.

Context for Businesses: Should your business require efficient handling of goods to Laos or Cambodia, leveraging the capabilities of Quy Nhon Port would be advantageous.

Vung Tau Port

Location and Volume: Positioned in Ba Ria-Vung Tau Province, Vung Tau Port has an annual handling volume of over 45 million tons.

Key Trading Partners and Strategic Importance: As a bustling port city, it offers diverse services to numerous international trading partners, handling a wide range of cargo, from crude oil to bulk cargo.

Context for Businesses: If your business involves diverse or bulk cargo types, especially related to the oil industry, Vung Tau's versatility and breadth of services could be vital to your shipping strategy.

Main shipping ports in China

Port of Shanghai

Location and Volume: Situated in the heart of the Yangtze River Delta, the Port of Shanghai plays a crucial role in the economic development of the region. It boasts a shipping volume of around 43.3 million TEU, making it the busiest port in the world.

Key Trading Partners and Strategic Importance: Key trading partners include the USA, Europe, and other Asia-pacific countries. As a strategic gateway to China's vast interior and owing to its comprehensive transportation hub network, it holds the premier position in China's maritime infrastructure.

Context for Businesses: If you're aiming to penetrate the Asia-Pacific market, the Port of Shanghai, with its excellent connectivity and comprehensive logistics services, can be a significant part of your plan.

Port of Ningbo-Zhoushan

Location and Volume: Located in the southeastern coastal region of Zhejiang province, the Port of Ningbo-Zhoushan handles approximately 27.5 million TEU annually.

Key Trading Partners and Strategic Importance: Its top trading partners include the USA, Europe, and Australia. It is strategically important for bulk commodities and is the world's largest cargo port.

Context for Businesses: Considering the shipment of bulk goods, or planning to reach customers in the prosperous market areas of Zhejiang province, then leverage the facilities offered by the Port of Ningbo-Zhoushan.

Port of Shenzhen

Location and Volume: Situated in Guangdong Province, the Port of Shenzhen ranks third in China for containerized cargo with a shipping volume of about 25.77 million TEU.

Key Trading Partners and Strategic Importance: Notable trading partners are Europe and the USA. The port is strategically located in the Pearl River Delta, making it the go-to choice for businesses targeting consumers in this region.

Context for Businesses: If you're planning on connecting with the manufacturing hub of South China or finding an ideal entry point to the Pearl River Delta, the Port of Shenzhen fits the bill.

Port of Guangzhou

Location and Volume: The Port of Guangzhou, located in Guangdong province, clocks an annual handling capacity of around 21.9 million TEU.

Key Trading Partners and Strategic Importance: Europe, Southeast Asia, and America are main trading partners. It carries strategic importance as an excellent transport hub connected with mainland China through an effective river-sea and coastal transportation system.

Context for Businesses: To exploit a comprehensive land and water network, and target manufacturing industries of Guangdong province, consider shipping through the Port of Guangzhou.

Port of Qingdao

Location and Volume: Situated in Shandong province, the Port of Qingdao handles approximately 18 million TEU annually.

Key Trading Partners and Strategic Importance: Major trading partners encompass the USA, Southeast Asia, and the rest of the Asia-Pacific region. It's strategically significant due to its close proximity to Japan and South Korea.

Context for Businesses: If you're targeting the booming economies of Northeast Asia, especially Japan and South Korea, the Port of Qingdao serves as a favorable option.

Port of Tianjin

Location and Volume: The Port of Tianjin, Northern China's leading port, contributes to around 15 million TEU shipping volume annually.

Key Trading Partners and Strategic Importance: It trades chiefly with the USA, ASEAN, and European countries. This port's strategic importance lies in serving Beijing and the broader northern Chinese market.

Context for Businesses: For businesses keen on transporting goods to Beijing or reaching out to a vast consumer base in Northern China, using the Port of Tianjin can streamline your shipping needs.

Should I choose FCL or LCL when shipping between Vietnam and China?

Choosing between Full Container Load (FCL) and Less than Container Load (LCL), commonly known as consolidation, is a strategic decision when shipping between Vietnam and China. Your choice can significantly impact not only the cost but also delivery time, affecting the overall success of your shipping process. An understanding of their differences can empower you to make an informed decision, tailored to your unique needs. So, let's dive into the intricacies of these two sea freight options, and get your cargo moving efficiently and economically!

LCL: Less than Container Load

Definition: LCL (Less than Container Load) shipping refers to a method of shipping goods that do not fill a complete container. It involves grouping your goods with others to form a full container load.

When to Use: LCL shipping proves more cost-effective and flexible for low volume consignments. Particularly, it is an ideal choice when your cargo is less than 13/14/15 CBM. This allows for more frequent shipments while optimizing your freight costs.

Example: For instance, a furniture business producing hand-crafted pieces in Vietnam might not have large volumes ready for shipment each week. By employing LCL freight options, they can send out smaller batches, ensuring their products are continually available in Chinese markets without overspending on shipping.

Cost Implications: When opting for LCL shipment, the costs are divided among the different shippers whose goods are in the container. It may include charges for handling, packing, or port charges. However, this might be a more cost-effective strategy than paying for a full container when your goods only occupy a fraction of the space. It allows businesses to better manage their freight costs according to the volume of their goods.

FCL: Full Container Load

Definition: FCL (Full Container Load) shipping refers to the use of an entire container for a single shipment, whether it's a 20'ft or a 40'ft container, effectively sealing your cargo from port of origin to destination.

When to Use: FCL shipping typically is the go-to option when your shipment exceeds 13/14/15 CBM (Cubic Meters). This is due to its cost-effectiveness with larger volume shipments and unparalleled safety since the container remains sealed during transit.

Example: Consider a manufacturing firm in Vietnam seeking to export 650 boxes of electronics, each box occupying 0.03 CBMS. The collective CBM exceeds 15 CBM, making FCL the logical choice for a safe and economical transport.

Cost Implications: To gauge costs, you need an FCL shipping quote. While the initial cost might seem high, FCL becomes cheaper per unit with larger volumes. Each FCL container can bear a higher cost than single LCL (Less than Container Load) shipment, but distributed over the larger volume, the cost per unit drops, proving to be more economical for larger shipments.

Say goodbye to shipping headaches!

Choose the best shipping method between Vietnam and China stress-free, with FNM Vietnam. As a leading freight forwarder, we specialize in simplifying complex shipping decisions. Our team of ocean freight experts assess various factors - like cargo size, urgency, and budget - to recommend the ideal choice: consolidation or a full container. Making the right choice can have a significant impact on your bottom line. Click here now for your free estimation. Our mission? Hassle-free cargo shipping for your business.

How long does sea freight take between Vietnam and China?

On average, sea freight transit times from Vietnam to China usually range from 5 to 10 days. However, these timings are subject to variations based on factors like the specific ports involved, the weight and nature of the goods. Given these variables, we recommend reaching out to a reputable freight forwarder like FNM Vietnam for a more personalized quote.

Table: Average Sea Freight Transit Times

| Origin Port (Vietnam) | Destination Port (China) | Average Transit Time (Days) |

| Port of Hai Phong | Port of Shanghai | 8 |

| Port of Da Nang | Port of Ningbo-Zhoushan | 9 |

| Port of Saigon | Port of Shenzhen | 7 |

| Cai Mep International Port | Port of Guangzhou | 8 |

How much does it cost to ship a container between Vietnam and China?

Determining the precise ocean freight rates for transporting a container from Vietnam to China is akin to hitting a moving target. Numerous factors come into play, such as your Point of Loading, Point of Destination, choice of carrier, nature of goods, and even monthly market fluctuations. This can cause shipping costs to vary widely, and the price per CBM can span a broad range. However, fear not. Our team of shipping specialists will ensure that you get the best possible quotation, tailoring our services to your unique needs with a personalized case-by-case consultation. No matter the variables, our mission is to empower your business with cost-effective solutions.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container can accommodate your out-of-gauge cargo which doesn't fit within the dimensions of a standard shipping container due to unusual height, length, or width.

Suitable for: Items that exceed the standard container dimensions, such as heavy machinery, industrial equipment, and construction materials.

Examples: Wind turbines, excavators, yachts.

Why it might be the best choice for you: If your cargo is larger than the standard freight dimensions yet it needs to be protected during transport, the OOG container is the solution.

Break Bulk

Definition: This involves separate loading of individual items or packaged goods, known as break bulk. Such kind of load does not use a container and often needs extensive labor during both loading and offloading.

Suitable for: Large items unsuitable for containers, unpackaged goods, or goods packaged differently such as in sacks or drums.

Examples: Barrels of oil, bags of coffee beans, cars.

Why it might be the best choice for you: If your cargo consists of numerous individual items with varied dimensions and packaging, break bulk shipping could be the best option.

Dry Bulk

Definition: Dry bulk refers to shipping loose cargo such as grain, coal, or gravel that can be loaded directly into a ship’s hold.

Suitable for: Commodities in large volumes and raw materials.

Examples: Grains, coal, sand.

Why it might be the best choice for you: If you're dealing with large, un-packaged raw goods that don't require specific containment, dry bulk shipping could be the most economical solution.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-ro refers to the method of transporting vehicles that can roll on and off a ro-ro vessel on their own wheels or with a platform vehicle.

Suitable for: Any drivable equipment or towable machinery.

Examples: Cars, trucks, trailers, buses.

Why it might be the best choice for you: For the transportation of motorized and wheeled vehicles, Ro-Ro allows easy loading and offloading that can expedite the shipping process.

Reefer Containers

Definition: These are refrigerated containers used for the transportation of temperature-sensitive goods.

Suitable for: Perishable goods like fruits, vegetables, dairy products, and pharmaceuticals.

Examples: Medicines, meat, fresh produce.

Why it might be the best choice for you: If you're transporting perishable items that require temperature control during the transit, reefer containers ensure your goods stay at the right temperature from pick-up to delivery.

At FNM Vietnam, we're committed to providing the best freight forwarding services. No matter what type of cargo you're moving between Vietnam and China, we've got your covered. To find out which solution best suits your needs, feel free to contact us for a free shipping quote in less than 24 hours.

FNM Vietnam Tip: Air freight might be the best solution for you if:

- You're on a tight schedule. Air freight delivers speed unmatched by other modes.

- Your cargo is under 2 CBM, a good fit for air's smaller capacity.

- Your destination is off the usual routes, making air's global network a key asset.

Air freight between Vietnam and China

In the high-speed game of international trade, air freight stands as the sprinter, and business between Vietnam and China, the finishing line. Here's the 411: air freight ensures swift and reliable deliveries – think small but precious cargo like electronics, fashion accessories and pharmaceuticals.

But watch out! Many shippers trip over critical details. Remember, with air freight, the rule of thumb is chargeable weight, not actual weight. And just like picking the perfect footwear for a sprint, there are best practices to follow – it's not as simple as showing up and racing. Every decision, big or small, impacts your wallet. Stick with us and you'll be winning air freight marathons in no time.

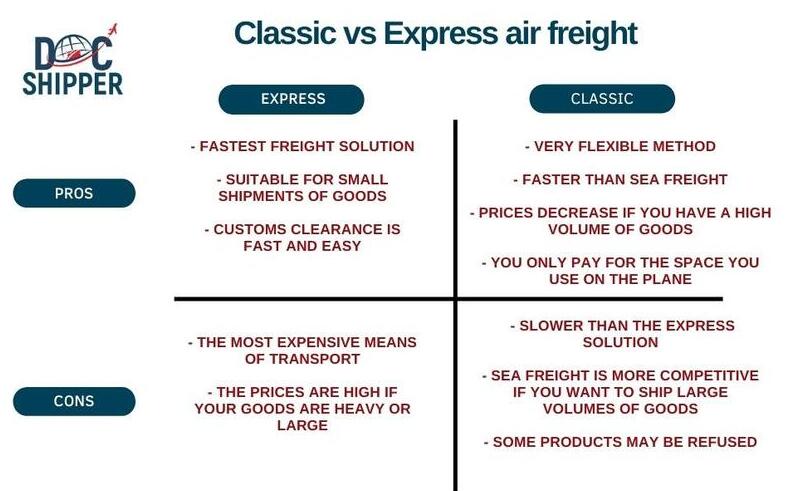

Air Cargo vs Express Air Freight: How should I ship?

If you're a business hustling between Vietnam and China, selecting the right air freight method is key to a smooth shipping operation. Think of it this way - air cargo has your goods hitching a ride on a commercial airline, while express air freight is like booking your goods on a private jet. It's all about finding the right balance for your business timeline and budget.

Should I choose Air Cargo between Vietnam and China?

Air cargo between Vietnam and China could be a fitting choice for heavier loads, starting to make sense for goods weighing around 100 to 150kg (220 to 330 lbs). This mode of freight, while dependable, can involve lengthier transit times due to set scheduling. However, it brings affordability and trustworthiness, featuring major carriers like Vietnam Airlines and Air China Cargo. So, if your goods meet the weight criteria and you're considering a cost-effective yet reliable solution, air cargo might just be your perfect fit.

Should I choose Express Air Freight between Vietnam and China?

Express air freight, an exclusive service utilizing cargo-only planes, excels when swiftly moving compact shipments under 1 CBM or 100/150 kg (220/330 lbs). This could be a strategic choice if your shipment falls within this range. Giants like FedEx, UPS, or DHL offer such services, renowned for their speed and reliability. Choosing express air freight could save you time and give you peace of mind, knowing your goods are in trusted hands.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Tan Son Nhat processed over 2.1 million tons of cargo in 2019, making it one of the busiest cargo airports in the region.

Key Trading Partners: Main trading partners include the USA, China, Japan, and other Southeast Asian countries.

Strategic Importance: Serving as the main hub of southern Vietnam, it's strategically located in buzzing Ho Chi Minh City, the business and industrial center of the country.

Notable Features: It has two parallel runways capable of landing large aircraft, as well as modern cargo handling facilities.

For Your Business: If your business mainly deals with markets in the US, China, Japan, or Southeast Asia, taking advantage of Tan Son Nhat's high cargo throughput and strategic location is an excellent move.

Noi Bai International Airport

Cargo Volume: In 2019, Noi Bai handled more than 900,000 tons of cargo.

Key Trading Partners: Major trade partners include China, South Korea, Japan, Taiwan, and the USA.

Strategic Importance: Situated in Hanoi, the capital city, it is the gateway to northern Vietnam's vast industrial and manufacturing zones.

Notable Features: It has two modern passenger terminals and a dedicated cargo terminal.

For Your Business: If your business is set in northern Vietnam's industrial sectors or you need to cater to markets in China, Japan, or South Korea, Noi Bai should be your top choice.

Da Nang International Airport

Cargo Volume: Da Nang International Airport processed approximately 170,000 tons of cargo in 2019.

Key Trading Partners: Main trading partners are other Asian countries, particularly China and Japan.

Strategic Importance: Centrally located in Vietnam, it serves as a principal port for transit cargo, particularly to and from the Central Highlands.

Notable Features: Its terminal 2 is for international flights, and the cargo handling facilities can accommodate both import and export freight.

For Your Business: If your business involves transiting goods through central Vietnam, especially for shipments to and from the Central Highlands, incorporating Da Nang into your logistics would be a strategic decision.

Cam Ranh International Airport

Cargo Volume: This growing airport handled about 35,000 tons of cargo in 2019.

Key Trading Partners: Key partners encompass China, South Korea, and various Southeast Asian countries.

Strategic Importance: Located in the bustling tourism hub of Nha Trang, Cam Ranh is a gateway to the South Central Coast region.

Notable Features: Its new terminal, inaugurated in 2018, has enhanced its international freight capabilities.

For Your Business: If your company operates in tourism-related sectors or deals with markets in the South Central Coast region, consider shipping your freight through this expanding airport.

Phu Cat Airport

Cargo Volume: As a developing cargo airport, Phu Cat handled over 2,200 tons of cargo in 2019.

Key Trading Partners: Its primary trading partners are within Asia, particularly China and Southeast Asia.

Strategic Importance: Positioned in Binh Dinh province, it serves the increasing demands of heavy industry and manufacturing in the South Central Coast region.

Notable Features: It consists of two runways and a modernized cargo terminal to handle increasing cargo volume.

For Your Business: If your business targets markets in Binh Dinh province or the surrounding South Central Coast region, utilizing Phu Cat Airport's ever-expanding cargo operations could be a beneficial choice.

Main international airports in China

Beijing Capital International Airport

Cargo Volume: Over 2 million metric tonnes annually

Key Trading Partners: USA, Japan, South Korea, Germany, Australia

Strategic Importance: As the second busiest airport in the world, Beijing Capital provides abundant routes, ensuring your businesses can reach major global markets swiftly.

Notable Features: Possesses three cargo areas with a total area of 152,000 square meters and is capable of handling vast amounts of freight simultaneously.

For Your Business: Its capacity to handle massive cargo volumes, coupled with sophisticated infrastructure, makes it an ideal choice for businesses aiming for speed and efficiency.

Shanghai Pudong International Airport

Cargo Volume: Approximately 3.5 million metric tonnes per year

Key Trading Partners: USA, Japan, South Korea, Germany, Australia

Strategic Importance: It's renowned as the world's third busiest airport by cargo traffic, providing a vital shipping hub between China and the western world.

Notable Features: Features two parallel runways and a state-of-the-art cargo area.

For Your Business: Shanghai Pudong's impressive handling capacity and strategic location may be the perfect fit for business seeking a steady flow of large-scale shipments, especially toward Europe and North America.

Guangzhou Baiyun International Airport

Cargo Volume: Over 1.8 million metric tonnes annually

Key Trading Partners: Singapore, USA, India, Japan, Australia

Strategic Importance: Guangzhou Baiyun acts as a cargo hub for China Southern Airlines, providing easy connection to numerous domestic and international destinations.

Notable Features: Renowned for its advanced logistics systems and customs efficiency.

For Your Business: It grants superb connectivity and streamlined customs procedures, facilitating seamless export and import processes for your business.

Shenzhen Bao’an International Airport

Cargo Volume: Approximately 1.2 million metric tonnes per year

Key Trading Partners: Hong Kong, USA, Germany, Japan, South Korea

Strategic Importance: Shenzhen Bao'an is a significant airport in southern China, well-placed for trade with Hong Kong and Southeast Asian countries.

Notable Features: Outstanding custom services and a multi-modal transportation system.

For Your Business: With its improved operations and proximity to key Asian markets, Shenzhen Bao’an could be the best option if your strategy involves frequent or heavy trade with South Asia.

Chengdu Shuangliu International Airport

Cargo Volume: Around 700,000 metric tonnes annually

Key Trading Partners: USA, Japan, Germany, South Korea, Australia

Strategic Importance: Positioned as the major aviation hub for western China, it serves as an access point to the growing economies of the region.

Notable Features: Provides various value-added services like warehousing and distribution.

For Your Business: Its robust infrastructure and strategic location make it a valuable choice if your business seeks penetration into western China and surrounding markets.

How long does air freight take between Vietnam and China?

On average, transporting freight by air from Vietnam to China typically takes between 1 to 3 days. However, this timeframe can vary greatly, depending on several factors. The specific airports in use, the weight of the shipment, as well as the nature of the goods being transported, can all impact the total transit time. Therefore, for the most precise estimate, it's advisable to consult with a seasoned freight forwarder, such as FNM Vietnam.

How much does it cost to ship a parcel between Vietnam and China with air freight?

Shipping air freight from Vietnam to China can cost between $3-5 per kg, on average. However, the price you'll pay isn't this straightforward. Factors such as distance between departure and arrival airports, parcel dimensions, weight, and the nature of the goods – they all influence the final shipping cost. Therefore, we provide quotes on a case-by-case basis, guaranteeing you the most competitive and fair rates. Rest assured, we're here to guide you through this process, working avidly to get you the best deal. Want a free quote? Contact us and receive it in less than 24 hours.

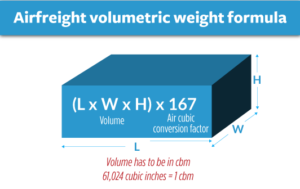

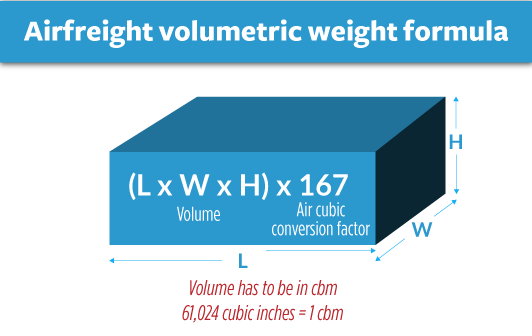

What is the difference between volumetric and gross weight?

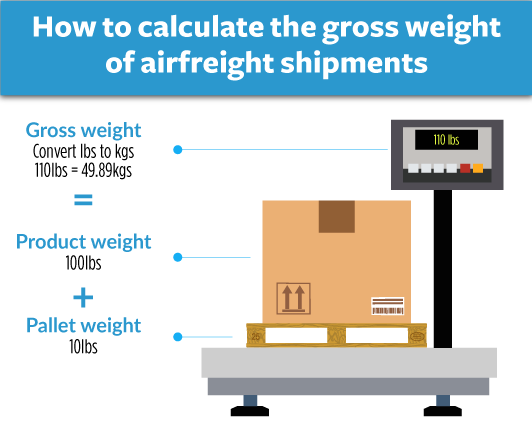

Gross weight refers to the actual weight of your shipment, including the goods and packaging. On the other hand, volumetric weight considers the space your shipment takes up in the aircraft, not just physical weight.

To calculate gross weight for Air Cargo, simply load your shipment on a scale and record the weight in kilograms. For instance, if your packed goods weigh 35 kg, that's the gross weight. In pounds, this comes to roughly 77 lbs.

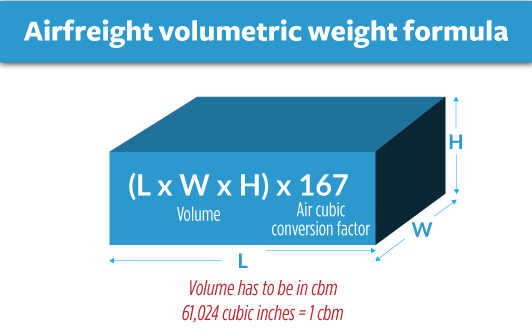

Volumetric weight in Air Cargo is a bit trickier. Here's how you calculate it: Measure the dimensions (length, width, height) of your package in centimetres and multiply them together. Then, divide the result by 6,000. For Express Air Freight, use a divisor of 5,000 instead.

Let's say your package measures 50cm x 30cm x 40cm. The volumetric weight for Air Cargo would be (503040)/6,000, giving 10 kg (or approximately 22 lbs). For Express Air Freight, with a divisor of 5,000, your volumetric weight would come up to 12 kg (or around 26.5 lbs).

Now, why does this matter? In air freight shipping, you're charged based on the higher of the two weights. It's a mechanism designed by carriers to ensure they're compensated for their space, whether your cargo is heavy or bulky. For our example, if you're using Express Air Freight, you would be charged based on the 12 kg volumetric weight, since it's higher than the 10 kg gross weight. It's crucial to keep these calculations in mind to accurately forecast your shipping expenses.

![]()

FNM Vietnam Tip: Door to Door might be the best solution for you if:

- You seek hassle-free shipping. Door-to-door manages the entire process for you.

- You like one go-to contact. A dedicated agent oversees your door-to-door shipment.

- You aim to limit cargo handling. Fewer transitions mean less risk of damage or loss.

Door to door between Vietnam and China

Delving into the world of international logistics, Door to Door shipping is a comprehensive, convenient solution where your goods are picked up from origin and delivered right to the doorstep of the destination. Particularly between Vietnam and China, its hassle-free nature and simplification of customs processes shine. Need a shipping method without the headaches? Well, let's dive in!

Overview – Door to Door

Imagine shipping from Vietnam to China without grappling with logistics hassles! Door to door is your secret to a stress-free experience. It proves popular among our valued clients at FNM Vietnam, and it's easy to see why: you simply let the experts handle everything from pickup to delivery. However, be aware of potential snags like unreliable service providers and unforeseen costs. With a deep understanding of shipping complexities, this service emerges as a clear winner. Dive deeper to explore how door to door shipping revolutionizes your international logistics!

Why should I use a Door to Door service between Vietnam and China?

Shipping goods can sometimes feel like taming a wild elephant, but don't fret, a Door to Door service is your friendly elephant whisperer when shipping from Vietnam to China! So why should you employ this fantastic service?

1. Alleviate Shipping Stress: Door to Door service lifts the heavy load off your shoulders! No worries about coordinating pickup and delivery or managing abrupt changes in plans. They handle everything from picking up goods from the initial location to arranging delivery at the final destination.

2. Ensure Timely Delivery: Time-sensitive shipment? No problem! The service streamlines the whole transportation process, ensuring your goods are delivered straight to their destination right on schedule.

3. Provide Special Care for Complex Cargo: For shipments that are awkward-to-handle or need special attention and care, this service is a dream come true. They ensure your delicate or oversized cargo is expertly managed and safely delivered.

4. Convenient Handover: Say goodbye to the headache of finding reliable trucking for your cargo. Door to Door services handle ground transportation at both ends, navigating complicated routes and ensuring your goods arrive safe and sound.

5. Integrated Service: This service is like a Swiss army knife - multi-functional and always handy. You have one main point of contact for a seamless, stress-free shipping experience. It's your no-hassle, all-in-one solution, covering every aspect from customs documentation through to careful handling of your goods.

In essence, Door to Door service is your secret weapon for an effortless, reliable, and expert shipping experience from Vietnam to China.

FNM Vietnam – Door to Door specialist between Vietnam and China

Discover the ease of door-to-door shipping between Vietnam and China with FNM Vietnam. Entrust us with your goods, as we manage it all from packing, transportation, customs clearance to selecting the best shipping method. Our skilled team guarantees a stress-free process, assisted by a dedicated Account Executive. Don't lift a finger, simply benefit from our efficient services. Request a free estimate within 24 hours or reach out to our friendly consultants at your convenience. Experience seamless shipping today.

Customs clearance in China for goods imported from Vietnam

Customs clearance is the juggernaut in the world of import-export, especially between Vietnam and China. It's a stage where goods can be stuck, triggering unexpected costs while coming across as bewildering due to its vast array of duties, taxes, quotas, and licensing requirements. This process is akin to navigating an intricate maze, brimming with possible pitfalls. Vast knowledge and understanding of all these factors are fundamental to keep things smooth-running and cost-effective. Fear not, this guide will zone in on these paramount aspects to provide you with clarity and confidence. Remember, FNM Vietnam can walk you through each step, whatever goods you're moving and wherever they're coming from. Just provide the origin of your goods, the value, and the HS Code. We're here to help you conquer your budgeting worries and any customs challenges head-on.

How to calculate duties & taxes when importing from Vietnam to China?

Duties and taxes can feel like a perplexing maze of numbers and regulations when importing from Vietnam to China. But, much like untangling any enigma, what counts is having the right pieces to make sense of it all. To get an accurate estimate of the customs duties you're likely to incur, it's crucial to know the country of origin, the Harmonized System (HS) code, the Customs Value, the Applicable Tariff Rate, and any other taxes and fees that pertain specifically to your products.

To set the ball rolling, your first objective should be pinpointing the country where the goods were originally manufactured or produced. This piece of information becomes the backdrop against which the rest of your duties and taxes calculation falls into place. It serves as a reliable signpost guiding you through the intricate landscape of international commerce.

Step 1 - Identify the Country of Origin

Identifying the country of origin, in this case Vietnam, is your first crucial step and here's why:

1. Trade Agreements : China and Vietnam are both members of the ASEAN-China Free Trade Area (ACFTA) agreement. This allows for significantly reduced duties on certain exported goods.

2. Correct Classification: The right origin identification leads to accurate HS code usage which undoubtedly helps in correctly estimating duties and taxes.

3. Import Restrictions: Vietnam has specific restrictions on products like raw minerals or certain types of wood. Knowing these can save you from unnecessary legal troubles.

4. Duty Savings: Certain goods originating from Vietnam may qualify for preferential duty rates due to ACFTA, bringing down your cost.

5. Legal Compliance: Getting your country of origin wrong can lead to penalties and delays, a headache you surely don't need.

Remember, every penny saved and every delay avoided counts. Keep your shipping documents ready and correct, and sail through the customs like a pro!

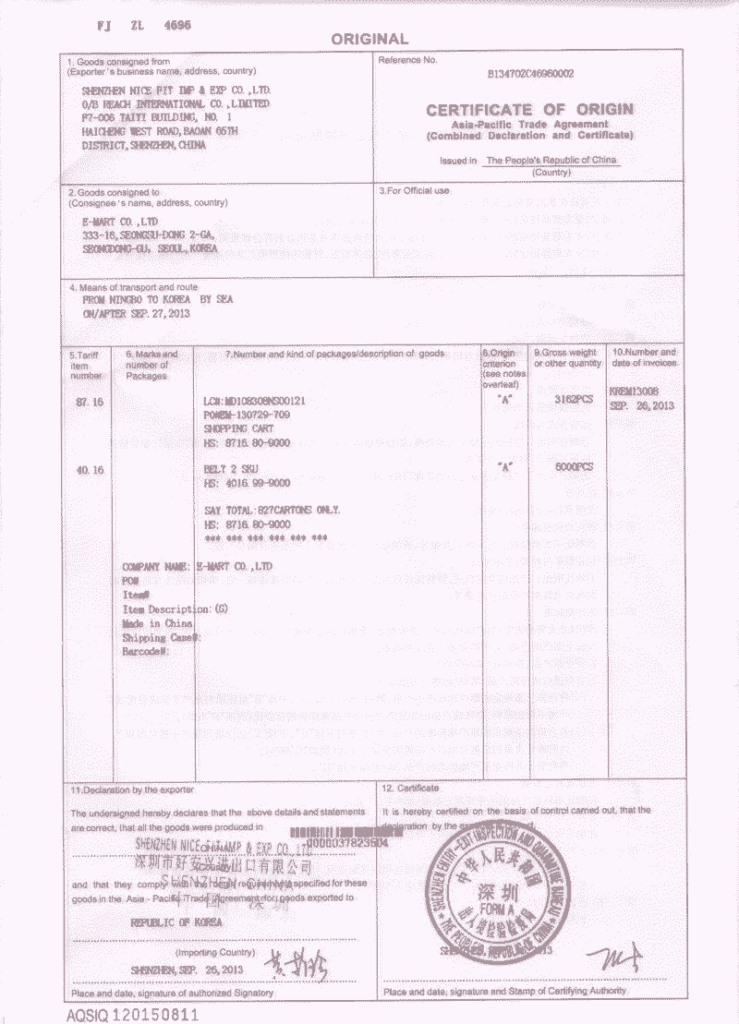

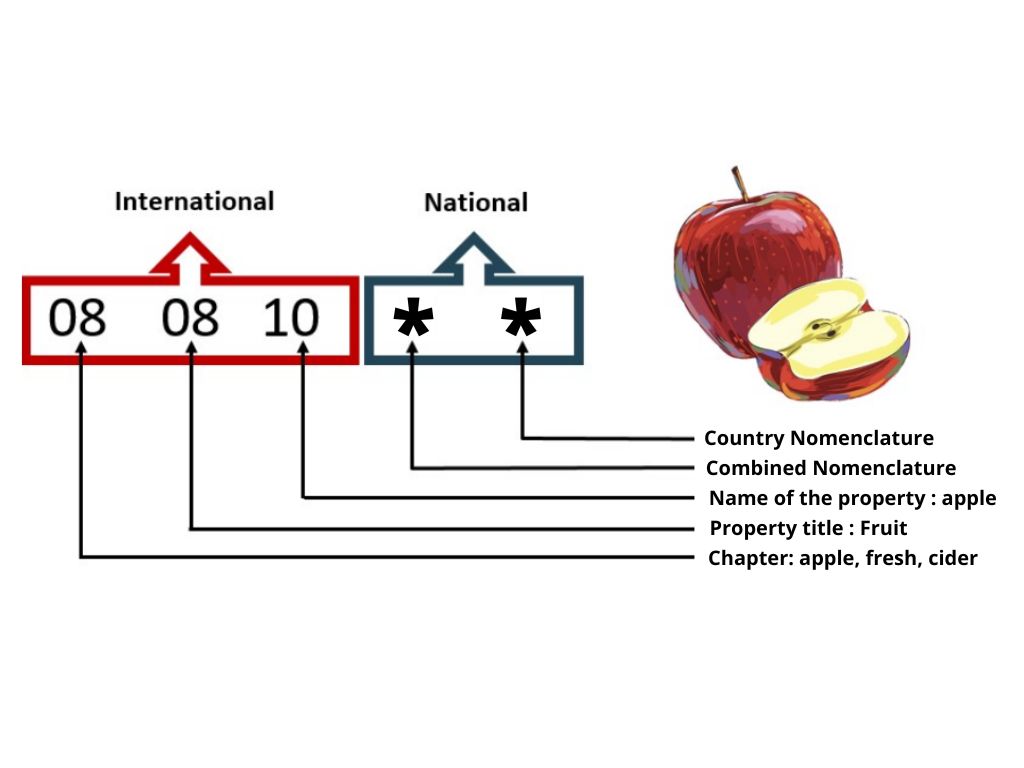

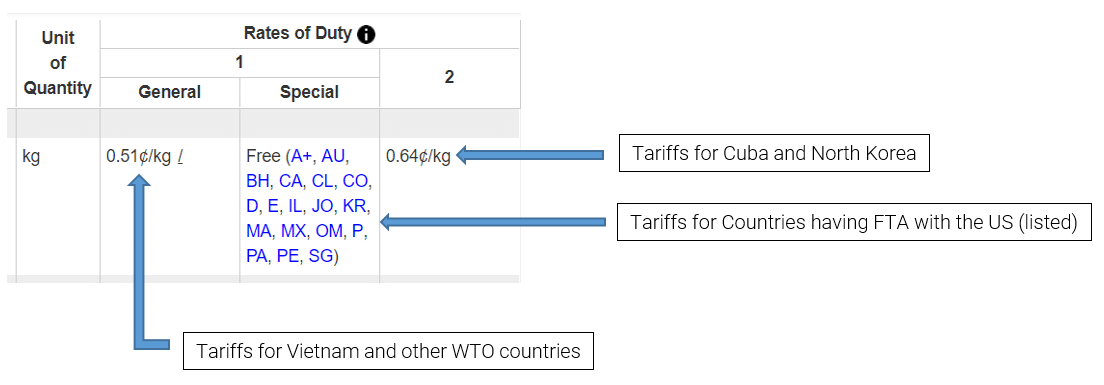

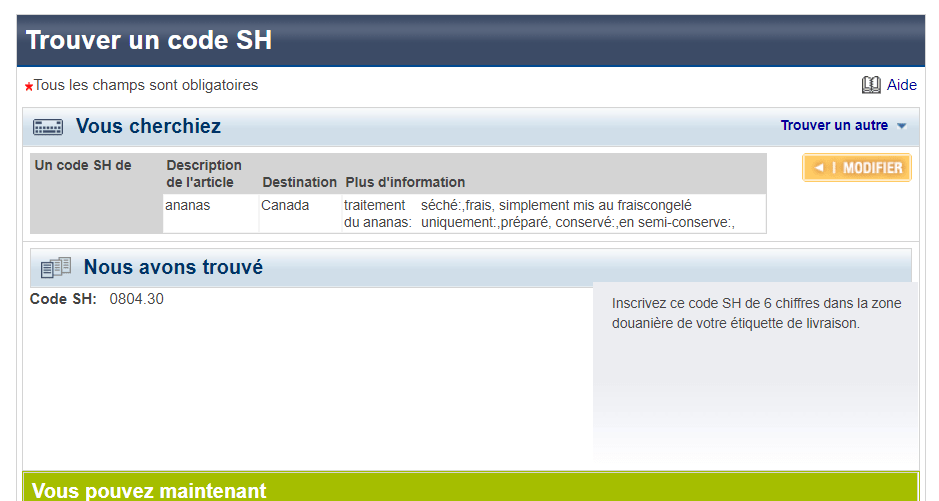

Step 2 - Find the HS Code of your product

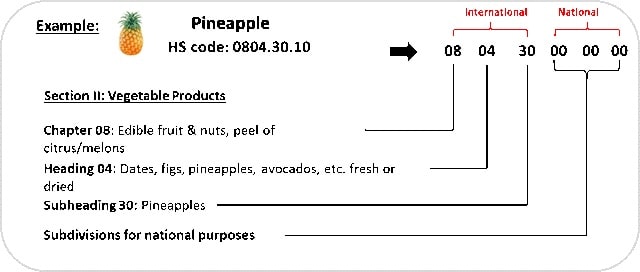

The Harmonized System (HS) Code is an internationally standardized system of names and numbers that classify traded products. This code allows customs authorities globally to easily identify products for the purpose of taxation and regulation enforcement. An accurate HS Code is crucial to ensuring that your freight moves through customs efficiently and smoothly.

The easiest way to find the HS Code of the product you're exporting or importing is directly from your supplier. They're typically familiar with the products they're dealing with and understand the relative regulations that accompany them.

However, if this isn't a viable option, there's a simple step-by-step process you can follow to identify the correct HS Code. Begin by utilizing the Harmonized Tariff Schedule, an HS lookup tool. Once on the site, simply type the product's name into the search bar. From the results, look at the Heading/Subheading column. Here, you will find the HS Code.

Make sure to analyze the search results carefully to choose the most accurate HS Code for your product. It's imperative to get it right because any inaccuracy can lead to delays in customs and potential fines. The trade of your goods depends largely on the correct classification and coding.

Here's an infographic showing you how to read an HS code. Understanding this system will make it easier for you to identify your product's category and ensure a smoother customs experience.

Step 3 - Calculate the Customs Value

In the world of international shipping, understanding the difference between product value and customs value is critical, particularly when importing goods from Vietnam to China. Unlike product value, which is simply the price of your goods, the customs value is something different - it is the CIF value. This includes not just your goods' price, but also the cost of international shipping and insurance (if any).

Think of it this way: If you buy a product for $1000 (Product Value), ship it for $200 (Shipping Cost), and insure it for $50 (Insurance), your Customs Value (CIF) is $1250. This is the value on which customs duties and taxes will be calculated upon reaching China. Simple, right? Remember, the more accurately you calculate, the smoother the clearance process!

Step 4 - Figure out the applicable Import Tariff

Import tariffs are essentially taxes paid on imported goods, commonly assessed based on the Harmonized System (HS) code of the product. China adopts a variety of tariffs, including most-favored-nation tariffs, conventional tariffs, and special preferential tariffs.

To find out the applicable tariff rate for your product imported from Vietnam, follow these steps:

1. Determine the HS code of your product. Let's take an example of '8517.12' for mobile phones.

2. Next, visit China's National Integrated Customs Information Center or a similar portal to check tariff-related information. Enter the HS code, and select Vietnam as the country of origin.

As an example, you might find a tariff of 10%. If you have an invoice value of $20,000 (USD) for the mobile phones and a CIF (Cost, Insurance, and Freight) of $2,000 (USD), the calculation for the import duty will be:

(Invoice Value + CIF) tariff rate= ($20,000 + $2,000) 10% = $2200.

Hence, your import duties will amount to $2,200. Understanding this process can help you better estimate your total landed cost and navigate the complexities of international shipping with China.

Step 5 - Consider other Import Duties and Taxes

Beyond the standard tariffs, you might encounter additional import duties and taxes when importing goods from Vietnam to China. These can depend on the country of origin and the nature of the product, varying widely from one shipment to another.

Consider the excise duty, an additional tax placed on certain goods like alcohol or tobacco. If you're in these industries, it's critical to account for this in your costs.

Another significant duty is the anti-dumping tax. Meant to protect domestic industries, China may impose these on goods believed to be sold at less than fair market value. Suppose you're exporting shoes at exceptionally low prices—you could be subject to these taxes.

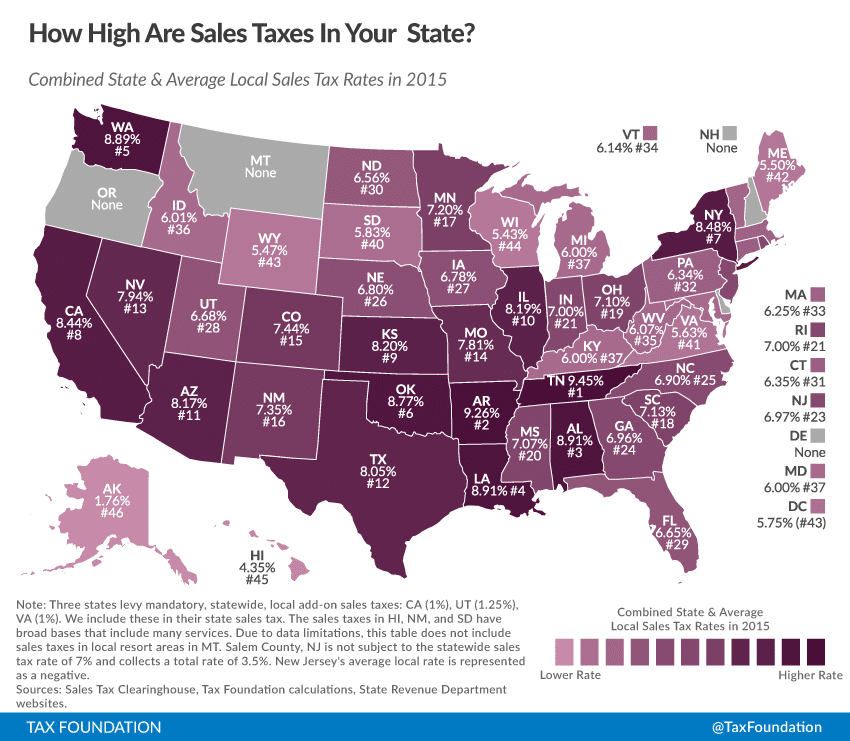

Lastly, let's delve into the Value-Added Tax (VAT). This is typically a significant portion of the total tax bill. In China, the standard VAT rate is 13%, but it can range from 9% to 16%. For instance, if you're importing ceramic vases valued at $10,000, your VAT could be anywhere from $900 to $1,600 (just examples, actual rates may vary).

Remember, calculating these duties and taxes can be complex. You might find it helpful to use a formula: CIF Value + Duty x VAT rate.

Being aware of these potential costs upfront can save you from unexpected expenses and trade disruptions.

Step 6 - Calculate the Customs Duties

Determining customs duties for your Vietnam-to-China cargo shipment involves a string of specific computations. The formula we'll use is: Customs Duties = Customs Value x Customs Duty Rate. Customs Value is your cargo's FOB (Free On Board) value.

Example 1: If you’re shipping goods worth $10,000 with a Duty Rate of 10% but without VAT, your customs duties will be $1,000.

In some cases, you’ll also need to account for VAT (Value Added Tax). The formula becomes: Total Duties and Taxes = Customs Duties + VAT.

Example 2: For the same $10,000 cargo and assuming VAT rate at 13%, you'll pay $1,000 customs duties (as above) plus $1,300 VAT, making your total duties and taxes $2,300.

For certain goods, there may also be anti-dumping taxes or Excise Duty. In such cases, each additional cost is added: Total Duties and Taxes = Customs Duties + VAT + Anti-Dumping Taxes + Excise Duty.

Example 3: Assuming the same cargo but now with a 5% anti-dumping tax and 10% Excise Duty, in addition to the $2,300 total from Example 2, you'll pay $500 for anti-dumping and $1,000 excise tax, totaling to $3,800 in duties and taxes.

Navigating these charges can be intricate, but the FNM Vietnam team offers comprehensive customs clearance services, ensuring you avoid paying more than necessary. Contact us for your free quote within 24 hours.

Does FNM Vietnam charge customs fees?

FNM Vietnam, serving as your customs broker, does not charge you for customs duties. Those duties and taxes are direct payments to the government. However, a customs clearance fee will be charged by FNM Vietnam or any broker for handling this process. To ensure transparency, you'll receive documents from the government to verify the exact charges. Think of it like getting your groceries bagged; although you're not paying for each apple, there's a service charge for the convenience of the store packing your items.

Contact Details for Customs Authorities

Vietnam Customs

Official Name: General Department of Vietnam Customs

Official Website: http://www.customs.gov.vn/

China Customs

Official name: General Administration of Customs of the People's Republic of China

Official website: http://english.customs.gov.cn/

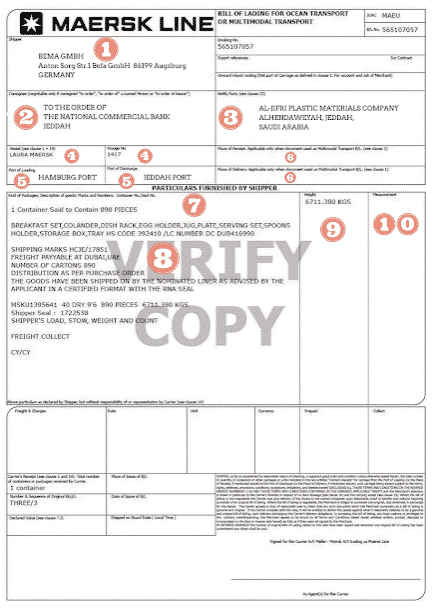

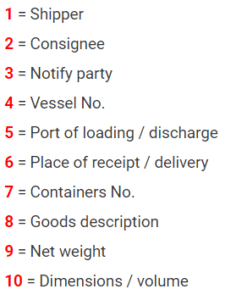

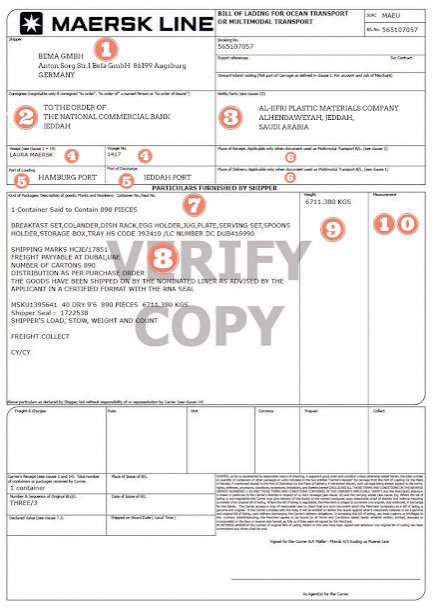

Required documents for customs clearance

Facing a maze of paperwork for customs clearance? Get clarity here. Learn about essential documents like the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE Standard). Master these to smooth your shipping experience!

Bill of Lading

Navigating freight between Vietnam and China can be tricky, but your ace in the hole is a document known as the Bill of Lading. It signifies ownership change, so getting it right is key. Ever had that aha moment when you sell your used car and hand over the title? It's like that, only for your goods. An electronic version, the telex release, makes it even easier, allowing you to transfer this document over the internet. You also have the AWB for air shipments. Don't overlook these details, they're your ticket to smooth sailing (or flying) of your cargo. Mastering these documents is like grabbing the steering wheel, it gives you control and keeps your shipment on course.

Packing List

Packing List - it's your trusted sidekick when shipping goods from Vietnam to China. It's more than a mere list; it's the magic decoder for your shipment's contents. Picture this: you're shipping machine parts. Your packing list will tell how many boxes, weight, and dimensions. Nothing should remain a mystery. Are you shipping via air or sea? No matter. Your packing list is universal; it's equally important for both. Agencies at the ports of both countries rely heavily on it. Your job is to ensure full transparency and accuracy. Miss a detail and you risk delaying your shipment at customs. So, always double-check your packing list. It's your golden ticket to a smooth shipping journey. Remember accuracy and clarity are your armor against potential customs issues. That's the power of the packing list. Treat it with respect!

Commercial Invoice

A Commercial Invoice is vital to ensure a smooth customs clearance process for your goods from Vietnam to China. It should detail your shipment's value, description, and HS code. Misalignment with your shipping documents can disrupt the process - let's say you've incorrectly recorded the HS code on your Invoice while it matches up on your Bill of Lading, that could spell trouble at the customs checkpoint.

Aligning these documents avoids such hiccups. Pro Tip: Don't underestimate your invoice's formatting. Organizing information clearly helps customs officers perform their job faster, resulting in expedited clearance. Remember, each time you ship, getting your Commercial Invoice spot-on directly impacts your business speed, reducing unforeseen hitches, and catering to shipping goods successfully between Vietnam and China.

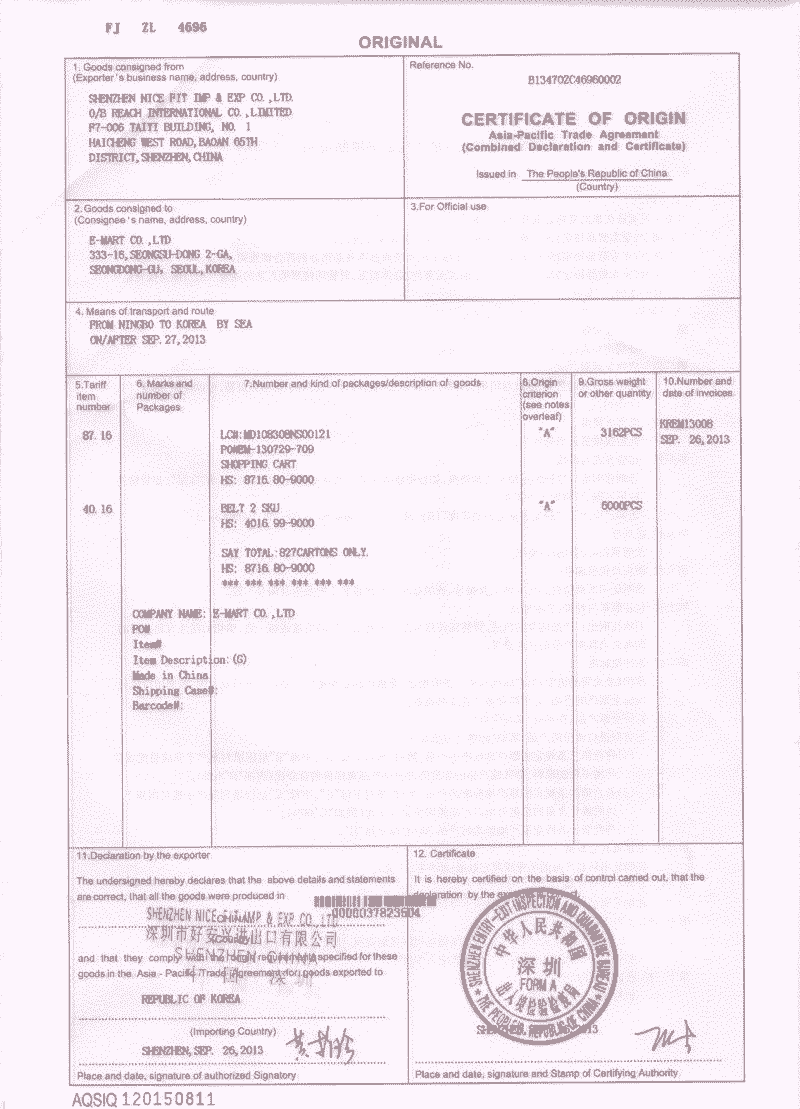

Certificate of Origin

When shipping goods from Vietnam to China, your Certificate of Origin (CO) is key. This document vouches for where your goods were manufactured, a vital piece of info for customs. Let's say you've got consignments of silk from Da Nang; the CO validates they're 100% Vietnamese. The biggest advantage? It gives you access to preferential customs duty rates, thanks to China’s free trade agreements. That means you save on costs when importing Vietnamese silk into Shanghai or Beijing. So, a correctly issued CO opens up smoother, more cost-effective shipping lanes, a cogent edge in this cross-border commerce.

Get Started with FNM Vietnam

Cut through the red tape of customs clearance between Vietnam and China with FNM Vietnam. Our expert team navigates the complexities, handling all administrative procedures swiftly and efficiently. Why worry about the hassles, when we're here to simplify your shipping journey? Connect with us today and receive a free, no-obligation quote within 24 hours. Your peace of mind is just a click away.

Prohibited and Restricted items when importing into China

Understanding China's import laws can be a maze. Your shipment can be delayed or even confiscated if it contains prohibited or restricted items. Let's avoid these hassles and help your business run smoothly with a clear view of what you can and cannot ship.

Restricted Products

Here are some of the categories of restricted products in China and the specific license or permit that you need, along with where to get them:

- Telecommunication devices: You'll need to apply for a Network Access License (NAL) from the Ministry of Industry and Information Technology (MIIT).

- Cosmetics: You have to acquire a Cosmetic Hygiene Sanitary License from the China Food and Drug Administration (CFDA).

- Health supplements: It’s mandatory to get a Health Food Registration Certificate from the National Medical Products Administration (NMPA).

- Meat and Seafood: A Quarantine Certificate must be pursued from the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ).

- Pharmaceuticals: You need to obtain a Pharmaceutical Product Registration Certificate from the National Medical Products Administration (NMPA).

- Dangerous chemicals: To import them, apply for a Dangerous Chemicals Import License from the Work Safety Administration.

- Books, magazine and digital content: You have to pursue a Publication Import License from the National Press and Publication Administration (NPPA).

Remember, the above list isn't exhaustive, and the authorization requirements can change based on Chinese regulations. So ensure you're always up-to-date with the latest rules and regulations. Always plan ahead to avoid delays or issues on arrival in China!

Prohibited products

- Narcotics and psychoactive drugs not intended for medical use

- Radioactive or harmful waste materials

- Weapons and ammunition

- Counterfeit currency

- Print media, films, photos, and other items that could harm China's politics, economy, culture, and ethics

- Food, medicines, and other items that are harmful to human and animal health, and can spread diseases

- Rare and endangered plants and animals, natural specimens

- Goods that infringe on intellectual property rights

- Used vehicles and certain types of used electrical equipment.

- Certain culturally significant artifacts and relics.

Are there any trade agreements between Vietnam and China

Yes, China and Vietnam are partners in both the ASEAN-China Free Trade Agreement (ACFTA) and the Regional Comprehensive Economic Partnership (RCEP), both of which help make trading between the two nations more effortless by reducing tariffs and simplifying customs procedures. Furthermore, their bilateral economic cooperation is being expanded with initiatives like the Two Corridors and One Economic Circle that includes infrastructure projects potentially improving shipping. These agreements could make shipping between these countries more manageable and cost-effective for your business.

Vietnam - China trade and economic relationship

Vietnam and China share a heritage of trade, with historical ties dating back over a millennium. As a testament to their economic interdependence, bilateral trade reached a hefty $175 billion in 2024. The two nations have carved a robust trade landscape with key sectors including manufacturing, agriculture, and technology. China currently stands as Vietnam's largest trading partner, a milestone achieved in 2004 and consistently upheld. This intimate trade relationship sees China invest heavily in Vietnamese sectors, with investments peaking at $4.1 billion in 2024. Major commodities exchanged between the nations are diverse, ranging from machinery to textiles. Though China accounts for nearly 25% of Vietnam's imports, the trade balance is on an encouraging path towards parity, driven by Vietnam's steady increase in exports to China. This Vietnam-China trade saga depicts an intertwined economic relation that is beneficial for both nations.

Your Next Step with FNM Vietnam

Confused by customs? Daunted by documentation? Shipping between Vietnam and China can be complex, even for experienced businesses. But fear no more, FNM Vietnam is at your service! We turn confusion into clarity, providing effortless and reliable shipping solutions. For worry-free, efficient cross-border trade, don't hesitate. Reach out to FNM Vietnam today and let us simplify your shipping.

Additional logistics services

Dive into our wide range of extra perks! Beyond moving goods globally and simplifying customs, FNM Vietnam orchestrates your entire supply chain, effortlessly smoothing out any logistical wrinkles. Entrepreneur to enterprise, consider us your one-stop-shop for a seamless shipping experience!

Warehousing and storage

Struggling to find trustworthy storage solutions in Vietnam or China? Ensuring optimal conditions, like temperature control for goods like electronics or perishables, can be a real headache. Thankfully, there's a solution. You're just a click away from reliable warehousing services that are in line with your unique needs. More info on our dedicated page: Warehousing.

Packaging and repackaging

Proper packaging is paramount when shipping between Vietnam and China. Why? To protect your goods from transit-related damages. That's where a reliable agent steps in. Whether it's ceramics, electronics or textiles, our crew are pros at custom packing and repackaging tailored to each product. We're like your personal shipping guardians. More info on our dedicated page: Freight packaging.

Cargo insurance

Mistakes happen, even with the best of planning. That's why safeguarding your cargo with transport insurance is critical. Unlike fire insurance, it covers potential mishaps during transit, think damages or loss. Picture your shipment of delicate ceramics; a single mishap could send profits tumbling. With the right insurance, your risks are mitigated and those shattered pieces aren't also your margins. More info on our dedicated page: Cargo Insurance

Supplier Management (Sourcing)

Shipping from Vietnam to China? FNM Vietnam's got you covered for supplier management. We locate reliable suppliers, handle procurement details, and demolish language barriers. Imagine trying to find and collaborate with a manufacturer in, say, Eastern Europe—no easy task. With us, it's a seemingly effortless process. Check out 'Sourcing services' for a more complete picture. Sourcing services

Personal effects shipping

Moving personal items, no matter how delicate or bulky, from Vietnam to China? Fear no more. Experience utmost care and adaptability with our personal effects shipping service. Think grandma's heirloom vase or your prized art collections, handled expertly across borders. Curious to understand more? Visit: Shipping Personal Belongings.

Quality Control

Quality control matters, especially when shipping between Vietnam and China. Imagine fine silk garments from Vietnam ruined by subpar sewing. Our service prevents this nightmare. We conduct strict inspections during manufacturing, ensuring your products meet all standards, and saving you time and money on returns. No more defective products ruining your plans! Let’s sail smoothly. More info on our dedicated page: Quality Inspection.

Product compliance services

Your products must meet destination regulations to clear customs smoothly. This is where our Product Compliance Services come in. By turning to our lab tests, you'll gain confidence in your items' compliance, securing necessary certifications, and ensuring a hassle-free move across borders. Think of it like taking a new toy for a spin – we help ensure it's up to standard before you set it off on its journey.

FAQ | Freight Forwarder in Vietnam and China

What is the necessary paperwork during shipping between Vietnam and China?

As FNM Vietnam, we manage the arduous tasks for you, including arranging the bill of lading for sea freight or air waybill for air freight. However, your cooperation is vital and your responsibility includes providing indispensable paperwork like the packing list and commercial invoice. Other mandatory documents may arise depending on the nature of your goods; an example includes the Material Safety Data Sheet (MSDS) or various certifications. Rest assured, we are here to guide you through this intricate process, ensuring a smooth and efficient shipping from Vietnam to China.

Do I need a customs broker while importing in China?

Yes, importing into China involves a complicated process and necessitates specific paperwork. To handle these intricacies, it's recommended to engage a customs broker who can interact with customs authorities on your behalf. As FNM Vietnam, we most commonly take on this role for our clients, providing representation for your cargo during customs clearance. This service ensures that all mandatory details are correctly provided and procedures diligently followed, sparing you the challenges of navigating the customs legislation, thus, streamlining your shipping experience.

Can air freight be cheaper than sea freight between Vietnam and China?

While it's tricky to give a one-size-fits-all answer because factors such as route, weight, and volume play crucial roles, we can generally say that if your cargo is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), air freight becomes a viable option and might even be cheaper than sea freight for shipping from Vietnam to China. At FNM Vietnam, our aim is always to offer the most competitive option for your specific needs, so rest assured that we'll provide a solution tailored for you, handled by your dedicated account executive.

Do I need to pay insurance while importing my goods to China?

Although insurance isn't a prerequisite when importing goods to China, we at FNM Vietnam highly encourage it, due to potential unexpected incidents. These could range from damage and loss to theft of your shipment. Considering the inherent risks involved in shipping, especially in international transportation, insuring your goods provides a layer of financial protection. Regardless of whether you're shipping a small or large consignment, having insurance helps to ensure peace of mind throughout the shipment journey. It's always wise to prepare for unpredictable situations by safeguarding your valuable goods with insurance.

What is the cheapest way to ship to China from Vietnam?

Given the relatively short geographical distance between Vietnam and China, the most cost-effective shipping method is typically road freight. This solution offers a balance of speed and cost, especially for less-than-truckload shipments. However, for very heavy or bulky items, sea freight may be more economical. We, at FNM Vietnam, provide efficient and affordable options for both. Please note, specific costs will depend on various factors like goods' dimension, weight, and customs requirements.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF significantly hinges on your relationship with your supplier. However, it's crucial to remember that suppliers might not be logistics experts. To alleviate this, we at FNM Vietnam can handle the international freight and the destination process for you. Typically, suppliers sell under EXW or FOB terms, which means the goods are either at the door of their factory or inclusive of all local charges until the terminal of origin. But don't worry, we have you covered! Our team at FNM Vietnam offers a comprehensive door-to-door service to ensure a smooth and hassle-free shipping experience for your business.

Goods have arrived at my port in China, how do I get them delivered to the final destination?

Upon the arrival of your goods at a Chinese port, if we've managed your cargo under CIF/CFR incoterms, you'd need a custom broker or freight forwarder to clear the goods at the terminal, pay import charges, and arrange delivery. Conversely, we offer a DAP incoterms service that covers these steps for you. Be sure to confirm these details with your FNM Vietnam account executive.

Does your quotation include all cost?

We pride ourselves on being transparent with our costings. Our quotes cover all expenses except for duties and taxes at the destination. Please rest assured, there are no hidden fees to surprise you. If you're wondering about duties and taxes, don't hesitate to ask your dedicated account executive. They're here to help you estimate those additional costs.

It is also the reason explaining why ocean freight is the most common solution to transfer goods between Vietnam and the US. For big shipments, air freight is generally way more expensive. Thereby, ocean freight is the best solution for voluminous and regular transfers through time.

It is also the reason explaining why ocean freight is the most common solution to transfer goods between Vietnam and the US. For big shipments, air freight is generally way more expensive. Thereby, ocean freight is the best solution for voluminous and regular transfers through time.

Reefer container is one of the favourite methods of chemical and food companies. It enables to transfer perishable or sensitive goods, in a totally mastered environment. Indeed, humidity and temperature inside a container are always controlled. Between Vietnam and the US, FNM can book for you a reefer container freight.

Reefer container is one of the favourite methods of chemical and food companies. It enables to transfer perishable or sensitive goods, in a totally mastered environment. Indeed, humidity and temperature inside a container are always controlled. Between Vietnam and the US, FNM can book for you a reefer container freight.

It is very important for us to establish a very good contact with your supplier from the beginning, to know the state of your products and their packing. We cannot allow a too fragile or incorrectly packed shipment to be internationally transferred. Thereby, we will avoid a great part of the incidents possible.

It is very important for us to establish a very good contact with your supplier from the beginning, to know the state of your products and their packing. We cannot allow a too fragile or incorrectly packed shipment to be internationally transferred. Thereby, we will avoid a great part of the incidents possible.

Canada is one of the largest countries in the world. Geographically, its situation crossing the northern American continent from east to west is providing great coastline on the Atlantic and the Pacific Ocean to the country. Numerous ports and well-developed infrastructures are enabling the country to handle important volumes of goods. Canadian ports are all ranked in the list of the 25 busiest ports of north America, according to the

Canada is one of the largest countries in the world. Geographically, its situation crossing the northern American continent from east to west is providing great coastline on the Atlantic and the Pacific Ocean to the country. Numerous ports and well-developed infrastructures are enabling the country to handle important volumes of goods. Canadian ports are all ranked in the list of the 25 busiest ports of north America, according to the

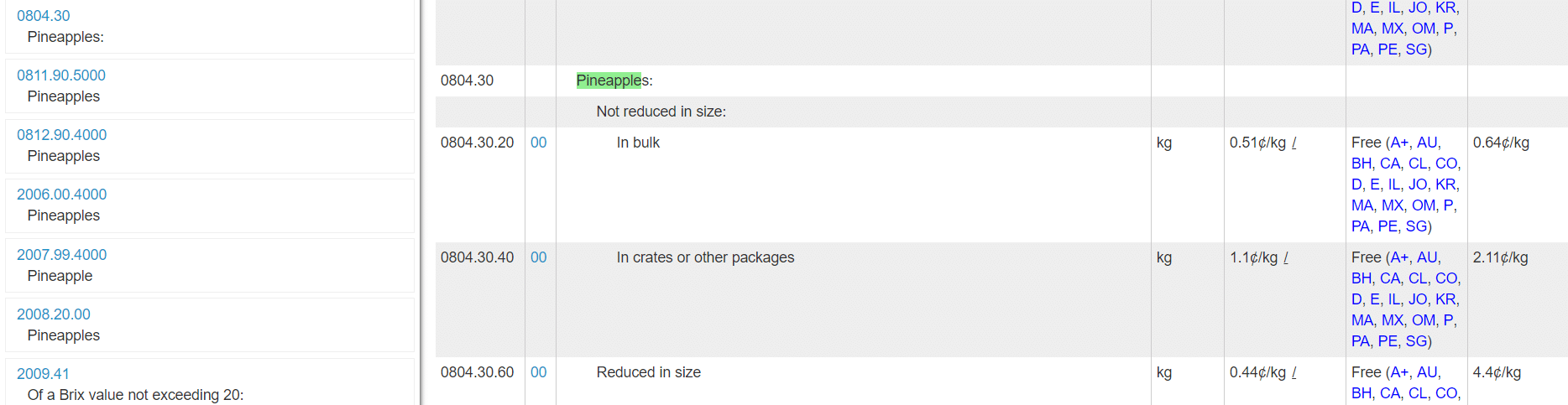

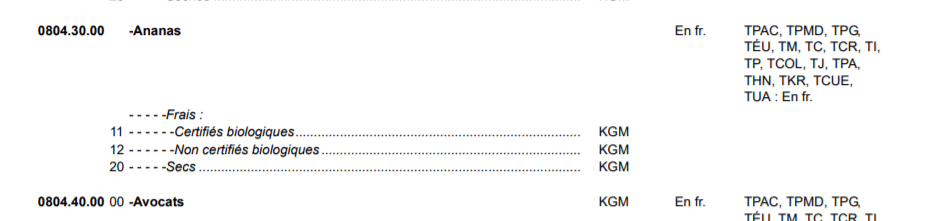

In case that you still don’t know what is the HS code of your product, the

In case that you still don’t know what is the HS code of your product, the  Now that you know the HS code of your product, you can find the inherent import taxes. In this objective you have to consult the

Now that you know the HS code of your product, you can find the inherent import taxes. In this objective you have to consult the  Prices are referred per Kgs of goods, as you can see. But pineapples are free of import taxes, so you will not have to pay any tariffs when you import this product. For all other kind of goods, please refer to the corresponding chapter, to the precise unit of measure used and the applicable preferential rate.

Prices are referred per Kgs of goods, as you can see. But pineapples are free of import taxes, so you will not have to pay any tariffs when you import this product. For all other kind of goods, please refer to the corresponding chapter, to the precise unit of measure used and the applicable preferential rate. Official name: General Department of Vietnam Customs Website: Vietnamese Customs Contact at the Canadian customs

Official name: General Department of Vietnam Customs Website: Vietnamese Customs Contact at the Canadian customs  Official name: Canada Border Services Agency Website:

Official name: Canada Border Services Agency Website: